For ambitious students and young professionals in finance, securing a role at Goldman Sachs is often seen as the pinnacle of achievement. The firm's prestige is legendary, but so is its reputation for demanding excellence. A key question for anyone aspiring to walk these revered halls is: What can you actually expect to earn?

An analyst position at Goldman Sachs is not only a powerful career launchpad but also one of the most lucrative entry-level roles available today. A first-year analyst can expect a total compensation package that often soars well into the six figures, combining a strong base salary with a significant performance-based bonus.

This article will break down the components of a Goldman Sachs analyst's salary, explore the key factors that influence your earnings, and provide a clear picture of what you can expect in this highly competitive and rewarding career.

What Does an Analyst at Goldman Sachs Do?

At Goldman Sachs, the "Analyst" title typically refers to the entry-level position for recent undergraduate hires. This is a two-to-three-year program designed to provide a foundational understanding of the firm and the financial markets. While the day-to-day responsibilities vary by division (e.g., Investment Banking, Asset Management, Global Markets), the core of the analyst role involves intense analytical and support work.

Common responsibilities include:

- Financial Modeling: Building complex spreadsheets to forecast a company's financial performance, often for mergers, acquisitions, or capital raising.

- Valuation Analysis: Using methodologies like Discounted Cash Flow (DCF), Comparable Company Analysis (Comps), and Precedent Transactions to determine the value of a company or asset.

- Creating Presentations: Developing detailed "pitch books" and other presentation materials for clients.

- Due Diligence: Conducting in-depth research on companies and industries to support transactions.

- Market Research: Staying abreast of market trends, economic news, and industry-specific developments.

It is a high-stakes, high-pressure role known for its demanding hours, but it offers an unparalleled learning experience.

Average Goldman Sachs Analyst Salary

Compensation at an investment bank like Goldman Sachs is famously divided into two main parts: a base salary and a year-end bonus. It is crucial to consider both to understand the full earning potential.

According to the latest industry reports and salary data aggregators, a first-year analyst at Goldman Sachs in a major financial hub like New York can expect the following:

- Base Salary: In recent years, major investment banks have standardized entry-level pay. The base salary for a first-year analyst is approximately $110,000 per year. This figure typically sees a modest increase for second and third-year analysts.

- Performance Bonus: The bonus is highly variable and depends on both the firm's overall performance and the individual's contribution. It can range from 50% to 100% of the base salary.

- Total Compensation: Combining these figures, a first-year analyst's total compensation typically falls in the range of $160,000 to $220,000.

As cited by Glassdoor, the estimated total pay for an analyst at Goldman Sachs is around $148,000 per year, with a base salary average of $109,000. These figures represent an aggregation across various divisions and experience levels within the analyst program, reinforcing the strong six-figure earning potential from day one.

Key Factors That Influence Salary

While the starting figures are high, several factors can significantly influence an analyst's compensation throughout their tenure and career progression.

### Level of Education

The standard entry point for an Analyst role is a bachelor's degree from a top-tier university. While the specific major is less important than demonstrated analytical ability, degrees in Finance, Economics, Mathematics, and Computer Science are common.

However, a graduate degree changes the entry point and salary equation entirely. Individuals with a Master of Business Administration (MBA), particularly from an elite program, do not enter as Analysts. They join at the Associate level, which comes with significantly higher pay. A first-year Associate's base salary often starts at $175,000 or more, with a bonus structure that can push total compensation well over $300,000.

### Years of Experience

Experience is the primary driver of compensation growth at an investment bank. The career track is well-defined:

- Analyst (Years 1-3): As mentioned, base salary starts around $110,000 and total compensation can approach $220,000. Pay increases incrementally each year in the program.

- Associate (Post-MBA or promotion): This is the next level up. Compensation jumps significantly, reflecting greater responsibility.

- Vice President (VP), Director, and Managing Director (MD): At these senior levels, base salaries continue to rise, but the bonus component becomes the vast majority of compensation. Earnings for VPs and above are heavily tied to performance and deal flow, regularly reaching the high six-figures and well into the seven-figures for successful Managing Directors.

### Geographic Location

Where you work matters. Goldman Sachs adjusts salaries to account for the cost of living and the competitiveness of the local market.

- Major Financial Hubs (New York, London, Hong Kong): These locations offer the highest salaries to attract top talent in the most expensive cities. The figures cited in this article are representative of these HCOL (high cost-of-living) areas.

- Other US Offices (e.g., Salt Lake City, Dallas): While still highly competitive, salaries in these locations may be slightly lower than in New York. However, the reduced cost of living can result in greater disposable income. Data from Salary.com shows that financial analyst salaries can vary by over 15-20% between a major metropolitan area and a smaller city.

### Area of Specialization

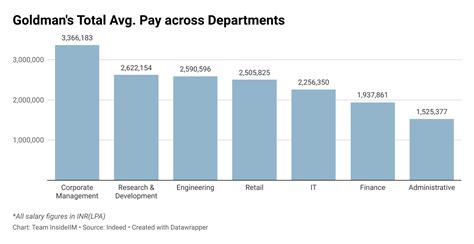

Not all analyst roles at Goldman Sachs are created equal in terms of pay. The division you work in is a major factor.

- Investment Banking Division (IBD): This is the traditional, client-facing M&A and capital markets group, and it typically offers the highest compensation for analysts.

- Global Markets (Sales & Trading): Compensation is also at the top-tier, but the bonus can be more volatile as it is often directly linked to trading performance (P&L).

- Asset & Wealth Management: These roles offer very strong compensation, though they may start slightly below the top IBD and Markets pay scales.

- Corporate and Support Divisions (e.g., Technology, Operations, Risk, Compliance): While these roles at Goldman Sachs pay extremely well compared to similar positions at other corporations, they generally have a lower salary and bonus structure than the "front-office" revenue-generating divisions.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) projects that employment for Financial Analysts in general is expected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS reported the median annual wage for financial analysts was $96,220 in May 2022.

It is critical to note that these BLS figures represent the entire profession, from corporate finance roles to government positions. Roles at elite investment banks like Goldman Sachs exist at the very top of this field. While the overall demand for financial expertise is strong, the competition for analyst positions at Goldman Sachs is exceptionally fierce, with thousands of applicants vying for a small number of spots each year.

Conclusion

A career as an analyst at Goldman Sachs represents an opportunity for unparalleled professional growth and significant financial reward. From the first year, you can expect a total compensation package that far exceeds nearly any other entry-level profession.

Key Takeaways:

- Expect Total Compensation: For first-year analysts, focus on total compensation (base + bonus), which typically ranges from $160,000 to $220,000.

- Bonus is Key: The performance-based bonus is a huge part of your earnings and grows in importance as you gain experience.

- Experience Pays: Your salary will scale dramatically as you progress from Analyst to Associate, VP, and beyond.

- Location and Division Matter: Where you work and which part of the bank you work for will have a direct impact on your salary.

While the path is demanding and requires unwavering dedication, for those with the ambition and analytical prowess to succeed, a career at Goldman Sachs provides a powerful and lucrative foundation for a future in finance.