The New York City skyline isn't just a collection of buildings; it's a testament to ambition, a vertical ledger of some of the most valuable real estate on the planet. For many, the dream of "making it in New York" is inextricably linked to this world of glass, steel, and brownstone. If you're drawn to the high-stakes, high-reward environment of real estate, you've likely asked the pivotal question: what is a real estate broker's salary in New York? The answer is as complex and layered as the city itself, a landscape of immense potential shaped by grit, expertise, and entrepreneurial spirit. While headlines may tout multi-million dollar deals, the reality for most is a career built on commission, where your income is a direct reflection of your effort. A successful New York broker can earn well into the six figures, with top producers reaching seven-figure incomes, a prospect that fuels the ambition of thousands.

I once sat in a Tribeca loft, observing a seasoned broker navigate a tense negotiation between a foreign investor and a family trust selling a legacy property. It wasn't about the marble countertops or the skyline views; it was about her masterful understanding of zoning laws, trust regulations, and the subtle art of human psychology. She was part financial advisor, part therapist, and part legal strategist. That moment crystallized for me that a top broker doesn't just sell property; they broker dreams, solve complex problems, and create immense value, earning every dollar of their commission. This guide is designed to take you beyond the simple salary numbers and into the intricate world of a New York real estate broker, providing a roadmap to building a lucrative and fulfilling career in the world's most dynamic market.

### Table of Contents

- [What Does a Real Estate Broker in New York Do?](#what-does-a-real-estate-broker-do)

- [Average Real Estate Broker Salary in New York: A Deep Dive](#average-salary-deep-dive)

- [Key Factors That Influence a New York Broker's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for NY Brokers](#job-outlook-and-career-growth)

- [How to Become a Real Estate Broker in New York](#how-to-get-started)

- [Conclusion: Is a Career as a New York Real Estate Broker Right for You?](#conclusion)

What Does a Real Estate Broker in New York Do?

On the surface, the role of a real estate broker seems straightforward: help people buy, sell, or rent property. However, this definition barely scratches the surface, especially in a market as regulated and competitive as New York. A real estate broker is a licensed professional who has met advanced educational and experience requirements beyond those of a real estate salesperson (or agent). This senior license grants them the ability to operate their own real estate firm and to hire other agents to work under their supervision.

The distinction is critical. While a real estate salesperson must work under a sponsoring broker, a real estate broker can be one of two types:

1. Associate Broker: An individual who holds a broker's license but chooses to work under the management of another broker. They have the qualifications to run their own firm but opt not to, functioning similarly to a senior agent.

2. Principal/Managing Broker: The individual who owns and operates the brokerage. This person is not only responsible for their own transactions but also for the legal and ethical conduct of all salespersons sponsored by the firm. Their income is derived from their own deals as well as a percentage of the commissions (an "override") earned by their agents.

Core Responsibilities of a New York Broker:

- Client Representation: Acting as a fiduciary for clients (buyers, sellers, landlords, tenants), legally obligated to act in their best interests.

- Market Analysis: Performing detailed Comparative Market Analyses (CMAs) to accurately price properties for sale or to advise buyers on fair offer prices. This involves deep knowledge of neighborhood trends, recent sales ("comps"), and market inventory.

- Marketing and Prospecting: Creating and executing sophisticated marketing plans for listings, including professional photography, virtual tours, online advertising, social media campaigns, and traditional open houses. They also constantly prospect for new clients.

- Negotiation: Masterfully negotiating all aspects of a deal, from the initial offer price to contingency clauses, closing dates, and repair requests.

- Transactional Management: Overseeing the entire transaction from contract to closing. In New York, this is a complex dance involving attorneys, mortgage brokers, co-op boards, and title companies. The broker acts as the central point of contact, ensuring deadlines are met and problems are solved.

- Legal & Regulatory Compliance: Ensuring all activities adhere to New York State licensing laws, fair housing regulations, and local rules (e.g., the complex requirements of the Real Estate Board of New York - REBNY).

- Brokerage Management (for Principal Brokers): This includes recruiting, training, and supervising agents; managing the firm's finances and liability (including Errors & Omissions insurance); and establishing the brokerage's brand and culture.

### A Day in the Life of a Manhattan Broker

To make this tangible, let's follow "Maria," a successful associate broker in Manhattan:

- 7:00 AM - 9:00 AM: Maria starts her day not by showing properties, but by analyzing data. She reviews the latest market reports, checks the MLS for new listings and recent sales in her target neighborhoods (e.g., Upper West Side, Chelsea), and reads industry news. She flags a new co-op listing that might be perfect for a buyer client.

- 9:00 AM - 11:00 AM: Team meeting at her brokerage. The managing broker provides a market update, and agents share "haves and wants." Maria then spends an hour on focused prospecting—making follow-up calls to past clients for referrals and responding to new online leads.

- 11:00 AM - 1:00 PM: She heads to a new listing appointment in a pre-war building. She presents her detailed marketing plan and CMA to the potential sellers, demonstrating her expertise and value proposition.

- 1:00 PM - 2:00 PM: A quick lunch while fielding calls. Her buyer's attorney has a question about the contract of sale for a condo in FiDi. She connects the attorneys and confirms the details.

- 2:00 PM - 4:00 PM: Showings. She meets her buyer client to tour three different two-bedroom apartments she pre-screened. One is the new co-op she found this morning. Her client loves it.

- 4:00 PM - 6:00 PM: Back at the office, she drafts an offer for the co-op. This involves not just the price but also carefully worded contingencies. She then begins preparing the client's co-op board package—a notoriously arduous process in NYC that requires extensive financial documentation.

- 6:00 PM - 7:30 PM: Maria hosts a "twilight" open house for one of her luxury listings, catering to professionals who can only view properties after work.

- After 8:00 PM: She finally heads home, but her phone is still buzzing. The seller's broker for the co-op calls to discuss the offer. The negotiation begins.

This snapshot reveals the reality: a broker's career is an entrepreneurial venture demanding discipline, market intelligence, and exceptional people skills. It's far more than just opening doors.

Average Real Estate Broker Salary in New York: A Deep Dive

Analyzing the salary of a real estate broker in New York is fundamentally different from analyzing a traditional salaried position. The vast majority of brokers and agents work on a 100% commission basis. Their income, known as Gross Commission Income (GCI), is entirely dependent on the number and value of transactions they close. Therefore, the term "salary" is often used as a shorthand for "average annual earnings," which can fluctuate dramatically from year to year.

It is crucial to understand the commission structure first. A typical real estate transaction involves a total commission (e.g., 5-6% of the sale price) which is then split.

Example Commission Breakdown for a $1,000,000 NYC Condo Sale:

- Total Commission (5%): $50,000

- Split between Listing Brokerage and Buyer's Brokerage (50/50): $25,000 to each firm.

- The agent's split with their sponsoring brokerage: This is the key variable. If the agent is on a 60/40 split, they receive 60% of the $25,000.

- Agent's Gross Commission: $15,000

- From this $15,000, the agent must pay all their business expenses: Marketing costs for the property, professional photography, Errors & Omissions (E&O) insurance, desk fees, MLS dues, association fees, taxes, etc. The net income is significantly less than the gross.

With this context, let's explore the data from authoritative sources.

### National & New York State Averages

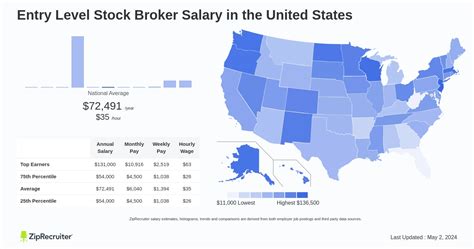

To establish a baseline, we look at the U.S. Bureau of Labor Statistics (BLS). The BLS groups Real Estate Brokers and Sales Agents together.

- National Median Pay (May 2022): The median annual wage for real estate brokers and sales agents was $52,030. The lowest 10 percent earned less than $26,270, and the highest 10 percent earned more than $160,830. *(Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook)*.

- New York State Median Pay (May 2022): The annual mean wage for real estate agents in New York State was $103,450. For brokers, this figure is often higher due to experience and the ability to earn from agents' deals. *(Source: BLS Occupational Employment and Wage Statistics)*.

- New York-Newark-Jersey City, NY-NJ-PA Metropolitan Area: This specific region shows an even higher annual mean wage of $111,040 for agents, highlighting the earning potential in the NYC metro area.

### New York City Specific Salary Data

Salary aggregators, which compile user-reported data and job listings, provide a more granular look at the New York City market. It's important to remember these are estimates and can vary widely.

- Salary.com: As of late 2023, the average Real Estate Broker salary in New York, NY is $113,858, but the range typically falls between $91,257 and $154,655. This range often reflects base salary plus commissions.

- Glassdoor: Reports an estimated total pay of $166,973 per year for a Real Estate Broker in the New York City area, with an average salary of $105,730 and additional pay (commissions, bonuses) estimated at $61,243.

- Payscale: Shows a wide range, with an average base salary around $79,000, but total pay (including commission and bonuses) extending up to $200,000+.

These figures tell a clear story: while the national median is modest, the potential in New York City is substantially higher, with average earnings easily clearing the six-figure mark for a competent, established professional.

### Salary Brackets by Experience Level in New York

Earnings in real estate are almost perfectly correlated with experience, network, and track record. Here’s a typical progression:

| Experience Level | Years in Business | Typical Annual GCI Range (NYC) | Key Characteristics |

| :--- | :--- | :--- | :--- |

| New/Entry-Level Broker | 2-4 (as Broker) | $75,000 - $150,000 | Recently licensed as a broker. May still be building their own client base or focusing more on agent management. Income can be inconsistent. |

| Mid-Career Broker | 5-10 | $150,000 - $350,000 | Has a consistent stream of referral business. A strong reputation in a specific neighborhood or property type. Manages a small team of productive agents. |

| Senior/Top Producer Broker | 10+ | $400,000 - $1,000,000+ | A recognized name in the industry. Dominates a specific market segment (e.g., UES luxury co-ops, Downtown new developments). Manages a large, successful brokerage or team, earning significant income from their agents' deals. |

*(Note: These are estimates of Gross Commission Income before expenses and taxes, based on industry reports and salary aggregator data for the NYC market.)*

### Deconstructing Compensation: Beyond the Commission Split

A broker's true take-home pay is what remains after all expenses. A principal/managing broker has two main income streams:

1. Personal Deals: Commission earned from their own buyer and seller clients.

2. Brokerage Income (Overrides): The company's portion of the commission from every deal closed by the agents they sponsor. For example, if an agent is on a 70/30 split, the brokerage (the broker) keeps 30%.

From this total income, a managing broker must cover significant overhead:

- Office Rent & Utilities: A physical office space in NYC is a major expense.

- Staff Salaries: Administrative assistants, marketing coordinators, transaction coordinators.

- Technology & Software: CRM systems, transaction management software, website hosting.

- Marketing & Advertising: Branding for the entire brokerage.

- Insurance: E&O insurance, general liability.

- Legal & Accounting Fees: Essential for compliance and financial management.

For an associate broker, the expenses are lower but still substantial: marketing for their own listings, association dues (REBNY, NYSAR), continuing education, and transportation. Understanding this cost structure is vital for anyone aspiring to become a broker, as high gross income doesn't always translate to high net profit.

Key Factors That Influence a New York Broker's Salary

A broker's income in New York is not a fixed number but a dynamic outcome influenced by a powerful set of variables. Two brokers with the same license and years of experience can have wildly different earnings. Mastering these factors is the key to moving into the top-tier income brackets.

### 1. Geographic Location within New York

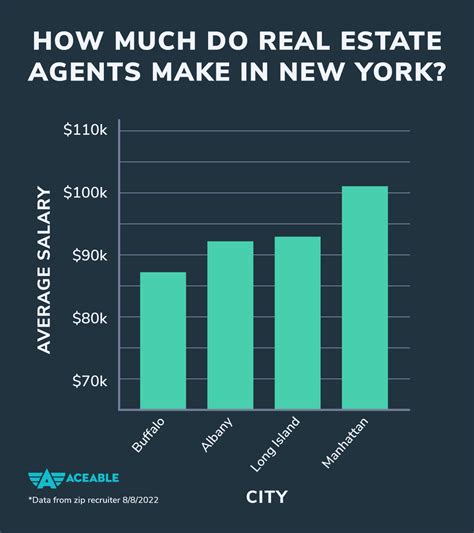

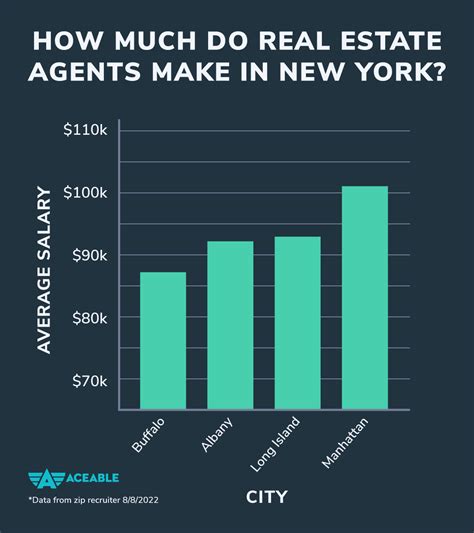

Nowhere is the mantra "location, location, location" more true than for a broker's own salary. New York State is vast, with dramatically different real estate markets.

- Manhattan: This is the epicenter. With a median sales price consistently well over $1 million for apartments, the potential GCI per transaction is enormous. A standard 2.5% co-broke on a $2 million condo is $50,000. Brokers specializing in ultra-luxury townhouses on the Upper East Side or penthouses in "Billionaires' Row" can earn life-changing commissions on a single deal. However, the competition is the fiercest on earth.

- Brooklyn & Queens: These boroughs have seen explosive growth. Neighborhoods like Williamsburg, Park Slope, and Long Island City now command prices that rival many parts of Manhattan. A broker who builds a reputation here can do exceptionally well, often with a more diverse range of property types (from brownstones to new construction condos).

- The Hamptons & Long Island: This is a world-class luxury and second-home market. A broker in East Hampton or Southampton deals with multi-million dollar waterfront estates. The seasonality can be a challenge, with a frenzy of activity in the spring and summer, but a single summer rental can bring in a five-figure commission.

- Westchester County: The affluent suburbs north of NYC (Scarsdale, Rye, Bronxville) offer high-priced single-family homes and a steady stream of clients moving to or from the city. The transaction process can be less complex than a Manhattan co-op deal.

- Upstate New York (Albany, Syracuse, Buffalo, Rochester): Property values are significantly lower. A broker in Buffalo, where the median home price is closer to $200,000, needs to close many more transactions to achieve the same GCI as a broker in Manhattan. The trade-off is often lower competition and a lower cost of doing business. For example, according to Salary.com, the average real estate broker salary in Buffalo, NY, is around $101,000, about 11% lower than in NYC.

### 2. Area of Specialization

Generalists can survive, but specialists thrive. Developing deep expertise in a specific niche builds a powerful brand and attracts high-quality clients.

- Residential Sales: The most common path. Success requires specializing further. Are you the go-to broker for pre-war co-ops on the Upper West Side? The expert on artist lofts in SoHo? The master of navigating Brooklyn brownstone deals?

- Commercial Real Estate (CRE): This is a different universe. It involves office leasing, retail spaces, industrial warehouses, or multi-family apartment buildings. The deal cycles are much longer (months or even years), but the transaction values are often far higher. A commercial broker needs advanced financial modeling skills, understanding of zoning laws, and a network of institutional investors and business owners. The income potential is immense but requires a greater initial investment in specialized knowledge.

- Luxury Real Estate: Operating in the $5 million+ market requires more than just a broker's license. It demands an impeccable network, a sophisticated personal brand, discretion, and the ability to cater to high-net-worth individuals. Success here places a broker in the absolute top tier of earners.

- New Development: Working directly with developers to market and sell entire new condominium buildings. This is a highly sought-after role within major brokerages like Douglas Elliman and Compass. It offers a steady pipeline of inventory but is incredibly competitive to break into.

- Rentals vs. Sales: Many new agents start in rentals. The commissions are much smaller (typically one month's rent up to 15% of the annual rent) but the transactions are fast, providing quick cash flow and a way to build a client database. Top brokers focus almost exclusively on sales, where the commissions are exponentially larger.

### 3. Brokerage Model and Commission Split

The choice of brokerage firm has a direct and immediate impact on a broker's net income.

- Traditional, Full-Service Brokerages (e.g., The Corcoran Group, Douglas Elliman): These firms offer strong brand recognition, extensive marketing support, office space, and in-house training. In exchange, they typically have more traditional commission splits that may start at 50/50 and scale up with production. This model is often best for new brokers who need support and lead generation.

- Capped Commission Models (e.g., Keller Williams, eXp Realty): These brokerages operate on a model where the agent pays a fixed amount (a "cap") to the company each year out of their commissions. Once the cap is met, the agent keeps 100% of their commission for the rest of the year (minus a small transaction fee). This is highly attractive to high-producing brokers who can "cap out" early in the year and maximize their earnings.

- 100% Commission / Desk Fee Models: Some firms offer a 100% commission split in exchange for a flat monthly "desk fee" and a per-transaction fee. This model favors disciplined, self-sufficient brokers who don't need the hand-holding of a traditional firm and can manage their own lead generation.

- Boutique & Niche Brokerages: Smaller, specialized firms may offer competitive splits and a more intimate culture. A broker might join a boutique firm that dominates a specific neighborhood or property type (e.g., a firm that only sells commercial property in Brooklyn).

### 4. Broker vs. Associate Broker vs. Salesperson

Your license type fundamentally changes your earning potential.

- Salesperson: Can only earn commission from their own deals, and must split it with their sponsoring broker.

- Associate Broker: Holds a broker's license but functions like a senior salesperson. Their earnings are also limited to their personal transactions. Their advanced license may, however, help them negotiate a more favorable commission split with their firm.

- Principal / Managing Broker: This is the role with the highest ceiling. In addition to their personal GCI, they earn revenue from every single agent in their office. A successful managing broker's income is leveraged; their wealth grows not just from what they sell, but from what their entire team sells. This is the path to building a true business enterprise.

### 5. Experience, Network, and Personal Brand

This is arguably the most important factor of all. Real estate is a relationship business.

- Years of Experience: A broker with a decade of experience has weathered different market cycles, built a massive database of past clients, and established deep relationships with attorneys, mortgage brokers, and other agents. Their business is fueled by referrals and repeat clients, a far more stable and lucrative source than cold leads.

- The Network (Your "Book of Business"): A top broker's network is their most valuable asset. This isn't just a list of contacts; it's a community of people who trust their expertise. Building this takes years of exceptional service, consistent follow-up, and community involvement.

- Personal Brand: In a sea of 60,000+ licensees in NYC, a broker must stand out. A strong personal brand—communicated through a professional website, active social media, content creation (like market reports or neighborhood guides), and public speaking—positions the broker as a trusted authority, attracting clients rather than chasing them.

### 6. In-Demand Skills

Beyond the basics, certain skills can directly translate to a higher income in the New York market.

- Digital Marketing & Social Media Savvy: Brokers who master Instagram, TikTok video tours, and targeted Facebook ads can reach a vastly wider audience.

- Data Analysis: The ability to go beyond basic comps and truly analyze market trends, absorption rates, and pricing data gives a broker a competitive edge in advising clients.

- Multilingual Abilities: In a global city like New York, being fluent in languages like Mandarin, Spanish, Russian, or Arabic can unlock entire segments of the market.

- Negotiation Expertise: Formal training in negotiation can add tens of thousands of dollars to a client's bottom line—and a broker's commission—over the course of a year.

- Knowledge of Co-op Boards: Successfully navigating a notoriously difficult co-op board is a highly valued skill in Manhattan. Brokers who have a reputation for getting their clients' board packages approved are in high demand.

Job Outlook and Career Growth for NY Brokers

For those considering a long-term career as a real estate broker in New York, understanding the future landscape is essential. The profession is both timeless—people will always need a place to live and work—and in a constant state of evolution.

### Official Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) projects that overall employment of real estate brokers and sales agents is expected to grow 3 percent from 2022 to 2032. This is about as fast as the average for all occupations.

The BLS cites several key drivers for this steady demand:

- Population Growth: A growing population will continue to require housing.

- Economic Health: A strong economy generally boosts the housing market as more people have the financial confidence to buy and sell homes.

- Household Formation: As new households are formed (e.g., by young adults moving out on their own), demand for rental properties and starter homes increases.

- The Desire for Professional Guidance: While technology provides more data to consumers than ever before, the complexity, high financial stakes, and emotional nature of a real estate transaction mean that most people will continue to seek the guidance of a qualified professional. This is especially true in a market like New York.

However, the BLS also notes that the number of job openings will be much higher than the net employment growth. Many openings will arise from the need to replace workers who transfer to different occupations or exit the labor force, a common occurrence in a commission-based industry with a high turnover rate among new agents. This means that while competition is fierce, opportunities consistently exist for dedicated and skilled professionals.

### Emerging Trends and Future Challenges

The New York real estate market is a bellwether for trends that shape the industry nationally. A forward-thinking broker must be prepared to adapt.

1. The Rise of Technology and AI:

- Opportunity: Artificial intelligence and big data are creating powerful tools for market analysis, lead generation, and even predicting property value trends. Virtual and augmented reality