A career as a tax preparer offers a unique blend of analytical challenge, client service, and remarkable stability. After all, as the old saying goes, nothing is certain except death and taxes. This constant demand creates a durable and potentially lucrative career path for detail-oriented professionals.

If you're considering this field, your primary question is likely about compensation. While the average salary for a tax preparer often falls in the $55,000 to $65,000 range, this figure is just the starting point. With the right credentials, experience, and specialization, top-tier tax professionals can earn well over $100,000 annually.

This guide will break down the salary you can expect as a tax preparer, explore the key factors that drive your earning potential, and provide a clear outlook on the profession's future.

What Does a Tax Preparer Do?

At its core, a tax preparer is a financial professional who calculates, prepares, and files income tax returns on behalf of individuals, businesses, and other organizations. But the role is far more than just data entry. A skilled tax preparer acts as a trusted advisor, meticulously analyzing financial records to ensure compliance with tax laws while legally maximizing their clients' refunds or minimizing their tax liabilities.

Key responsibilities include:

- Gathering and organizing financial documents like W-2s, 1099s, and expense reports.

- Interviewing clients to understand their complete financial picture.

- Identifying all potential deductions and credits.

- Calculating taxes owed or the refund due.

- Filing returns electronically with the IRS and state tax authorities.

- Advising clients on tax planning strategies for future years.

Average Tax Preparer Salary

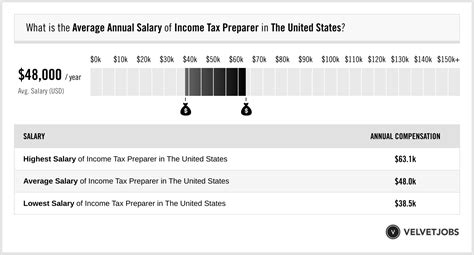

Salary figures for tax preparers can vary based on the data source, but they consistently point to a wide range of potential earnings.

The most authoritative source, the U.S. Bureau of Labor Statistics (BLS), reports that the median annual wage for tax preparers was $55,410 in May 2023. This is the midpoint, meaning half of the preparers earned more and half earned less. The BLS data also highlights the vast potential in the field:

- Lowest 10%: Earned less than $31,310 (typical for entry-level, seasonal roles).

- Highest 10%: Earned more than $101,840 (typical for senior, certified professionals).

Reputable salary aggregators provide a similar, multi-faceted view:

- Salary.com reports the median salary for a Tax Preparer I (entry-level) to be around $61,500 as of early 2024, with a typical range between $53,500 and $71,100.

- Glassdoor, which incorporates user-submitted data and can include bonuses and additional compensation, estimates the total pay for a tax preparer to be in the range of $50,000 to $78,000 per year.

These figures prove that while a solid income is achievable, your specific salary will be heavily influenced by several key factors.

Key Factors That Influence Salary

Your journey from the lower end of the salary spectrum to the top is not based on luck. It's a direct result of your qualifications, choices, and expertise.

### Level of Education & Credentials

This is arguably the most significant driver of a tax preparer's income. While you can start in the field with just a high school diploma and a Preparer Tax Identification Number (PTIN) from the IRS, higher earnings are directly tied to advanced credentials.

- PTIN Holder: This is the minimum requirement to legally prepare federal tax returns for compensation. These roles are often seasonal at large retail tax chains and fall into the lower end of the salary range.

- Enrolled Agent (EA): An EA is a tax professional who has earned the privilege of representing taxpayers before the Internal Revenue Service by passing a comprehensive three-part IRS test. This federal credential signals a high level of expertise in tax law and ethics, leading to a significant salary increase and year-round employment opportunities.

- Certified Public Accountant (CPA): While broader than just tax, a CPA license is the gold standard in the accounting world. CPAs who specialize in taxation command the highest salaries, as they can handle the most complex corporate, international, and high-net-worth individual tax situations.

### Years of Experience

As with any profession, experience pays. As you move from handling simple 1040s to navigating complex business returns and tax planning strategies, your value and compensation will grow accordingly.

- Entry-Level (0-2 years): In this phase, you are building foundational knowledge. Expect to earn on the lower end of the scale as you learn from senior preparers.

- Mid-Career (3-9 years): With several tax seasons under your belt, you can manage a larger client base and tackle more complex returns. Your salary will see a substantial increase, moving well into the national median range.

- Senior/Experienced (10+ years): Senior tax professionals, especially those with credentials like EA or CPA, often move into management, firm ownership, or highly specialized advisory roles. This is where salaries can easily cross the six-figure threshold.

### Geographic Location

Where you work matters. Salaries are often adjusted to reflect the local cost of living and demand for services. Metropolitan areas with major financial hubs tend to offer higher wages. According to BLS data, some of the top-paying states for tax preparers include:

- Washington D.C.

- Massachusetts

- California

- New York

- Colorado

Working in a major city like New York, San Francisco, or Boston will almost always yield a higher salary than working in a rural area, though the cost of living will also be significantly higher.

### Company Type

The type of organization you work for has a direct impact on your compensation structure and overall earnings.

- Large Retail Tax Chains (e.g., H&R Block, Jackson Hewitt): These are excellent entry points into the industry. Compensation is often hourly or based on commission per return, which can be lucrative during the busy season but may not provide a stable, high annual salary.

- Public Accounting/CPA Firms: From small local firms to the "Big Four" (Deloitte, PwC, Ernst & Young, KPMG), these organizations offer salaried positions, comprehensive benefits, and clear career progression. Salaries here are consistently higher and offer the greatest long-term growth potential.

- Corporate In-House Tax Departments: Many large corporations have their own tax departments to manage their complex tax obligations. These roles offer stable, competitive salaries and good work-life balance outside of peak reporting periods.

- Self-Employed/Own Practice: The ultimate path for entrepreneurial tax professionals. While it involves the risks of running a business, owning your own practice offers unlimited earning potential, limited only by your ability to attract and retain clients.

### Area of Specialization

General tax preparation is valuable, but specialization is what creates top earners. Developing deep expertise in a complex or high-demand area of taxation makes you an indispensable expert. High-paying specializations include:

- International Tax: Assisting multinational corporations or expatriates.

- Corporate Tax: Navigating the complex world of C-Corp and S-Corp tax law.

- Trust and Estate Tax: Helping high-net-worth individuals with wealth transfer and succession planning.

- Real Estate Taxation: Specializing in transactions, depreciation, and 1031 exchanges.

Job Outlook

The career outlook for tax preparers is stable. The BLS projects little to no change in employment from 2022 to 2032. While this may not sound explosive, it indicates durability.

The rise of tax software has automated many simple returns, but it has simultaneously increased the need for human experts. The tax code is becoming more complex, not less. As a result, the role of the tax preparer is evolving from data processor to strategic advisor—a role that software cannot replace. Individuals and businesses will continue to need skilled professionals to navigate audits, plan for the future, and interpret intricate tax legislation.

Conclusion

A career as a tax preparer is what you make of it. While you can earn a respectable wage as a seasonal preparer, the path to a truly rewarding and high-paying career is paved with continuous learning and professional development.

By investing in advanced credentials like the Enrolled Agent (EA) or CPA license, gaining diverse experience, and developing a niche specialization, you can move far beyond the national average. For those who are meticulous, analytical, and dedicated to client success, the field of tax preparation offers a stable and financially prosperous future.