For those with a knack for numbers and a passion for the law, a career as a tax attorney offers an intellectually stimulating and financially rewarding path. It's a field where expertise is not just valued—it's essential. But what does that high level of demand mean for your wallet? In this guide, we'll break down the salary you can expect as a tax attorney, with average salaries often ranging from $130,000 to well over $250,000 for top-tier professionals.

We'll explore the factors that shape this impressive figure, from education and experience to where you work and what you specialize in. Let's dive into the numbers and see what a future in tax law could hold for you.

What Does a Tax Attorney Do?

Before we talk numbers, let's clarify the role. A tax attorney is a lawyer who specializes in the complex and ever-evolving world of tax law. They are expert navigators of tax codes, regulations, and legal precedents. Their primary goal is to help clients—ranging from individuals and small businesses to multinational corporations—manage their tax obligations and resolve disputes legally and efficiently.

Key responsibilities often include:

- Tax Planning: Advising clients on how to structure financial transactions, business operations, and investments to minimize tax liability.

- Compliance: Ensuring clients file all necessary tax documents accurately and on time.

- Tax Controversy: Representing clients in disputes with government entities like the Internal Revenue Service (IRS) or state tax authorities.

- Corporate Law: Providing critical tax guidance during mergers, acquisitions, and other major corporate transactions.

- Estate Planning: Helping individuals structure their estates to preserve wealth and minimize estate and gift taxes for their heirs.

Average Tax Attorney Salary

A career in tax law is one of the more lucrative specializations within the legal profession. While salary figures vary, they consistently trend well above the average for many other legal practices.

According to recent data, the figures paint a strong picture:

- Salary.com reports that the median tax attorney salary in the United States is approximately $136,590, with a typical range falling between $119,000 and $156,000 as of late 2023.

- Payscale notes a similar average base salary of around $123,000, with the salary range for experienced professionals extending beyond $205,000.

- Glassdoor places the average total pay (including bonuses and profit sharing) for a tax attorney at around $168,000 per year.

It's important to remember that these figures are national averages. Entry-level positions may start closer to the $80,000-$110,000 range, while senior partners at major law firms can earn salaries that climb deep into the high six or even seven figures. The significant variation is driven by several key factors.

Key Factors That Influence Salary

The national average is just a starting point. Your actual earnings as a tax attorney will be shaped by a combination of your qualifications, career choices, and market dynamics.

###

Level of Education

While a Juris Doctor (J.D.) degree is the standard requirement to practice law, an additional credential can significantly boost a tax attorney's earning potential and marketability.

- Master of Laws in Taxation (LL.M.): This is the gold standard for tax attorneys. An LL.M. is a postgraduate law degree that provides intensive, specialized training in tax law. Holding this degree signals a deep level of expertise to employers and clients, often leading to higher starting salaries and access to more prestigious positions at top law and accounting firms.

- Certified Public Accountant (CPA): While not a legal degree, having a CPA license in addition to a J.D. can be a powerful combination. It demonstrates a comprehensive understanding of both the legal and accounting sides of tax issues, making you a highly versatile and valuable asset.

###

Years of Experience

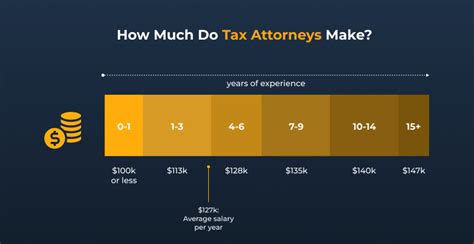

Like most professions, experience pays. The salary trajectory for a tax attorney shows significant growth over time as you build expertise and a track record of success.

- Entry-Level (0-3 years): Attorneys fresh out of law school or an LL.M. program typically start as associates. Their focus is on research, drafting documents, and supporting senior attorneys. Salaries generally fall in the $80,000 to $130,000 range, though this can be much higher at large, top-tier law firms.

- Mid-Career (4-9 years): With several years of experience, attorneys take on more complex cases, manage client relationships, and begin supervising junior associates. Salaries often increase to the $140,000 to $220,000 range.

- Senior/Partner Level (10+ years): Senior attorneys and partners are experts in their field. They are responsible for bringing in new business, leading major cases, and setting firm strategy. Their compensation, which often includes a share of the firm's profits, can easily exceed $250,000 to $500,000+ annually.

###

Geographic Location

Where you practice matters—a lot. Salaries are heavily influenced by the cost of living and the concentration of large corporations and high-net-worth individuals. Major metropolitan areas command the highest salaries.

Cities known for top-tier tax attorney salaries include:

- San Francisco, CA

- New York, NY

- Washington, D.C.

- Chicago, IL

- Boston, MA

Salaries in these hubs can be 20-50% higher than the national average. Conversely, salaries in smaller cities and rural areas will typically be lower to reflect the local market rate.

###

Company Type

The type of organization you work for is one of the most significant determinants of your salary and overall compensation package.

- Large Law Firms ("BigLaw"): These firms, especially the Am Law 100, offer the highest starting salaries, often following a lockstep compensation model that can start near $200,000 for first-year associates. The work is demanding, but the financial rewards are substantial.

- In-House Counsel: Large corporations hire tax attorneys to manage their tax strategies and compliance internally. Salaries are very competitive with law firms and often come with benefits like stock options and a better work-life balance.

- "Big Four" Accounting Firms: Deloitte, PwC, EY, and KPMG have large and respected tax law practices. They offer competitive salaries and excellent opportunities to work on complex international and corporate tax issues.

- Boutique Tax Firms: These smaller, specialized firms focus exclusively on tax law. While starting salaries may not match BigLaw, successful partners can earn incomes that are just as high, if not higher.

- Government: Working for the IRS, Department of Justice, or U.S. Tax Court offers lower starting salaries than the private sector. However, these positions provide unparalleled experience, excellent job security, federal benefits, and a more predictable work schedule. Many attorneys leverage this experience to transition into high-paying private-sector jobs later in their careers.

###

Area of Specialization

Even within tax law, some sub-specialties are more lucrative than others due to the complexity and high stakes involved.

- International Tax: Advising multinational corporations on navigating the tax laws of multiple countries is a highly sought-after and well-compensated skill.

- Mergers & Acquisitions (M&A): Tax planning is a critical component of any large corporate transaction. M&A tax attorneys command premium salaries for their role in structuring these multi-billion dollar deals.

- Tax Controversy: Representing clients in high-stakes disputes against the IRS requires a unique skill set and can be very profitable.

Job Outlook

The demand for skilled legal professionals remains steady. The U.S. Bureau of Labor Statistics (BLS) projects that employment for all lawyers will grow by 4% from 2022 to 2032, which is about as fast as the average for all occupations.

For tax attorneys, the outlook is particularly stable. As long as federal, state, and international tax codes exist and continue to change, there will be a strong and persistent need for experts who can interpret and apply them. Globalization and the increasing complexity of business ensure that tax law will remain a critical and in-demand field for the foreseeable future.

Conclusion

A career as a tax attorney is a journey of continuous learning and high-level problem-solving. While demanding, it offers a clear path to a significant and rewarding income. The data shows that with the right education (especially an LL.M. in Taxation), a strategic choice of employer, and a commitment to building experience, a six-figure salary is not just possible—it's the standard. For those with a meticulous mind and a passion for navigating intricate legal and financial landscapes, becoming a tax attorney is one of the most financially sound investments you can make in your professional future.