The role of a dealership Finance and Insurance (F&I) Manager is one of the most dynamic and financially rewarding careers in the automotive industry. Often working in the fast-paced "box," the F&I office is the profit center of a dealership, making the manager a critical component of its success. If you have a knack for finance, a talent for sales, and excellent interpersonal skills, this career path offers significant earning potential, with top performers earning well into the six figures.

This guide will provide a data-driven look into what a dealership finance manager earns, the factors that dictate their salary, and the future outlook for this exciting profession.

What Does a Dealership Finance Manager Do?

Before diving into the numbers, it's essential to understand the responsibilities of a dealership finance manager. This is far more than a simple administrative role; it's a high-stakes position that blends finance, sales, legal compliance, and customer service.

Key responsibilities include:

- Securing Financing: Working with a network of banks and lenders to find and secure competitive auto loans for customers.

- Selling F&I Products: Presenting and selling aftermarket products such as extended warranties, GAP (Guaranteed Asset Protection) insurance, tire and wheel protection, and vehicle service contracts. This is a primary source of commission-based income.

- Ensuring Compliance: Guaranteeing all sales and finance contracts adhere to strict federal, state, and local regulations, such as the Truth in Lending Act (TILA) and the Red Flags Rule.

- Managing Paperwork: Overseeing the vast amount of documentation required to complete a vehicle sale, ensuring accuracy and timeliness.

- Building Customer Relationships: Explaining complex financial terms and products in a clear, trustworthy manner to ensure customer satisfaction and repeat business.

Average Dealership Finance Manager Salary

The compensation for a dealership finance manager is heavily performance-based, typically consisting of a modest base salary supplemented by significant commissions and bonuses. This structure means that "average" salary figures can vary widely, but they consistently point to a lucrative career.

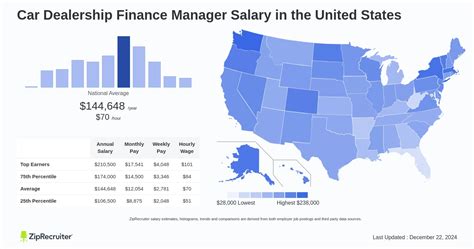

Here’s a look at the data from leading salary aggregators (last updated in 2023/2024):

- Salary.com: Reports the median salary for an Automotive Finance and Insurance Manager in the United States is $107,593, with a typical range falling between $92,670 and $124,960.

- Payscale: Shows a broader range, with total pay spanning from $52,000 to $158,000 per year. They report a median base salary of around $51,000, but emphasize that bonuses and commissions can add substantially to that figure.

- Glassdoor: Places the total estimated pay for a Finance Manager at a car dealership at $139,471 per year, with a likely range between $102,000 and $190,000.

Key Takeaway: While base salaries may start around $50,000, the total compensation package is where this role shines. A proficient finance manager can realistically expect to earn over $100,000 annually, with top-tier professionals in high-volume dealerships exceeding $200,000.

Key Factors That Influence Salary

Your earning potential isn't set in stone. Several key factors directly impact how much you can make as a dealership finance manager.

### Level of Education

While there is no strict educational requirement to enter the field, a formal degree can provide a significant advantage. A Bachelor's degree in Finance, Business Administration, or a related field is highly preferred by larger dealer groups and can lead to a higher starting salary. However, many successful F&I managers have built their careers on extensive in-dealership experience, often starting in sales. Industry-specific certifications in financial compliance or sales techniques can also boost your credentials and earning power.

### Years of Experience

Experience is arguably the most critical factor in determining a finance manager's income. The ability to structure complex deals, build lender relationships, and master the art of selling F&I products is honed over time.

- Entry-Level (0-2 Years): Individuals in this stage are often F&I trainees or have recently transitioned from a sales role. Their compensation is typically lower as they learn the ropes, often in the $60,000 to $85,000 range.

- Mid-Career (3-9 Years): With a solid track record, established lender connections, and a deep understanding of F&I products, these professionals see a significant jump in earnings. Their total compensation frequently falls between $90,000 and $150,000.

- Senior/Experienced (10+ Years): Top performers with a decade or more of experience are masters of their craft. They work at high-volume or luxury dealerships and may oversee an entire F&I department. Their earnings can consistently exceed $150,000 and push past $250,000 in prime markets.

### Geographic Location

Where you work matters. Salaries for finance managers vary significantly based on the cost of living and the size of the automotive market in a given area. Major metropolitan areas with high vehicle sales volume and higher living costs typically offer the highest salaries.

For example, data for the broader category of "Financial Managers" from the U.S. Bureau of Labor Statistics (BLS) shows that states like New York, California, New Jersey, and Texas offer some of the highest average salaries. This trend holds true within the dealership world, as a finance manager at a busy dealership in Los Angeles will likely have a higher earning potential than one in a small, rural town.

### Company Type

The type and size of the dealership play a massive role in your income potential.

- Large, Franchised Dealerships (e.g., Ford, Toyota, Honda): These high-volume stores offer a steady stream of customers, providing the greatest opportunity to write contracts and earn commissions.

- Luxury Brand Dealerships (e.g., BMW, Mercedes-Benz, Lexus): While they may have lower volume, the higher price of vehicles means larger loan amounts and more expensive F&I products, leading to bigger commissions per deal.

- Large Dealer Groups (e.g., AutoNation, Penske Automotive Group): These corporations offer structured career paths, excellent benefits, and opportunities for advancement into regional management roles.

- Independent Used Car Dealerships: Earnings here can be highly variable. A successful, high-volume independent lot can be very lucrative, but it may lack the brand recognition and structured support of a franchised dealer.

### Area of Specialization

Within the F&I role, developing specific skills can make you an indispensable asset. Managers who specialize in subprime financing—the ability to get loans approved for customers with poor credit—are extremely valuable to dealerships and can command higher pay. Likewise, becoming an expert in legal and regulatory compliance can increase your job security and value, as it protects the dealership from costly fines and legal action.

Job Outlook

The career outlook for financial professionals, including those in dealerships, is very strong. According to the U.S. Bureau of Labor Statistics (BLS), employment for Financial Managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations.

The BLS projects about 69,500 openings for financial managers each year, on average, over the decade. As the automotive industry continues to evolve with complex financing options and stringent regulations, the demand for skilled, knowledgeable, and ethical dealership finance managers will remain high.

Conclusion

A career as a dealership finance manager offers a direct path to a six-figure income for motivated and skilled individuals. It is a challenging, performance-driven role that rewards expertise in finance, sales acumen, and a commitment to customer service.

For those considering this path, the key takeaways are:

- High Earning Potential: Total compensation regularly exceeds $100,000, with top earners making over $200,000.

- Performance is Key: Your income is directly tied to your ability to secure financing and sell F&I products.

- Experience Pays: Longevity and a proven track record are the most significant drivers of salary growth.

- Strong Future Demand: The job market for skilled financial professionals is expected to grow significantly over the next decade.

If you are ready for a demanding but highly rewarding career at the financial heart of the automotive industry, the role of a dealership finance manager is an opportunity worth pursuing.