Welcome to the definitive guide on securing a top-tier accountant salary in New York City. If you're standing at the crossroads of your career, contemplating a future where your analytical skills are not just valued but highly rewarded, you've arrived at the right place. An accounting career in NYC isn't just a job; it's an entry ticket to the financial epicenter of the world, a place where numbers tell the story of global commerce, groundbreaking startups, and artistic empires. It's a path paved with challenges, complexity, and, for those who master it, significant financial and professional rewards.

The allure of New York City is powerful, but so is the cost of living. This reality makes understanding your earning potential not just an academic exercise, but a critical component of your life planning. The good news? The demand for skilled accountants in the five boroughs is perennial, and the compensation reflects that. While salaries can start in the respectable $70,000s for entry-level roles, it's not uncommon for experienced, specialized accountants—especially those with a CPA license—to command salaries well into the $150,000 to $250,000+ range.

I remember speaking with a partner at a major accounting firm overlooking Bryant Park a few years ago. She didn't talk about spreadsheets or tax codes; she talked about saving a beloved city institution from bankruptcy by uncovering financial misstatements and charting a new path to solvency. That’s the real power of an accountant in this city—you’re not just crunching numbers; you’re the trusted advisor, the financial strategist, and the guardian of economic integrity. This guide is built to give you the same strategic clarity for your own career that you will one day provide to your clients. We will dissect every factor, from certifications to specializations, to build your personal roadmap to success.

### Table of Contents

- [What Does an Accountant in NYC Do?](#what-does-an-accountant-in-nyc-do)

- [Average Accountant Salary in NYC: A Deep Dive](#average-accountant-salary-in-nyc-a-deep-dive)

- [Key Factors That Influence Your NYC Accountant Salary](#key-factors-that-influence-your-nyc-accountant-salary)

- [Job Outlook and Career Growth in NYC](#job-outlook-and-career-growth-in-nyc)

- [How to Become an Accountant in NYC: Your Step-by-Step Guide](#how-to-become-an-accountant-in-nyc-your-step-by-step-guide)

- [Conclusion: Is an Accounting Career in NYC Right for You?](#conclusion-is-an-accounting-career-in-nyc-right-for-you)

What Does an Accountant in NYC Do?

To the uninitiated, the word "accountant" might conjure images of a solitary figure hunched over a calculator during tax season. In a dynamic metropolis like New York City, this picture is woefully incomplete. An accountant here is a financial chameleon, adapting to the wildly diverse needs of the city's economic ecosystem. They are the bedrock of Wall Street, the strategic partners for Silicon Alley startups, the financial stewards of world-renowned museums, and the auditors ensuring the integrity of global fashion brands.

The core of the role remains constant: to prepare, analyze, and verify financial records. However, the application of this function is what defines the job. Your responsibilities are less about rote calculation and more about interpretation and strategy. You are the translator who converts raw financial data into actionable business intelligence.

Core Responsibilities and Daily Tasks:

A typical NYC accountant's duties can be broken down into several key areas:

- Financial Reporting & Record-Keeping: This is the foundation. You'll be responsible for maintaining the general ledger, preparing financial statements (like the balance sheet, income statement, and statement of cash flows), and ensuring all transactions are recorded accurately and comply with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- Tax Compliance and Strategy: Whether for a multinational corporation or a high-net-worth individual, you'll prepare federal, state, and local tax returns. More strategically, you'll work to minimize tax liabilities legally and advise on the tax implications of business decisions.

- Auditing and Assurance: In public accounting, you'll act as an independent third party, examining a company's financial statements to provide an opinion on their accuracy and fairness. As an internal auditor, you'll work within a company to identify and mitigate financial and operational risks.

- Budgeting and Forecasting: You will collaborate with department heads and executives to create annual budgets, monitor spending, analyze variances, and develop financial forecasts to guide future strategy. This is where accounting becomes forward-looking and highly strategic.

- Advisory and Consulting: Experienced accountants often move into advisory roles, providing guidance on mergers and acquisitions (M&A), corporate restructuring, risk management, and process improvement.

### A Day in the Life: Senior Accountant at a Media Company

To make this tangible, let's follow a day in the life of "Alex," a Senior Accountant at a large media company in Midtown Manhattan.

- 8:45 AM: Alex arrives, grabs coffee, and logs in. The first 45 minutes are spent reviewing overnight emails and the prior day's financial reports from their ERP system (like SAP or Oracle). They flag an unusual spike in production costs for a new streaming series.

- 9:30 AM: It's "month-end close" week. Alex spends the morning deep in reconciliation work, ensuring that sub-ledgers for accounts receivable and fixed assets tie out to the general ledger. This is detailed, meticulous work that requires intense focus.

- 11:00 AM: Alex joins a video call with the production manager for the streaming series. They share their screen, showing the cost variance report they generated. Together, they investigate the spike and discover it was due to an unexpected vendor charge. Alex documents the explanation for the monthly variance analysis report for the CFO.

- 12:30 PM: Alex grabs a quick lunch with colleagues from the finance team. The conversation is a mix of weekend plans and a debrief on the challenges of implementing a new expense reporting software.

- 1:30 PM: The afternoon shifts to a more strategic project. The company is considering acquiring a small podcasting network. Alex is part of the due diligence team and is tasked with analyzing the target company's financial health, identifying potential accounting risks, and building a model to project future cash flows.

- 4:00 PM: Alex meets with their manager, the Accounting Controller, to provide a status update on the month-end close progress and present initial findings from the due diligence project. They receive feedback and outline the next steps for their analysis.

- 5:30 PM: Before logging off, Alex prepares a to-do list for the next day, which includes finalizing several key reconciliations and scheduling a follow-up meeting with the legal team regarding the potential acquisition. The day was a blend of routine process, collaborative problem-solving, and high-stakes strategic analysis—a perfect snapshot of modern accounting in a major NYC corporation.

Average Accountant Salary in NYC: A Deep Dive

New York City operates on a different economic scale, and salaries for professional roles reflect this reality. The high cost of living, coupled with the immense concentration of high-value industries, creates a market where skilled accountants are compensated at a significant premium compared to the rest of the United States.

To establish a baseline, let's first look at the national picture. According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for accountants and auditors was $78,000 in May 2022. The lowest 10 percent earned less than $48,560, and the highest 10 percent earned more than $132,690.

Now, let's pivot to the New York City metropolitan area, where these figures see a substantial increase. It's important to consult multiple reputable sources, as each uses a slightly different methodology, data set, and definition of "accountant." By aggregating this data, we can form a more holistic and reliable picture.

- Salary.com (as of early 2024): Reports the average Staff Accountant I salary in New York, NY, is $77,092, with a typical range falling between $69,963 and $84,943. For a more senior role, like an Accounting Manager, the average jumps to $148,095, with a range typically between $131,883 and $165,998.

- Glassdoor (as of early 2024): Indicates the estimated total pay for an Accountant in the New York City area is $96,571 per year, with an average base salary of $81,392. "Total pay" includes bonuses, profit sharing, and other forms of cash compensation.

- Payscale (as of early 2024): Shows the average salary for an Accountant in New York, New York, is $81,041 per year. It also highlights the significant impact of skills, noting that proficiency in Financial Analysis can increase pay substantially.

Synthesizing this data, a general accountant in NYC can expect a base salary in the $75,000 to $95,000 range, with total compensation pushing closer to six figures once bonuses are included. However, this "average" is heavily skewed by a large number of early-career professionals. The real story—and the path to higher earnings—is revealed when we break down salaries by experience level.

### NYC Accountant Salary by Experience Level

Your value and, therefore, your salary, grows directly with your experience, your proven track record, and the complexity of the work you can handle. Here is a typical salary progression for an accountant in New York City.

| Experience Level | Typical Title(s) | Typical Base Salary Range (NYC) | Total Compensation Estimate (NYC) | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level (0-2 Years) | Staff Accountant, Junior Accountant, Audit Associate | $70,000 - $85,000 | $75,000 - $90,000 | Data entry, bank reconciliations, assisting with month-end close, preparing basic audit workpapers. |

| Mid-Career (3-7 Years) | Accountant, Senior Accountant, Senior Audit Associate | $85,000 - $125,000 | $95,000 - $140,000 | Managing full month-end close, complex reconciliations, financial statement preparation, mentoring junior staff, variance analysis. |

| Senior/Lead (8-15 Years) | Accounting Manager, Senior Manager, Controller (at smaller firms) | $125,000 - $180,000 | $140,000 - $220,000+ | Overseeing the entire accounting department, managing a team, internal controls, strategic financial planning, technical accounting research. |

| Executive (15+ Years) | Controller, Director of Accounting, VP of Finance, CFO | $180,000 - $300,000+ | $200,000 - $500,000+ | Setting financial strategy for the entire organization, M&A, investor relations, risk management, leading large finance functions. |

*Note: These are estimates based on aggregated data from sources like Robert Half, Salary.com, and Glassdoor. Actual salaries can vary significantly based on the factors discussed in the next section.*

### Beyond the Base Salary: Understanding Total Compensation

In the competitive NYC market, base salary is only one part of the financial equation. Total compensation provides a truer measure of your annual earnings. Here’s a breakdown of the other components you should expect and negotiate:

- Annual Performance Bonus: This is standard in most corporate and public accounting roles. It can range from 5-10% of base salary for junior staff to 20-50% or more for managers and directors. In high-finance industries like hedge funds or investment banking, bonuses can exceed 100% of base salary in good years.

- Signing Bonus: To attract top talent, especially those with in-demand skills or coming from a competitor, firms often offer a one-time signing bonus. This can range from $5,000 to $25,000 or more.

- Profit Sharing: Some private companies and partnerships distribute a portion of their annual profits to employees, tying your success directly to the company's performance.

- Stock Options & Restricted Stock Units (RSUs): Highly prevalent in the tech industry ("Silicon Alley"), equity compensation can be a significant long-term wealth builder. You are granted the option to buy company stock at a predetermined price (options) or are given shares that vest over time (RSUs).

- Retirement Contributions (401k Matching): A common benefit is a company match on your 401(k) contributions. A typical match might be 50% of your contributions up to 6% of your salary, which is essentially a guaranteed return on your investment.

- Other Benefits & Perks: Don't underestimate the value of a comprehensive health insurance plan (which can be worth $10,000-$20,000 annually), generous paid time off (PTO), paid parental leave, wellness stipends, and tuition reimbursement for continuing education or certifications like the CPA.

When evaluating a job offer in NYC, always look beyond the base salary. Calculate the full value of the total compensation package to make a truly informed decision.

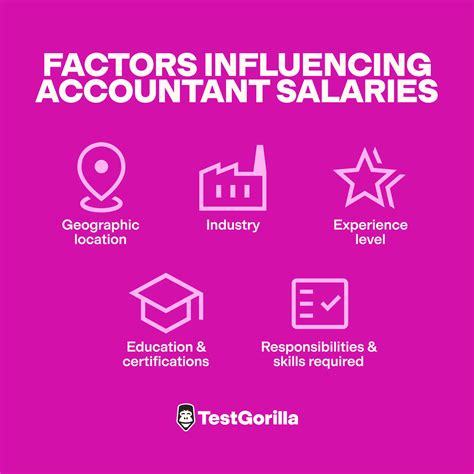

Key Factors That Influence Your NYC Accountant Salary

While we've established a baseline, the ~6000-word truth is that "average" salaries are a starting point for a much more nuanced conversation. Two accountants with the same years of experience can have vastly different incomes in New York City. Your personal salary trajectory will be determined by a powerful combination of specific, strategic choices you make throughout your career. This section is the most critical part of this guide; mastering these factors is the key to maximizing your earnings.

###

Level of Education and Professional Certifications

Your educational foundation sets the initial floor for your salary, but your professional certifications build the skyscraper.

Bachelor's Degree: A Bachelor of Science in Accounting is the non-negotiable entry ticket. Employers in NYC expect this as the bare minimum. The reputation of your university can matter, especially for your first job. Graduates from highly-ranked programs like NYU's Stern School of Business, Columbia University, Baruch College (known as a "CPA factory"), and Fordham University often have a competitive edge in recruiting for top firms and may command slightly higher starting salaries.

Master's Degree: A master's degree, typically a Master of Accountancy (MAcc) or a Master of Science in Taxation (MST), serves two primary purposes. First, it's the most common way to meet the 150-credit-hour requirement to sit for the CPA exam in New York State (a standard bachelor's is 120 hours). Second, it provides specialized knowledge that can lead to higher starting pay (a 5-10% bump is common) and faster promotions, especially in complex fields like international tax or forensic accounting. An MBA with an accounting concentration is another powerful option, particularly for those aiming for executive leadership (Controller, CFO) down the line.

The CPA: Your Golden Ticket

If there is one single factor that has the greatest impact on an accountant's salary and career ceiling, it is the Certified Public Accountant (CPA) license.

- What it is: The CPA is the highest standard of competence in the accounting profession, governed by state boards and the AICPA. It requires passing a rigorous four-part exam (Auditing, Business, Financial, and Regulation), meeting the 150-hour education rule, and fulfilling a work experience requirement.

- Why it's critical in NYC: In a market saturated with talent, the CPA is the ultimate differentiator. It signals expertise, ethical commitment, and professional dedication. For many roles, particularly in public accounting and management positions, it's not just preferred—it's mandatory. You cannot sign an audit report without it, and you'll find it nearly impossible to become a manager or partner at a public accounting firm without those three letters after your name.

- The Salary Impact: The impact is immediate and significant. According to a survey by the AICPA, CPAs earn, on average, 10-15% more than their non-credentialed counterparts. In NYC, this premium is often even higher. Robert Half's salary guide frequently notes that a CPA can add 5-15% to a candidate's salary range. Over a lifetime, this differential can amount to over $1 million in earnings. Firms often pay a "CPA bonus" of around $5,000 upon passing the exam and will cover the cost of review materials and exam fees.

Other High-Value Certifications:

- Certified Management Accountant (CMA): Ideal for those in corporate finance and managerial accounting. It focuses on internal financial planning, analysis, and decision support. It's a strong credential for aspiring Controllers and CFOs.

- Certified Internal Auditor (CIA): The global standard for professionals in internal audit. Essential for climbing the ladder in a corporation's internal audit department.

- Chartered Financial Analyst (CFA): While more finance-focused, many accountants in roles that bridge accounting and finance (e.g., transaction advisory, equity research) pursue the CFA charter. It's incredibly demanding but can lead to some of the highest-paying jobs in the financial services industry.

- Certified Fraud Examiner (CFE): This credential opens doors to the lucrative and fascinating world of forensic accounting, investigating white-collar crime, litigation support, and financial disputes.

###

Years of Experience and Career Trajectory

Experience is the engine of salary growth. In accounting, your career is not a single, linear path but a series of distinct stages, each with a corresponding jump in responsibility and compensation.

- Stage 1: The Foundation (Years 0-3): As a Staff Accountant or Audit Associate, you're learning the ropes. Your primary job is to execute tasks assigned by seniors. The learning curve is steep, especially in a "Big Four" public accounting firm (Deloitte, PwC, EY, KPMG), where you'll be exposed to numerous clients and industries. Salary growth is structured and predictable, with annual raises and a significant bump upon promotion to Senior (usually after 2-3 years).

- *NYC Salary Example:* Starting at $75,000, promoted to Senior Accountant at year 3, salary jumps to $95,000-$100,000.

- Stage 2: The Senior & Specialization Phase (Years 3-8): As a Senior Accountant, you're no longer just executing; you're managing. You review the work of junior staff, manage smaller projects, and are the primary point of contact for clients or business unit managers. This is a critical juncture where you often choose between staying in public accounting to pursue a management track or moving to an "industry" role in a corporation. Your salary growth accelerates as you demonstrate mastery and leadership potential.

- *NYC Salary Example:* A Senior Accountant at a tech company with 5 years of experience can earn $115,000 + bonus. A second-year Manager in public accounting could be at $140,000 + bonus.

- Stage 3: The Management Track (Years 8-15): Now you are an Accounting Manager, Controller, or Senior Manager. Your focus shifts from doing the work to managing the people and the processes. You are responsible for the accuracy and timeliness of the entire accounting function for a department, division, or entire company. Strategic thinking, leadership, and communication skills become more important than your technical accounting prowess.

- *NYC Salary Example:* An Accounting Manager at a Fortune 500 company in Manhattan can earn $160,000 base + 20% bonus. A Controller at a mid-sized manufacturing firm in Queens might earn $175,000 total compensation.

- Stage 4: The Executive Level (Years 15+): Titles like Director of Finance, VP of Finance, and Chief Financial Officer (CFO) occupy this tier. At this level, you are a key part of the executive leadership team. Your work is almost entirely strategic: guiding M&A activity, managing investor relations, securing financing, and setting the long-term financial course for the organization. Compensation becomes heavily tied to company performance and often includes significant equity.

- *NYC Salary Example:* A Controller at a large investment bank can earn well over $250,000 in total compensation. A CFO's salary can range from $200,000 at a non-profit to millions at a publicly traded company.

###

Company Type, Size, and Industry

Where you work is just as important as what you do. NYC’s diverse economy offers a wide spectrum of opportunities, each with its own distinct salary structure and culture.

Public Accounting (The Big Four & Mid-Tiers):

The "Big Four" firms are the premier training ground for accountants. They work you hard, but the experience and resume prestige are unparalleled. Compensation is highly structured, with lock-step salary increases for the first 5-7 years. While starting salaries are competitive, the hours can be brutal (60-80+ hours/week during busy season). Many accountants spend 3-5 years here to get their CPA and senior title before moving to a corporate role with better work-life balance and often, a significant pay increase. Mid-tier firms like BDO, Grant Thornton, and RSM offer a similar experience, sometimes with a slightly better work-life balance.

Corporate / Industry Accounting (By Sector):

This is where the real salary divergence occurs. Working "in-house" for a company can be vastly different depending on the industry.

- Financial Services (The Top Tier): This is the pinnacle of earning potential for accountants in NYC. Roles at investment banks, hedge funds, and private equity firms are extremely demanding but pay a massive premium. An accountant here is not just keeping the books; they are involved in fund accounting, product control, valuation, and supporting traders. It's not uncommon for a Vice President (a mid-level title in banking) in finance/accounting to earn $200,000 - $350,000+ in total compensation.

- Technology (Silicon Alley): NYC's booming tech scene offers high salaries and the allure of equity. A Senior Accountant at a pre-IPO startup might earn a base of $120,000, but their stock options could be worth hundreds of thousands if the company succeeds. Large, established tech companies (like Google or Meta's NYC offices) offer very high base salaries and RSU packages that can add another 20-40% to total compensation.

- Media, Entertainment & Fashion: These are iconic NYC industries. Salaries are very competitive