For individuals with a talent for sales, a sharp mind for numbers, and a passion for the automotive industry, the role of a Car Dealship Finance Manager is one of the most lucrative and rewarding career paths available. While challenging, this position offers a direct link between performance and pay, with top earners commanding impressive six-figure incomes. But what can you realistically expect to earn, and what factors control that potential?

This comprehensive guide will break down the salary for a car dealership finance manager, exploring the national averages, the key drivers of income, and the future outlook for this dynamic profession.

What Does a Car Dealership Finance Manager Do?

Often referred to as an F&I (Finance & Insurance) Manager, this professional is the final and one of the most critical steps in the vehicle purchasing process. They are the financial hub of the dealership, responsible for securing profitable deals for the business while helping customers navigate the complexities of vehicle financing.

Key responsibilities include:

- Securing Customer Financing: Working with a network of banks and lenders to find and secure loan approvals for customers at competitive rates.

- Selling Aftermarket Products: Presenting and selling optional "back-end" products that increase the dealership's profitability, such as extended warranties, GAP (Guaranteed Asset Protection) insurance, and vehicle protection plans.

- Ensuring Compliance: Meticulously managing all legal paperwork and ensuring every transaction adheres to strict federal, state, and local regulations.

- Building Lender Relationships: Maintaining strong relationships with lending institutions to ensure favorable terms and a high rate of approvals for the dealership.

In essence, the role is a high-stakes blend of finance, sales, and customer service.

Average Car Dealership Finance Manager Salary

A car dealership finance manager's salary is heavily performance-based, meaning "average" can be misleading. Total compensation is typically structured with a modest base salary supplemented by a significant commission and bonus component. This commission is earned on the profit from loans and the sale of F&I products.

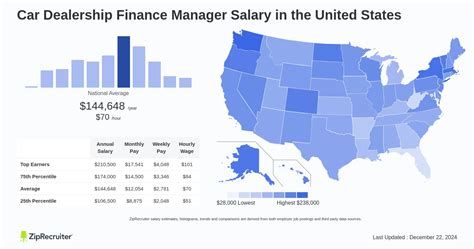

Here’s a look at what leading salary data aggregators report for total compensation (including base salary, commission, and bonuses):

- Salary.com: As of early 2024, the median total compensation for an Automotive Finance and Insurance Manager in the United States is $144,305. The typical range falls between $123,439 and $167,495, but top performers in high-volume dealerships can earn significantly more.

- Glassdoor: Reports an estimated total pay of $136,831 per year for an Automotive Finance Manager in the U.S., with a "likely range" of $99,000 to $190,000.

- Payscale: Shows a total pay range from $74,000 to $201,000 annually. It notes that a significant portion of this income comes from commissions, which can reach upwards of $120,000 per year for high achievers.

Key Takeaway: While a six-figure income is standard, there is a vast spectrum of earnings. A realistic expectation for a competent F&I manager is a total compensation package between $100,000 and $170,000, with the potential to exceed $200,000 for the elite in the field.

Key Factors That Influence Salary

Your specific earnings as an F&I manager are not left to chance. They are directly influenced by a combination of your skills, your environment, and your performance.

###

Level of Education

While a bachelor's degree is not always a strict requirement, it can provide a significant advantage. A degree in Finance, Business Administration, or Accounting equips you with a strong theoretical foundation in financial principles, which is highly valued by larger, corporate dealership groups. In many cases, candidates without a degree can substitute years of proven sales experience, often by working their way up from a car salesperson role. However, holding a relevant degree can accelerate your career path and open doors to management opportunities beyond a single dealership.

###

Years of Experience

Experience is arguably the most critical factor in determining an F&I manager's income.

- Entry-Level (0-3 years): Professionals new to the F&I office are building their skills, learning compliance, and establishing relationships with lenders. Their income will be on the lower end of the scale as they learn to master the art of selling aftermarket products.

- Mid-Career (4-10 years): With a proven track record, deep product knowledge, and strong negotiation skills, mid-career F&I managers see their income rise substantially. They are efficient, effective, and consistently produce profit for the dealership.

- Senior-Level (10+ years): These seasoned experts are top performers, often working at high-volume, luxury dealerships. They have mastered every aspect of the role and may take on additional responsibilities like training new F&I staff. Their earnings represent the peak potential for the profession.

###

Geographic Location

Where you work matters. Salaries are often higher in major metropolitan areas with a higher cost of living, such as Los Angeles, New York City, and Miami. More importantly, earnings are tied to the health of the local car market. A manager in a thriving economic region with high vehicle sales volume has more opportunities to write deals—and earn commission—than one in a slower, more rural market.

###

Company Type

The type of dealership you work for has a direct impact on your paycheck.

- Dealership Volume: A high-volume dealership that sells hundreds of cars per month provides far more opportunities for commission than a small, low-volume store.

- Brand Type (Luxury vs. Economy): Working at a luxury brand dealership (e.g., BMW, Lexus, Mercedes-Benz) often leads to higher earnings. The loan amounts are larger, and the profit margins on F&I products can be greater.

- Dealer Group Size: Large, publicly owned dealer groups (like AutoNation or Penske Automotive Group) may offer more structured training, better benefits, and a more stable base salary. In contrast, a smaller, family-owned dealership might offer a higher commission percentage as an incentive.

###

Area of Specialization

Within the F&I role, specializing in certain skills can make you an indispensable asset. A manager who becomes an expert in subprime financing—securing loans for customers with poor credit—can unlock a whole new segment of buyers for a dealership and be compensated accordingly. Likewise, a manager who consistently excels at selling high-margin products like ceramic coatings or extended service contracts will see their commission totals soar.

Job Outlook

The career outlook for financial professionals remains strong. According to the U.S. Bureau of Labor Statistics (BLS), employment for Financial Managers is projected to grow 16 percent from 2022 to 2032, a rate that is much faster than the average for all occupations.

While this data applies to all financial managers, it underscores the continued need for skilled professionals who can manage complex financial transactions. In the automotive world, as long as people are buying and financing vehicles, the need for talented F&I managers to secure profits and ensure compliance will remain constant.

Conclusion

The career of a Car Dealership Finance Manager is not for everyone. It demands resilience, exceptional sales skills, and a meticulous eye for detail. However, for those who thrive in a performance-driven environment, the rewards are substantial.

Here are the key takeaways for anyone considering this path:

- High Earning Potential: A six-figure income is not just possible; it's the standard for experienced professionals.

- Pay is Tied to Performance: Your success is directly in your hands. The more profit you generate for the dealership, the more you will earn.

- Experience is King: Your income will grow significantly as you gain experience and build a proven track record.

- Environment Matters: Your choice of dealership—from brand and volume to location—will play a huge role in your overall compensation.

If you are a driven individual looking for a career where your hard work and financial acumen can translate directly into a high income, becoming a car dealership finance manager is an opportunity well worth pursuing.