New York City. The name itself conjures images of towering skyscrapers, iconic landmarks, and a relentless energy that pulses through its five boroughs. For the ambitious and driven, it's a city of unparalleled opportunity. And at the very heart of this opportunity lies its most valuable and dynamic asset: real estate. If you've ever gazed at the Manhattan skyline and wondered about the fortunes made and lost within those glass and steel canyons, you've likely considered the role of the real estate broker—the ultimate gatekeeper, negotiator, and strategist in the world's most competitive property market. But beyond the glamour and high-stakes deals, what does a career as a New York City real estate broker truly entail, and more importantly, what is the realistic salary potential?

The answer is as complex and varied as the city itself. A real estate broker salary in NYC isn't a fixed number; it's a direct reflection of grit, network, market knowledge, and an unwavering entrepreneurial spirit. While some may earn a modest income, top-tier brokers regularly clear seven figures annually, orchestrating deals that reshape neighborhoods and define legacies. I once had the privilege of observing a senior broker navigate a tense, multi-million-dollar negotiation for a commercial space in SoHo. It wasn't just about the property; it was a masterful performance of psychology, financial acumen, and an encyclopedic knowledge of zoning laws, ending with a handshake that secured her a commission larger than many people's annual salaries. That moment crystallized for me that being a broker in NYC isn't just a job; it's the art of building a business, one relationship and one property at a time.

This comprehensive guide is designed to pull back the curtain on the world of NYC real estate brokerage. We will dissect every component of a broker's earnings, explore the factors that separate the average from the exceptional, and provide a clear, actionable roadmap for anyone aspiring to join this exhilarating profession.

### Table of Contents

- [What Does a real estate broker salary nyc Do?](#what-does-a-nyc-real-estate-broker-do)

- [Average real estate broker salary nyc Salary: A Deep Dive](#average-nyc-real-estate-broker-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-a-nyc-real-estate-broker-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth-for-nyc-real-estate-brokers)

- [How to Get Started in This Career](#how-to-become-a-real-estate-broker-in-nyc)

- [Conclusion](#conclusion-is-a-career-as-a-nyc-real-estate-broker-right-for-you)

---

What Does a real estate broker salary nyc Do?

While a real estate *agent* must work under a supervising broker, a real estate *broker* has completed additional education and licensing requirements, allowing them to operate their own brokerage firm, hire other agents, and assume ultimate legal responsibility for all transactions. In New York City, the distinction is critical. Brokers are not just salespeople; they are entrepreneurs, managers, legal overseers, and market analysts.

The core function of a NYC real estate broker is to act as an intermediary between buyers and sellers (or landlords and tenants) of real estate. However, the scope of their responsibilities extends far beyond simply showing properties. They are fiduciaries, legally and ethically bound to act in their client's best interest, navigating one of the most complex and regulated real estate markets on the planet.

Core Responsibilities and Daily Tasks:

- Client Acquisition (Prospecting): This is the lifeblood of the business. Brokers spend a significant amount of time generating leads through networking, cold calling, digital marketing, referrals, and building a powerful personal brand.

- Market Analysis: They conduct Comparative Market Analyses (CMAs) to determine a property's optimal listing price or to advise buyers on a fair offer. This requires an intimate understanding of current inventory, recent sales data, and neighborhood-specific trends.

- Property Marketing: For sellers, brokers create and execute sophisticated marketing plans. This includes professional photography and videography, writing compelling listing descriptions, advertising on platforms like StreetEasy and the MLS, hosting open houses, and leveraging their network to find qualified buyers.

- Client Representation: Brokers guide clients through every stage of the transaction. For buyers, this means understanding their needs, curating property viewings, and advising on the nuances of different building types (e.g., co-ops vs. condos). For sellers, it involves qualifying potential buyers and managing showing schedules.

- Negotiation: This is where top brokers earn their commission. They skillfully negotiate purchase prices, contingencies, closing dates, and other terms on behalf of their clients.

- Transaction Management: Once an offer is accepted, the real work begins. The broker coordinates with attorneys, mortgage lenders, appraisers, home inspectors, and building management companies to ensure a smooth path to closing. In NYC, this often involves the painstaking process of preparing and submitting a co-op board package.

- Compliance and Paperwork: Brokers are responsible for ensuring all contracts, disclosures, and legal documents are prepared and executed correctly, adhering to New York State and local laws.

- Managing Agents (for Managing Brokers): A broker who runs their own firm is also responsible for recruiting, training, and supervising their team of real estate agents, as well as managing the brokerage's finances and operations.

### A Day in the Life of a NYC Residential Broker

To make this tangible, let's follow "Maria," a mid-career broker specializing in Brooklyn townhouses and condos.

- 7:30 AM - 8:30 AM: Maria starts her day not in the office, but on her laptop at home. She reviews overnight inquiries from StreetEasy and Zillow, checks the latest market data and new listings in her core neighborhoods (Park Slope and Carroll Gardens), and scans *The Real Deal* for industry news.

- 8:30 AM - 9:30 AM: She prepares for her day, checking in with her assistant to confirm her schedule. She then spends 30 minutes on "power prospecting"—following up with three past clients for potential referrals and sending personalized notes to two contacts she met at a networking event last week.

- 10:00 AM - 12:00 PM: Maria meets a new client, a young family looking to buy their first three-bedroom condo. This is a "buyer consultation," where she spends time understanding their budget, lifestyle needs, and non-negotiables. She explains the entire NYC buying process, including the difference between co-ops and condos and the importance of mortgage pre-approval.

- 12:30 PM - 1:30 PM: Lunch meeting with a real estate attorney to discuss a particularly complex closing for a townhouse in a historic district. They strategize on how to handle a last-minute issue raised by the title company.

- 2:00 PM - 4:00 PM: Showings. Maria shows a client from the morning two condos in Park Slope. She doesn't just open the door; she points out the building's amenities, discusses the health of the building's financials, and explains the local school zoning.

- 4:30 PM - 5:30 PM: Back in her office, Maria works on a board package for another client whose offer was just accepted on a co-op. This is a meticulous, time-consuming task that requires gathering financial statements, reference letters, and dozens of other documents. A single mistake could derail the entire deal.

- 5:30 PM - 6:30 PM: Negotiation call. Maria represents a seller who received an offer that was slightly below asking price. She calls the buyer's agent to present a counter-offer, professionally articulating her client's position and highlighting the property's unique value to justify the price.

- 7:00 PM onwards: Evening showings or open houses are common, especially for clients who work 9-to-5 jobs. If her evening is free, she might attend a community board meeting or a professional networking event to stay visible and connected.

This schedule illustrates that a broker's role is a dynamic blend of sales, marketing, analysis, and intense project management, all built on a foundation of exceptional people skills.

---

Average real estate broker salary nyc Salary: A Deep Dive

This is the central question, but it requires a fundamental clarification: NYC real estate brokers are almost exclusively paid on a 100% commission basis. They do not receive a traditional "salary." Their income is a direct percentage of the sales price of the properties they transact. This means their earning potential is theoretically unlimited, but it also comes with a complete lack of a guaranteed paycheck.

The "salary" figures reported by aggregators are estimates based on commission data reported by brokers. They represent an average of what a broker might earn in a year, but the month-to-month reality can be wildly inconsistent—a six-figure commission check one month could be followed by two months with zero income.

### National vs. NYC Broker Earnings

To understand the unique earning potential in New York City, it's helpful to start with a national benchmark.

- According to the U.S. Bureau of Labor Statistics (BLS), the median annual pay for Real Estate Brokers and Sales Agents in the United States was $52,030 in May 2022. The top 10% earned more than $160,560. It's important to note that the BLS groups agents (who earn a portion of a commission) and brokers (who earn the full commission or a larger split) together, which can skew the median downward.

Now, let's focus on the supercharged New York City market.

### NYC Broker Salary Data: A Multi-Source Analysis

Because income is commission-based, different data aggregators report slightly different figures based on their proprietary data sets. Here is a snapshot of estimated annual earnings for a real estate broker in New York, NY (data accessed Q4 2023):

| Data Source | Average Estimated Annual Salary | Typical Range | Additional Compensation (Bonus, Profit Sharing, Commission) |

| :--- | :--- | :--- | :--- |

| Salary.com | $126,904 (Broker) | $102,463 - $161,289 | Data suggests total compensation can be significantly higher. |

| Glassdoor | $145,528 (Total Pay) | $91,000 - $233,000 | Average additional pay (commission) is estimated at $89,322. |

| Payscale | $102,500 (Median) | $49,000 - $298,000+ | Includes base, bonus, and commission. Top earners report well over $300k. |

| Indeed | $118,631 (Average) | Data varies widely based on self-reported figures. | Highlights commission potential from $10k to over $250k annually. |

Key Takeaway: While the "average" reported salary hovers around $120,000 to $145,000, the range is enormous. A first-year broker might struggle to clear $50,000 after expenses, while a top-producing broker specializing in luxury Manhattan properties can easily earn $1 million or more in a single year.

### The Commission Structure Explained

Understanding compensation requires understanding how commissions are calculated and split.

1. The Gross Commission: Typically, the total commission on a sale is 5% to 6% of the property's sale price. This is paid by the seller.

2. The Co-Broke Split: In most transactions, there is a buyer's broker and a seller's broker. This 6% commission is usually split evenly between the two brokerage firms, meaning each side gets 3%.

- *Example:* On a $2,000,000 condo sale with a 6% commission ($120,000), the seller's brokerage receives $60,000 and the buyer's brokerage receives $60,000.

3. The Brokerage/Agent Split: This is the most critical part for an individual's take-home pay. The broker (or agent) must then split their portion of the commission with their sponsoring brokerage firm. This split varies dramatically based on the broker's experience and the brokerage's model.

- Newer Agents/Brokers: Might start on a 50/50 split. On their $60,000 commission, they would take home $30,000, and the brokerage would keep $30,000.

- Experienced, Top-Producing Brokers: Can negotiate much more favorable splits, such as 70/30, 80/20, or even 90/10. Some models involve paying a monthly "desk fee" in exchange for a 100% commission split.

- Owning Your Own Brokerage: If you are the broker-owner, you keep 100% of the brokerage's side of the commission, but you are also responsible for all overhead: rent, marketing, insurance, salaries, and legal compliance.

### Beyond Commission: Other Compensation and Expenses

- Bonuses: Managing brokers who are paid a salary may receive performance bonuses based on their office's profitability.

- Profit Sharing: Some firms offer profit-sharing plans to their top-producing agents and brokers.

- The Hidden "Salary" Cut - Expenses: As independent contractors, brokers pay for all their own business expenses out-of-pocket. This is a crucial factor often overlooked. These expenses effectively reduce the "salary."

- Marketing Costs: Professional photos, floor plans, advertising on StreetEasy (which can be very expensive), social media ads, personal website.

- Licensing & Dues: NYS license renewal fees, Realtor board dues (e.g., REBNY), MLS fees.

- Insurance: Errors & Omissions (E&O) insurance.

- Business Tools: CRM software, phone, laptop, transportation (Ubers, subway).

- Taxes: As independent contractors, brokers must pay self-employment tax (Social Security and Medicare) and make quarterly estimated tax payments. A good rule of thumb is to set aside 30-40% of every commission check for taxes.

A broker who earns a $100,000 commission does not take home $100,000. After brokerage splits, business expenses, and taxes, their net income might be closer to $40,000-$50,000.

---

Key Factors That Influence a real estate broker salary nyc

A broker's income is a direct result of their performance, and that performance is influenced by a multitude of interconnected factors. Mastering these variables is the key to moving from an average earner to a top-tier professional.

### ### Geographic Location (Within NYC)

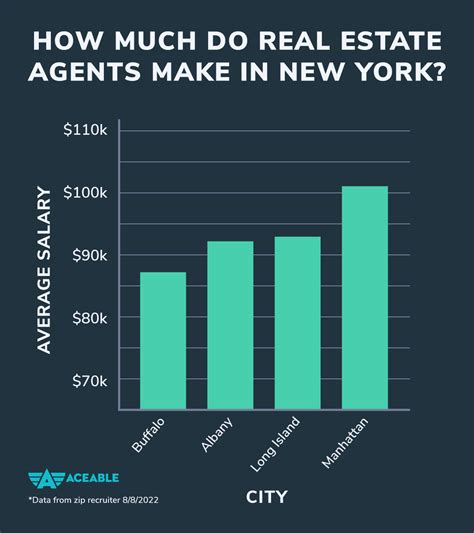

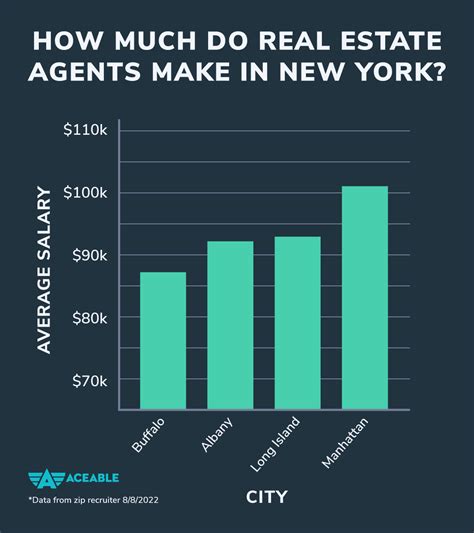

In New York City real estate, "location, location, location" doesn't just apply to properties; it applies to a broker's earning potential. The median home price in a neighborhood directly correlates to the size of a potential commission check. A broker's area of focus is arguably the single most significant determinant of their income ceiling.

- Manhattan: This is the epicenter of high-value real estate. A broker specializing in luxury co-ops on the Upper East Side or sprawling lofts in SoHo or TriBeCa is dealing with average price points of $2 million to $10 million and beyond. A single 3% commission on a $5 million sale is $150,000. These brokers often cater to high-net-worth individuals and international buyers, requiring immense discretion and sophistication.

- Brooklyn: No longer just a cheaper alternative, Brooklyn has luxury markets that rival Manhattan's. A broker focused on brownstones in Brooklyn Heights or Park Slope, or new development condos in Williamsburg and DUMBO, will consistently work with properties in the $1.5 million to $5 million range.

- Queens: Areas like Long Island City have seen a massive boom in new luxury condo developments, offering significant opportunities. Other neighborhoods like Astoria and Forest Hills offer a mix of multi-family homes, co-ops, and single-family houses at more moderate price points, which can lead to higher transaction volume.

- The Bronx and Staten Island: These boroughs generally have lower median sale prices but offer different kinds of opportunities. A broker might specialize in multi-family investment properties in The Bronx or large single-family homes in Staten Island, building a business on volume and deep community ties.

### ### Area of Specialization / Niche

Just as doctors specialize, successful brokers carve out a niche. A generalist approach is difficult in a market as vast as NYC.

- Residential Sales vs. Rentals: The rental market in NYC is a high-volume, fast-paced machine. While an individual rental commission (typically one month's rent to 15% of the annual rent) is much smaller than a sales commission, a dedicated rental agent can close dozens of deals a month, creating a steady, albeit lower-ceiling, income stream. Sales offer massive payouts but are infrequent and have long deal cycles (3-6 months or more). Many brokers start in rentals to learn the market and build a client base before transitioning to sales.

- Luxury Market ($5M+): This is a highly exclusive niche. It requires an impeccable network, a sophisticated understanding of wealth management and privacy, and access to off-market listings. The commissions are immense, but the competition is fierce, and the client expectations are extraordinarily high.

- New Developments: Brokers who work directly for developers to sell entire new buildings (sell-outs) work on a different model. They may earn a smaller percentage per unit but benefit from a massive volume of sales over a 1-2 year period.

- Commercial Real Estate: This is a completely different world from residential. A commercial broker might specialize in:

- Office Leasing: Representing tenants looking for office space or landlords looking to fill their buildings. Deals can be massive, with commissions paid out over the life of the lease.

- Retail Leasing: Placing stores, restaurants, and boutiques in storefronts. This requires a deep understanding of foot traffic, consumer demographics, and brand needs.

- Industrial/Warehouse Space: A growing field with the rise of e-commerce.

- Investment Sales: Brokering the sale of entire office buildings, apartment complexes, or development sites. These are highly complex, multi-million or even billion-dollar transactions with correspondingly large commissions. Commercial real estate often requires a stronger background in finance and financial modeling.

### ### Brokerage Type and Size

The firm a broker hangs their license with has a profound impact on their brand, resources, and commission split.

- Large National Brokerages (e.g., Compass, Douglas Elliman, The Corcoran Group, Sotheby's International Realty):

- Pros: Instant brand recognition and credibility, extensive marketing support, cutting-edge technology platforms, access to a vast network of agents for referrals and co-broking, and often in-house legal and administrative support.

- Cons: Commission splits may be less generous, especially for newer agents. There can be more corporate structure and bureaucracy.

- Boutique Firms (e.g., Warburg Realty, smaller local firms):

- Pros: Often offer more favorable commission splits, a more collaborative and tight-knit culture, and the ability to be more agile and personalized in their marketing.

- Cons: Less brand recognition outside of their specific niche or neighborhood, fewer resources for marketing and technology, and a smaller internal network.

- 100% Commission / Desk Fee Models (e.g., RE/MAX, Keller Williams - though models vary):

- Pros: The broker keeps 100% or a very high percentage of their commission. This is ideal for established, self-sufficient brokers with a consistent deal flow.

- Cons: The broker pays a monthly "desk fee" or "franchise fee" regardless of whether they close any deals. They are often responsible for more of their own marketing and administrative costs. This model can be financially risky for new brokers.

- Broker-Owner: The ultimate autonomy. You keep all profits but are responsible for all liabilities and overhead. This offers the highest earning potential but also the greatest risk and management responsibility.

### ### Years of Experience and Strength of Network

This is perhaps the most intuitive factor. Real estate is a relationship business, and relationships take time to build.

- Entry-Level (0-2 Years): The first two years are often the most challenging. The broker is focused on learning the market, building a contact list from scratch, and likely working primarily in the rental market. Income is often low and unpredictable. Many people leave the industry during this phase. Estimated annual earnings: $30,000 - $70,000, highly variable.

- Mid-Career (3-9 Years): The broker has established a niche, built a solid client base, and now operates primarily on referrals and repeat business. They have a track record of closed deals and are confident in their ability to manage complex transactions. They have likely transitioned primarily to sales. Estimated annual earnings: $90,000 - $250,000.

- Senior/Top-Producer (10+ Years): These brokers are masters of their domain. Their name *is* their brand. They have a deep, powerful network of past clients, attorneys, wealth managers, and other brokers. They often lead a team of junior agents and primarily handle high-value listings. Their income is consistently high and can easily enter the high six- or seven-figure range. Estimated annual earnings: $300,000 - $1,000,000+.

### ### In-Demand Skills

Beyond market knowledge, specific skills directly translate into higher earnings.

- Negotiation: The ability to artfully negotiate can save or make a client tens or even hundreds of thousands of dollars, directly justifying the commission.

- Digital Marketing & Personal Branding: In the age of social media, brokers who can build a compelling online presence through Instagram, YouTube, or a blog can attract clients and establish themselves as thought leaders, creating an inbound lead generation machine.

- Financial Acumen: Especially in the luxury and commercial spaces, the ability to analyze a building's financials, understand cap rates, and speak the language of investors is crucial.

- Co-op Board Package Expertise: This is a uniquely NYC skill. The ability to flawlessly prepare and navigate the submission of a co-op board package is invaluable and can be the difference between a deal closing or falling apart.

- Multilingual Abilities: In a global city like New York, being fluent in languages like Mandarin, Spanish, Russian, or French opens up entire markets of international buyers and sellers.

- Grit and Resilience: Perhaps the most important "soft skill." The ability to handle rejection, manage the stress of volatile income, and stay motivated during slow market periods is what separates long-term successes from short-term flameouts.

### ### Level of Education and Certifications

While a specific college degree is not required to become a real estate broker, a strong educational background can provide a significant advantage.

- Baseline Requirement: To become a broker in NY, you must first be a licensed salesperson for at least two years and complete an additional 75-hour broker qualifying course on top of the initial 77-hour salesperson course.

- Relevant Degrees: A Bachelor's degree in Finance, Business, Marketing, or Communications can be incredibly helpful. It provides a foundation in financial principles, marketing strategies, and professional communication that is directly applicable to the job.

- Advanced Certifications: While not required, pursuing designations from the National Association of Realtors (NAR) or other bodies can signal expertise and increase credibility. These include:

- Certified Residential Specialist (CRS): A prestigious designation for top-performing residential agents.

- Accredited Buyer's Representative (ABR®): Specializes in representing buyers.

- Certified Commercial Investment Member (CCIM): The gold standard for commercial real estate professionals, requiring an extensive curriculum and portfolio of experience. Earning a CCIM can significantly boost a commercial broker's salary potential.

---

Job Outlook and Career Growth for NYC Real Estate Brokers

The career path for a real estate broker is not a linear corporate ladder but rather an entrepreneurial journey of business growth. The outlook is shaped by national economic trends, local market dynamics, and technological disruption.

### National Job Outlook

The U.S. Bureau of Labor Statistics (BLS) projects employment for real estate brokers and sales agents to grow by 3 percent from 2022 to 2032. This is about as fast as the average for all occupations. The BLS notes that "demand for these workers will continue, as people turn to real estate agents and brokers when looking to buy or sell a home." While the overall number of agents is expected to grow, turnover in the industry is high, meaning there will always be opportunities for new, dedicated professionals to enter the field.

### NYC-Specific Market Trends and Future Challenges

The outlook in New York City is more nuanced and subject to a unique set of variables:

- Interest Rates and Economic Health: The NYC real estate market is highly sensitive to interest rates and the broader financial health of the nation. Higher interest rates can cool buyer demand, leading to lower transaction volume and downward pressure on prices, which in turn affects broker commissions. A