A career at Goldman Sachs is one of the most sought-after paths in the financial world, synonymous with prestige, challenge, and significant financial reward. For ambitious graduates and young professionals, the Analyst role is the primary entry point into this elite institution. But what does that prestige translate to in terms of compensation? While the hours are long and the work is demanding, the salary for a Goldman Sachs Analyst is among the highest for any entry-level corporate position.

First-year Analysts can expect a total compensation package that often ranges from $150,000 to over $200,000, a figure composed of a strong base salary and a substantial year-end bonus. This article will provide a data-driven breakdown of what you can expect to earn and the key factors that will shape your compensation at this financial powerhouse.

What Does a Goldman Sachs Analyst Do?

Before diving into the numbers, it's crucial to understand the role. A Goldman Sachs Analyst is typically a recent university graduate who joins a specific division within the firm, such as Investment Banking, Global Markets, Asset Management, or Operations. The title "Analyst" refers to the entry-level rank in a multi-year program.

Key responsibilities often include:

- Financial Modeling and Valuation: Building complex financial models to assess companies, projects, and investment opportunities.

- Due Diligence: Conducting research and analysis on companies and industries to support transactions like mergers and acquisitions (M&A) or initial public offerings (IPOs).

- Creating Presentations: Developing "pitch books" and other presentation materials for client meetings.

- Market Analysis: Tracking market trends, news, and economic data to inform strategic decisions.

The Analyst program is effectively an apprenticeship where individuals learn the fundamentals of high finance through rigorous, hands-on experience under immense pressure.

Average Goldman Sachs Analyst Salary

Compensation in investment banking is multifaceted, consisting primarily of two components: a base salary and a performance-based bonus.

According to the latest available data from salary aggregator Glassdoor, the estimated total pay for a Financial Analyst at Goldman Sachs is approximately $169,000 per year in the United States. This figure is a composite of:

- Average Base Salary: Approximately $111,000 per year.

- Average Additional Pay (Bonus): Approximately $58,000 per year.

It is critical to note that these figures are averages across various divisions and experience levels within the Analyst rank. For first-year Analysts specifically in the highly coveted Investment Banking Division (IBD), the numbers are often higher. Industry reports frequently place the starting base salary for first-year IBD analysts at bulge bracket firms like Goldman Sachs at $110,000 - $125,000, with a year-end bonus that can range from 50% to 100% of that base, depending on individual, team, and firm performance for the year.

Key Factors That Influence Salary

Your compensation as a Goldman Sachs Analyst is not a single, fixed number. It is influenced by a variety of factors that can significantly impact your total earnings.

### Level of Education

While a bachelor's degree from a top-tier university is the standard requirement for the Analyst role, the level of education becomes more impactful during career progression. The traditional path is for an Analyst to work for two to three years and then either exit to the "buy-side" (e.g., private equity, hedge funds) or pursue a Master of Business Administration (MBA). After completing an MBA, individuals can return to the firm at the "Associate" level, which comes with a substantial increase in both base salary and bonus potential. According to Salary.com, a financial analyst with a Master's Degree or MBA can expect to earn a notable premium over those with only a bachelor's degree.

### Years of Experience

Experience is one of the most direct drivers of salary growth within the Analyst program. Compensation is structured to increase each year.

- First-Year Analyst: Base salary of $110,000 - $125,000, with a year-end bonus.

- Second-Year Analyst: Base salary typically increases by $10,000-$15,000, and the bonus potential grows, often leading to total compensation well over $200,000.

- Third-Year Analyst ("Stub" Year): Analysts who stay for a third year see another bump in base pay and a bonus that reflects their increased competence and value to the team.

This structured progression rewards commitment and the rapid development of skills.

### Geographic Location

Where you work matters immensely. Goldman Sachs has offices worldwide, but compensation is highest in major financial centers to account for the high cost of living and concentration of deal flow.

- New York City & San Francisco: These locations offer the highest salaries, setting the benchmark for the industry.

- Other U.S. Hubs (e.g., Dallas, Salt Lake City): While the base salary in these locations may be comparable or slightly lower than in NYC, the overall cost of living is significantly less, which can improve disposable income. However, bonus potential might be tied to the revenue generated by that specific office.

- International Hubs (e.g., London, Hong Kong): Compensation structures are competitive but will vary based on local market standards, currency exchange rates, and regulatory differences in bonus caps (particularly in Europe).

### Company Type

While this article focuses on Goldman Sachs, it's helpful to see how its pay stacks up. Goldman Sachs is a "bulge bracket" investment bank, which sits at the top of the pay scale.

- Bulge Bracket Banks (e.g., Goldman Sachs, J.P. Morgan): Offer the highest entry-level compensation packages.

- Elite Boutique Banks (e.g., Evercore, Centerview): Often match or even exceed bulge bracket pay, especially in bonus compensation, as they focus purely on high-margin advisory work.

- Middle-Market Banks: Offer competitive but generally lower salaries than the top-tier firms.

- Corporate Finance Roles: An entry-level financial analyst role at a Fortune 500 company will typically have a significantly lower starting salary and bonus than an investment banking role. Payscale data shows the average corporate financial analyst salary is substantially lower than what is offered at a firm like Goldman Sachs.

### Area of Specialization

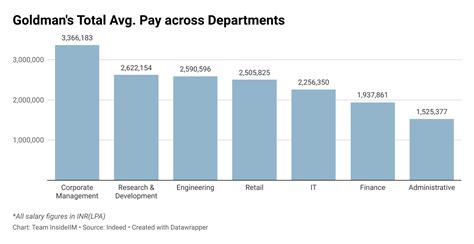

Your division within Goldman Sachs is a major determinant of your compensation, particularly the bonus component.

- Investment Banking Division (IBD): This is the most traditionally lucrative area, with the highest bonus potential tied directly to M&A and capital-raising deal flow.

- Global Markets (Sales & Trading): Compensation is heavily tied to performance, both of the individual trader and the market itself. A good year can lead to extremely high bonuses.

- Asset & Wealth Management: Salaries are very competitive, but bonuses may be less volatile and slightly lower on average than in IBD.

- Operations, Compliance, and Technology: These "back office" and "middle office" roles are essential to the firm's success and are well-compensated, but the bonus structure is generally not as high as in the "front office" revenue-generating divisions.

Job Outlook

The demand for top financial talent remains consistently high. According to the U.S. Bureau of Labor Statistics (BLS), employment for Financial Analysts is projected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS notes that "growing complexity of financial products and the need for in-depth knowledge of geographic regions are expected to lead to strong employment growth."

While this statistic applies to all financial analysts, it underscores a healthy and growing industry. However, it's important to remember that positions at elite firms like Goldman Sachs are exceptionally competitive, with acceptance rates often lower than those of Ivy League universities. The demand for these specific roles will always outpace the supply of available positions.

Conclusion

A career as a Goldman Sachs Analyst is a launchpad for a successful future in finance. The compensation is a direct reflection of the role's demands: high-stakes work, long hours, and an incredibly steep learning curve.

Key Takeaways:

- Expect High Total Compensation: A first-year analyst can realistically expect a package of $150,000 - $200,000+, driven by a strong base and a significant performance bonus.

- Compensation Grows Quickly: Your salary and bonus will increase substantially with each year of experience.

- Location and Division are Key: Working in the Investment Banking Division in New York City will yield the highest potential earnings.

- It's More Than a Job: The Analyst program is an investment in your career capital, opening doors to opportunities in private equity, hedge funds, and corporate leadership that are unavailable to most.

For those with the ambition, resilience, and intellectual horsepower to succeed, the role of a Goldman Sachs Analyst offers a financial and professional payoff that is nearly unmatched in the corporate world.

Sources:

- *U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Financial Analysts. (Data retrieved 2024).*

- *Glassdoor, "Goldman Sachs Financial Analyst Salaries." (Data retrieved 2024).*

- *Salary.com, "Financial Analyst I Salary." (Data retrieved 2024).*

- *Payscale.com, "Financial Analyst Salary." (Data retrieved 2024).*