Reaching the level of Partner at a Big Four accounting firm like PricewaterhouseCoopers (PwC) represents the pinnacle of a career in professional services. It's a role synonymous with leadership, expertise, and significant financial reward. For those aspiring to this prestigious position, the ultimate question often is: what is the salary of a PwC Partner?

While the exact figure varies, the earning potential is substantial. Total compensation for a PwC Partner in the United States typically ranges from $450,000 to well over $1,200,000 annually, with the most senior partners in high-demand markets exceeding this significantly. This article will break down what a PwC Partner does, the components of their compensation, and the key factors that influence their impressive earnings.

What Does a PwC Partner Do?

A PwC Partner is far more than a senior accountant or consultant; they are owners and leaders of the business. Their responsibilities are multifaceted and carry immense weight, shifting from day-to-day project execution to firm-wide strategy and growth.

Key responsibilities include:

- Driving Business Development: Partners are the primary rainmakers for the firm. They are responsible for building and maintaining executive-level client relationships, identifying new business opportunities, and selling large-scale engagement contracts.

- Ultimate Engagement Ownership: They hold the ultimate accountability for the quality, delivery, and profitability of all client projects within their portfolio. While they delegate heavily, the buck stops with them.

- Team Leadership and Mentorship: Partners lead large teams of managers, consultants, and associates. A significant part of their role involves mentoring the next generation of leaders and fostering a high-performance culture.

- Firm Strategy and Governance: As owners, partners contribute to the strategic direction of their practice and the firm as a whole. This includes decisions on service offerings, market expansion, and internal policies.

Average PwC Partner Salary

Understanding a PwC Partner's salary requires looking beyond a simple base salary. Their compensation is a complex package designed to reward firm ownership, performance, and profitability.

The total compensation is generally composed of three main parts:

1. Base Salary: This is the guaranteed portion of their pay. It is often a smaller component of their total earnings compared to performance-based pay.

2. Performance Bonus: An annual bonus tied to individual performance, the success of their team, and the achievement of specific business development goals.

3. Profit Sharing (or "The Draw"): This is the most significant part of a partner's compensation. As owners of the firm, partners receive a share of the company's profits. This amount varies each year based on the overall financial success of the firm and the partner's individual unit contribution.

According to data aggregated from various sources:

- Glassdoor reports that the estimated total pay for a Partner at PwC is around $686,000 per year in the United States, with a likely range between $416,000 and $1,300,000. This estimate includes base salary, bonuses, and profit sharing.

- Reputable industry reports and forums suggest that first-year partners often start in the $300,000 to $500,000 range, while senior equity partners in major markets can earn $1,000,000 to $3,000,000+ annually.

It's crucial to recognize that these figures are estimates and can fluctuate significantly based on the factors discussed below.

Key Factors That Influence Salary

Not all partners earn the same amount. Compensation is carefully calibrated based on a number of influential factors.

### Years of Experience

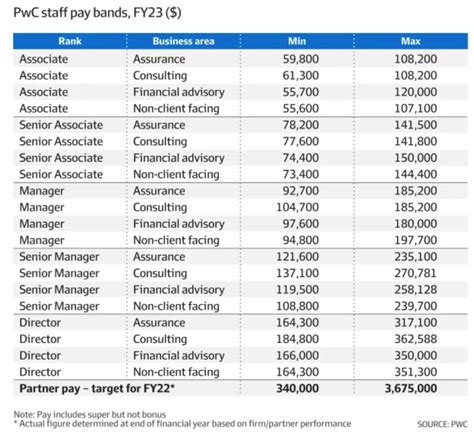

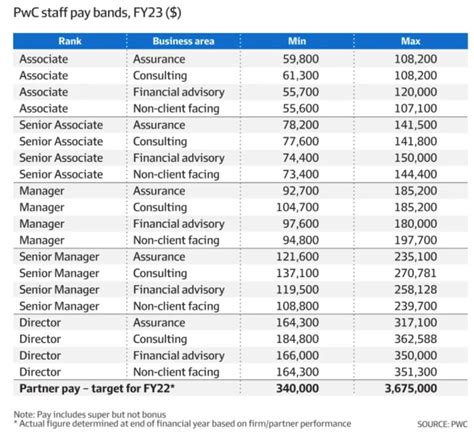

Experience is arguably the most critical factor. The path to partnership at PwC is a long-term journey, typically taking 12-15+ years of progressive advancement through roles like Associate, Senior Associate, Manager, Senior Manager, and Director.

- New Partners: First-year partners (those just "making partner") will be at the lower end of the compensation spectrum.

- Experienced Partners: Partners with 5-10 years of experience in the role have larger client portfolios, more significant leadership responsibilities, and thus, higher earnings.

- Senior Equity Partners: Those with decades of experience who lead major geographic markets or global service lines sit at the very top of the pay scale.

### Area of Specialization (Line of Service)

The specific line of service a partner leads has a direct impact on their earning potential, as some practice areas are more profitable than others.

- Advisory / Consulting: This is often the most lucrative practice. Partners specializing in high-demand areas like M&A (Mergers and Acquisitions), Deals, Strategy Consulting (particularly within the Strategy& division), or Cybersecurity command some of the highest compensation packages due to the high-value, high-margin nature of their work.

- Tax: Tax partners, especially those specializing in complex international tax law or M&A tax, also have very high earning potential.

- Assurance (Audit): While foundational to the firm, the Assurance practice is often more regulated and has lower margins than advisory work. As a result, partner compensation in this line of service, while still extremely high, may be on the lower end of the overall partner range.

### Geographic Location

Where a partner is based matters significantly. Compensation is adjusted based on the cost of living and, more importantly, the size and profitability of the market.

- Major Markets: Partners in major financial hubs like New York, San Francisco, Chicago, and Los Angeles will earn the most. These offices manage the largest clients and generate the most revenue for the firm.

- Secondary Markets: Partners in smaller cities or regional offices will have a lower compensation package, reflecting the smaller client base and lower revenue generation of that specific office.

### Level of Education

While a Bachelor's degree in accounting, finance, or a related field is the minimum requirement, advanced education and professional certifications are standard at the partner level.

- CPA (Certified Public Accountant): This is virtually a mandatory certification for partners in the Assurance and Tax practices.

- MBA or Master's Degree: An MBA from a top-tier business school or a specialized Master's degree (e.g., in Taxation or Data Science) is highly valued, particularly in the Advisory practice. While it doesn't guarantee a higher salary in itself, it provides the strategic business acumen essential for the role.

### Company Type

*Note: As this role is specific to PwC, this factor is best understood as the "Type of Client Portfolio" the partner manages.*

A partner's book of business is a key determinant of their value to the firm. A partner managing a portfolio of Fortune 100 clients in the technology or financial services sector will have a greater impact on firm revenue—and be compensated accordingly—than a partner managing smaller, regional clients.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track "Big Four Partners" as a distinct category, we can look at related professions for a proxy of industry health. The outlook for high-level financial and consulting expertise is strong.

The BLS projects that employment for Management Analysts (a role aligned with PwC's Advisory practice) will grow by 10% from 2022 to 2032, much faster than the average for all occupations. Similarly, the outlook for Accountants and Auditors is projected to grow by 4%, indicating steady, ongoing demand.

This data suggests a healthy and growing market for the core services PwC provides. While making partner is exceptionally competitive, the underlying demand for strategic advice, financial assurance, and tax expertise remains robust, ensuring the firm's continued need for strong leadership.

Conclusion

Aspiring to become a PwC Partner is a long and challenging journey, but one that comes with extraordinary professional and financial rewards. The role is a testament to years of dedication, exceptional performance, and the ability to lead people and drive business.

For those considering this path, the key takeaways are:

- Compensation is a Package: Total pay is a combination of base salary, bonus, and a significant profit-sharing component, with total earnings often reaching high six-figures or well into the seven-figures.

- Specialization Matters: Your line of service and area of expertise, particularly in high-growth advisory fields, can significantly boost your earning potential.

- It's a Marathon, Not a Sprint: The path to partnership is built on over a decade of consistent, high-level performance and relationship-building.

Ultimately, a PwC Partner salary reflects the immense value, responsibility, and business impact these leaders bring to the firm and its clients every day.