Understanding your compensation is one of the most critical aspects of managing your career and financial health. While job offers often include a variety of perks and benefits, the cornerstone of any pay package is the base salary. This figure is the starting point for negotiation and the predictable foundation upon which you can build your budget. Grasping what a base salary is, the factors that determine it, and how it fits into your total compensation package is essential for making informed career decisions.

What is a Base Salary?

A base salary is the fixed, regular amount of money an employer pays you for your work over a year, paid out in regular intervals (such as weekly, bi-weekly, or monthly). This amount is agreed upon in your employment contract and does not include any additional payments or benefits.

Think of it as the core of your earnings before anything is added or taken away. It's the number you see in a job offer, often stated as an annual figure (e.g., "$70,000 per year").

It's important to distinguish base salary from other pay-related terms:

- Total Compensation: This is the big picture. It includes your base salary *plus* the value of any bonuses, commissions, stock options, health insurance, retirement plan contributions (like a 401(k) match), and other benefits.

- Gross Pay: This is your base salary plus any additional earnings for a specific pay period, such as overtime, bonuses, or commissions.

- Net Pay (Take-Home Pay): This is the actual amount of money deposited into your bank account after all deductions—such as federal and state taxes, Social Security, and contributions for health insurance or retirement—are taken out of your gross pay.

Your base salary is the most reliable component of your income, providing a stable financial floor regardless of company performance or individual quarterly results.

Understanding Base Salary Ranges

There is no single "average base salary" because this figure is unique to each specific job, industry, and location. Every role has a salary band, which is the range an employer is willing to pay for a position. To illustrate this, let's look at the median base salaries for a few diverse professions in the United States.

- Software Developer: The U.S. Bureau of Labor Statistics (BLS) reports the median pay for software developers was $132,270 per year as of May 2023. However, salary aggregator Glassdoor shows a typical range from $91,000 (for entry-level) to $190,000 (for senior roles) in early 2024, depending on experience and location.

- Registered Nurse: According to the BLS, the median annual wage for registered nurses was $86,070 in May 2023. Salary.com data from February 2024 shows a common range between $72,148 and $95,952, highlighting the significant impact of factors like specialization and geography.

- Marketing Manager: The BLS lists the median pay for marketing managers as $156,580 per year as of May 2023. Data from Payscale in early 2024 indicates a typical base salary range of $70,000 to $154,000, with significant earning potential tied to experience and industry.

These examples show that a base salary isn't just one number but part of a spectrum. The following key factors determine where you might fall on that spectrum.

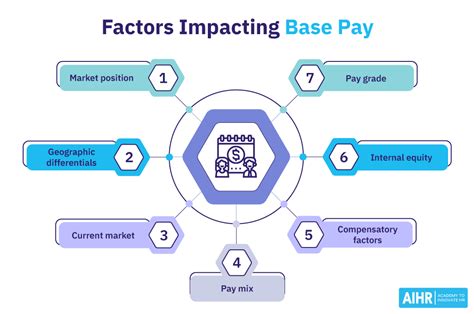

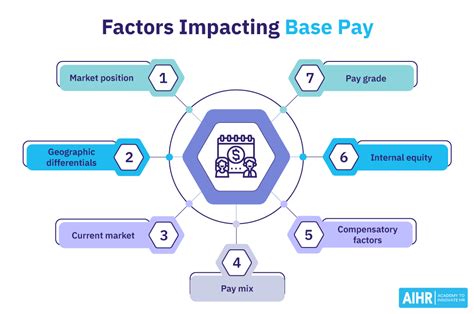

Key Factors That Influence Your Base Salary

Your base salary is not an arbitrary number. It is the result of a complex calculation based on your qualifications, market demand, and other variables. Here are the most significant factors that influence your earning potential.

### Level of Education

Generally, a higher level of formal education correlates with a higher base salary. Advanced degrees like a Master's, MBA, or Ph.D. often unlock access to more specialized, higher-paying roles. The BLS consistently reports a strong link between education and earnings. For example, 2022 data showed that workers with a bachelor's degree had median weekly earnings of $1,432, while those with a master's degree earned $1,661—a nearly 16% increase. This premium is often even higher for professional or doctoral degrees.

### Years of Experience

Experience is arguably one of the most powerful determinants of your base salary. As you accumulate years in your field, you develop practical skills, industry knowledge, and a track record of success that employers are willing to pay for.

- Entry-Level (0-2 years): You are typically learning the ropes and will earn a salary at the lower end of the job's salary band.

- Mid-Career (3-8 years): You have proven your competence and can work independently. Your salary will reflect this increased value.

- Senior/Lead (8+ years): You are now an expert, potentially managing teams or leading complex projects. Your salary will be at the higher end of the band, and you are eligible for leadership roles with even higher pay.

### Geographic Location

Where you work matters immensely. Salaries are often adjusted based on the cost of living in a specific metropolitan area. A job in a high-cost city like San Francisco or New York City will almost always have a higher base salary than the exact same job in a lower-cost city like Omaha, Nebraska. This "geographic differential" is intended to provide employees with similar purchasing power. Companies use data from sources like the BLS and salary aggregators to set competitive local pay rates. With the rise of remote work, some companies are moving toward location-agnostic pay, while others adjust salaries based on the employee's home address.

### Company Type and Industry

The type of company you work for and its industry play a massive role in determining salary bands.

- Industry: Certain industries are more profitable and have higher revenue per employee, allowing them to pay more. For example, technology, finance, and pharmaceuticals typically offer higher base salaries than non-profit, education, or retail sectors.

- Company Size: Large, established corporations often have more structured (and sometimes higher) pay scales than small businesses or startups. However, a startup might compensate for a lower base salary with significant equity or stock options.

- Public vs. Private vs. Non-Profit: Publicly traded companies may offer more competitive pay, while government and non-profit roles, though often providing excellent benefits and job security, may have lower base salaries.

### Area of Specialization

Within any given profession, having in-demand, niche skills can significantly boost your base salary. A generalist may earn a solid wage, but a specialist is often seen as a rare and valuable asset. For instance, a general practice physician earns a strong salary, but a specialized neurosurgeon earns substantially more. In the tech world, a general software developer's salary is high, but a developer who specializes in a high-demand field like Artificial Intelligence or Cybersecurity can command a much higher premium.

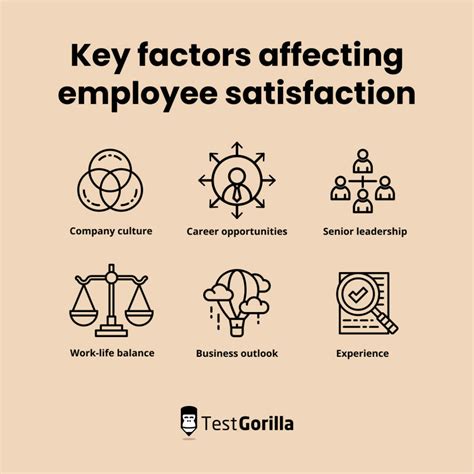

Beyond Base Salary: Understanding Total Compensation

While base salary is crucial, it's vital to evaluate it as part of a larger total compensation package. A job offer with a slightly lower base salary but exceptional benefits could be more valuable than a high-salary offer with poor benefits. When evaluating an offer, always consider the monetary value of:

- Bonuses and Commissions: Performance-based pay that can significantly increase your annual earnings.

- Health Insurance: A plan with low premiums and deductibles can save you thousands of dollars a year.

- Retirement Plans: A generous 401(k) or 403(b) match is essentially free money for your future.

- Paid Time Off (PTO): More vacation, sick, and personal days contribute to better work-life balance.

- Stock Options or Equity: Particularly in startups and tech companies, this can lead to substantial wealth over time.

Conclusion

Your base salary is the predictable, reliable engine of your income. It serves as the foundation for your personal budget and the primary benchmark for your professional value in the marketplace. However, it is not a static number. It is dynamically shaped by your education, experience, location, industry, and specialization.

By understanding these influencing factors, you empower yourself to negotiate effectively, evaluate job offers holistically, and strategically plan your career path. Viewing your base salary as a key component of a larger total compensation package will enable you to make choices that support both your immediate financial needs and your long-term professional growth.