A career in asset management offers a unique blend of analytical rigor, strategic thinking, and the potential for significant financial rewards. For those fascinated by the dynamics of financial markets, it's a field where expertise directly translates into impact—and compensation. Professionals in this sector often command six-figure salaries, with top performers earning well into the millions through performance-based bonuses.

But what can you *really* expect to earn? The answer is complex, shaped by a variety of factors from your education and location to the type of firm you work for. This guide will break down the salary landscape in asset management, providing a clear, data-driven overview to help you navigate your career path.

What Does an Asset Manager Do?

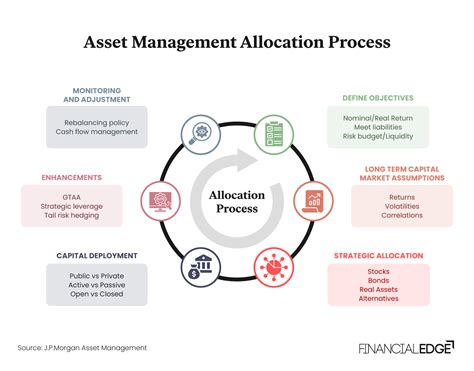

At its core, an asset manager is a financial steward responsible for managing investments on behalf of clients. These clients can range from individuals and families to large institutions like pension funds, insurance companies, and university endowments. The primary goal is to grow the value of the client's portfolio while managing an appropriate level of risk.

Key responsibilities include:

- Market Research & Analysis: Deeply analyzing economic trends, market conditions, and specific securities (stocks, bonds, real estate, etc.).

- Financial Modeling: Building complex models to forecast performance and value potential investments.

- Portfolio Construction: Strategically selecting a mix of assets that aligns with the client's goals and risk tolerance.

- Risk Management: Continuously monitoring the portfolio to mitigate potential losses.

- Client Relations: Communicating strategy, performance, and market outlooks to clients.

In essence, an asset manager makes critical decisions about where and how to invest capital to achieve financial growth.

Average Asset Management Salary

While headline-grabbing bonuses are common, it's important to understand the components of compensation: a base salary plus variable pay (bonuses, profit-sharing).

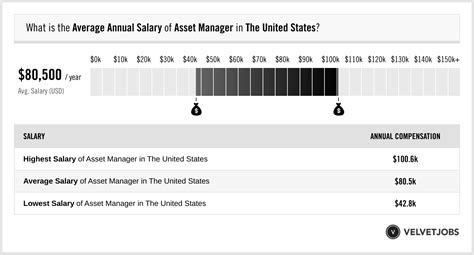

According to recent data from leading salary aggregators, the average base salary for an Asset Manager in the United States typically falls between $95,000 and $125,000 per year.

- Salary.com reports a median salary for an Asset Manager I at approximately $100,500, with a typical range between $89,000 and $117,000.

- Glassdoor lists a similar average base pay of around $104,000, but importantly, it also estimates an average "additional pay" (bonuses, etc.) of over $25,000, bringing the total compensation much higher.

However, this average is just a starting point. For entry-level analysts, salaries might begin in the $70,000 to $95,000 range, while senior portfolio managers and directors at top firms can see base salaries exceeding $200,000, with bonuses that can double or even triple their total earnings.

Key Factors That Influence Salary

Your specific salary will be determined by a combination of factors. Understanding these levers is key to maximizing your earning potential.

Level of Education

A strong educational foundation is non-negotiable in asset management.

- Bachelor's Degree: A bachelor's degree in finance, economics, accounting, or a related quantitative field is the standard entry requirement.

- Master's Degree: An advanced degree, such as a Master of Business Administration (MBA) from a top-tier school or a Master's in Finance (MFin), can significantly increase starting salaries and accelerate career progression.

- Professional Certifications: The Chartered Financial Analyst (CFA) designation is the gold standard in the investment management industry. Earning a CFA charter demonstrates a mastery of complex portfolio management and investment analysis, often leading to a substantial salary premium and access to more senior roles. Other valuable certifications include the Certified Financial Planner (CFP) for wealth management roles and the Chartered Alternative Investment Analyst (CAIA) for those specializing in hedge funds or private equity.

Years of Experience

Experience is perhaps the single most significant factor in determining your base salary and bonus potential. The career path is typically well-defined.

- Entry-Level (0-2 years): Working as a Research Analyst or Junior Analyst, you'll focus on data gathering, financial modeling, and supporting senior managers. Payscale estimates an average salary of around $75,000 at this stage.

- Mid-Career (3-8 years): As an Asset Management Associate or Manager, you gain more autonomy, manage smaller portfolios, and may begin to have client-facing responsibilities. Salaries often move into the $95,000 to $140,000 range, with bonus potential increasing significantly.

- Senior/Director Level (8+ years): At this level, you become a Senior Portfolio Manager, Director, or Vice President. Your role is highly strategic, and you are responsible for managing large pools of capital—often measured in "Assets Under Management" (AUM). Compensation becomes heavily tied to the performance of these assets. Base salaries can range from $150,000 to over $250,000, with bonuses making up a large portion of total pay.

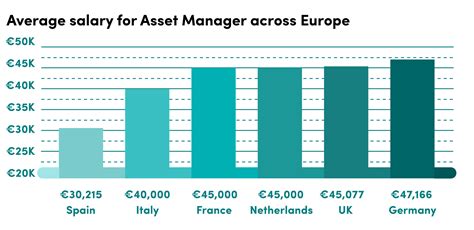

Geographic Location

Where you work matters. Major financial centers offer the highest salaries due to a concentration of top firms, a deep talent pool, and a higher cost of living.

- Top-Tier Cities: New York City is the undisputed leader in asset management compensation in the U.S., with salaries often 25-40% above the national average. Other high-paying hubs include San Francisco, Boston, and Chicago.

- Other Major Metro Areas: Cities like Charlotte, Dallas, and Los Angeles also have robust financial sectors and offer competitive salaries that are typically above the national average.

- Smaller Markets: In smaller cities, salaries will generally be lower, though this is often offset by a lower cost of living.

Company Type

The type of firm you work for has a dramatic impact on your compensation structure and ceiling.

- Large Asset Management Firms (e.g., BlackRock, Vanguard, Fidelity): These firms offer competitive base salaries, structured bonus programs, and excellent benefits. They provide stable, prestigious career paths.

- Hedge Funds: Known for their high-risk, high-reward environment. Base salaries may be comparable to or even slightly lower than large firms, but the bonus potential is astronomical. Compensation is heavily tied to performance fees ("2 and 20" model), meaning a successful year can lead to multi-million dollar paydays.

- Private Equity & Venture Capital: Similar to hedge funds, these firms offer massive upside potential through "carried interest," which is a share of the profits from successful investments. These are some of the most lucrative and competitive jobs in finance.

- Investment Banks (Asset Management Division): The asset management arms of banks like Goldman Sachs and J.P. Morgan offer highly competitive compensation packages that rival standalone firms.

- Insurance Companies and Pension Funds: These roles are often more conservative, with a focus on stable, long-term growth. Salaries are competitive, but bonus potential is generally more modest compared to hedge funds or private equity.

Area of Specialization

Within asset management, your niche can influence your value.

- Public Equities and Fixed Income: These are the traditional and largest areas of asset management. Compensation is strong and follows the experience-based path outlined above.

- Alternative Investments: Specializing in areas like private equity, venture capital, real estate, or complex derivatives is highly sought after. The complexity and illiquid nature of these assets mean that skilled managers can command premium salaries and performance fees.

- ESG (Environmental, Social, and Governance): This is a rapidly growing field as investor demand for sustainable investing skyrockets. Professionals with expertise in ESG analysis are in high demand, and compensation is becoming increasingly competitive.

Job Outlook

The future for asset management professionals is bright. According to the U.S. Bureau of Labor Statistics (BLS), employment for financial and investment analysts is projected to grow 8% from 2022 to 2032, which is much faster than the average for all occupations.

This growth is fueled by several factors, including:

- An aging population (e.g., Baby Boomers) in need of retirement planning and wealth management.

- Increasingly complex and globalized financial markets.

- A growing variety of investment products and services available to both individuals and institutions.

Conclusion

A career in asset management is both intellectually challenging and financially rewarding. While the national average salary provides a useful benchmark, your personal earning potential is directly in your control. The path to a top-tier salary is paved with a strong education, a commitment to continuous learning (like pursuing the CFA designation), and a track record of delivering performance.

By strategically choosing your specialization, targeting firms that align with your risk/reward appetite, and accumulating experience, you can build a successful and highly lucrative career as a steward of capital in the dynamic world of finance.