Your In-Depth Guide to PwC Senior Partner Salary

Reaching the level of Senior Partner at a "Big Four" accounting firm like PricewaterhouseCoopers (PwC) represents the pinnacle of a career in professional services. It's a role defined by leadership, strategic influence, and significant financial rewards. While the journey is demanding, the compensation can be extraordinary, often reaching well into the high six-figures and frequently crossing the seven-figure threshold.

This article will break down the complex compensation structure for a PwC Senior Partner, explore the key factors that determine their earnings, and provide a realistic view of what it takes to reach this elite professional tier.

What Does a PwC Senior Partner Do?

A Senior Partner at PwC is far more than just a top-tier accountant or consultant. They are business leaders responsible for the firm's health, growth, and reputation. Their responsibilities are multifaceted and typically fall into three core areas:

- Business Development & Revenue Generation: A Senior Partner's primary role is to drive business. This involves cultivating relationships with C-suite executives at major corporations, leading high-stakes proposals, and securing multimillion-dollar contracts for the firm's services. Their "book of business" is a direct measure of their value.

- Strategic Leadership & Client Management: They provide the ultimate oversight on the firm's most complex and important client engagements. They act as the final point of escalation, ensuring quality delivery and maintaining strong client relationships. Internally, they mentor junior partners and help set the strategic direction for their specific practice area or geographic market.

- Firm Ambassadorship: Senior Partners are the public face of PwC. They often speak at industry conferences, contribute to thought leadership, and represent the firm's values and expertise in the wider business community.

Average PwC Senior Partner Salary

Understanding a PwC Senior Partner's compensation requires looking beyond a traditional "salary." Partners are owners of the firm, and their compensation is a share of the firm's profits, often referred to as a "draw" or "profit distribution." This amount can fluctuate annually based on the performance of the firm, the partner's individual business unit, and their personal performance.

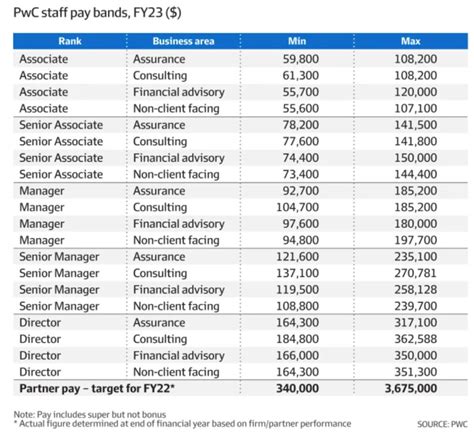

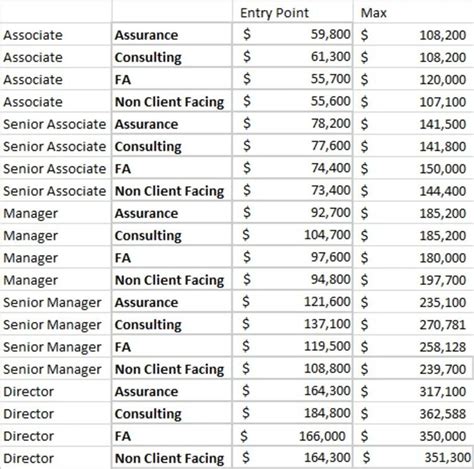

While PwC, as a private partnership, does not publicly disclose its salary data, we can synthesize information from reputable salary aggregators and industry reports to build a clear picture.

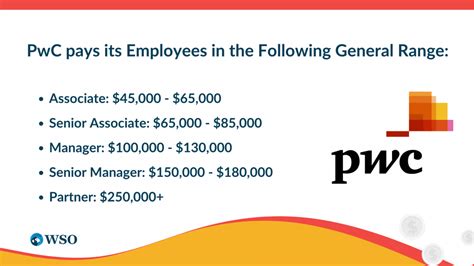

- Partner (Entry-Level): A new partner just admitted to the partnership can expect total compensation in the range of $450,000 to $650,000 annually. This includes their base draw and potential bonuses.

- Experienced Partner: A partner with several years of experience will see their compensation rise significantly, typically into the $650,000 to $950,000 range.

- Senior Partner: This is the top tier. A Senior Partner—one with significant tenure, a large book of business, and major leadership responsibilities—has an average total compensation that typically starts around $900,000 and can exceed $3,000,000. According to industry reports, average pay per partner at major firms like PwC regularly falls in the high six-figures, with top earners in high-demand fields pushing well into the millions (Source: The Wall Street Journal, eFinancialCareers).

It's crucial to understand this is a wide range because compensation is not standardized; it's highly variable and based on performance and other factors discussed below.

Key Factors That Influence Salary

Several key variables directly impact a Senior Partner's earning potential. Performance is paramount, but these structural factors set the foundation for their compensation.

###

Years of Experience and Performance

This is the most significant factor. The path to partnership at PwC is a marathon, typically taking 12-15 years of progressing through roles like Associate, Senior Associate, Manager, Senior Manager, and Director. A "Senior Partner" usually has 20+ years of experience. Compensation is directly tied to a partner's track record of:

- Generating revenue: The size and profitability of the clients they bring in.

- Managing teams: The scale and success of the teams and projects under their oversight.

- Contributing to the firm: Their involvement in internal leadership, mentorship, and strategic initiatives.

###

Line of Service

The business area a partner works in has a major impact on their earnings. PwC's main lines of service have different profitability models and market demands.

- Advisory (Consulting & Deals): This is often the most lucrative practice. Partners in areas like Mergers & Acquisitions (M&A), Strategy Consulting, and Cybersecurity command the highest fees and often have a larger performance-based component to their compensation. Earnings here can be at the highest end of the partner spectrum.

- Tax: Tax partners, especially those specializing in complex international tax or M&A tax, are also high earners. This is a consistently profitable and essential service for all major clients.

- Assurance (Audit): While foundational to the firm, Assurance is often seen as a more regulated and less variable service. As such, partner compensation, while still very high, may average slightly less than in Advisory or specialized Tax practices.

###

Geographic Location

Where a partner is based matters immensely. This is driven by both the cost of living and the concentration of high-value clients. Major financial hubs offer the highest compensation.

- Tier 1 (Highest Pay): New York City, San Francisco, London. Partners in these global cities oversee the largest and most complex client accounts, leading to the highest profit shares.

- Tier 2 (High Pay): Chicago, Los Angeles, Boston, Houston. These major markets have a high concentration of Fortune 500 clients and offer compensation well above the national average.

- Tier 3 (Standard Pay): Smaller metropolitan areas and regional offices. Compensation is still exceptional but is scaled to the local market's client base and billing rates.

Data from Salary.com for similar "Audit Partner" roles confirms this trend, showing that salaries in New York City can be over 20% higher than the national average.

###

Area of Specialization

Within each line of service, specialization in a high-growth, high-demand area can act as a significant salary multiplier. In today's market, partners with deep expertise in the following areas are among the highest compensated:

- Digital Transformation & Cloud Strategy

- Cybersecurity & Privacy

- ESG (Environmental, Social, and Governance) Consulting

- Artificial Intelligence (AI) Strategy and Implementation

- M&A and Deals Advisory

###

Level of Education

For a Senior Partner, education is a foundational requirement, not a differentiator for pay at that level. A bachelor's degree in accounting, finance, or a related field is the minimum. A Master's degree (e.g., an MBA or Master of Accountancy) is very common.

Crucially, professional certifications like the CPA (Certified Public Accountant) are virtually mandatory for partners in Assurance and Tax. Certifications like the CFA (Chartered Financial Analyst) are highly valued in Advisory. While these credentials don't directly set partner pay, they are essential milestones on the path to partnership.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track "PwC Partner" as a distinct profession, we can look at a closely related proxy: Management Analysts (which includes management consultants) and Top Executives.

The BLS projects that employment for Management Analysts will grow by 10% from 2022 to 2032, which is much faster than the average for all occupations. The BLS attributes this growth to an increased demand for consulting services in areas like IT, healthcare, and human resources efficiency.

This strong industry growth indicates that the demand for the high-value strategic services that PwC partners sell will remain robust. For those with the ambition, skills, and resilience to climb the ladder, the position of Senior Partner will continue to be a secure and highly sought-after role.

Conclusion

Becoming a Senior Partner at PwC is a long-term career goal that requires exceptional performance, dedication, and leadership. The financial rewards reflect this immense responsibility.

Key Takeaways:

- Compensation is a Profit Share, Not a Salary: Partners earn a draw based on firm, unit, and individual performance, with total compensation for Senior Partners often ranging from $900,000 to over $3,000,000.

- Performance is Everything: Your value is measured by the business you generate and the clients you manage.

- Specialization Drives Value: Expertise in high-growth areas like Advisory, Deals, and specialized Tax services leads to the highest earning potential.

- Location Matters: Being based in a major financial center like New York City significantly boosts compensation.

For anyone aspiring to a career in professional services, the path to Senior Partner at PwC is a clear illustration of the heights that can be achieved through sustained excellence and strategic focus. It remains one of the most challenging, and rewarding, roles in the modern business world.