Introduction

Have you ever looked at your paycheck and wondered, "Am I being paid what I'm truly worth?" It's a question that echoes in the minds of professionals across every industry. But behind this universal query lies a specialized, strategic, and increasingly vital profession—one dedicated to answering that very question not just for one person, but for an entire organization. Welcome to the world of the Compensation Analyst.

These professionals are the architects of fairness, the data wizards who ensure that pay is competitive, equitable, and motivating. They blend the art of human resources with the science of data analytics to design the compensation structures that attract, retain, and inspire top talent. In 2024, as companies grapple with fierce competition for skilled workers, pay transparency laws, and a renewed focus on equity, the role of the Compensation Analyst has never been more critical or more lucrative. The national average salary for a Compensation Analyst hovers around $79,889 per year, with senior professionals and managers easily earning well into the six figures.

I remember early in my career, I was tasked with helping a mid-sized tech company that was losing talented engineers to larger competitors. Their leadership was convinced they couldn't afford to match the giants. By conducting a thorough salary survey and analysis, we discovered it wasn't just about base pay; their entire incentive structure was misaligned with what engineers valued. We redesigned their bonus and equity plans, and within a year, their regrettable turnover had dropped by over 40%. It was a powerful lesson in how a strategic approach to compensation isn't just an expense—it's one of the most powerful investments a company can make.

This comprehensive guide is your definitive salary survey for 2024, viewed through the lens of the experts who shape the market. We will delve deep into the salary you can expect, the factors that drive it, and the precise steps you can take to build a thriving career in this rewarding field.

### Table of Contents

- [What Does a Compensation Analyst Do?](#what-does-a-compensation-analyst-do)

- [Average Compensation Analyst Salary: A Deep Dive](#average-compensation-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

---

What Does a Compensation Analyst Do?

At its core, a Compensation Analyst is a strategic partner to the business who ensures an organization's compensation practices are both competitive and equitable. They are the guardians of a company's "total rewards" philosophy, which encompasses everything from base salary and bonuses to benefits and long-term incentives. This is not a simple data-entry role; it's a dynamic blend of market research, statistical analysis, financial modeling, and human psychology.

Their work ensures that a company can attract the right talent in the marketplace, retain its top performers, and motivate its entire workforce, all while managing one of the largest expenses on the balance sheet: payroll. They are the crucial link between a company's financial health and its people strategy.

Core Responsibilities and Daily Tasks:

A Compensation Analyst's duties are varied and project-driven, but they generally revolve around a few key functions:

- Market Pricing and Benchmarking: This is a foundational task. Analysts use salary surveys from reputable vendors (like Radford, Mercer, and Willis Towers Watson) to benchmark the company's jobs against the external market. They match internal roles to survey jobs to determine the "market rate" for a specific position in a specific geographic area and industry.

- Job Evaluation: Before a job can be priced, it must be understood. Analysts conduct job evaluations to determine the internal value and complexity of a role. They use established methodologies (like point-factor or job slotting) to ensure internal equity—that jobs of similar scope and impact are paid similarly.

- Salary Structure Design and Maintenance: They are the architects of the company's pay infrastructure. This involves creating salary ranges or bands for different job levels, complete with a minimum, midpoint, and maximum. They regularly review and update this structure to ensure it remains competitive with the market.

- Incentive Plan Design: Analysts often help design and administer short-term incentive plans (annual bonuses) and long-term incentive plans (stock options, restricted stock units). This involves modeling costs, setting performance metrics, and ensuring the plans drive the desired behaviors.

- Data Analysis and Reporting: A significant portion of their time is spent in spreadsheets and HR Information Systems (HRIS). They analyze compensation data to identify trends, model the financial impact of pay decisions (like a company-wide salary increase), and prepare reports for leadership.

- Compliance and Pay Equity Audits: With the rise of pay transparency and equity legislation, this has become a critical function. Analysts conduct regular audits to ensure the company is compliant with laws like the Equal Pay Act and to identify and remedy any pay gaps based on gender, race, or other protected classes.

### A Day in the Life of a Mid-Career Compensation Analyst

To make this tangible, let's imagine a Tuesday for "Alex," a Compensation Analyst at a 2,000-employee software company.

- 9:00 AM - 10:30 AM: Market Pricing a New Role. The engineering department wants to hire a "Principal AI Ethics Engineer," a brand-new role. Alex meets with the hiring manager to understand the job's scope, responsibilities, and required skills. Alex then dives into multiple tech-specific salary surveys, blending data from several sources to propose a competitive salary range for this niche, high-demand position.

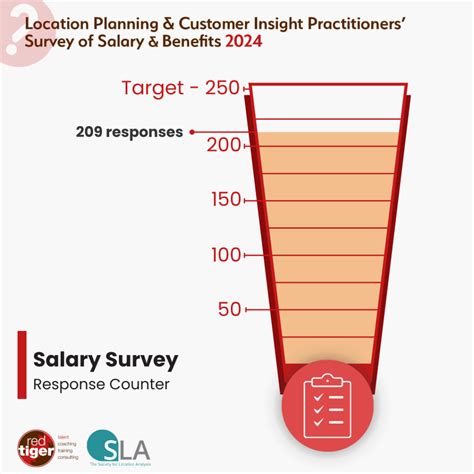

- 10:30 AM - 12:00 PM: Annual Salary Survey Submission. It's that time of year. Alex spends time meticulously matching the company's employees to the benchmark jobs in a major industry salary survey. This task is detail-oriented and critical, as the quality of the data submitted will determine the quality of the market insights the company receives back.

- 12:00 PM - 1:00 PM: Lunch.

- 1:00 PM - 2:30 PM: Pay Equity Analysis Meeting. Alex presents findings from a recent pay equity audit to the HR leadership team. Using statistical analysis, Alex shows the "raw" and "adjusted" pay gaps for the organization and recommends specific salary adjustments for a small group of employees to ensure fairness. The presentation is data-heavy but explained in clear, business-focused terms.

- 2:30 PM - 4:00 PM: Focal Review Modeling. The company's annual salary review cycle is approaching. Alex is deep in an Excel model, calculating the budget impact of different merit increase scenarios (e.g., a 3.5% vs. a 4% average increase). The model accounts for employee performance ratings, position in the salary range, and promotion pools.

- 4:00 PM - 5:00 PM: Answering Manager Queries. A manager in marketing has a question about a promotion for a team member. Alex provides guidance on the appropriate salary increase, explaining how it aligns with the company's compensation philosophy and the employee's new responsibilities.

This snapshot shows a role that is both deeply analytical and highly collaborative, requiring a unique ability to translate complex data into actionable business strategy.

---

Average Compensation Analyst Salary: A Deep Dive

The compensation for those who manage compensation is, fittingly, quite competitive. The role's strategic importance and the specialized skills it requires command a strong salary that grows significantly with experience and expertise. As of our 2024 analysis, the data shows a robust and rewarding pay scale for this career path.

For official statistics, we turn to the U.S. Bureau of Labor Statistics (BLS), which groups this role under the category "Compensation, Benefits, and Job Analysis Specialists." According to the most recent BLS data (May 2023), the median annual wage for these specialists was $74,980. The lowest 10 percent earned less than $49,500, while the highest 10 percent earned more than $119,770.

However, data from salary aggregators, which can often capture more real-time and role-specific information, paints an even more detailed picture. Let's examine the data from leading platforms:

- Salary.com (as of May 2024): Reports the median salary for a Compensation Analyst I (entry-level) at $66,902, a Compensation Analyst II (mid-level) at $79,889, and a Compensation Analyst III (senior) at $96,161. This showcases a clear progression.

- Payscale (as of June 2024): Indicates an average salary of $74,136 per year, with a typical range between $56,000 and $99,000.

- Glassdoor (as of June 2024): Shows a total pay average of $88,629 per year in the United States, which includes a base average of $78,851 and additional pay (like bonuses) averaging $9,778.

Synthesizing this data, a reasonable national average for a mid-career Compensation Analyst in 2024 falls between $75,000 and $85,000, with significant variance based on the factors we'll explore in the next section.

### Salary Brackets by Experience Level

One of the most appealing aspects of a career in compensation is the clear and significant salary growth that accompanies experience. As you move from executing tasks to designing strategy, your value—and your paycheck—increases accordingly.

| Experience Level | Typical Years of Experience | Typical Salary Range (Annual Base) | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level Analyst | 0-2 years | $60,000 - $75,000 | Participating in salary surveys, conducting basic job evaluations, running pre-made reports, assisting with annual review cycle data entry. |

| Mid-Career Analyst | 2-5 years | $75,000 - $95,000 | Independently market pricing jobs, administering incentive plans, analyzing data for pay equity audits, developing initial recommendations for leadership. |

| Senior/Lead Analyst | 5-10 years | $95,000 - $125,000+ | Designing new salary structures, leading complex projects (e.g., job family leveling), mentoring junior analysts, acting as a primary consultant to HR and business leaders. |

| Compensation Manager | 8+ years | $120,000 - $160,000+ | Managing a team of analysts, developing the overall compensation strategy, presenting to executive leadership, managing vendor relationships, overseeing entire programs (e.g., executive pay). |

| Director/VP of Total Rewards| 12+ years | $160,000 - $250,000++ | Setting the strategic direction for all rewards programs (compensation, benefits, wellness), aligning rewards with long-term business goals, serving as a key advisor to the C-suite and Board of Directors. |

*Sources: Salary.com, Payscale, Glassdoor, and Zippia career path data, cross-referenced for 2024.*

### Beyond the Base: Deconstructing Total Compensation

A Compensation Analyst's pay isn't just about the base salary. True to their profession, they often have a sophisticated "total rewards" package. Understanding these components is crucial for evaluating a job offer.

- Base Salary: This is the fixed, annual amount you earn. It's the foundation of your compensation and what the figures above primarily represent.

- Annual Bonus / Short-Term Incentive (STI): This is a performance-based payment, typically paid out once a year. For an analyst, it's often tied to both company performance (e.g., revenue or profit targets) and individual performance. A typical bonus target for a mid-level analyst might be 5-10% of their base salary, while a manager's target could be 15-20% or more.

- Long-Term Incentives (LTI): Particularly common in publicly traded companies or late-stage startups, LTIs are designed to retain employees and align their interests with long-term company success. These can include:

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period (typically 3-4 years).

- Stock Options: The right to buy company stock at a predetermined price in the future.

- For senior roles (Manager and above), LTI can add a significant amount—often 15-40% of base salary annually—to their total compensation.

- Benefits and Perks: While not direct cash, these have immense value. This includes comprehensive health, dental, and vision insurance; a 401(k) or other retirement plan with a company match; paid time off; and increasingly, wellness stipends, parental leave, and professional development budgets. A strong benefits package can be worth tens of thousands of dollars annually.

- Profit Sharing: Some companies, particularly in finance or consulting, offer profit-sharing plans where a portion of the company's profits is distributed among employees.

When considering a role, it's essential to look at the entire picture. A job with a $90,000 base salary and a 15% bonus target ($103,500 total cash) is very different from one with a $95,000 base and no bonus.

---

Key Factors That Influence Salary

While the national averages provide a useful benchmark, a Compensation Analyst's actual salary is a complex equation with many variables. Understanding these factors is key to maximizing your earning potential throughout your career. This section, a "salary survey" within our guide, breaks down the most critical drivers of pay for this profession in 2024.

###

Level of Education

Your educational background serves as the foundation for your career and directly impacts your starting salary and long-term trajectory.

- Bachelor's Degree (The Standard): A bachelor's degree is the minimum requirement for almost all Compensation Analyst roles. The most common and sought-after majors are Human Resources, Business Administration, Finance, and Economics. A degree in a quantitative field like Statistics or Mathematics is also highly valued. Employers see these degrees as evidence that a candidate possesses the necessary analytical and business acumen. Starting salaries for candidates with a relevant bachelor's degree typically fall within the entry-level range ($60k - $75k).

- Master's Degree (The Accelerator): Pursuing a master's degree can significantly accelerate your career and earning potential. The most relevant degrees are a Master of Business Administration (MBA) or a specialized master's in Human Resource Management (MHRM). An MBA, especially from a top-tier school, signals strong business and financial acumen, often allowing graduates to enter roles at a higher level (e.g., Senior Analyst or consultant) with salaries potentially 15-25% higher than their bachelor's-only peers.

- Certifications (The Differentiator): In the world of compensation, professional certifications are the gold standard for demonstrating expertise and commitment. They are often a prerequisite for senior and managerial roles and can lead to a substantial salary premium. The most important certification body is WorldatWork.

- Certified Compensation Professional (CCP®): This is the most recognized and respected certification in the industry. Achieving it requires passing a series of rigorous exams covering topics like base pay administration, market pricing, variable pay, and quantitative principles. According to WorldatWork, professionals holding the CCP earn, on average, 9% more than their non-certified peers.

- Advanced Certified Compensation Professional (ACCP™): For those looking to move into strategic leadership.

- Global Remuneration Professional (GRP®): Essential for those specializing in international compensation.

- Other valuable certifications include the SHRM-CP/SHRM-SCP from the Society for Human Resource Management, which provide broader HR context.

###

Years of Experience

As illustrated in the previous section, experience is arguably the single most significant factor in salary growth. The value you provide evolves from tactical execution to strategic leadership, and your compensation reflects this journey.

- 0-2 Years (The Learner): In this phase, you are absorbing information and learning the fundamentals. Your focus is on accuracy and execution under supervision. You'll spend most of your time in Excel, pulling data, participating in surveys, and answering basic queries. Your salary reflects your status as an investment for the company.

- 2-5 Years (The Contributor): You now operate with more autonomy. You can independently price jobs, analyze data sets, and make well-reasoned recommendations. You're a trusted resource for HR partners and managers. This is where you see the first major salary jump, moving firmly into the national median range of $75,000 to $95,000.

- 5-10 Years (The Expert/Leader): As a Senior or Lead Analyst, you are now a subject matter expert. You're not just executing the plan; you're designing it. You lead large-scale projects, like a full redesign of the salary structure or the implementation of a new sales incentive plan. You mentor junior analysts and have a strong voice in strategic discussions. Your salary will typically cross the $100,000 threshold, with top performers in high-cost-of-living areas earning $125,000 or more.

- 10+ Years (The Strategist): In manager and director roles, your focus shifts from individual analysis to team leadership and enterprise-wide strategy. You manage budgets, set the philosophy for the entire organization, and present to the C-suite. Your compensation structure changes, with a much larger percentage coming from variable pay like annual bonuses and long-term equity. Base salaries start around $120,000 and can easily exceed $200,000 for VPs of Total Rewards at large corporations.

###

Geographic Location

Where you work has a massive impact on your paycheck, primarily driven by cost of labor and cost of living. Companies in major metropolitan hubs with intense competition for talent pay a significant premium.

Here's a comparative look at median salaries for a mid-career Compensation Analyst across different U.S. cities, illustrating the wide variance.

| Metropolitan Area | Median Salary (Mid-Career Analyst) | Cost of Living Index (vs. National Avg) |

| :--- | :--- | :--- |

| San Jose / San Francisco, CA | $110,000 - $130,000 | Very High |

| New York, NY | $100,000 - $120,000 | Very High |

| Boston, MA | $95,000 - $115,000 | High |

| Seattle, WA | $95,000 - $110,000 | High |

| Washington, D.C. | $90,000 - $105,000 | High |

| Chicago, IL | $85,000 - $100,000 | Slightly Above Average |

| Austin, TX | $80,000 - $95,000 | Average |

| Atlanta, GA | $78,000 - $93,000 | Average |

| Phoenix, AZ | $75,000 - $90,000 | Average |

| Kansas City, MO | $70,000 - $85,000 | Below Average |

*Sources: Combination of data from BLS, Salary.com geo-differentials, and Glassdoor salary reports by location for 2024.*

The Remote Work Effect: The rise of remote work has introduced a new layer of complexity. Some companies have adopted a national pay rate, regardless of location. However, many large organizations use "geo-differentials," adjusting pay based on the employee's location, even for remote roles. This means a remote analyst living in San Francisco will likely earn more than a remote analyst doing the exact same job from Kansas City. Understanding a company's remote pay philosophy is now a crucial part of the job search.

###

Company Type & Size

The context in which you work—the industry, size, and type of company—profoundly shapes your role and your earnings.

- Large Corporations (Fortune 500): These companies offer the most structured career paths and typically pay at or above the market average. They have large, specialized compensation teams, sophisticated tools, and well-defined salary structures. Benefits and LTI are often very generous. The work can be more bureaucratic but provides excellent training.

- Tech Startups (Pre-IPO): Compensation here is a different game. Base salaries might be slightly below the market rate for a large corporation. The real draw is equity (stock options or RSUs), which has the potential for a massive payout if the company succeeds. The work is fast-paced, and you'll likely wear many hats, gaining broad experience quickly.

- Consulting Firms (e.g., Mercer, Willis Towers Watson, Aon): Working for a major HR consulting firm places you on the other side of the table. You'll work with multiple clients across various industries, providing expert advice on their compensation strategies. The pay is often very high, with steep performance expectations and demanding hours. This is a prestigious and highly lucrative path for top performers.

- Non-Profit / Government: These sectors typically pay less than their for-profit counterparts, often 10-20% below the market median. However, they compensate with exceptional job security, excellent benefits (especially pensions in government roles), and a strong sense of mission. The work-life balance can also be more favorable.

###

Area of Specialization

As you advance in your career, you can develop deep expertise in a specific niche of compensation. These specializations often command a significant salary premium due to their complexity and direct impact on the business.

- Executive Compensation: This is one of the most lucrative and complex areas. These professionals design the multi-million dollar pay packages for C-suite executives, including base salary, bonuses, long-term equity grants, deferred compensation, and perks. It requires deep knowledge of SEC regulations, corporate governance, and tax law. Senior specialists and managers in this area can earn $150,000 - $250,000+.

- Sales Compensation: This specialty focuses on designing and administering the incentive plans (commissions, bonuses, SPIFFs) for sales teams. It's a highly analytical role that directly impacts revenue generation. A good sales comp plan can supercharge a sales force, while a bad one can demotivate them and harm the business. Experts in this field are highly sought after.

- Global Compensation: For multinational corporations, managing pay across dozens of countries is a massive challenge. Global compensation specialists deal with different currencies, tax laws, labor regulations, and cultural norms around pay. This requires a unique skill set and often commands a premium salary.

- Technical Compensation: In the tech industry, competing for software engineers, data scientists, and product managers is fierce. Technical compensation analysts specialize in this hyper-competitive market, using specialized tech-industry surveys (like Radford) to ensure their company's pay practices can attract and retain top engineering talent.

###

In-Demand Skills

Beyond your background, the specific skills you cultivate can make you a more effective and higher-paid analyst.

- Advanced Data Analysis & Modeling (Excel Mastery): This is non-negotiable. You must be a master of Microsoft Excel. This goes beyond basic formulas. You need to be an expert in VLOOKUP/XLOOKUP, INDEX/MATCH, Pivot Tables, and building complex, multi-variable financial models to project the cost of compensation programs.

- HRIS & Compensation Software Proficiency: Experience with major HR Information Systems is critical. Proficiency in the compensation modules of platforms like Workday, SAP SuccessFactors, or Oracle HCM is a highly marketable skill.

- Data Visualization: Being able to analyze data is one thing; being able to communicate your findings is another. Skills in data visualization tools like Tableau or Power BI allow you to create compelling dashboards and presentations that tell a story with data, making your recommendations more impactful to leaders.

- Statistical Knowledge: A foundational understanding of statistics (mean, median, regression analysis, standard deviation) is crucial for conducting sound pay equity audits and making data-driven decisions.

- Business Acumen & Communication: The highest-paid analysts are those who can connect their work to the bottom line. They understand the company's business strategy and can articulate how compensation decisions support those goals. Strong presentation and negotiation skills are essential for gaining buy-in from senior leadership.

---

Job Outlook and Career Growth

For those considering a career as a Compensation Analyst, the future is bright. The demand for skilled professionals who can navigate the complexities of modern pay strategy is strong and expected to grow. This section explores the quantitative outlook and the qualitative trends shaping the profession's future.

### A Strong Growth Trajectory

The U.S. Bureau of Labor Statistics (BLS) provides the most authoritative long-term forecast. In its 2022-2032 projections, the BLS anticipates that employment for Compensation, Benefits, and Job Analysis Specialists will grow by 5 percent. This is faster than the average for all occupations, translating to approximately 6,200 new job openings projected each year, on average, over the decade.

What's driving this sustained growth? Several powerful forces are at play:

1. The War for Talent: In