For those with a knack for numbers and a strategic mind, a career in tax accounting offers a stable, challenging, and financially rewarding path. One of the most common entry points into this field is the Tax Associate role. But what can you realistically expect to earn? This guide breaks down the salary landscape for a tax associate, exploring the key factors that influence your earning potential.

While a tax associate's salary can vary, the potential is significant. Entry-level professionals can expect to start with a competitive salary, often in the $65,000 to $85,000 range, with a clear trajectory for six-figure earnings as they gain experience and specialized skills.

What Does a Tax Associate Do?

Before diving into the numbers, it's essential to understand the role. A Tax Associate is typically an entry-level professional at a public accounting firm or within the tax department of a large corporation. They are the engine of the tax team, responsible for the foundational work that ensures individuals and companies comply with complex tax laws.

Key responsibilities often include:

- Tax Compliance: Preparing federal, state, and local tax returns for a diverse portfolio of clients, including corporations, partnerships, and high-net-worth individuals.

- Tax Research: Investigating and interpreting tax laws, regulations, and rulings to address specific client issues or support tax planning strategies.

- Data Analysis: Analyzing financial records, such as income statements and balance sheets, to identify potential tax savings and risk areas.

- Supporting Senior Staff: Assisting Senior Associates and Managers with more complex projects, tax audits, and client communication.

It's a role that demands meticulous attention to detail, strong analytical skills, and a commitment to continuous learning as tax codes evolve.

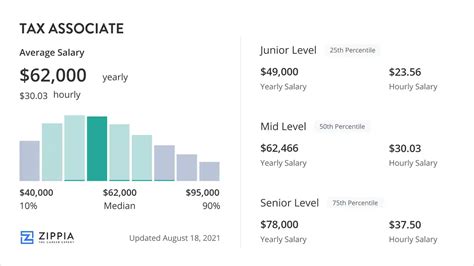

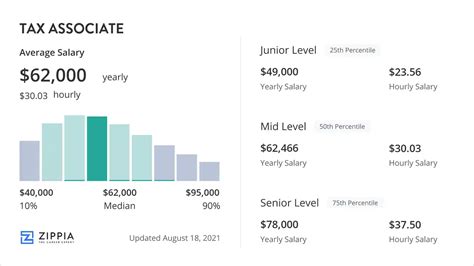

Average Tax Associate Salary

Across the United States, the salary for a tax associate is competitive, reflecting the high demand for skilled accounting professionals.

According to data from Salary.com, the median annual salary for a Tax Associate in the U.S. is approximately $72,100 as of early 2024. However, the typical salary range often falls between $64,400 and $81,200.

Other reputable sources provide a similar picture:

- Glassdoor reports a total pay average of $78,500 per year, which includes base salary and additional compensation like cash bonuses.

- Payscale places the average base salary around $65,200, emphasizing that this figure grows substantially with just a few years of experience.

This range highlights a crucial point: your starting salary is just that—a start. Several key factors will significantly impact your earnings throughout your career.

Key Factors That Influence Salary

Your compensation as a tax associate isn't a fixed number. It's a dynamic figure influenced by a combination of your qualifications, choices, and market forces. Understanding these factors is key to maximizing your earning potential.

###

Level of Education

Your educational background is the foundation of your career. A Bachelor's degree in Accounting, Finance, or a related field is the standard requirement. However, advanced credentials can give you a significant salary advantage.

- Master's Degree: Pursuing a Master of Science in Taxation (MST) or a Master of Accountancy (MAcc) can lead to a higher starting salary and make you a more competitive candidate, especially at top-tier firms.

- CPA License: The Certified Public Accountant (CPA) license is the gold standard in the accounting industry. While most associates start their jobs while still studying for the exam, earning your CPA license is the single most impactful step you can take to increase your salary and accelerate your career progression. Many firms offer bonuses for passing the exam and cover associated costs.

###

Years of Experience

Public accounting offers a well-defined career ladder, and compensation increases with each step.

- Entry-Level (0-2 years): As an Associate, you are learning the fundamentals. Your salary will be in the initial range described above.

- Senior Associate (2-5 years): After a few years, you are promoted to Senior Associate. You take on more complex work, begin reviewing the work of junior staff, and have more client interaction. This promotion comes with a significant salary jump, often into the $85,000 to $110,000+ range.

- Manager and Beyond (5+ years): As you progress to Manager, Senior Manager, and eventually Partner or Director, your compensation shifts dramatically, often well into the six figures, with a greater emphasis on performance bonuses and business development.

###

Geographic Location

Where you work matters. Salaries are adjusted to reflect the local cost of living and market demand. Major metropolitan areas with a high concentration of large corporations and financial institutions will offer higher salaries.

- High-Cost-of-Living (HCOL) Cities: Cities like New York, San Francisco, Boston, and San Jose typically offer the highest salaries to offset the expensive cost of living.

- Major Business Hubs: Cities like Chicago, Dallas, and Atlanta also offer competitive salaries that are well above the national average.

- Lower-Cost-of-Living (LCOL) Areas: Salaries will generally be lower in smaller cities and rural areas, but the purchasing power of your income may be comparable or even greater.

###

Company Type

The type of firm you work for is a major determinant of your salary and overall career experience.

- The "Big Four" (Deloitte, PwC, EY, KPMG): These global giants are known for paying top-of-market starting salaries to attract the best talent. They offer prestigious training and exposure to large, multinational clients, but are also known for demanding work environments.

- National and Regional Firms: Mid-tier firms like Grant Thornton, BDO, and RSM, along with strong regional players, offer competitive compensation that may be slightly below the Big Four but often provide a better work-life balance.

- Industry/Corporate: Some associates may start or move to an in-house tax department at a large corporation. Salaries here are competitive, and the experience is focused on the specific tax issues of a single entity rather than multiple clients.

###

Area of Specialization

As you gain experience, you may choose to specialize. Niche, in-demand specializations are highly lucrative and can significantly boost your earning potential. Some of the most sought-after areas include:

- International Tax: Advising multinational corporations on cross-border transactions.

- M&A (Mergers & Acquisitions) Tax: Structuring deals to be as tax-efficient as possible.

- SALT (State and Local Tax): Navigating the incredibly complex web of tax laws across different states.

- Transfer Pricing: Setting and defending the prices for goods and services exchanged between related entities within a multinational corporation.

Developing expertise in one of these areas can make you an invaluable asset and a high earner.

Job Outlook

The future for tax professionals is bright and stable. According to the U.S. Bureau of Labor Statistics (BLS), employment for Accountants and Auditors is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

This steady demand is driven by several factors:

- The complexity and constant evolution of tax laws.

- Increased globalization of business.

- A consistent need for companies to ensure tax compliance and engage in strategic tax planning.

In short, skilled tax associates will always be in demand, making it a secure and future-proof career choice.

Conclusion

A career as a tax associate is more than just a job; it's an investment in a prosperous future. While the initial salary is competitive, the real story is the potential for growth. Your earnings are not static—they are a direct reflection of your commitment to professional development, your willingness to gain experience, and the strategic choices you make regarding your education, location, and specialization.

For anyone considering this path, the message is clear: a tax associate salary provides a strong foundation, but the ceiling is remarkably high for those who are driven to become true experts in their field.