For ambitious students and young professionals with a passion for finance, a career as an investment banking analyst is one of the most prestigious and financially rewarding paths available. While notorious for its demanding hours and high-pressure environment, the role offers unparalleled learning opportunities and a compensation package that is difficult to match in any other entry-level profession. First-year analysts can realistically expect a total compensation package well into the six figures, often ranging from $175,000 to over $225,000.

This article provides a data-driven, in-depth look at what an investment banking analyst earns, the key factors that influence their salary, and what you can expect from this challenging yet lucrative career.

What Does an Investment Banking Analyst Do?

Before diving into the numbers, it's essential to understand the role. Investment banking analysts are the workhorses of the banking world. They are typically recent university graduates who join a bank for a two-to-three-year program.

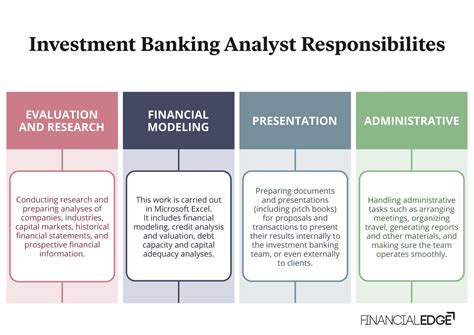

Their primary responsibilities are to support senior bankers in providing advisory services to corporations, governments, and other institutions. This involves:

- Financial Modeling: Building complex spreadsheets to project a company's financial performance.

- Valuation Analysis: Using various methods like Discounted Cash Flow (DCF), Comps (Comparable Company Analysis), and Precedent Transactions to determine a company's worth.

- Preparing Materials: Creating "pitch books," presentations, and memorandums for client meetings.

- Due Diligence: Conducting in-depth research on companies and industries ahead of a merger, acquisition, or capital raise.

In short, analysts provide the analytical foundation that enables banks to execute major transactions like Initial Public Offerings (IPOs), Mergers & Acquisitions (M&A), and debt financing.

Average Investment Banking Analyst Salary

The compensation for an investment banking analyst is famously split into two main components: a base salary and an end-of-year performance bonus. Understanding both is critical to grasping the full earnings potential.

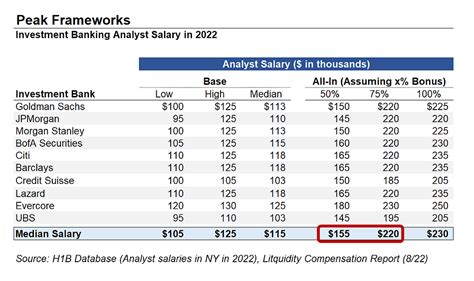

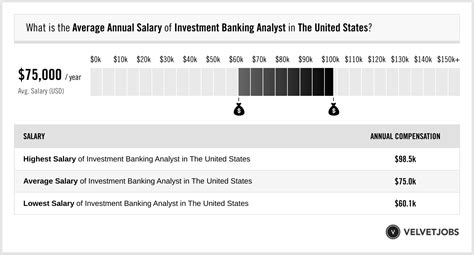

- Base Salary: As of 2023 and early 2024, the industry standard for first-year analyst base salaries at major banks in the U.S. has risen significantly. According to data from Salary.com and industry reports from sources like Wall Street Oasis, entry-level base salaries typically fall between $100,000 and $125,000 per year.

- Performance Bonus: The bonus is the variable component and is a major part of the total compensation. It's paid out at the end of the year and is based on both individual and firm performance. For a first-year analyst, this bonus can range from 50% to 100% of their base salary.

- Total Compensation: Combining these figures, a first-year investment banking analyst can expect a total compensation package in the range of $175,000 to $225,000. This number typically increases each year of the analyst program. A second-year analyst, for example, might see their base rise to $125,000-$135,000 with a bonus that pushes their total compensation closer to the $250,000 mark.

Data from Glassdoor supports this, showing an average total pay for an Investment Banking Analyst in the United States at around $169,000, with a likely range that extends well beyond $200,000 when top-tier firms and bonuses are factored in.

Key Factors That Influence Salary

While the headline numbers are high, actual compensation can vary based on several crucial factors.

###

Level of Education

A bachelor's degree is the standard entry requirement for an analyst role. While banks hire from all majors, degrees in finance, economics, accounting, or a STEM field are most common. Crucially, the prestige of your university plays a significant role. Banks heavily recruit from "target schools" (e.g., Ivy League universities, NYU, UChicago, Michigan) and "semi-target schools," and a degree from one of these institutions can enhance your earning potential and opportunities.

An MBA (Master of Business Administration) is the typical path to the post-analyst "Associate" level, which comes with a substantial pay increase. An MBA graduate starting as an Associate can expect a base salary of $175,000 or more, with a total compensation package that can exceed $300,000 in their first year.

###

Years of Experience

Experience is a direct driver of compensation within the analyst program. Banks have a structured and transparent progression for salary increases.

- First-Year Analyst: Base: $100k - $125k | Total Compensation: $175k - $225k

- Second-Year Analyst: Base: $115k - $135k | Total Compensation: $200k - $250k

- Third-Year Analyst: Base: $125k - $150k | Total Compensation: $225k - $275k+

This steady progression rewards analysts for staying with the firm and developing their skills.

###

Geographic Location

Where you work matters. Major financial hubs command the highest salaries, largely to compensate for a higher cost of living.

- New York City: As the epicenter of global finance, NYC sets the benchmark for salaries. Compensation here is typically at the top of the range.

- San Francisco: Driven by the tech industry, Bay Area banking jobs also offer top-tier pay, often rivaling or even exceeding New York.

- Other Major Hubs: Cities like Chicago, Los Angeles, and Houston also host significant banking operations with competitive salaries, though they may be slightly below the NYC benchmark. Salaries in international hubs like London and Hong Kong are also highly competitive but can be affected by currency exchange rates and local market conditions.

###

Company Type

The type of bank you work for is one of the most significant factors influencing your pay.

- Bulge Bracket Banks (e.g., Goldman Sachs, J.P. Morgan, Morgan Stanley): These are the largest global banks. They generally offer standardized, high base salaries and very strong bonuses. The brand prestige is also a major career asset.

- Elite Boutique Banks (e.g., Evercore, Lazard, Centerview Partners): These smaller, specialized firms often focus exclusively on advisory services like M&A. While their base salaries are competitive with bulge brackets, their bonuses can sometimes be even higher, leading to potentially greater all-in compensation.

- Middle Market Banks (e.g., Baird, Houlihan Lokey, William Blair): These firms work on smaller deals than the bulge brackets but offer excellent experience. Their compensation is very competitive, though it may trail the absolute top tier by a small margin. They are often cited as offering a slightly better work-life balance.

###

Area of Specialization

Within a bank, analysts are assigned to either an industry group or a product group. While base salaries are generally uniform across the analyst class, bonus payouts can be influenced by the performance of your specific group.

- Industry Groups: Cover specific sectors like Technology, Media & Telecom (TMT), Healthcare, Industrials, or Financial Institutions Group (FIG).

- Product Groups: Specialize in certain transaction types, such as Mergers & Acquisitions (M&A), Leveraged Finance (LevFin), or Restructuring.

A group that has a very successful year with high deal flow (e.g., M&A or TMT during a tech boom) may see a larger bonus pool, which can translate into higher individual bonuses for its analysts.

Job Outlook

The field of finance is dynamic and competitive. According to the U.S. Bureau of Labor Statistics (BLS), the broader category of "Financial and Investment Analysts" is projected to grow 8% from 2022 to 2032, which is faster than the average for all occupations. The BLS reports a median pay of $99,140 per year for this category in May 2023.

It's important to note that investment banking is a highly specialized and top-paying subset of this broader category, and its compensation far exceeds this median figure. While overall growth is projected, entry into top-tier investment banks remains exceptionally competitive, with firms seeking only the most qualified and driven candidates.

Conclusion

A career as an investment banking analyst is not for the faint of heart. It demands long hours, intense focus, and a high degree of resilience. However, the rewards are commensurate with the challenges. For those who succeed, the career offers:

- Exceptional Earning Potential: A first-year total compensation package approaching or exceeding $200,000 is standard.

- Accelerated Career Growth: The skills learned in financial modeling, valuation, and transaction execution are a powerful launchpad for future roles in private equity, hedge funds, or corporate finance.

- Unmatched Experience: Analysts gain direct exposure to the most significant financial transactions shaping the global economy.

For any prospective student or professional considering this path, the financial incentives are clear and compelling. If you have the drive, analytical prowess, and work ethic, a role as an investment banking analyst can be one of the most rewarding starts to a career in finance.