Quantitative finance is one of the most intellectually demanding and financially rewarding careers in the modern economy. For individuals with a deep passion for mathematics, statistics, and computer science, a "quant" role offers the chance to solve complex puzzles at the very heart of the financial markets. The compensation reflects this high level of skill, with starting salaries often well into the six figures and total compensation for experienced professionals reaching seven figures.

But what does a quantitative analyst's salary *really* look like? This guide will break down the numbers, explore the key factors that drive earning potential, and provide a clear outlook on this exciting career path.

What Does a Quantitative Analyst Do?

Before diving into the numbers, it's essential to understand the role. A quantitative analyst, or "quant," is a specialist who applies mathematical and statistical methods to financial and risk management problems. They are the architects of the sophisticated algorithms and computer models that investment banks, hedge funds, and trading firms use to:

- Price complex financial instruments (like derivatives).

- Develop and implement automated trading strategies.

- Manage portfolio risk and optimize returns.

- Analyze market data to identify profitable opportunities.

In essence, quants use data to replace human intuition with systematic, evidence-based decision-making, giving their firms a competitive edge.

Average Quant Finance Salary

The compensation for a quantitative analyst is typically composed of two main parts: a base salary and a significant performance-based bonus. This bonus structure means that total compensation can vary dramatically from year to year.

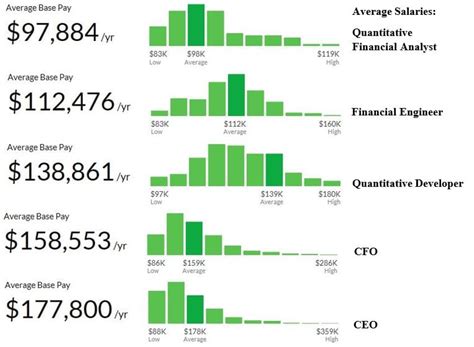

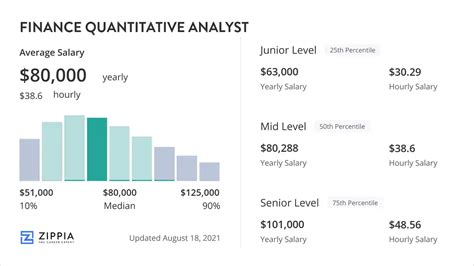

Based on an analysis of recent data, here is a typical salary range you can expect:

- Average Base Salary: According to data from salary aggregators like Salary.com, the average base salary for a Quantitative Analyst in the United States is approximately $162,590 as of early 2024.

- Typical Salary Range: Most quants will see a base salary falling between $139,000 and $184,000.

- Total Compensation (Base + Bonus): This is where the numbers become truly impressive. Glassdoor reports an average total pay of around $212,000, including bonuses and profit-sharing. However, this figure is heavily weighted by entry- and mid-level roles. For experienced quants at top firms, total compensation packages of $400,000 to $700,000+ are common, with top performers earning well over $1 million.

Entry-level quants, typically with a Ph.D. or a specialized Master's degree, can expect to start with a base salary between $125,000 and $175,000, plus a signing and/or annual bonus that can add another $50,000 or more to their first-year earnings.

Key Factors That Influence Salary

Averages provide a useful benchmark, but a quant's actual salary is determined by a combination of critical factors. Understanding these drivers is key to maximizing your earning potential.

### Level of Education

In quantitative finance, education is more than a prerequisite; it's a direct indicator of your analytical capabilities. A higher level of academic achievement in a relevant field translates directly to a higher salary.

- Master's Degree: A Master of Science (M.S.) in a field like Financial Engineering, Mathematical Finance, Statistics, or Computer Science is often the minimum requirement.

- Doctorate (Ph.D.): A Ph.D. is the gold standard, particularly for quant researcher roles at elite hedge funds and proprietary trading firms. A doctorate in Physics, Mathematics, Statistics, or Computer Science signals an ability to conduct original, high-level research—a skill that is highly prized and compensated. Graduates with a Ph.D. often command starting salaries that are $25,000 to $50,000 higher than their Master's-level counterparts and are put on a faster track to higher-impact, higher-paying roles.

### Years of Experience

As with any profession, experience pays. However, in quantitative finance, the salary curve is exceptionally steep, especially in the first decade.

- Entry-Level (0-2 years): These professionals are typically focused on learning the firm's systems, cleaning data, and assisting senior quants. Total compensation is strong but heavily weighted towards base salary, often in the $150,000 - $250,000 range.

- Mid-Level (3-7 years): Quants with a few years of experience begin to take ownership of models and strategies. Their performance bonus becomes a much larger percentage of their total compensation. Total pay can range from $250,000 to $500,000.

- Senior/Lead (8+ years): Senior quants are responsible for generating significant profits (P&L) for the firm, leading teams, and developing firm-wide strategies. Their compensation is heavily tied to performance, and it is at this level that seven-figure annual incomes become attainable.

### Geographic Location

Finance is a geographically concentrated industry, and salaries reflect the cost of living and the density of high-paying firms in major financial hubs.

- Top Tier (New York, Chicago): New York City is the undisputed epicenter of finance, and quant salaries there are the highest in the nation. Chicago, with its history in derivatives and proprietary trading, is a close second.

- Other Major Hubs (San Francisco/Bay Area, Boston, Houston): These cities also have a strong finance or tech-finance presence and offer highly competitive salaries, though they may be slightly lower than in New York.

- International Hubs (London, Hong Kong, Singapore): These global centers also command extremely high salaries for top quant talent, often comparable to or exceeding U.S. figures depending on the firm and currency exchange rates.

### Company Type

Where you work is arguably the single most significant factor in your earning potential. The business model of the firm dictates its profitability and, therefore, its compensation structure.

- Hedge Funds & Proprietary Trading Firms (e.g., Citadel, Jane Street, Renaissance Technologies): These firms are at the pinnacle of quant compensation. They directly invest their own (or investors') capital, and a quant's bonus is often tied directly to the profitability of their strategies. The upside is virtually unlimited, and total compensation packages for successful quants are the highest in the industry.

- Investment Banks (e.g., Goldman Sachs, J.P. Morgan): Large banks employ quants across various desks, from derivatives pricing to electronic trading. Compensation is excellent but can be more structured and bureaucratic than at hedge funds. Bonuses are substantial but may not have the same explosive upside.

- Asset Management Firms & Fintech Companies: These firms also employ quants for portfolio management, risk analysis, and technology development. While salaries are very competitive and offer a great career, the bonus potential is typically lower than at hedge funds or top-tier investment banks.

### Area of Specialization

Not all quant roles are the same. Your specific function within the quant ecosystem will heavily influence your pay.

- Quantitative Researcher/Strategist: This is often the highest-paid role. These are the individuals (frequently Ph.D.s) who develop the novel trading strategies that generate profit. Their compensation is most directly tied to performance.

- Quantitative Developer: These quants are expert programmers who build the high-performance infrastructure and systems needed to execute trading strategies. Their work is critical, and they are compensated extremely well, though with slightly less performance-based volatility than researchers.

- Quantitative Analyst (Bank/Validation): This role is often focused on pricing models, model validation, and risk management within a bank's regulatory framework. The role is less tied to direct profit generation, and as such, the bonus potential is generally lower than in front-office trading roles, but it offers more stability.

Job Outlook

The demand for quantitative skills in finance is robust and expected to grow. While the U.S. Bureau of Labor Statistics (BLS) does not track "Quantitative Analyst" as a distinct profession, we can look at related fields for a strong proxy.

The BLS projects that employment for Financial and Investment Analysts will grow by 8% from 2022 to 2032, which is "much faster than the average for all occupations." The outlook for Mathematicians and Statisticians is even more remarkable, with a projected growth rate of 30%.

This strong demand is driven by the increasing computerization of financial markets, the explosion of available data, and the relentless search for a competitive edge through technology and advanced analytics.

Conclusion

A career in quantitative finance offers a rare combination of intellectual stimulation and exceptional financial reward. While the path is challenging and demands a high level of academic and technical expertise, the potential returns are immense.

For aspiring quants, the key takeaways are:

- Aim High in Education: A Ph.D. or specialized Master's in a quantitative field is your entry ticket.

- Focus on Performance: Your value—and your bonus—is ultimately tied to the results you can generate.

- Be Strategic About Location and Firm: Targeting top financial hubs and understanding the differences between hedge funds, prop shops, and banks is crucial for maximizing earnings.

If you have a passion for solving complex problems with math and code, the field of quantitative finance offers a career path where your skills are not only valued but rewarded at the highest level.