A career in accounting is known for its stability and structure, but what is the real earning potential once you climb the first few rungs of the ladder? For many, the role of a Senior Accountant represents a significant career milestone—a position of greater responsibility, expertise, and, crucially, higher compensation.

If you're an aspiring accountant or a professional ready for your next move, understanding the salary landscape is essential. A Senior Accountant in the United States can expect to earn a salary that typically ranges from $80,000 to over $115,000 annually, with numerous factors creating opportunities to earn even more.

This guide will break down what a Senior Accountant does, analyze the average salary figures from authoritative sources, and explore the key factors you can leverage to maximize your income.

What Does a Senior Accountant Do?

A Senior Accountant is far more than a number-cruncher; they are a critical pillar of a company's finance department. Acting as a bridge between junior staff and accounting managers, they take on complex accounting tasks and often serve as a mentor and reviewer.

Key responsibilities typically include:

- Financial Reporting: Preparing and analyzing monthly, quarterly, and annual financial statements.

- Month-End Close: Leading the process of closing the books, including reconciling complex accounts and posting journal entries.

- Compliance and Audits: Ensuring adherence to regulations (like GAAP or IFRS) and acting as a key point of contact for internal and external auditors.

- Process Improvement: Identifying inefficiencies in financial processes and implementing solutions.

- Mentorship: Training and reviewing the work of junior accountants.

- Budgeting and Forecasting: Assisting with the development of company budgets and financial forecasts.

This role requires a sharp analytical mind, meticulous attention to detail, and strong leadership potential.

Average Senior Accountant Salary

While a national average provides a useful benchmark, it's important to look at data from multiple sources to get a complete picture. The figures below reflect the most current data available.

The U.S. Bureau of Labor Statistics (BLS) groups all accountants and auditors together. As of May 2022, the median annual wage for this broad category was $78,000. However, the top 10% of earners in this field made more than $132,690, a range where experienced Senior Accountants are firmly situated (Source: BLS).

For more specific data on the "Senior Accountant" title, we turn to leading salary aggregators:

- Salary.com reports the median salary for a Senior Accountant in the U.S. is $93,892, with a typical range falling between $85,022 and $103,467 (as of early 2024).

- Payscale indicates an average salary of $81,570, with the salary range typically spanning from $65,000 to $103,000.

- Glassdoor places the total pay average (including base and additional pay like bonuses) at $96,684, with a likely range of $82,000 to $115,000.

In summary, a competitive salary for a Senior Accountant in the current market falls squarely in the $85,000 to $105,000 range, with significant potential to exceed this based on the factors below.

Key Factors That Influence Salary

Your salary isn't set in stone. It's a dynamic figure influenced by your qualifications, choices, and environment. Here are the five most significant factors that determine your earning potential.

###

Level of Education

A bachelor's degree in accounting or a related field is the standard entry requirement. However, advanced credentials are the single most powerful way to boost your salary.

- Master's Degree: A Master of Accountancy (MAcc) or an MBA with a concentration in accounting can make you a more competitive candidate and often leads to a higher starting salary.

- CPA License: The Certified Public Accountant (CPA) license is the gold standard in the accounting profession. Obtaining your CPA is a clear signal of expertise and dedication that employers are willing to pay for. According to various industry reports, holding a CPA can increase your salary by 5% to 15% and is often a prerequisite for advancing to management roles like Controller or CFO.

###

Years of Experience

Experience is a direct driver of salary growth. The transition from a Staff Accountant to a Senior Accountant typically occurs after three to five years of solid performance.

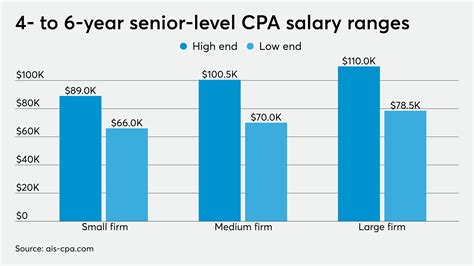

- Early-Career Senior (4-6 years): At this stage, you've mastered the core functions and can expect a salary in the lower-to-mid end of the typical range.

- Experienced Senior (7-10+ years): With more years under your belt, you can take on more complex projects, lead small teams, and command a salary at the higher end of the range. This level of experience also positions you for promotion to an Accounting Manager, where salaries often exceed $120,000.

###

Geographic Location

Where you work matters—a lot. Salaries are adjusted for local market demand and cost of living. Major metropolitan areas with large financial centers consistently offer the highest pay.

According to the BLS, the top-paying states for accountants and auditors are:

1. District of Columbia: $105,670 (mean annual wage)

2. New York: $101,440

3. New Jersey: $98,120

4. California: $92,230

5. Massachusetts: $91,010

Working in cities like New York City, San Francisco, San Jose, or Boston will almost certainly result in a higher salary than working in a smaller, rural market.

###

Company Type

The type of organization you work for has a profound impact on your compensation package.

- Public Accounting (The "Big Four"): Firms like Deloitte, PwC, EY, and KPMG are known for offering competitive salaries, excellent training, and rapid career progression. While the hours can be demanding, the experience gained here is highly valued and often leads to lucrative opportunities in private industry.

- Corporate/Industry Accounting: Working directly for a company in a specific sector (e.g., tech, healthcare, manufacturing) can be very rewarding. Salaries are often competitive with public accounting, and work-life balance can be better. High-growth sectors like technology and pharmaceuticals tend to offer the highest corporate accounting salaries.

- Government and Non-Profit: These sectors typically offer lower base salaries compared to the private sector. However, they often compensate with exceptional job security, generous benefits packages (pensions, healthcare), and a more predictable work schedule.

###

Area of Specialization

Within accounting, certain specializations are more in-demand and command higher pay. As a Senior Accountant, developing expertise in one of these areas can significantly increase your value.

- Technical Accounting & Financial Reporting: Experts who can navigate complex GAAP/IFRS rules are always in demand, especially at publicly traded companies.

- Tax Accounting: Specializing in corporate tax, international tax, or M&A tax can be extremely lucrative.

- Forensic Accounting: This niche involves investigating financial fraud and is a high-skill, high-pay field.

- IT Audit & Risk Assurance: As companies become more reliant on technology, accountants who can bridge the gap between finance and IT are highly compensated.

Job Outlook

The future for accountants is bright. The U.S. Bureau of Labor Statistics projects that employment for accountants and auditors will grow by 4% from 2022 to 2032, which is about as fast as the average for all occupations.

This steady growth translates to approximately 126,500 openings for accountants and auditors each year, on average, over the decade. This demand is driven by economic growth, changing financial regulations, and the need for financial accountability in all sectors of the economy. This ensures that skilled Senior Accountants will remain in high demand for the foreseeable future.

Conclusion

Becoming a Senior Accountant is a rewarding and financially sound career move. While a baseline salary is attractive, your ultimate earning potential is in your hands. By focusing on key drivers, you can strategically build a career that is both professionally fulfilling and financially lucrative.

Key Takeaways:

- Aim for Six Figures: A salary over $100,000 is an achievable goal for experienced Senior Accountants with the right credentials and location.

- Get Your CPA: This is the single most impactful step you can take to increase your lifetime earnings and open doors to leadership positions.

- Be Strategic: Consider specializing in a high-demand area like tax or technical accounting, and be open to opportunities in major metropolitan markets or high-growth industries.

Whether you are planning your education or looking to advance, the path to a high-paying Senior Accountant role is clear, stable, and full of opportunity.