One of the most persistent myths in the modern workplace is that receiving a salary automatically disqualifies you from earning overtime pay. For many professionals, this misunderstanding can lead to uncompensated work and significant lost earnings over a career. The truth is far more nuanced and is governed by specific federal and state laws.

Understanding your classification is crucial. For eligible salaried employees, overtime pay—typically 1.5 times their regular rate—can significantly boost annual income. This guide will demystify the rules, explain who is eligible, and detail the factors that determine your right to overtime pay, empowering you to ensure you are being compensated fairly for your time and expertise.

What It Means to Be a Salaried Employee

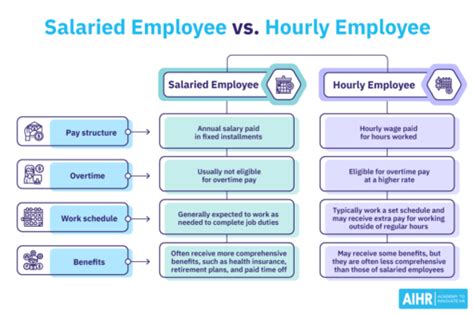

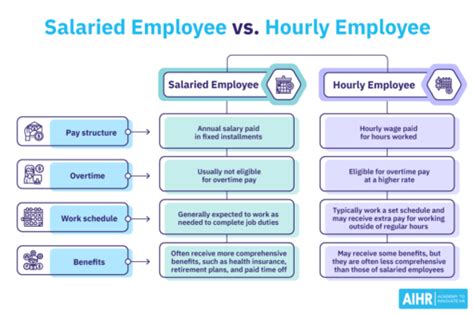

At its core, being a "salaried" employee means you receive a fixed, regular payment, such as weekly or bi-weekly, that does not fluctuate based on the specific number of hours you work in a pay period. However, this payment structure is only one piece of the puzzle.

The critical distinction for overtime purposes is not whether you are salaried, but whether you are classified as exempt or non-exempt under the Fair Labor Standards Act (FLSA), the federal law that establishes minimum wage and overtime standards.

- Non-Exempt Employees: Are entitled to overtime pay for all hours worked over 40 in a workweek. This applies to both hourly and some salaried employees.

- Exempt Employees: Are *not* entitled to overtime pay. To be classified as exempt, an employee must meet specific criteria related to their salary amount and their job duties.

Simply put: all employees are considered non-exempt unless their employer can prove they meet all the requirements for exemption.

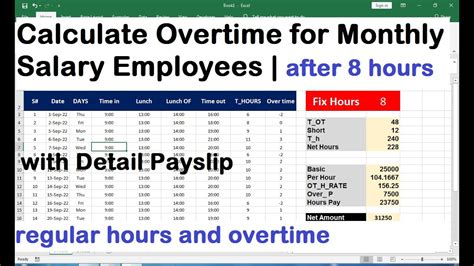

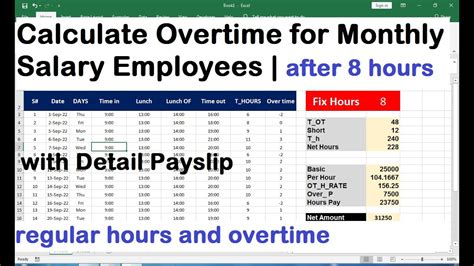

How Overtime Pay is Calculated for Salaried Employees

For salaried, non-exempt employees, calculating overtime can seem confusing, but it follows a clear formula. First, you must determine your "regular rate of pay."

1. Calculate Your Hourly Rate: Divide your weekly salary by the number of hours that salary is intended to cover (typically 40).

- *Example:* An employee earns a salary of $52,000 per year.

- Weekly Salary: $52,000 / 52 weeks = $1,000 per week.

- Regular Hourly Rate: $1,000 / 40 hours = $25 per hour.

2. Calculate the Overtime Rate: Multiply your regular hourly rate by 1.5.

- *Example:* $25 per hour x 1.5 = $37.50 per hour (overtime rate).

3. Calculate Total Pay: If this employee worked 45 hours in a week, their pay would be:

- 40 hours x $25 = $1,000 (regular pay)

- 5 hours x $37.50 = $187.50 (overtime pay)

- Total Weekly Pay: $1,187.50

Key Factors That Determine Overtime Eligibility

To be legally classified as exempt from overtime, an employee must meet both a salary threshold test and a duties test. If either test is not met, the employee is non-exempt and must be paid for overtime.

###

The Salary Threshold Test

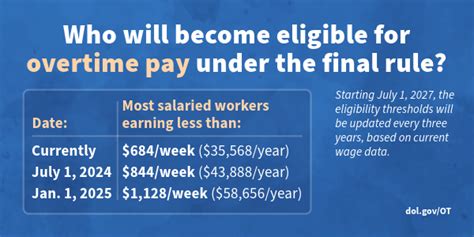

The U.S. Department of Labor (DOL) sets a minimum salary an employee must earn to even be considered for exemption. This threshold is updated periodically to reflect changes in wages.

As of a final rule issued in 2024, the federal salary threshold is increasing significantly:

- Effective July 1, 2024: The minimum salary for exemption rises to $844 per week (equivalent to $43,888 per year).

- Effective January 1, 2025: The threshold rises again to $1,128 per week (equivalent to $58,656 per year).

Source: U.S. Department of Labor, "Final Rule: Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees."

If a salaried employee earns less than this amount, they are automatically non-exempt and eligible for overtime, regardless of their job title or duties.

###

The Duties Test

If an employee meets the salary threshold, they must *also* primarily perform job duties that fit into one of the DOL's exemption categories. A job title alone is meaningless; the actual day-to-day responsibilities are what matter. The primary categories are:

- Executive Exemption: The employee’s primary duty must be managing the enterprise or a recognized department. They must customarily direct the work of at least two other full-time employees and have the authority to hire or fire (or their recommendations must be given significant weight).

- Administrative Exemption: The employee’s primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer. This role must include the exercise of discretion and independent judgment with respect to matters of significance. This is one of the most complex and frequently misapplied exemptions.

- Professional Exemption: This falls into two subcategories:

- Learned Professional: The employee's primary duty must be work requiring advanced knowledge in a field of science or learning, typically acquired through prolonged, specialized intellectual instruction (e.g., doctors, lawyers, engineers, accountants).

- Creative Professional: The employee's primary duty must be work requiring invention, imagination, originality, or talent in a recognized artistic or creative field (e.g., artists, musicians, writers).

- Computer Employee Exemption: The employee must be employed as a computer systems analyst, computer programmer, software engineer, or other similarly skilled worker in the computer field.

- Outside Sales Exemption: The employee’s primary duty must be making sales or obtaining orders, and they must be customarily and regularly engaged away from the employer’s place of business.

###

Geographic Location

While the FLSA sets the federal floor, many states have their own, more employee-friendly laws. In these cases, the employer must follow the law that provides greater protection to the employee.

For example, California has a much higher salary threshold for exemption. In 2024, an employee must earn at least $66,560 per year to be considered exempt. California also has stricter duties test requirements and provides for daily overtime (over 8 hours in a day), not just weekly.

Similarly, New York has different salary thresholds depending on the county, with the highest requirements in New York City, Westchester, and Long Island. As of 2024, the exempt salary threshold in these areas is $1,200 per week ($62,400 per year).

Sources: California Department of Industrial Relations; New York State Department of Labor.

###

Company Type and Industry

The type of company or industry doesn't change the legal tests, but it can influence how they are applied. For instance:

- Startups: In fast-paced startup environments, employees are often given broad titles but may spend most of their time on non-exempt tasks. An "Operations Manager" who primarily handles office supply orders and scheduling is likely non-exempt.

- Retail and Hospitality: Assistant managers in these industries are frequently misclassified as exempt. If their primary duty is performing the same work as the staff they supervise (e.g., running a cash register, stocking shelves) rather than true management, they are likely non-exempt.

- Tech Industry: While many software engineers meet the Computer Employee exemption, roles like IT help desk support or QA testers often do not, as their work may not require the level of systems analysis or programming specified by the DOL.

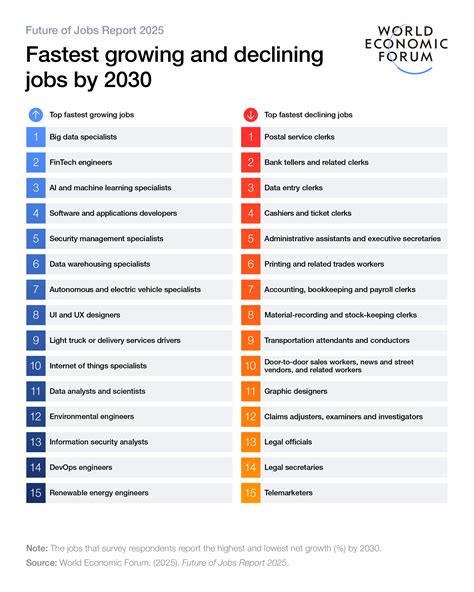

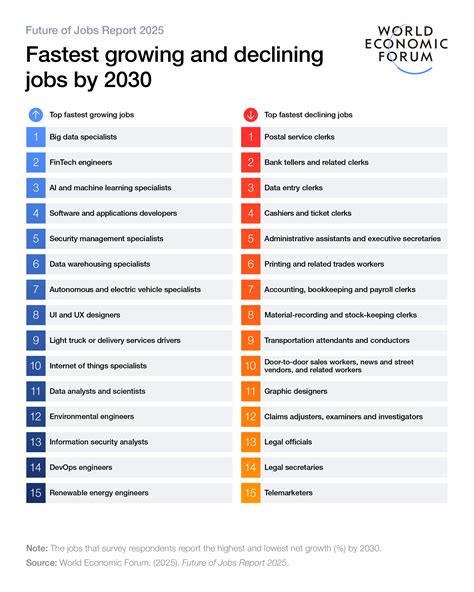

Job Outlook: An Evolving Landscape

The legal landscape surrounding overtime pay is not static. The recent DOL rule changes are a clear indication that federal and state governments are actively re-evaluating compensation standards to keep pace with the modern economy.

The trend is toward expanding overtime protections. This means that in the coming years, millions of U.S. workers who were previously considered exempt may become eligible for overtime pay. For professionals, this presents both a challenge and an opportunity. It is more important than ever to stay informed about your rights and to understand how your specific role is classified under these evolving regulations. According to salary aggregators like Payscale and Salary.com, roles that frequently hover near the salary thresholds—such as junior project managers, administrative coordinators, and certain specialized analysts—will be the most impacted by these changes.

Conclusion: Know Your Worth and Your Rights

Navigating the rules of salaried employment and overtime can be complex, but understanding the core principles is a vital part of professional self-advocacy.

Key Takeaways for Every Salaried Professional:

- "Salaried" does not equal "Exempt." Your right to overtime is determined by your pay level and your specific job duties, not your pay structure.

- Know the Thresholds. Be aware of the current federal and, more importantly, your state's minimum salary threshold for exemption. If you earn less, you are entitled to overtime.

- Analyze Your Duties. A fancy title doesn't make you exempt. Honestly assess if your primary, day-to-day responsibilities truly align with the executive, administrative, or professional duties tests.

- You Are Your Own Best Advocate. If you believe you are being misclassified, start by reviewing your job description and speaking with your HR department. If you need further clarification, consulting with your state's labor agency or an employment law attorney is a prudent next step.

By arming yourself with this knowledge, you can ensure that you are being fairly compensated for every hour of your hard work and expertise, paving the way for a more equitable and financially rewarding career.