In a world of ever-increasing rules, regulations, and ethical standards, the role of a Compliance Analyst has never been more critical. These professionals are the guardians of integrity for their organizations, ensuring operations run smoothly, legally, and ethically. This high level of responsibility comes with significant career potential and, importantly, competitive compensation.

If you're considering a career in this dynamic field, you're likely asking a key question: what is the salary of a compliance analyst? The answer is promising. A skilled Compliance Analyst can expect a robust salary that often ranges from $65,000 to over $115,000 annually, with significant potential for growth based on several key factors. This article will break down what you can expect to earn and how to maximize your income potential in this rewarding career.

What Does a Compliance Analyst Do?

Before we dive into the numbers, let's briefly define the role. A Compliance Analyst ensures that a company adheres to external laws and regulations as well as internal policies and procedures. They are meticulous investigators and strategic thinkers who protect their company from legal trouble and reputational damage.

Key responsibilities often include:

- Monitoring and auditing business processes to ensure they meet regulatory standards.

- Investigating potential compliance breaches and reporting findings to management.

- Developing and implementing internal controls and policies.

- Keeping up-to-date with changes in industry-specific regulations (e.g., in finance, healthcare, or tech).

- Training employees on compliance matters and ethical standards.

Essentially, they are the navigators of the complex regulatory landscape, guiding their organization to safe harbor.

Average Compliance Analyst Salary

While salaries can vary widely, we can establish a strong baseline using data from authoritative sources.

Across the United States, the average base salary for a Compliance Analyst typically falls between $75,000 and $85,000 per year.

- Salary.com reports a median salary for a Compliance Analyst I (entry-level) at $67,692, with the more experienced Compliance Analyst III earning a median of $102,156 as of late 2023.

- Glassdoor lists the average total pay (including bonuses and other compensation) for a Compliance Analyst at approximately $88,500 per year.

- The U.S. Bureau of Labor Statistics (BLS) groups this role under "Compliance Officers." As of May 2022, the median annual wage for Compliance Officers was $75,810. The top 10% of earners in this category made more than $120,480.

It's clear that while a solid starting salary is achievable, there is substantial room for financial growth as you gain expertise and experience.

Key Factors That Influence Salary

Your specific salary as a Compliance Analyst will be influenced by a combination of factors. Understanding these drivers is the key to negotiating your worth and charting a high-earning career path.

### Level of Education

A bachelor's degree is typically the minimum requirement for a Compliance Analyst role. Degrees in finance, business administration, law, or accounting are highly valued. However, advanced education can significantly increase your earning potential.

- Bachelor's Degree: The standard entry point into the field.

- Master's Degree: A Master of Business Administration (MBA), a Master's in a specialized field like Forensic Accounting, or a Juris Doctor (JD) can command a higher starting salary and qualify you for senior and management positions much faster.

- Certifications: Industry-specific certifications are a major salary booster. Earning credentials like the Certified Compliance & Ethics Professional (CCEP) or the Certified Anti-Money Laundering Specialist (CAMS) demonstrates a high level of expertise and can add thousands to your annual salary.

### Years of Experience

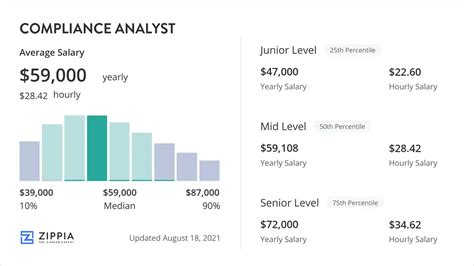

Experience is arguably the most significant factor in determining a Compliance Analyst's salary. The career path has a clear and rewarding progression.

- Entry-Level (0-2 years): Analysts at this stage are typically learning the ropes, supporting senior staff, and handling routine monitoring tasks. Expect a salary range of $60,000 to $75,000.

- Mid-Level (3-7 years): With a few years of experience, analysts take on more complex projects, work with greater autonomy, and may begin to specialize. Their salary often rises to the $75,000 to $95,000 range.

- Senior-Level (8+ years): Senior analysts are experts who often manage teams, develop compliance strategy, and report directly to executive leadership. Their salaries regularly exceed $100,000, with many earning $115,000+, especially in high-demand specializations.

### Geographic Location

Where you work matters. Salaries are often adjusted for the cost of living, meaning major metropolitan areas with a high concentration of corporate headquarters tend to offer the highest pay.

- Top-Tier Cities: Financial and tech hubs like New York City, San Francisco, Washington D.C., and Boston offer the highest salaries to attract top talent, often 15-25% above the national average.

- Mid-Tier Cities: Major cities like Chicago, Dallas, and Atlanta offer competitive salaries that are closer to the national average.

- Lower Cost-of-Living Areas: Rural areas and smaller cities will typically offer lower salaries, but this is often offset by a more affordable lifestyle.

### Company Type

The industry and size of your employer play a huge role in your compensation.

- Finance, Insurance, and Banking: This sector is consistently the highest-paying for compliance professionals due to the immense financial risk and heavy regulatory burden (e.g., Anti-Money Laundering, Sarbanes-Oxley).

- Healthcare and Pharmaceuticals: With complex regulations like HIPAA, compliance is a top priority, leading to very competitive salaries.

- Technology: The tech industry, with its focus on data privacy (GDPR, CCPA), is a rapidly growing and high-paying area for compliance experts.

- Government: Government agencies offer stable careers and excellent benefits, though salaries may be slightly lower than in the private sector.

### Area of Specialization

General compliance roles are always needed, but specializing in a high-demand niche can make you a more valuable—and higher-paid—asset.

- Anti-Money Laundering (AML) / Know Your Customer (KYC): A critical and often lucrative specialty within the financial services industry.

- Data Privacy: With the rise of GDPR and CCPA, analysts who can navigate data protection laws are in extremely high demand.

- Environmental, Social, and Governance (ESG): A newer but rapidly expanding field as companies focus on sustainability and corporate responsibility.

- Sarbanes-Oxley (SOX): A foundational area of compliance for publicly traded companies, offering consistent and stable career opportunities.

Job Outlook

The future for Compliance Analysts is bright. The U.S. Bureau of Labor Statistics projects that employment for Compliance Officers will grow 4 percent from 2022 to 2032, which is as fast as the average for all occupations.

This steady growth is driven by several trends: a more complex global business environment, a continuous stream of new regulations (especially in finance and technology), and a greater emphasis on corporate ethics to protect brand reputation. This all translates to strong job security and sustained demand for skilled analysts.

Conclusion

A career as a Compliance Analyst is an excellent choice for individuals who are detail-oriented, analytical, and driven by a strong sense of ethics. The path offers not only intellectual stimulation but also significant financial rewards.

Key Takeaways:

- Strong Earning Potential: You can expect a competitive starting salary with a clear path to a six-figure income.

- Growth is in Your Hands: Your salary is directly influenced by your choices in education, certifications, and specialization.

- Experience is King: The longer you stay in the field and build your expertise, the more valuable you become.

- Demand is Stable and Growing: With a positive job outlook, compliance is a future-proof career field that offers long-term stability.

If you are looking for a career that is both professionally meaningful and financially rewarding, the role of a Compliance Analyst is one of the most compelling opportunities in today's professional landscape.