Considering a career as a relationship manager? It's a smart move. In a world increasingly driven by automation, the human touch of building and nurturing professional relationships is more valuable than ever. This role is a dynamic blend of sales, customer service, and strategic advice, offering a rewarding career path for those with strong interpersonal skills.

But what about the compensation? The earning potential for a relationship manager is significant and multifaceted, with top performers earning well into the six figures. A typical salary package often ranges from a solid $70,000 for entry-level positions to over $200,000 for senior roles in high-stakes industries, fueled by a combination of base salary and performance-based bonuses.

This guide will break down what you can expect to earn as a relationship manager, the key factors that drive your salary, and the promising outlook for this profession.

What Does a Relationship Manager Do?

Before we dive into the numbers, let's clarify the role. A relationship manager is the primary point of contact for a portfolio of clients. They are the linchpin responsible for building trust, ensuring client satisfaction, and fostering long-term loyalty. While their specific duties vary by industry (e.g., banking vs. tech), their core responsibilities generally include:

- Client Onboarding & Retention: Ensuring a smooth start for new clients and proactively working to keep them satisfied.

- Needs Assessment: Understanding a client's goals and challenges to provide tailored solutions.

- Cross-selling & Upselling: Identifying opportunities to offer additional products or services that benefit the client.

- Problem Resolution: Acting as a trusted advisor and advocate to resolve any issues that arise.

- Strategic Growth: Working to grow the value of their client portfolio over time.

In essence, they move beyond transactional interactions to build strategic partnerships.

Average Relationship Manager Salary

The salary for a relationship manager isn't a single number; it's a range influenced by numerous factors. However, we can establish a strong baseline using data from authoritative sources.

It's important to note that the U.S. Bureau of Labor Statistics (BLS) does not have a dedicated category for "Relationship Manager." The role's duties often overlap with categories like "Securities, Commodities, and Financial Services Sales Agents" (median pay of $71,720 per year as of May 2023) or "Sales Managers" (median pay of $134,380 per year). This highlights the vast range of the profession.

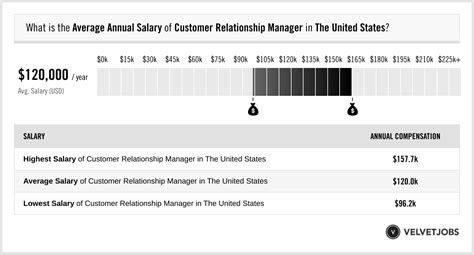

For a more direct look, we turn to reputable salary aggregators:

- Salary.com: As of early 2024, the median base salary for a Relationship Manager in the United States is approximately $120,535. The typical range falls between $97,850 and $152,780, depending heavily on experience, location, and industry.

- Glassdoor: This platform reports an average "total pay" (including bonuses, commission, and other incentives) for a Relationship Manager at around $116,000 per year, with a likely range between $84,000 and $162,000. The emphasis on "total pay" is critical, as bonuses can add tens of thousands of dollars to a relationship manager's annual income.

- Payscale: Payscale data shows an average base salary of around $75,000, but notes that bonuses can reach upwards of $49,000 and commissions can exceed $50,000 for high performers, showcasing the powerful impact of variable pay.

Key Takeaway: While base salaries are competitive, your true earning potential lies in total compensation, which includes significant performance-based incentives.

Key Factors That Influence Salary

Your specific salary will be determined by a combination of factors. Understanding these levers is the first step to maximizing your earning potential.

###

Level of Education

While a bachelor's degree in business, finance, communications, or a related field is typically the minimum requirement, advanced education can unlock higher-paying opportunities. An MBA (Master of Business Administration) is particularly valuable for roles in corporate banking or wealth management, as it demonstrates advanced financial acumen and strategic thinking. Furthermore, professional certifications can provide a significant salary boost.

- CFP (Certified Financial Planner): Essential for roles in wealth management and private banking.

- CFA (Chartered Financial Analyst): A highly respected credential that opens doors to senior roles managing complex investment portfolios.

###

Years of Experience

Experience is arguably the most significant driver of a relationship manager's salary. As you build your skills, your client portfolio, and a track record of success, your compensation will grow accordingly.

- Entry-Level (0-3 Years): In this phase, you are likely a Relationship Manager I or an Associate. You'll handle smaller accounts and focus on learning the ropes. Expect a salary in the $65,000 to $90,000 range.

- Mid-Career (4-8 Years): As a Relationship Manager II or III, you manage more complex, higher-value client portfolios. Your autonomy increases, as does your bonus potential. Total compensation often falls in the $95,000 to $150,000 range.

- Senior-Level (8+ Years): Senior or Principal Relationship Managers handle the most strategic, high-net-worth, or enterprise-level accounts. Many also move into leadership, managing a team of other RMs. At this level, total compensation can easily exceed $150,000 and push well beyond $200,000, especially in lucrative sectors.

###

Geographic Location

Where you work matters. Salaries are typically higher in major metropolitan areas with a high cost of living and a concentration of large corporations and financial institutions. According to Salary.com's location-based calculator, a relationship manager in New York, NY, or San Francisco, CA, can expect to earn 20-25% more than the national average. Other high-paying cities include Chicago, Boston, and Los Angeles. Conversely, salaries in smaller cities and rural areas will likely be closer to the lower end of the national range.

###

Company Type

The type of company you work for dramatically impacts your earning potential.

- Retail Banking: RMs at local or regional banks work with individual consumers and small businesses. Compensation is solid but generally on the lower end of the spectrum.

- Commercial Banking: These RMs manage relationships with medium to large corporations. The role is more complex, and the compensation packages, including bonuses tied to loan origination and business growth, are significantly higher.

- Private Banking / Wealth Management: This is the most lucrative area. RMs cater to high-net-worth individuals (HNWIs) and families, managing substantial investment portfolios. Compensation is heavily tied to Assets Under Management (AUM), with nearly unlimited upside potential.

- Technology (SaaS): A growing field for RMs, often titled "Customer Success Managers" or "Account Managers." They work with enterprise clients to ensure they get value from a software product, focusing on retention and expansion. Salaries are very competitive and often include stock options.

###

Area of Specialization

Within these industries, specialization further refines your salary. A Corporate Banking Relationship Manager specializing in multi-million dollar commercial real estate loans will earn substantially more than a Small Business Banking Relationship Manager whose portfolio consists of smaller local businesses. Similarly, a Wealth Management Advisor for ultra-high-net-worth clients will out-earn a financial advisor at a retail investment firm.

Job Outlook

The future for relationship managers is bright. The U.S. Bureau of Labor Statistics projects that employment for Securities, Commodities, and Financial Services Sales Agents—a close proxy for many RM roles—is expected to grow 8% from 2022 to 2032, which is much faster than the average for all occupations.

This growth is driven by a simple fact: as financial products become more complex and clients seek personalized advice, the need for skilled professionals who can build trust and navigate a complex landscape will only increase. Automation can handle routine tasks, but it cannot replicate the strategic counsel and trusted partnership that a great relationship manager provides.

Conclusion

A career as a relationship manager offers a compelling package: engaging work, a direct impact on client success, and a lucrative compensation structure. While your starting salary will be solid, your long-term earning potential is firmly within your control.

To maximize your salary, focus on these key takeaways:

- Think Total Compensation: Look beyond the base salary and understand the significant role that bonuses and commissions play.

- Gain Experience & Specialize: Target high-value industries like commercial banking, wealth management, or enterprise tech.

- Never Stop Learning: Pursue advanced degrees or certifications like an MBA or CFP to stand out.

- Build Your Network: Your reputation and relationships are your most valuable assets.

For professionals who possess a powerful combination of financial acumen, strategic insight, and exceptional interpersonal skills, the path of a relationship manager is not just a job—it's a high-growth career with outstanding financial rewards.