A career as a State Farm agent offers a unique blend of entrepreneurship and brand-name stability, attracting professionals who are driven, personable, and eager to build their own success. But what does that success look like financially? For those considering this path, the primary question is often: "What is the typical salary for a State Farm agent?"

The answer is complex and rewarding. While entry-level team members can expect a solid starting salary, successful State Farm Agent owners often build businesses that generate six-figure incomes. This article will break down the salary structures, influencing factors, and long-term outlook for this dynamic career.

What Does a State Farm Agent Do?

Before diving into the numbers, it's crucial to understand the role. A State Farm agent is more than just a salesperson; they are a trusted local advisor and a small business owner. Operating as independent contractors under the renowned State Farm brand, their responsibilities include:

- Consulting with Clients: Assessing the insurance needs of individuals and families to recommend appropriate coverage, including auto, home, life, and health insurance.

- Sales and Marketing: Proactively generating leads, marketing their agency within the local community, and selling new policies.

- Client Relationship Management: Providing ongoing service, handling claims, and conducting regular policy reviews to retain customers.

- Business Operations: As agency owners, they are responsible for hiring and training their own team members, managing budgets, and overseeing the day-to-day operations of their office.

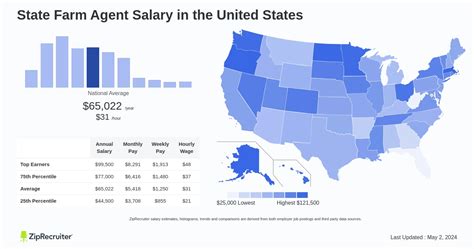

Average Salary for State Farm Agents

Salaries in the State Farm ecosystem are not one-size-fits-all. The most significant distinction is between a State Farm Agent (Agency Owner) and a State Farm Team Member who works for that agent.

- State Farm Agent (Agency Owner): An agent's income is not a traditional salary. It is derived from commissions on new policies and renewals, minus the significant expenses of running a business (rent, utilities, marketing, and team member salaries). The earning potential is directly tied to their ability to build and retain a large book of business. According to Glassdoor, the estimated total pay for a State Farm Agent in the United States is around $129,500 per year, with a likely range between $86,000 and $196,000. However, top-performing agents in prime locations can significantly exceed this range.

- State Farm Team Member: These professionals are employees of the agent owner. Their compensation is typically a combination of a base salary plus commissions or bonuses. Data from Salary.com shows that an Insurance Sales Agent working at a State Farm agency can expect an average salary between $47,905 and $58,201, with experienced team members earning more.

For broader industry context, the U.S. Bureau of Labor Statistics (BLS) reports that the median annual wage for all Insurance Sales Agents was $57,860 as of May 2022. The top 10% of earners in the profession brought in more than $131,970, highlighting the high potential in this field.

Key Factors That Influence Salary

Your earnings as a State Farm professional are not set in stone. Several key factors will determine your financial trajectory, whether you are an agency owner or a team member.

### Level of Education

While a bachelor's degree is not a strict requirement to become a licensed insurance agent, it is often preferred by State Farm for its agency owner program. A degree in business, finance, economics, or marketing provides a strong foundation for managing a business, understanding financial products, and developing effective marketing strategies. For team members, a degree can make a candidate more competitive but is less critical than sales aptitude and customer service skills. The primary requirement for all roles is passing the state licensing exams.

### Years of Experience

Experience is arguably the most powerful driver of income in an insurance career.

- For Agency Owners: A new agent's income is primarily from new business commissions. Over time, as their book of business grows, a substantial portion of their income comes from recurring renewal commissions. A veteran agent with thousands of policies in force will have a much higher and more stable income than one just starting out.

- For Team Members: An entry-level team member may start with a lower base salary and smaller commission percentages. With proven success in sales and service, they can command a higher base pay, better commission structures, and may be promoted to roles like Office Manager or Senior Account Manager.

### Geographic Location

Where you operate your agency has a direct impact on your bottom line. According to BLS data, states with a high cost of living and dense populations often have higher average salaries for insurance agents. For a State Farm agent, a location in a thriving metropolitan area can mean a larger pool of potential clients with higher-value assets to insure (more expensive homes and cars), leading to larger policy premiums and higher commissions. For example, an agent in Los Angeles, California, will likely have a different earning potential than an agent in a small town in the Midwest.

### Company Type (Role Structure)

As highlighted earlier, the structure of your role is a fundamental factor. Operating as an independent contractor agent offers unlimited earning potential but also carries the risks and costs of business ownership. Your success is your own. Conversely, working as a salaried team member provides a predictable paycheck and benefits, but with a capped earning potential compared to the agency owner you work for. This trade-off between security and entrepreneurial opportunity is a core consideration.

### Area of Specialization

A State Farm agent’s income potential grows with the number of products they are licensed to sell and actively market. An agent who only focuses on Property & Casualty (Auto and Home) insurance is limiting their revenue streams. The most successful agents are also licensed to sell:

- Life Insurance: These policies often come with large first-year commissions.

- Health Insurance: Another critical product for clients that adds to an agent's portfolio.

- Financial Products: Agents who obtain securities licenses (like Series 6 and 63) can offer mutual funds and other financial services, opening up significant, high-value opportunities.

Job Outlook

The career outlook for insurance professionals is stable and promising. According to the U.S. Bureau of Labor Statistics, employment of insurance sales agents is projected to grow 6 percent from 2022 to 2032, which is faster than the average for all occupations.

This steady growth is fueled by a continued need for insurance across all sectors of the economy. As the population grows and ages, the demand for life insurance and long-term financial planning will increase. Furthermore, the complexity of insurance products means that consumers will continue to rely on knowledgeable agents to help them navigate their options.

Conclusion

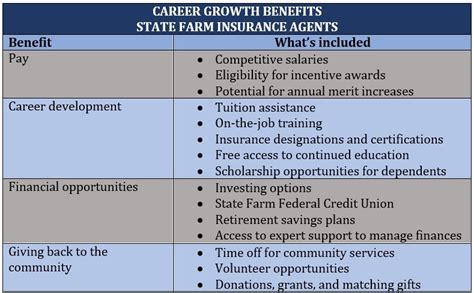

A career with State Farm offers a clear path to financial success for the right individual. While there is a significant distinction between the entrepreneurial, high-potential role of an Agency Owner and the stable, salaried position of a Team Member, both offer rewarding opportunities.

Key takeaways for anyone considering this path include:

- High Earning Potential: Successful agency owners can build lucrative businesses that generate well into the six figures.

- Experience is King: Your income will grow substantially over time as you build a book of business and gain expertise.

- Location and Specialization Matter: Your choice of location and the breadth of products you offer will directly influence your bottom line.

- A Stable Future: The industry has a positive job outlook, ensuring long-term demand for skilled insurance professionals.

If you are a self-starter with a passion for helping people and a drive to build something of your own, a career as a State Farm agent could be an exceptionally rewarding choice, both professionally and financially.