If you're considering a career that combines the intellectual rigor of law with the complex, ever-evolving world of finance, you may have found your calling in tax law. This specialized field is not only challenging but also one of the most stable and lucrative paths within the legal profession. But what does that earning potential actually look like?

A career as a tax lawyer offers significant financial rewards, with salaries for experienced professionals in major markets often soaring well into the six-figure range and beyond. While entry-level positions are handsomely compensated, seasoned partners and in-house counsel can command earnings exceeding $300,000 to $500,000 annually.

This guide breaks down everything you need to know about a tax lawyer's salary, from average compensation figures to the key factors that will shape your personal earning potential.

What Does a Tax Lawyer Do?

Before diving into the numbers, it's essential to understand the role. A tax lawyer is a legal expert who specializes in the complex statutes and regulations of tax law. They guide individuals, businesses, and organizations through the intricate maze of federal, state, and local tax systems.

Key responsibilities include:

- Advising Clients: Helping corporations structure mergers and acquisitions, or assisting individuals with estate planning to minimize tax liabilities.

- Ensuring Compliance: Ensuring clients file their taxes correctly and comply with all applicable laws.

- Tax Controversy: Representing clients in disputes with government agencies like the Internal Revenue Service (IRS) or the Department of Justice (DOJ).

- Transactional Structuring: Playing a critical role in business deals to ensure the most tax-efficient outcomes.

It's a high-stakes, detail-oriented profession that is perpetually in demand, as taxes are a constant for every business and individual.

Average Tax Lawyer Salary

While salary figures can vary widely, we can establish a strong baseline by looking at data from several authoritative sources. It's important to note that many data aggregators provide slightly different numbers, but together they paint a clear picture of the profession's earning power.

- Salary.com: As of May 2024, Salary.com reports that the median salary for a Tax Attorney in the United States is $172,401. The typical range falls between $149,890 and $197,901, but this can vary significantly based on the factors discussed below.

- Glassdoor: This platform, which incorporates user-submitted data, reports an estimated total pay of $180,578 per year for a Tax Lawyer in the U.S. as of mid-2024. This figure includes an average base salary of $139,000 with an estimated $42,000 in additional pay, such as bonuses and profit sharing.

- Payscale: According to Payscale, the average base salary for a Tax Attorney is approximately $126,854. Their data shows a broad range, from $79,000 on the low end to over $204,000 for top earners.

Synthesizing this data, a newly qualified tax lawyer might start in the low six figures, while a typical mid-career professional can expect to earn between $150,000 and $200,000. Senior-level attorneys and partners see their compensation climb dramatically higher.

Key Factors That Influence Salary

Your salary as a tax lawyer isn't a single number—it's a spectrum. Your position on that spectrum will be determined by a combination of critical factors.

###

Level of Education

While a Juris Doctor (J.D.) degree is the mandatory foundation for any lawyer, an additional credential often sets tax lawyers apart: the Master of Laws (LL.M.) in Taxation.

- Juris Doctor (J.D.): This is the baseline degree required to pass the bar exam and practice law.

- Master of Laws (LL.M.): This is a one-year postgraduate degree that provides intensive, specialized training in tax law. Earning an LL.M. from a top-tier program (like those at NYU, Georgetown, or Florida) is the gold standard in the tax community. It signals a high level of expertise to employers and can lead to a significant starting salary bump and access to more prestigious job opportunities, particularly in "BigLaw" and specialized boutique firms.

###

Years of Experience

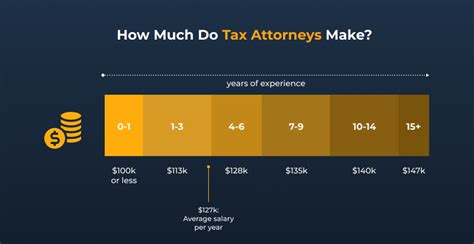

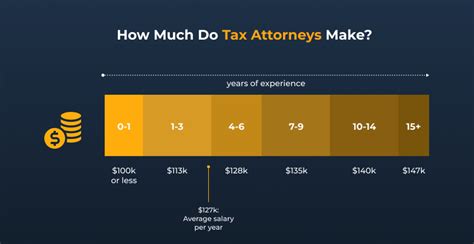

As with any profession, experience is a primary driver of compensation. The career and salary progression for a tax lawyer often looks like this:

- Entry-Level (0-3 Years): A first-year associate, especially one with an LL.M., can expect to earn a starting salary between $120,000 and $225,000. The higher end of this range is typically reserved for associates at large corporate law firms in major cities.

- Mid-Career (4-10 Years): With several years of experience, a tax lawyer has developed expertise and a track record of success. Salaries in this phase typically range from $180,000 to $275,000+. These professionals manage more complex cases and may begin to supervise junior associates.

- Senior/Partner Level (10+ Years): This is where earning potential truly takes off. A senior counsel or partner at a law firm can earn anywhere from $300,000 to well over $1,000,000 annually. At the partner level, compensation is often tied to the firm's profits and the amount of business the partner generates.

###

Geographic Location

Where you practice law has a massive impact on your salary. Major metropolitan areas with high concentrations of corporate headquarters and high-net-worth individuals command the highest salaries due to a higher cost of living and greater demand for sophisticated tax advice.

Top-paying cities for tax lawyers include:

- New York, NY

- San Francisco, CA

- Washington, D.C.

- Los Angeles, CA

- Chicago, IL

- Boston, MA

Salaries in smaller cities and rural areas will be lower but are often balanced by a significantly lower cost of living.

###

Company Type

The type of organization you work for is perhaps the most significant determinant of your salary.

- Large Law Firms ("BigLaw"): These firms, often with 500+ attorneys, pay the highest starting salaries. According to the National Association for Law Placement (NALP), the median first-year associate salary at the largest firms was $225,000 in 2023. These jobs are highly demanding but offer unparalleled experience and compensation.

- In-House Counsel: Many large corporations have their own in-house tax attorneys. Salaries are very competitive with law firms and often come with attractive benefits, including stock options and bonuses. Total compensation can be extremely high for a Chief Tax Officer or VP of Tax at a Fortune 500 company.

- Boutique Tax Firms: These are smaller firms that specialize exclusively in tax law. They can be just as prestigious and high-paying as BigLaw, sometimes offering a better work-life balance and a more focused career path.

- Government: Working for the IRS, the Department of Justice, or the U.S. Tax Court offers lower starting salaries compared to the private sector. However, these roles provide exceptional job security, excellent benefits, a pension, and invaluable experience that is highly sought after by private-sector employers later on.

- Accounting Firms: The "Big Four" accounting firms (Deloitte, EY, PwC, KPMG) employ a large number of tax attorneys. Their compensation is competitive with law firms, and they offer a unique environment that blends legal and accounting services.

###

Area of Specialization

Even within tax law, certain niches are more lucrative than others due to their complexity and direct link to high-value transactions. Highly profitable specializations include:

- International Tax: Advising multinational corporations on cross-border transactions.

- Mergers & Acquisitions (M&A): Structuring the tax aspects of corporate takeovers.

- Tax Controversy: Representing major corporations in high-stakes disputes with the IRS.

- Private Equity & Hedge Fund Taxation: A highly complex and well-compensated field.

Job Outlook

The career outlook for lawyers, in general, is positive. According to the U.S. Bureau of Labor Statistics (BLS), employment for lawyers is projected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations.

The outlook for *tax lawyers* is particularly robust. As long as governments levy taxes and businesses engage in commerce, there will be a strong, consistent demand for tax experts. The increasing globalization of the economy and the constantly changing complexity of tax codes ensure that tax lawyers will remain essential professionals for the foreseeable future.

Conclusion

A career as a tax lawyer is an intellectually stimulating journey that offers exceptional financial rewards and long-term stability. While the path requires significant educational investment and a dedication to lifelong learning, the returns are substantial.

Key takeaways for any aspiring tax lawyer:

- Aim High on Education: A J.D. is required, but an LL.M. in Taxation will open the most lucrative doors.

- Be Strategic About Location: Major metropolitan hubs offer the highest salaries.

- Choose Your Path Wisely: BigLaw and top-tier in-house roles offer the highest compensation, while government roles provide invaluable experience and security.

- Experience Pays: Your earning potential will grow significantly as you build expertise and a strong reputation in the field.

For those with a meticulous mind and a passion for complex problem-solving, a career as a tax lawyer offers not just financial security, but a durable and highly respected profession at the intersection of law and business.