A career as a tax litigator sits at the lucrative intersection of law, finance, and high-stakes strategy. For those with a sharp analytical mind and a penchant for advocacy, it’s one of the most intellectually challenging and financially rewarding legal specializations available. But what does that compensation actually look like?

While salaries can vary significantly, the field offers exceptional earning potential. A qualified tax litigator can expect to earn a starting salary well into the six figures, with experienced partners at top firms commanding compensation of $500,000 or more. This article will break down the numbers, explore the key factors that drive your salary, and provide a clear picture of what you can expect to earn in this dynamic profession.

What Does a Tax Litigator Do?

Before diving into the numbers, it's essential to understand the role. A tax litigator is a specialized attorney who represents individuals, businesses, and organizations in disputes with tax authorities. These authorities can include the Internal Revenue Service (IRS) at the federal level, as well as state and local tax agencies.

Their work isn't about preparing tax returns; it's about resolving conflict after a return has been filed and challenged. Core responsibilities include:

- Representing clients during audits, appeals, and collections processes.

- Negotiating settlements with the IRS or state tax officials.

- Arguing cases in judicial settings, such as the U.S. Tax Court, U.S. District Courts, and appellate courts.

- Providing strategic counsel to prevent future tax controversies.

It's a high-pressure role that demands deep expertise in the tax code, strong negotiation skills, and exceptional courtroom presence.

Average Tax Litigator Salary

The title "Tax Litigator" is a specialized subset of "Tax Attorney." Therefore, salary data often reflects the broader category, but litigation-focused roles, especially in the private sector, typically occupy the upper end of that scale.

According to data from early 2024, the salary landscape for a tax attorney in the United States is quite strong:

- Salary.com reports the median salary for a Tax Attorney is $159,885, with a typical range falling between $139,189 and $183,189. Top earners in the 90th percentile can exceed $204,000 in base salary alone.

- Glassdoor estimates a higher total pay average, which includes bonuses and profit-sharing. It lists the average total pay for a Tax Attorney at approximately $181,429 per year.

- Payscale shows a wide range based on experience, with an average base salary around $124,000, but notes that salaries can climb well above $225,000 for senior, experienced professionals with strong bonus potential.

It’s crucial to understand that these figures are national averages. Your actual salary will be determined by a combination of powerful factors, which we will explore next.

Key Factors That Influence Salary

An average salary is just a starting point. To truly understand your earning potential, you must consider the variables that can dramatically increase or decrease your compensation.

###

Level of Education

In law, education is your foundation. For a tax litigator, there are two key credentials:

- Juris Doctor (J.D.): This is the mandatory law degree required to practice. The prestige of the law school you attend can influence your starting salary, primarily by opening doors to higher-paying "BigLaw" firms.

- Master of Laws (LL.M.) in Taxation: While not strictly required, an LL.M. in Taxation is the gold standard in this field. It provides a year of intensive, specialized study in tax law. Possessing an LL.M. from a top program (like NYU, Georgetown, or Florida) is a significant differentiator. It signals a high level of expertise, making you a more attractive candidate for elite firms and complex cases, and almost always results in a higher starting salary and faster career progression.

###

Years of Experience

Experience is perhaps the single most significant driver of salary growth. The career and salary path for a tax litigator typically follows a clear progression:

- Entry-Level / Junior Associate (0-3 years): Attorneys fresh out of law school or an LL.M. program will start at the firm's established salary scale. In a large firm, this could be anywhere from $150,000 to over $215,000.

- Mid-Level Associate (4-7 years): With several years of experience handling cases, drafting motions, and participating in trials, your value and salary increase significantly. You'll take on more responsibility and may begin supervising junior attorneys. Salaries at this stage often climb to the $250,000 - $350,000 range in major markets.

- Senior Attorney / Partner (8+ years): At this level, you are either a senior counsel with deep expertise or a partner with equity in the firm. Partners are not just practitioners; they are business generators. Their compensation is a mix of salary and a share of the firm's profits, often pushing their total earnings well into the $400,000 to over $1,000,000 range, especially at highly profitable firms.

###

Geographic Location

Where you practice matters immensely. Salaries are adjusted for market demand and cost of living. Major legal and financial hubs offer the highest compensation for tax litigators.

- Top-Tier Markets: Cities like New York, San Francisco, Los Angeles, Washington D.C., and Chicago have the highest concentration of large corporations and wealthy individuals, leading to more complex and high-value tax disputes. Salaries here are consistently the highest in the nation to reflect this demand and the high cost of living.

- Secondary Markets: Cities like Houston, Dallas, Atlanta, and Boston also have robust legal markets and offer competitive salaries that, while lower than the top tier, are still very strong.

- Smaller Markets: In smaller cities and rural areas, salaries will be considerably lower. However, the lower cost of living can sometimes offset the difference in pay.

###

Company Type

The type of organization you work for has a profound impact on your paycheck and overall career path.

- Large Law Firms ("BigLaw"): These firms (e.g., the Am Law 100) represent the largest corporate clients and offer the highest salaries, especially for associates. They often adhere to a lockstep compensation model (like the "Cravath Scale"), where associate salaries and bonuses are set by years of experience and are public knowledge. This is the most lucrative path, but it also comes with the highest demands on your time.

- Boutique Tax Law Firms: These are smaller firms that specialize exclusively in tax law. They may not match BigLaw starting salaries, but successful partners at top boutiques can earn just as much, if not more, than their BigLaw counterparts. They offer a highly focused environment and excellent mentorship.

- Government: A tax litigator can work for the government, representing the public's interest. Key employers include the IRS Office of Chief Counsel and the Department of Justice's Tax Division. Government salaries are lower and are based on the General Schedule (GS) pay scale. For example, an experienced attorney might be a GS-14 or GS-15, with a 2024 salary range of roughly $117,000 to $183,000, depending on location. While the pay is lower, these roles offer unparalleled training, excellent work-life balance, and strong federal benefits.

- Corporate In-House: Large corporations have in-house tax departments that may include tax controversy specialists. Their role is often to manage disputes and hire outside counsel (from BigLaw or boutiques) for litigation. Compensation is competitive and includes base salary, bonuses, and stock options.

###

Area of Specialization

Even within tax litigation, sub-specialties can influence earnings. Niche areas that involve extremely complex rules or high financial stakes tend to command a premium. These include:

- International Tax & Transfer Pricing: Involves disputes over how multinational corporations allocate profits between countries.

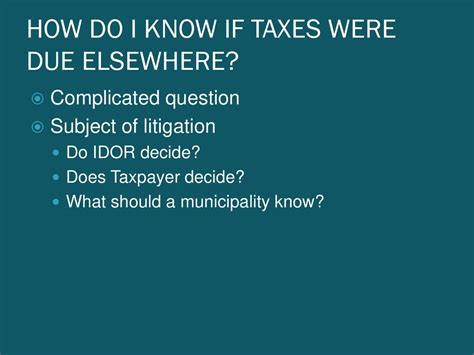

- State and Local Tax (SALT) Controversy: Focuses on disputes with state revenue departments over issues like sales tax and income apportionment.

- Criminal Tax Defense: Involves representing clients accused of tax fraud or evasion, where liberty is at stake.

Job Outlook

The long-term career outlook for lawyers, in general, is positive. According to the U.S. Bureau of Labor Statistics (BLS), employment for lawyers is projected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations.

The outlook for tax litigators is particularly stable. Tax laws are in a constant state of flux and are growing ever more complex. As long as governments need to collect revenue and individuals and businesses seek to minimize their tax burden, there will be disputes. This enduring need for skilled advocates to navigate complex tax controversies ensures a consistent demand for talented tax litigators.

Conclusion

A career as a tax litigator is not for the faint of heart. It requires a significant educational investment, a commitment to lifelong learning, and the ability to thrive under pressure. However, the rewards are commensurate with the challenges.

For prospective professionals, the key takeaways are clear:

- The earning potential is exceptionally high, with a clear path from a strong starting salary to a seven-figure income as a partner.

- Your salary is something you build. Earning an LL.M. in Taxation is one of the most powerful steps you can take to maximize your income potential from day one.

- Strategic choices matter. Your earning trajectory will be heavily influenced by your choice of employer (BigLaw, boutique, government) and geographic location.

If you are driven, analytical, and ready for a challenging career at the pinnacle of the legal profession, tax litigation offers a stable and remarkably lucrative path forward.