For aspiring finance professionals, securing a position at Goldman Sachs is often seen as the pinnacle of achievement. The firm's prestige, challenging work, and unparalleled exit opportunities are legendary. But beyond the reputation, a critical question looms for every candidate: What can you actually expect to earn?

An Analyst role at Goldman Sachs is not just a job; it's a launchpad for a high-impact career, and the compensation reflects that. While demanding, the financial rewards are substantial, with first-year total compensation packages often soaring well into the six-figure range, frequently between $175,000 and $200,000.

This article will break down the salary for a Goldman Sachs Analyst, explore the key factors that influence your earnings, and provide a clear outlook on what to expect from this coveted career path.

What Does a Goldman Sachs Analyst Do?

The title "Analyst" at Goldman Sachs typically refers to the entry-level position for recent undergraduate hires. It is an intensive two-to-three-year program designed to build a strong foundation in finance. While responsibilities vary by division (e.g., Investment Banking, Global Markets, Asset Management), a typical Analyst's duties include:

- Financial Modeling and Valuation: Building complex financial models to analyze companies, assess investment opportunities, and perform valuations for mergers, acquisitions, and IPOs.

- Market Research: Conducting in-depth research on industries, markets, and economic trends to support transactions and investment strategies.

- Preparing Client Materials: Creating detailed presentations, pitchbooks, and reports to communicate analysis and recommendations to senior bankers and clients.

- Due Diligence: Assisting with the due diligence process for deals, which involves verifying financial information and assessing potential risks.

- Supporting Senior Staff: Working closely with Associates, Vice Presidents, and Managing Directors on live deals and client requests.

Essentially, an Analyst is the engine room of the deal team, responsible for the analytical groundwork that drives major financial decisions.

Average Goldman Sachs Analyst Salary

When discussing compensation at an investment bank like Goldman Sachs, it's crucial to distinguish between base salary and total compensation. Total compensation includes the base salary plus a significant year-end performance bonus.

- Base Salary: As of 2023-2024, the base salary for a first-year Analyst at Goldman Sachs in a major financial hub like New York is typically $110,000 to $125,000. This base salary sees incremental increases with each year in the Analyst program.

- Performance Bonus: The bonus is highly variable and depends on individual performance, the division's success, and the firm's overall profitability for the year. For a first-year Analyst, this bonus can range from $60,000 to $90,000+.

- Total Compensation: Combining these figures, a first-year Analyst can realistically expect a total compensation package in the range of $175,000 to $215,000.

According to salary data aggregator Levels.fyi, which provides verified professional submissions, the median total compensation for a first-year Analyst at Goldman Sachs in 2023 was approximately $187,000, comprising a base salary of around $113,000 and a bonus of $74,000. Data from Glassdoor supports this, showing an estimated total pay range of $120,000 to $225,000 for the role.

Key Factors That Influence Salary

While the headline numbers are impressive, actual earnings can vary based on several critical factors.

### Level of Education

For an Analyst role, a bachelor's degree is the standard requirement. The prestige of the university (often referred to as "target schools" like Ivy League institutions, MIT, Stanford, etc.) is a major factor in securing an interview, but does not typically cause a direct variation in the starting base salary for undergraduate hires. All first-year Analysts in the same group and location generally receive the same base salary.

However, candidates with a Master of Business Administration (MBA) enter the firm at a higher level, typically as an "Associate," with a significantly higher compensation package.

### Years of Experience

Experience is a primary driver of salary growth. The Analyst program is structured for progression:

- First-Year Analyst: Earns the standard starting package.

- Second/Third-Year Analyst: Receives a bump in base salary and is eligible for a larger performance bonus as they take on more responsibility.

- Promotion to Associate: After 2-3 years, successful Analysts are often promoted to Associate. This comes with a substantial pay increase, with base salaries jumping to the $175,000-$225,000 range and total compensation potentially exceeding $300,000-$400,000.

### Geographic Location

Where you work matters. Goldman Sachs has offices worldwide, and compensation is adjusted based on the cost of living and local market rates.

- Major Financial Hubs (New York, London, Hong Kong): These locations offer the highest salaries to compensate for the extremely high cost of living and fierce competition for talent.

- Secondary Hubs (Salt Lake City, Dallas, Warsaw): The firm has been expanding its presence in lower-cost locations. While the base salary and bonus in these offices will be lower than in New York, the difference in cost of living can often result in higher disposable income for employees there. For example, an Analyst in Salt Lake City might have a lower nominal salary but greater purchasing power.

### Company Type

This article focuses on Goldman Sachs, a premier "bulge bracket" investment bank. Compensation within the industry varies:

- Bulge Bracket Banks (e.g., Goldman Sachs, J.P. Morgan): These firms offer very competitive and relatively standardized starting salaries for Analysts.

- Elite Boutique Banks (e.g., Evercore, Lazard, Centerview Partners): These smaller, specialized firms often compete for the same talent. While their base salaries are similar to bulge brackets, they are known for sometimes offering higher, more performance-sensitive bonuses, potentially leading to greater overall compensation in good years.

### Area of Specialization

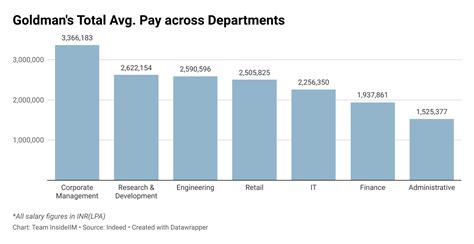

Your division within Goldman Sachs is one of the most significant factors in your earning potential.

- Investment Banking Division (IBD): This is traditionally the highest-paying division, focused on M&A advisory, underwriting, and other corporate finance activities. The bonuses here are typically the largest.

- Global Markets (Sales & Trading): Compensation is also very high but can be more volatile, as bonuses are tied closely to trading performance and market conditions.

- Asset Management & Wealth Management: These divisions offer very strong compensation, though the bonus component may be a slightly smaller percentage of the total package compared to IBD.

- Support & Federation Roles (e.g., Operations, Technology, Compliance, HR): While still well-compensated compared to other industries, these roles have a different pay structure with lower base salaries and significantly smaller bonuses than front-office roles.

Job Outlook

The broader profession of "Financial and Investment Analysts" is projected to grow, according to the U.S. Bureau of Labor Statistics (BLS). The BLS Occupational Outlook Handbook projects an 8% growth for financial analysts between 2022 and 2032, which is much faster than the average for all occupations. This growth is driven by a need for expert financial analysis across the economy.

However, it is critical to note that this statistic covers a wide range of analyst roles. Competition for positions at elite firms like Goldman Sachs remains extraordinarily intense. The number of applicants far exceeds the number of available positions, making it one of the most competitive career paths for new graduates.

Conclusion

A career as an Analyst at Goldman Sachs offers a pathway to exceptional financial rewards and professional growth. While the work is famously demanding, the compensation structure is designed to attract and retain top-tier talent.

For those considering this path, here are the key takeaways:

- Think in Total Compensation: Your salary is more than just the base; the year-end bonus is a massive component of your earnings.

- Performance is Paramount: Your bonus, and therefore a large part of your pay, is directly tied to your performance and the success of your team and the firm.

- Your Division and Location Matter: The highest earning potential is in front-office roles like Investment Banking, located in major financial centers like New York.

- It's a Marathon, Not a Sprint: Compensation grows significantly with experience and promotion, making the long-term career trajectory incredibly lucrative.

Ultimately, a role at Goldman Sachs is an investment in your future. The skills, network, and financial foundation you build as an Analyst can set the stage for a successful and rewarding career, whether you stay in finance or pursue other ventures.