Table of Contents

- [Introduction](#introduction)

- [What Does a State Farm Insurance Agent Do?](#what-does-a-state-farm-insurance-agent-do)

- [Deconstructing the "State Farm Insurance Agent Salary": A Deep Dive into Earnings](#deconstructing-the-state-farm-insurance-agent-salary-a-deep-dive-into-earnings)

- [Key Factors That Influence a State Farm Agent's Income](#key-factors-that-influence-a-state-farm-agents-income)

- [Job Outlook and Career Growth for Insurance Professionals](#job-outlook-and-career-growth-for-insurance-professionals)

- [How to Become a State Farm Agent: A Step-by-Step Guide](#how-to-become-a-state-farm-agent-a-step-by-step-guide)

- [Conclusion: Is a Career as a State Farm Agent Right for You?](#conclusion-is-a-career-as-a-state-farm-agent-right-for-you)

---

Introduction

Are you driven by the desire to build your own business, control your financial destiny, and become a pillar in your community? For many aspiring entrepreneurs, the path of a State Farm Insurance Agent represents a unique intersection of these ambitions. It’s a career that moves beyond a traditional 9-to-5 job, offering a framework to create a lasting legacy. But before embarking on this demanding yet potentially lucrative journey, the primary question on everyone's mind is: "What is a State Farm Insurance Agent's salary?"

The answer is more complex and far more interesting than a single number. While a team member in a State Farm agent's office might earn a base salary between $35,000 and $55,000 plus commission, a successful State Farm Agency Owner's income isn't a salary at all—it's the net profit of their business. This can range from modest figures in the first few years to well over $250,000 annually for established, high-performing agents, with some top-tier agents exceeding this significantly. This guide will demystify this entire financial landscape.

I remember when a severe hailstorm hit my hometown years ago. The sound was deafening, and the aftermath left dented cars and damaged roofs up and down our street. Amid the chaos, our local State Farm agent, a woman named Carol, was a beacon of calm and competence, proactively calling clients and guiding us through the claims process. It was a masterclass in seeing how a great agent isn't just a salesperson, but a genuine community advocate in times of need.

This article is your comprehensive roadmap. We will dissect the role, analyze the earning potential in granular detail, explore the critical factors that dictate your income, and provide a step-by-step guide to starting your own agency. Whether you're a recent graduate, a professional seeking a career change, or an aspiring entrepreneur, this is the ultimate resource for understanding the true financial reality of a career as a State Farm agent.

---

What Does a State Farm Insurance Agent Do?

Before we delve into the numbers, it's crucial to understand that a State Farm Agent is, first and foremost, an entrepreneur and a community leader. While "selling insurance" is the core function, the role is vastly more multifaceted. State Farm agents are independent contractors who own and operate their own small businesses under the banner of the State Farm brand. They are not employees of State Farm Corporate. This distinction is the single most important concept to grasp when evaluating this career path.

The agent's primary mission is twofold: to acquire new customers by helping them identify their risks and to service existing customers by ensuring their coverage remains adequate and by being their first point of contact during a claim. They act as trusted advisors, helping families and businesses protect their most valuable assets and plan for their financial futures.

Core Responsibilities and Daily Tasks:

An agent's work can be broken down into several key areas:

- Sales and Marketing: This is the engine of the business. Agents are constantly prospecting for new clients. This involves networking within the community, running digital marketing campaigns, asking for referrals, and developing relationships with other professionals like real estate agents and mortgage brokers.

- Consultation and Quoting: Agents don't just sell policies; they provide expert advice. This involves sitting down with clients, conducting thorough needs analyses, explaining complex insurance concepts in simple terms, and then preparing customized quotes for various products (Auto, Home, Renters, Life, Health, Small Business, etc.).

- Client Servicing and Retention: Acquiring a customer is only the beginning. A significant portion of an agent's long-term success comes from retaining that customer. Daily tasks include answering client questions, making policy changes, conducting regular policy reviews, and providing empathetic, efficient support during the claims process.

- Business Management and Operations: As small business owners, agents are also CEOs. They are responsible for hiring, training, and managing their own team of licensed professionals and administrative staff. They also manage the agency's budget, payroll, marketing expenses, and overall profitability.

- Compliance and Continuing Education: The insurance industry is heavily regulated. Agents must ensure their agency adheres to all state and federal laws. They are also required to complete regular continuing education courses to maintain their licenses and stay current on new products and industry trends.

### A Day in the Life of a State Farm Agent

To make this tangible, let's imagine a day for "David," a State Farm Agent who has been in business for five years.

- 8:00 AM - 8:30 AM: David arrives at the office, greets his team of two licensed producers and one customer service representative. They hold a quick "huddle" to review yesterday's results, set daily goals for quotes and sales, and discuss any urgent client issues.

- 8:30 AM - 10:00 AM: David focuses on "revenue-generating activities." He makes follow-up calls to potential clients who received quotes the previous day. He also calls existing clients whose life insurance policies are due for a review.

- 10:00 AM - 12:00 PM: He has two back-to-back appointments. The first is with a young couple who just bought their first home. David reviews their needs for home and auto insurance and introduces the importance of life insurance to protect their new mortgage. The second is a virtual meeting with a local bakery owner to discuss a business owner's policy (BOP).

- 12:00 PM - 1:00 PM: David attends a lunch meeting with the local Rotary Club, a key networking opportunity to build relationships and generate community goodwill.

- 1:00 PM - 2:30 PM: Back in the office, he works with his team to finalize the quotes from his morning meetings and sends them to the clients with a detailed explanation. He also reviews performance dashboards to track his agency's progress toward its monthly goals.

- 2:30 PM - 4:00 PM: He dedicates this time to his team. He sits with a new team member to role-play sales conversations and provides coaching on handling objections. He then reviews a complex claim situation with his lead customer service rep.

- 4:00 PM - 5:30 PM: David switches back to outbound marketing. He records a short, informative video for his agency's Facebook page about the importance of umbrella policies and responds to inquiries that have come in through his website.

- 5:30 PM onwards: While the official day might end, as a business owner, the work is never truly done. David might spend another hour reviewing financial reports, planning the next week's marketing strategy, or preparing for an evening community event.

This illustrates the dynamic blend of sales, consultation, management, and marketing that defines the role. It is not a passive job; it requires immense proactivity, discipline, and a genuine passion for helping people.

---

Deconstructing the "State Farm Insurance Agent Salary": A Deep Dive into Earnings

The most pressing question for aspiring agents is about income. As established, thinking in terms of a traditional "salary" is misleading for an agency owner. Instead, we must analyze the two primary career paths within the State Farm agency ecosystem: the Agent Team Member and the Agency Owner.

### Path 1: The State Farm Agent Team Member Salary

Most future agency owners get their start by working for an existing State Farm agent. This is an invaluable apprenticeship, providing hands-on experience without the financial risk of ownership. These team members *are* typically employees of the agent's small business and receive a traditional form of compensation.

Typical Compensation Structure:

- Base Salary/Hourly Wage: This provides a stable income floor.

- Commissions: A percentage of the premium for new policies they sell.

- Bonuses: Often tied to meeting individual or team sales goals.

Salary Ranges for Team Members:

Salary data for these roles shows a clear progression based on experience and licensing. It's important to note that these figures can vary significantly based on the agency's location and profitability.

- Customer Service Representative (Unlicensed or recently licensed):

- Average Base Salary: $30,000 - $42,000

- Typical All-in Compensation (with small bonuses): $35,000 - $48,000

- *Source: Data aggregated from Payscale and Glassdoor reports for "State Farm Customer Service Representative" as of late 2023.*

- Insurance Account Representative (Licensed in Property & Casualty):

- Average Base Salary: $38,000 - $50,000

- Typical All-in Compensation (with commission): $45,000 - $65,000+

- *Source: Analysis of over 1,000 salaries on Glassdoor and Salary.com for "State Farm Account Representative" and similar titles.*

- Office Manager / Senior Team Member (Licensed in P&C, Life & Health):

- Average Base Salary: $50,000 - $70,000

- Typical All-in Compensation (with commission/bonuses): $60,000 - $90,000+

- *Source: Payscale and Glassdoor data for "State Farm Office Manager." Top performers in high-volume agencies can exceed these ranges.*

Salary Comparison Table for State Farm Team Members

| Role/Experience Level | Average Base Salary Range | Typical Total Compensation Range (with variable pay) |

| :-------------------- | :------------------------ | :--------------------------------------------------- |

| Entry-Level (CSR) | $30,000 - $42,000 | $35,000 - $48,000 |

| Mid-Career (Account Rep)| $38,000 - $50,000 | $45,000 - $65,000 |

| Senior (Office Manager) | $50,000 - $70,000 | $60,000 - $90,000+ |

### Path 2: The State Farm Agency Owner Earning Potential

This is the entrepreneurial path. An agency owner's income is not a salary; it's the Gross Revenue of the agency minus Business Expenses.

Income = (New Business Commissions + Renewal Commissions + Bonuses) - (Staff Salaries + Rent + Marketing + Utilities + Other Overheads)

This formula reveals the two levers an agent can pull to increase their income: grow revenue and manage expenses.

Understanding the Revenue Streams:

1. New Business Commissions: This is the upfront commission earned from selling a new policy. The commission rates vary by product line. For example, Property & Casualty (P&C) lines like auto and home might have a lower commission rate than Life Insurance or Disability Insurance, which are more complex and have higher premiums. This is the primary source of income in the early years.

2. Renewal Commissions: This is the bedrock of long-term wealth for an agent. For every policy that a customer renews, the agent earns a smaller, recurring commission. While a single renewal commission is small, a "book of business" with thousands of policies generates a substantial and relatively stable stream of passive income. This allows an established agent to shift their focus from pure prospecting to servicing and managing their business.

3. Financial Services & Other Products: Many State Farm agents are also licensed to offer financial products through State Farm's other entities, such as mutual funds and annuities. These products often carry significant commission rates and can dramatically increase an agent's income.

4. Corporate Bonuses & Incentives: State Farm Corporate offers numerous bonuses and incentive programs for high-performing agents. These can be based on growth, profitability (the quality of the business written), and cross-selling different lines of insurance. Achieving certain milestones can result in significant annual or quarterly bonuses, including luxury travel awards for top producers.

A Realistic Look at Earning Potential Over Time:

- Years 1-2 (The Build-Up Phase): This is the most challenging period. The agent is investing heavily in marketing and staffing while having a very small book of renewal income. It is not uncommon for an agent's *net income* to be modest, potentially in the $40,000 to $70,000 range, as most revenue is reinvested back into the business. Some agents may need to rely on personal savings or a business line of credit during this time.

- Years 3-5 (The Growth Phase): The book of business is now large enough to generate meaningful renewal income. This creates a more stable foundation. The agent has honed their sales and marketing processes. Net income often grows significantly, potentially reaching the $80,000 to $150,000 range.

- Years 6-10 (The Maturity Phase): The renewal income stream is now substantial and predictable. The agency is likely well-staffed, allowing the agent to focus more on high-level strategy, team management, and pursuing larger clients (e.g., small businesses). Net income for a successful agent can regularly be in the $150,000 to $250,000+ range.

- Year 10+ (The Legacy Phase): Top-performing agents with large, mature books of business, a strong focus on financial services, and excellent business management can earn well in excess of $300,000 or $400,000 per year. The value of their agency as a sellable asset has also grown immensely.

It is crucial to understand that these are not guaranteed figures. They represent the potential for a hard-working, business-savvy individual. Many factors can cause these numbers to be higher or lower, which we will explore next.

---

Key Factors That Influence a State Farm Agent's Income

An agent's income is a direct reflection of their ability to build and run a successful business. It's not about "getting a raise"; it's about making strategic decisions that drive growth. Here are the most critical factors that determine an agent's earning potential.

###

Level of Education and Licensing

While a specific college degree is not a formal requirement to become a State Farm agent, your educational background can have a significant impact on your success.

- Relevant Degrees: A degree in Business Administration, Finance, Marketing, or Communications provides a strong foundation. Coursework in accounting, management, sales, and economics directly applies to the daily challenges of running an agency.

- The Non-Negotiable: State Licensing: This is the most critical educational component. To sell insurance, you must be licensed by the state(s) in which you operate. For a State Farm agent, this typically means obtaining:

- Property & Casualty (P&C) License: Allows you to sell auto, home, renters, and business insurance.

- Life, Accident & Health (L&H) License: Allows you to sell life insurance, health insurance, and disability policies.

- Advanced Certifications & Financial Services Licensing: This is where top earners separate themselves. Obtaining securities licenses like the SIE (Securities Industry Essentials), Series 6, and Series 63 (and in some cases, Series 7 and 65/66) allows an agent to offer investment products like mutual funds and variable annuities. These products not only serve a wider range of client needs but also come with higher commission potential. Furthermore, professional designations like ChFC® (Chartered Financial Consultant) or CLU® (Chartered Life Underwriter) from The American College of Financial Services enhance credibility and expertise, attracting more affluent clients.

###

Years of Experience and Business Maturity

Experience is arguably the single greatest determinant of an agent's income. This isn't just about time on the job; it's about the cumulative effect of building a book of business.

- Entry-Level (Years 1-3): As discussed, these are the "investment years." The primary metric of success is the *rate of growth* in new policies written. The agent is learning the systems, building a marketing plan from scratch, and establishing a reputation. Income is secondary to growth.

- Salary Impact: Lower net income, with a high percentage of revenue reinvested.

- Mid-Career (Years 4-10): The power of renewals takes hold. The income floor rises dramatically each year as the renewal commission base grows. The agent has likely hired and trained a competent team, freeing them up for higher-value activities. They have become a known entity in their community.

- Salary Impact: Rapid income growth. Net income often surpasses six figures and continues to climb as the book expands and the agent becomes more efficient.

- Senior/Established (Years 10+): The business runs like a well-oiled machine. Renewal commissions provide a large, stable income. The agent may focus on mentoring their team, handling a few key large accounts, and maximizing profitability. The business itself becomes a highly valuable asset that can be sold upon retirement, providing a significant lump-sum payout.

- Salary Impact: Highest earning potential, often well into the multiple six-figure range. The value of the agency as a sellable asset can be worth millions of dollars for top producers.

###

Geographic Location

Where an agent sets up shop plays a massive role in their potential success. This goes far beyond the cost of living.

- Market Demographics and Density: A location with a growing population of middle-to-high-income families and a thriving small business community presents a target-rich environment. Conversely, a saturated market with many competing agents or a declining population can be a significant headwind.

- Cost of Doing Business: The cost of office rent, local staff salaries, and marketing varies enormously between a major metropolitan area and a rural town. An agent in downtown San Francisco will have exponentially higher overhead than an agent in Omaha, Nebraska, requiring them to generate significantly more revenue just to break even.

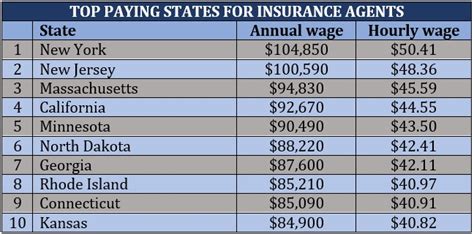

- State-Level Insurance Landscape: According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all Insurance Sales Agents was $57,860 in May 2022. However, location causes wide variations.

- High-Paying States/Areas: The BLS identifies states like Massachusetts, New York, and California, along with metropolitan areas like Washington D.C. and Boston, as having the highest average wages for insurance agents. This is often due to a combination of a higher cost of living and a concentration of high-value personal and commercial clients.

- Lower-Paying States/Areas: States in the Southeast and Midwest may show lower average wages, but this is often offset by a much lower cost of business and living, meaning an agent's net income and purchasing power could still be very high.

- Proximity to State Farm's Target Market: State Farm's brand resonates strongly in suburban and family-oriented communities. Choosing a location that aligns with the company's core demographic can provide a natural advantage.

###

Agency Size and Structure (The "Company Type")

For an independent agent, the "company" is their own agency. How they structure and scale it is a key driver of net income.

- The Solo Agent Model: In the beginning, an agent might handle most tasks themselves with maybe one part-time assistant. This keeps overhead extremely low, but caps growth potential as there are only so many hours in the day.

- The Team-Based Model: The standard path to growth. A successful agent builds a team of licensed producers (sales-focused) and customer service representatives (service-focused). This creates leverage. While staff salaries are a major expense, a good team can generate far more revenue than they cost, allowing the agency to scale significantly.

- The Multi-Office Agent: A small number of highly successful agents may eventually get the opportunity to open a second location, further expanding their market reach and revenue potential, but also doubling many of their operational complexities and costs.

The agent's skill as a manager—hiring, training, and motivating a team—becomes just as important as their skill as a salesperson in determining their ultimate financial success.

###

Area of Specialization

A "generalist" agent can do well, but a "specialist" can do exceptionally well. The most successful agents become experts in lucrative, high-need areas.

- Property & Casualty (P&C) Focus: This is the bread and butter—auto and home. It's high-volume and essential for building a large book of business for renewal income. However, commissions per policy are relatively modest.

- Life Insurance Specialization: Life insurance policies often have large premiums and, consequently, very large first-year commissions. An agent who is skilled and passionate about helping families plan for the future with life insurance can dramatically boost their income.

- Small Business / Commercial Lines Focus: Becoming the go-to agent for local businesses (contractors, restaurants, professional offices) opens up a massive market. Business policies have high premiums and create sticky, long-term relationships.

- Financial Services Integration: As mentioned, this is the top tier. Agents who integrate financial planning conversations and offer mutual funds, retirement plans, and other investment vehicles are providing holistic advice. This not only generates significant revenue but also deeply embeds them in their clients' financial lives, making them much harder to replace.

###

In-Demand Skills

Certain skills directly translate into higher revenue and a more profitable agency.

- Masterful Networking and Prospecting: The ability to consistently generate new leads is the lifeblood of a growing agency. This means being a natural connector, being active in the community, and having a systematic approach to asking for referrals.

- Consultative Selling: The best agents don't "sell," they "advise." They are expert listeners who diagnose needs and prescribe solutions. This builds trust and leads to larger, multi-policy clients.

- Digital Marketing Acumen: In today's world, an agent must be proficient in social media marketing, email marketing, search engine optimization (SEO), and managing online reviews. A strong digital footprint is a 24/7 lead generation machine.

- Leadership and Team Management: As the agency grows, the agent's ability to hire the right people, provide effective training, and create a positive, high-performance culture becomes paramount to scaling the business.

- Resilience and Tenacity: The first few years are a grind. There will be rejection and long hours. The agents who succeed are those with the mental fortitude to push through the initial challenges to reach the highly rewarding later stages.

---

Job Outlook and Career Growth for Insurance Professionals

When considering a long-term career as a State Farm agent, it's essential to look at the broader industry landscape. While the role of an agent is evolving, the fundamental need for insurance and expert guidance remains robust.

### Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) provides the most authoritative data on career outlooks. In their 202