Are you fascinated by the world of investing, retirement planning, and wealth management? Have you ever wondered about the professionals who help people make the most of their "salary saving schemes" like 401(k)s and IRAs? This role, belonging to the Financial Advisor, is not only personally rewarding but also offers significant earning potential. With median salaries approaching six figures and top professionals earning well over $200,000 annually, a career in financial advising is a lucrative path for those with a talent for numbers and a passion for helping others.

This in-depth guide will break down the salary you can expect as a Financial Advisor and the key factors that will shape your career and income.

What Does a Financial Advisor Do?

Before diving into the numbers, it's essential to understand the role. A Financial Advisor is a qualified professional who helps individuals and organizations manage their finances and achieve their long-term financial goals. They are the experts who guide clients through the complexities of investments, insurance, estate planning, tax strategies, and, of course, retirement and salary saving schemes.

Key responsibilities include:

- Meeting with clients to assess their financial health, risk tolerance, and life goals.

- Developing personalized, comprehensive financial plans.

- Advising on various financial products, including stocks, bonds, mutual funds, and insurance.

- Managing client investment portfolios.

- Explaining and optimizing employee benefits like 401(k)s, 403(b)s, and other pension plans.

- Staying current with market trends, new investment vehicles, and regulatory changes.

Average Financial Advisor Salary

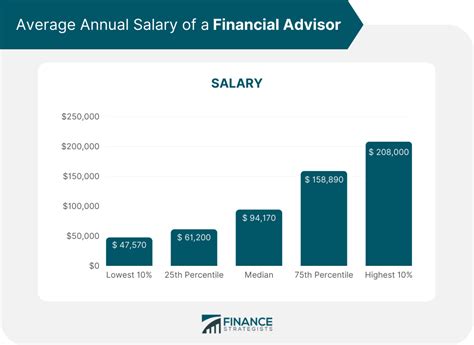

The earning potential for a Financial Advisor is strong and grows substantially with experience and expertise. While compensation models can vary (from fee-only to commission-based or a hybrid), the overall salary data paints a promising picture.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for personal financial advisors was $99,580 in May 2023. This figure represents the midpoint, meaning half of the advisors earned more and half earned less.

However, this single number doesn't tell the whole story. The salary range is quite broad:

- The lowest 10% earned less than $48,470, which often represents entry-level or salaried positions in smaller firms.

- The highest 10% earned more than $239,200, a figure typically achieved by senior advisors with extensive client portfolios and specialized expertise.

Data from Salary.com corroborates this, showing a typical salary range for a Financial Advisor in the United States between $85,000 and $125,000, with many variables influencing where an individual falls on that spectrum.

Key Factors That Influence Salary

Your salary as a Financial Advisor isn't set in stone. Several key factors directly impact your earning potential, and understanding them is crucial for career planning.

### Level of Education

A bachelor's degree in finance, economics, business, or a related field is the standard entry requirement. While a bachelor's degree will get you in the door, advanced education and, more importantly, professional certifications are what truly unlock higher earnings.

- Master's Degree: An MBA or a Master's in Finance can lead to higher starting salaries and open doors to management or specialized roles in wealth management and investment banking.

- Certifications: This is arguably the most significant educational factor. Earning prestigious certifications demonstrates a high level of expertise and ethical commitment. The Certified Financial Planner (CFP) designation is the industry gold standard and can significantly boost earning potential. According to a 2023 survey by the CFP Board, advisors with CFP certification report earning 16% to 26% more than advisors without it. Other valuable certifications include the Chartered Financial Analyst (CFA) and the Chartered Financial Consultant (ChFC).

### Years of Experience

Experience is paramount in financial advising. As you build your skills, reputation, and client base, your income grows exponentially.

- Entry-Level (0-3 years): New advisors often start in support roles or salaried positions, earning between $50,000 and $75,000 as they learn the business and build their book of clients.

- Mid-Career (4-10 years): With a solid client base and a proven track record, advisors can expect to earn well into the six-figure range, typically from $90,000 to $150,000. Their compensation is often a mix of salary and commissions or fees based on Assets Under Management (AUM).

- Senior/Principal (10+ years): Top-tier advisors who manage large portfolios for high-net-worth clients can earn $200,000+ annually. At this stage, income is heavily tied to the success of their AUM and the breadth of services they provide.

### Geographic Location

Where you work matters. Salaries for Financial Advisors are highest in major financial hubs and areas with a high concentration of wealth and a higher cost of living.

According to BLS data, the top-paying states for personal financial advisors include:

1. New York: Average annual salary of $179,350

2. District of Columbia: Average annual salary of $164,050

3. Illinois: Average annual salary of $156,050

4. California: Average annual salary of $143,620

5. Massachusetts: Average annual salary of $142,670

Working in a major metropolitan area like New York City, San Francisco, or Chicago will generally yield a higher salary than working in a smaller town or rural area.

### Company Type

The type of firm you work for has a significant impact on both your compensation structure and overall earnings.

- Large Investment Banks & Wirehouses (e.g., Morgan Stanley, Merrill Lynch): These firms often offer high earning potential through structured training programs and access to a wide range of products. However, they can also be high-pressure environments.

- Independent Registered Investment Advisor (RIA) Firms: Working for or starting an RIA offers more autonomy. Earnings are directly tied to the fees generated from AUM, meaning there is technically no ceiling on income, but it also carries more entrepreneurial risk.

- Commercial Banks and Credit Unions: These positions are often salaried with bonus potential. They provide stability and a steady stream of client referrals but may have a lower top-end earning potential compared to independent firms.

- Insurance Companies: Advisors here may focus heavily on insurance products and annuities as part of a broader financial plan.

### Area of Specialization

General financial planning is valuable, but specializing can make you an indispensable expert for a niche clientele, leading to higher fees and greater demand.

- High-Net-Worth (HNW) Individuals: Managing the complex finances of wealthy clients is one of the most lucrative specializations.

- Retirement Planning: With an aging population, experts in retirement income strategies, 401(k) rollovers, and pension maximization are in high demand.

- Estate Planning: This specialization involves working with attorneys and tax professionals to create comprehensive plans for wealth transfer.

- Corporate Financial Wellness: Some advisors specialize in working with companies to design and manage their employee benefit programs, including salary saving schemes.

Job Outlook

The future for Financial Advisors is bright. The BLS projects employment for personal financial advisors to grow 13 percent from 2022 to 2032, which is much faster than the average for all occupations.

This robust growth is driven by several factors, including the increasing complexity of financial products and the large wave of Baby Boomers entering retirement who need professional guidance to manage their savings. As financial literacy becomes more important, people at all stages of life are seeking out expert advice.

Conclusion

A career as a Financial Advisor offers a direct path to a high-paying, dynamic, and meaningful profession. While the median salary is an impressive $99,580, your potential is truly in your hands.

For those considering this career, the key takeaways are:

- Aim for Certification: Earning your CFP is one of the most powerful steps you can take to increase your authority and income.

- Build Experience: Your value (and your salary) will grow in lockstep with your client base and years in the industry.

- Choose Your Location and Firm Wisely: Strategically positioning yourself in a major financial center or with a firm that aligns with your goals can significantly impact your earnings.

- Specialize: Developing deep expertise in a high-demand area like retirement or wealth management will set you apart and boost your income potential.

For those with a strategic mindset and a genuine desire to help people navigate their financial lives, the path of a Financial Advisor is not just a job—it's a gateway to significant professional and financial success.