A career as a bank branch manager is a cornerstone of the financial services industry. It’s a dynamic role that blends leadership, sales acumen, operational oversight, and community engagement. For those with ambition and a head for numbers, it also offers significant financial rewards. So, what can you expect to earn? While salaries vary, a typical bank branch manager in the U.S. can expect to earn a total compensation package ranging from $65,000 to over $120,000 annually, with top performers in major markets exceeding that figure considerably.

This article will break down everything you need to know about a bank branch manager's salary, the key factors that drive your earnings, and the promising future of this career path.

What Does a Bank Branch Manager Do?

Before diving into the numbers, it's essential to understand the scope of the role. A bank branch manager is the leader of a local banking center. They are ultimately responsible for the branch's success, which is measured by its profitability, operational efficiency, and customer satisfaction.

Key responsibilities include:

- Leading and Developing a Team: Hiring, training, and motivating tellers, personal bankers, and loan officers.

- Driving Growth and Sales: Setting and meeting goals for loans, deposits, new accounts, and investment services.

- Ensuring Operational Excellence: Overseeing daily operations to ensure compliance with banking regulations, security protocols, and company policies.

- Cultivating Customer Relationships: Acting as the face of the bank, resolving complex customer issues, and ensuring a high level of service.

- Community Engagement: Representing the bank at local events and building relationships with small business owners and community leaders.

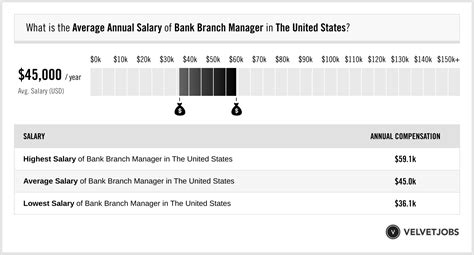

Average Bank Branch Manager Salary

The compensation for a bank branch manager is more than just a base salary; it often includes significant performance-based bonuses and incentives.

According to Salary.com, the median base salary for a Branch Manager in banking is $88,279 as of late 2023. The typical range falls between $76,966 and $102,465. However, this figure doesn't tell the whole story.

When including bonuses, commissions, and profit-sharing, the total compensation picture becomes much more robust. Glassdoor reports an average total pay of $106,857 per year for bank branch managers, which includes an average base salary of around $80,000 and additional pay (bonuses, etc.) of nearly $27,000.

Your position within this range is not arbitrary. It is influenced by a combination of your qualifications, location, and the specific institution you work for.

Key Factors That Influence Salary

Several key variables can significantly impact your earning potential. Understanding them is crucial for negotiating your salary and planning your career trajectory.

###

Level of Education

While extensive experience can sometimes substitute for formal education, a bachelor's degree is typically the standard requirement for a branch manager position. Degrees in finance, business administration, or accounting are highly preferred and establish a strong foundation for success. For those aiming for senior roles—such as managing larger, more complex branches or advancing to regional management—an MBA (Master of Business Administration) can provide a substantial competitive edge and unlock higher salary brackets.

###

Years of Experience

Experience is perhaps the most significant factor in determining salary. The career path is often progressive, with earnings increasing at each stage.

- Entry-Level (0-4 years): Professionals in this stage may be managing a smaller branch or serving as an Assistant Branch Manager. Base salaries typically fall in the $60,000 to $75,000 range.

- Mid-Career (5-9 years): With a proven track record of meeting sales goals and managing a team effectively, mid-career managers can expect to earn a base salary in the $75,000 to $95,000 range, with total compensation often breaking the six-figure mark.

- Senior/Experienced (10+ years): Senior managers are often entrusted with the largest, highest-volume branches in prime locations. They may also take on mentorship or multi-branch oversight roles. Their base salaries can easily exceed $100,000 to $120,000, with significant bonus potential pushing their total compensation even higher. Payscale data confirms this, showing a distinct increase in average salary with accumulated experience.

###

Geographic Location

Where you work matters immensely. Salaries are adjusted to reflect the local cost of living and the demand for talent in a specific market. A branch manager in a major metropolitan hub like New York City or San Francisco will earn significantly more than a manager in a smaller midwestern or southern city. For example, a manager position that pays $90,000 in Dallas might command over $110,000 in Boston to account for the difference in living expenses.

###

Company Type

The type of financial institution also plays a role in compensation structure.

- Large National Banks (e.g., JPMorgan Chase, Bank of America): These institutions often offer higher base salaries and highly structured, performance-based bonus programs. The potential for large bonuses tied to ambitious sales targets can be very high.

- Regional and Community Banks: These banks may offer slightly lower base salaries but can provide a strong sense of community, a better work-life balance, and bonus structures tied more to overall branch and bank success rather than just individual metrics.

- Credit Unions: As non-profit, member-owned institutions, credit unions may have different compensation philosophies. While base salaries might be competitive, bonuses may be more modest and tied to member growth and satisfaction rather than pure profit.

###

Area of Specialization

Not all branches are created equal. A manager overseeing a standard retail branch will have a different earnings potential than one managing a branch with a specialized focus. For instance, a branch located in an affluent area with a strong focus on wealth management and private banking will handle more complex products and larger sums of money. The manager for such a branch requires a higher level of expertise and is compensated accordingly. Similarly, a branch that specializes in small business or commercial lending offers higher earning potential due to the value and complexity of those relationships.

Job Outlook

The future for skilled financial managers is bright. According to the U.S. Bureau of Labor Statistics (BLS), employment for Financial Managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations.

While the rise of digital and mobile banking is changing the landscape, the physical branch remains crucial for complex transactions, personalized advice, and building customer trust. The role of the branch manager is evolving from a transactional overseer to a relationship-focused financial leader. This shift ensures that skilled, adaptable managers who can lead teams and drive growth in specialized areas like wealth management and business banking will remain in high demand.

Conclusion

A career as a bank branch manager offers a clear and rewarding path for professionals who are driven, personable, and financially savvy. The salary is competitive and provides significant room for growth, heavily influenced by your experience, performance, and the strategic choices you make in your career.

Key Takeaways:

- Solid Earning Potential: Expect a total compensation package well above the national average, with the potential to exceed six figures.

- Performance is Paramount: Your ability to meet sales and growth targets will directly impact your income through bonuses and incentives.

- Experience and Location Drive Salary: Seniority and working in a high-cost-of-living area are two of the biggest factors in maximizing your earnings.

- Strong Job Outlook: The need for skilled financial leaders is growing, ensuring long-term career stability and opportunity.

For individuals with a passion for finance, a talent for leadership, and a drive to help businesses and individuals achieve their financial goals, the role of a bank branch manager is an excellent and lucrative career to pursue.