Table of Contents

- [Introduction: The Unsung Heroes of Business](#introduction)

- [What Does a Payroll Professional Do? The Core of the Role](#what-does-a-payroll-professional-do)

- [Average Payroll Salary: A Deep Dive into Your Earning Potential](#average-payroll-salary-a-deep-dive)

- [Key Factors That Influence Your Payroll Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth in Payroll](#job-outlook-and-career-growth)

- [How to Launch Your Career in Payroll Accounting](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career in Payroll Right for You?](#conclusion)

---

Introduction: The Unsung Heroes of Business

In the intricate machinery of any successful company, there is a role so critical that its flawless execution goes unnoticed, yet a single mistake can cause widespread disruption and distress. This is the world of the payroll professional—the guardian of the company's most vital transaction: paying its people accurately and on time. If you're drawn to a career that combines meticulous detail, unwavering integrity, and a tangible impact on every single employee, then understanding the path of a payroll specialist, the professional who manages the "salaries payable account," is your first step toward a remarkably stable and rewarding future.

This career is far more than just data entry; it's a strategic function that sits at the intersection of finance, human resources, and legal compliance. The potential is significant. An entry-level payroll clerk might start around $45,000, but with experience, certifications, and specialization, a senior payroll manager or director can command a salary well into the six figures, often exceeding $120,000 or more annually.

I once consulted for a fast-growing tech firm that had just acquired a smaller competitor. The integration was a logistical nightmare, but the biggest immediate crisis was merging two entirely different payroll systems before the next pay cycle. It was the calm, methodical work of the senior payroll manager who, over one grueling week, reconciled every discrepancy, mapped every data field, and ensured that all 300+ employees were paid correctly. She was, without a doubt, the hero of that merger, preventing a catastrophe of morale and legal compliance.

This guide is designed to be your definitive roadmap. We will dissect every facet of this career, from daily responsibilities and salary expectations to the specific skills and certifications that will maximize your earning potential. Whether you're a recent graduate exploring your options or a professional considering a pivot, you'll find the expert insights and data-driven advice you need to build a successful and lucrative career in payroll.

---

What Does a Payroll Professional Do? The Core of the Role

Before diving into the numbers, it's crucial to understand the role itself. The term "salaries payable account" is a specific line item on a company's balance sheet—it's a liability representing the amount of money a company owes its employees for work they've already performed but for which they have not yet been paid. The individuals who manage the processes leading to this accounting entry are known by titles like Payroll Clerk, Payroll Specialist, Payroll Administrator, or Payroll Manager. For clarity, we'll refer to them collectively as "Payroll Professionals."

A Payroll Professional is the architect and executor of a company's entire payroll cycle. Their fundamental responsibility is to ensure that every employee receives the correct compensation in a timely and compliant manner. This goes far beyond simply multiplying hours by an hourly rate.

Core Responsibilities and Daily Tasks:

- Data Collection and Management: This is the foundation. Payroll Professionals collect and verify timekeeping information, whether from digital time clocks, manual timesheets, or salaried employee records. They are also responsible for maintaining pristine employee master files, which include details like pay rates, W-4 tax withholding information, direct deposit details, and benefit deduction authorizations.

- Payroll Processing: This is the main event. Using specialized payroll software (like ADP, Paychex, Workday, or Gusto), they process the payroll for a specific period (weekly, bi-weekly, semi-monthly). This involves calculating gross wages, overtime, bonuses, and commissions.

- Deductions and Withholdings: A critical and complex part of the job is accurately calculating and withholding statutory deductions like federal, state, and local income taxes, Social Security, and Medicare (FICA). They also manage voluntary deductions, such as health insurance premiums, 401(k) contributions, and wage garnishments.

- Compliance and Reporting: Payroll is governed by a labyrinth of laws. Professionals must stay current on the Fair Labor Standards Act (FLSA), state-specific wage and hour laws, and tax regulations. They are responsible for remitting withheld taxes to the appropriate government agencies and filing quarterly and annual reports, such as Form 941 and year-end W-2s.

- Employee Support and Communication: Payroll is often the first point of contact for employees with questions about their paychecks, deductions, or tax forms. A key part of the role is providing clear, patient, and accurate answers to these sensitive inquiries.

- Record Keeping and Audits: Meticulous records must be kept for a legally specified number of years. These records are essential for internal and external audits, where the Payroll Professional will work with auditors to verify the accuracy and compliance of the company's payroll processes.

### A "Day in the Life" of a Payroll Specialist (During a Processing Week)

To make this more concrete, let's walk through a typical day for a specialist at a mid-sized company.

- 8:30 AM: Log in and review emails. There's a notification from HR about a new hire starting today and a query from a manager about the deadline for submitting team bonuses.

- 9:00 AM: Begin the pre-processing audit. Run a report to check for missing timecard approvals. Send reminder emails to three managers who haven't approved their team's hours.

- 10:30 AM: Enter the new hire's information into the payroll system, carefully cross-referencing their W-4 and direct deposit forms to ensure 100% accuracy.

- 11:30 AM: Receive and process a court-ordered wage garnishment for an employee. This requires careful calculation and setup in the system to ensure legal compliance.

- 12:30 PM: Lunch break.

- 1:30 PM: The core processing begins. Initiate the bi-weekly payroll run in the ADP system. The software calculates gross-to-net pay for all 250 employees.

- 2:30 PM: Run a payroll register report. Begin the meticulous process of reconciliation, spot-checking a dozen employees' pay stubs against their records to look for any anomalies in pay rates, overtime hours, or deduction amounts.

- 4:00 PM: An employee from the marketing department calls, confused about why their net pay is lower this period. You patiently walk them through their pay stub, explaining that their new, higher 401(k) contribution started this cycle.

- 4:45 PM: After a final review and sign-off from the Payroll Manager, you submit the final payroll for processing. You then generate and save the required reports for the finance department and internal records.

- 5:15 PM: Final check of emails, set a reminder for the tax remittance deadline, and log off, knowing that 250 people will be paid correctly on Friday.

This snapshot reveals a role that demands a unique blend of technical skill, attention to detail, legal knowledge, and interpersonal communication.

---

Average Payroll Salary: A Deep Dive into Your Earning Potential

Now, let's talk numbers. Compensation for Payroll Professionals is influenced by a range of factors we'll explore in the next section, but it's essential to first establish a baseline. The salary for this career is competitive and offers a clear path for financial growth as you accumulate experience and expertise.

It's important to distinguish between different levels within the payroll hierarchy, as this is the primary driver of salary. We will look at data from several authoritative sources to build a comprehensive picture.

National Averages and Ranges

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Bookkeeping, Accounting, and Auditing Clerks, the category that most closely encompasses Payroll Specialists, was $47,440 in May 2022. The lowest 10 percent earned less than $31,300, and the highest 10 percent earned more than $71,150. However, this category is broad and includes general bookkeepers.

Data from more specialized salary aggregators, which allow us to filter specifically for "payroll" titles, often show higher figures.

- Salary.com, as of November 2023, reports the median salary for a Payroll Clerk II (a mid-level, experienced specialist) in the United States is $58,901, with a typical range falling between $52,997 and $65,581.

- Payscale.com provides a slightly broader view, stating the average salary for a Payroll Specialist is $55,270 per year, with a common range of $42,000 to $74,000.

- Glassdoor corroborates this data, reporting a total pay average of $64,449 per year for a Payroll Specialist in the US, which includes a base average of $56,715 and additional pay (bonuses, etc.) of around $7,734.

For senior and managerial roles, the compensation climbs steeply:

- For a Payroll Manager, Salary.com reports a median national salary of $105,178, with the top 10% earning over $128,000.

- A Payroll Director, who oversees the entire payroll function for a large organization, can expect a median salary of $160,832, according to Salary.com, with top earners exceeding $200,000.

### Salary Progression by Experience Level

Your salary will grow predictably as you move from an entry-level position to a seasoned expert. Here’s a typical salary trajectory for a Payroll Professional in the United States, synthesized from multiple data sources.

| Career Stage | Typical Job Title(s) | Years of Experience | Typical Annual Salary Range | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Payroll Clerk, Payroll Assistant | 0-2 Years | $42,000 - $52,000 | Data entry, verifying timesheets, processing new hire paperwork, answering basic employee queries. |

| Mid-Career | Payroll Specialist, Payroll Administrator | 2-5 Years | $53,000 - $70,000 | Full-cycle payroll processing, reconciliations, tax compliance, handling garnishments, generating standard reports. |

| Senior | Senior Payroll Specialist, Payroll Analyst | 5-8+ Years | $65,000 - $85,000 | Handling complex payroll issues (e.g., stock options, executive pay), system implementation, training junior staff, audit lead. |

| Management | Payroll Manager, Payroll Supervisor | 8+ Years | $85,000 - $125,000+ | Managing the payroll team, overseeing all payroll operations, developing policies, ensuring multi-state compliance, strategic planning. |

| Director-Level | Payroll Director, Global Payroll Director | 12+ Years | $125,000 - $200,000+ | Setting global payroll strategy, managing vendor relationships, ensuring enterprise-wide compliance, integrating payroll with finance/HR strategy. |

*Note: These ranges are national averages and can vary significantly based on the factors discussed in the next section.*

### Beyond the Base Salary: Understanding Total Compensation

Your paycheck is only one part of the equation. Total compensation provides a more accurate picture of your financial rewards. When evaluating a job offer, consider the full package:

- Bonuses: Many companies offer annual performance-based bonuses. For payroll departments, this can be tied to metrics like accuracy rates, successful audits, or project completion (e.g., implementing a new system). Bonuses can range from 3-5% of base salary at the specialist level to 10-20% or more at the manager and director levels.

- Profit-Sharing: Some companies, particularly private or smaller firms, distribute a portion of their profits to employees. This can be a significant addition to annual earnings but is less predictable than a standard bonus.

- Retirement Plans (401(k)/403(b)): A strong employer match is essentially free money. A common offering is a 50% match on the first 6% of your contribution, which is equivalent to an immediate 3% boost to your salary that grows tax-deferred.

- Health Insurance: The value of a comprehensive, low-deductible health, dental, and vision insurance plan cannot be overstated. A company that covers 80-100% of your monthly premiums is providing a benefit worth thousands of dollars per year compared to a company with high-premium, high-deductible plans.

- Paid Time Off (PTO): A generous PTO policy (vacation, sick days, personal days) is a valuable non-monetary benefit that contributes to work-life balance.

- Professional Development: Many employers will pay for the cost of certifications (like the CPP), continuing education courses, and attendance at industry conferences. This is a direct investment in your career and future earning potential.

When you combine a strong base salary with these additional components, a career in payroll becomes not just professionally stable, but financially robust.

---

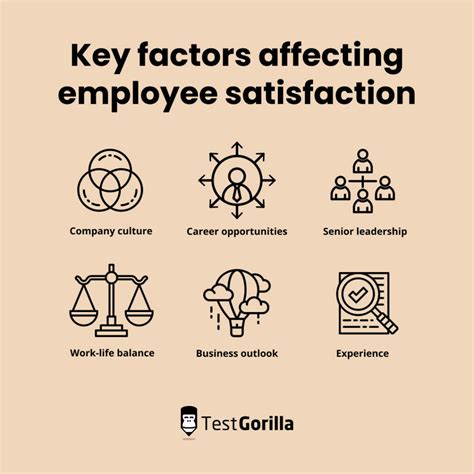

Key Factors That Influence Your Payroll Salary

While the national averages provide a good starting point, your personal earning potential is determined by a combination of specific, influential factors. Mastering these elements is the key to accelerating your salary growth. This is the most critical section for understanding how to maximize your income in the payroll profession.

### 1. Level of Education and Professional Certifications

Your formal education and, more importantly, your professional certifications, serve as the foundation of your career and have a direct impact on your starting salary and long-term trajectory.

Formal Education:

- High School Diploma or GED: This is the minimum requirement for most entry-level Payroll Clerk positions. At this level, you can expect a salary at the lower end of the spectrum, likely in the $40,000 to $48,000 range. The focus will be on your on-the-job trainability.

- Associate's Degree: An A.A. or A.S. in Accounting, Finance, or Business Administration is highly advantageous. It demonstrates a foundational understanding of accounting principles and business operations. Employers are often willing to pay a premium for this, and it can help you secure a Payroll Specialist role over a clerk position, potentially starting in the $48,000 to $55,000 range.

- Bachelor's Degree: A B.A. or B.S. in Accounting, Finance, or Human Resources is the gold standard for those with long-term ambitions of reaching management. While not strictly necessary for a specialist role, it opens the door to senior analyst, manager, and director positions. A bachelor's degree signals advanced analytical and strategic thinking skills, making you a candidate for roles that involve system implementation, process improvement, and financial reporting. Graduates can often command starting salaries in the $55,000 to $65,000 range, even with limited experience.

Professional Certifications (The Real Salary Multiplier):

In the payroll world, certifications from the American Payroll Association (APA) are the single most powerful tool for boosting your authority and salary.

- Fundamental Payroll Certification (FPC): This is the entry-level certification, designed for those new to the field. It validates your baseline knowledge of payroll fundamentals, from paycheck calculation to compliance. Earning your FPC can add $5,000 to $10,000 to your annual salary compared to a non-certified peer. It makes you a much more attractive candidate for your first or second job.

- Certified Payroll Professional (CPP): This is the most respected and sought-after credential in the industry. It is a rigorous exam that requires several years of experience and deep knowledge of advanced payroll topics, including taxation, accounting, systems, and management. Earning your CPP is a clear signal of expertise and leadership potential. According to the APA, CPPs earn, on average, 17% more than their non-certified counterparts. For a mid-career professional, this can translate to an immediate salary increase of $10,000 to $20,000 or more. It is often a prerequisite for Payroll Manager and Director roles.

### 2. Years of Experience

Experience is a direct measure of your ability to handle complexity, and you are compensated accordingly. The career ladder in payroll is well-defined, and each step comes with a significant pay increase.

- 0-2 Years (Entry-Level): At this stage, you are learning the ropes. Your focus is on accuracy in data entry and basic processing. Your value is in your reliability and attention to detail. Salary: $42,000 - $52,000.

- 2-5 Years (Mid-Career Specialist): You can now manage the entire payroll cycle independently. You understand tax withholdings, can handle most employee queries, and can perform reconciliations. You are a trusted, functional member of the team. Salary: $53,000 - $70,000.

- 5-10 Years (Senior Specialist/Analyst): You are the go-to person for complex problems. You might be the expert on multi-state payroll, stock option compensation, or international assignments. You likely lead projects like system upgrades and train junior staff. You might have your CPP at this stage. Salary: $65,000 - $85,000.

- 10+ Years (Manager/Director): You have transitioned from doing the work to managing the function. Your role is strategic. You are responsible for team performance, departmental budget, vendor management, and ensuring enterprise-wide compliance. Your expertise directly mitigates significant financial and legal risk for the company. Salary: $85,000 - $125,000+ for a Manager, and $125,000 - $200,000+ for a Director.

### 3. Geographic Location

Where you work matters—a lot. Salaries for the same role can vary by 30% or more depending on the cost of living and the demand for talent in a specific city or state.

High-Paying Metropolitan Areas:

Companies in major tech hubs and financial centers must offer higher salaries to attract talent and account for a high cost of living. According to data from Salary.com, a Payroll Specialist with typical experience can expect significantly higher pay in these cities:

1. San Jose, CA: ~25-30% above the national average.

2. San Francisco, CA: ~20-25% above the national average.

3. New York, NY: ~15-20% above the national average.

4. Boston, MA: ~10-15% above the national average.

5. Washington, D.C.: ~10-15% above the national average.

In a city like San Jose, a mid-career Payroll Specialist earning $60,000 on average nationally could expect to earn closer to $75,000 - $80,000.

Lower-Paying States and Regions:

Conversely, salaries tend to be lower in areas with a lower cost of living, typically in the South and rural Midwest. States like Mississippi, Arkansas, West Virginia, and Alabama often have payroll salaries that are 10-20% below the national average. However, the purchasing power of that salary may be equivalent to or even greater than a higher salary in an expensive city.

The Rise of Remote Work: The pandemic has complicated this factor. Many companies now hire nationally for remote roles. Some adjust pay based on the employee's location (geo-arbitrage), while others are moving toward standardized national pay bands, regardless of where the employee lives. As a job seeker, clarifying a company's philosophy on remote pay is crucial.

### 4. Company Type, Size, and Industry

The type of organization you work for has a profound impact on your compensation structure, work environment, and career opportunities.

- Startups and Small Businesses (<100 employees):

- Salary: Often at or slightly below the market average for base pay.

- Pros: Potential for equity/stock options which can be highly lucrative if the company succeeds. You'll likely wear many hats (HR, accounting, payroll), leading to rapid skill acquisition.

- Cons: Less job security, fewer resources, and benefits may be less comprehensive.

- Mid-Sized Companies (100 - 1,000 employees):

- Salary: Typically right around the market average.

- Pros: Often the "sweet spot." More structure and better benefits than a startup, but less bureaucracy than a massive corporation. Clear paths for advancement often exist.

- Cons: May lack the brand recognition or cutting-edge systems of larger competitors.

- Large Corporations (1,000+ employees):

- Salary: Often at or slightly above market average, with highly structured pay bands.

- Pros: Excellent benefits, robust retirement plans, job stability, and opportunities for specialization (e.g., joining the "Expat Payroll Team" or the "Payroll Tax Team").

- Cons: Can be bureaucratic, and career progression can sometimes be slower or more competitive.

- Government (Federal, State, Local):

- Salary: Base pay is often slightly below the private sector equivalent.

- Pros: Unmatched job security, excellent benefits, and generous pension plans that are rare in the private sector. Predictable hours and strong work-life balance.

- Cons: Slower-paced environment, advancement is often tied to tenure, and compensation is less flexible.

- Non-Profit Organizations:

- Salary: Tends to be 5-15% below the private sector.

- Pros: Mission-driven work that can be personally fulfilling. Often a strong sense of community and purpose.

- Cons: Tighter budgets can mean fewer resources and lower pay.

Industry Specialization: Certain industries have more complex payroll needs, and they pay a premium for professionals who can manage them.

- Construction: Requires knowledge of union contracts, certified payroll, and prevailing wage laws.

- Technology: Often involves complex equity compensation like stock options (ISOs, NSOs) and Restricted Stock Units (RSUs), which have unique tax implications.

- Healthcare: Involves complex scheduling, shift differentials, and on-call pay for a large, diverse workforce.

- Professional Services (e.g., Law, Consulting): May involve intricate partner draws and bonus structures.

Specializing in one of these high-complexity industries can make you a more valuable and higher-paid professional.

### 5