A career in venture capital (VC) is often seen as the pinnacle of the finance and technology worlds. It’s a high-stakes, high-reward profession where you don't just work with money—you fuel innovation and help build the future. For those with the right blend of financial acumen, strategic vision, and industry expertise, the compensation can be extraordinary, with top earners making well into the seven figures. But what does a venture capitalist's salary really look like?

This article breaks down the complex world of VC compensation, from entry-level analyst roles to the lucrative earnings of a General Partner. We’ll explore the key components of their pay, the factors that drive their income, and what you can expect if you're considering this dynamic career path.

What Does a Venture Capitalist Do?

Before diving into the numbers, it’s essential to understand the role. A venture capitalist is an investor who provides capital to startups and early-stage, high-growth-potential companies. In exchange for this funding, the VC firm takes an equity stake in the business.

Their responsibilities go far beyond writing checks. A typical day can involve:

- Sourcing Deals: Identifying promising startups through their network, industry events, and research.

- Due Diligence: Rigorously analyzing a company's business plan, market potential, team, technology, and financial health.

- Investing: Negotiating the terms of the investment and structuring the deal.

- Portfolio Management: Taking an active role in the companies they fund, often by taking a board seat, providing strategic guidance, and connecting founders with valuable resources and talent.

- Fundraising: Raising capital from investors (Limited Partners) to create new venture funds.

The ultimate goal is to nurture these startups until they achieve a successful "exit"—either through an acquisition by a larger company or an Initial Public Offering (IPO)—at which point the VC firm realizes a significant return on its investment.

Average Venture Capitalist Salary

Venture capitalist compensation is famously complex and is composed of two primary elements: base salary and carried interest.

- Base Salary: A fixed annual salary, similar to any other professional role.

- Carried Interest (or "Carry"): The share of the profits (typically 20%) from a venture fund that is distributed to the firm's partners after returning the initial capital to investors. This is where the largest financial gains are made, but it's performance-based and often takes years to realize.

Given this structure, salary ranges are incredibly wide. According to data from Salary.com, the average base salary for a Venture Capitalist in the United States is approximately $160,890, but the typical range falls between $137,890 and $188,990. However, this figure primarily reflects base pay and doesn't capture the full picture.

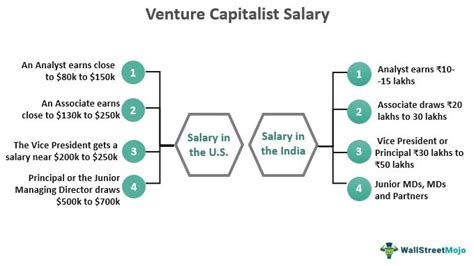

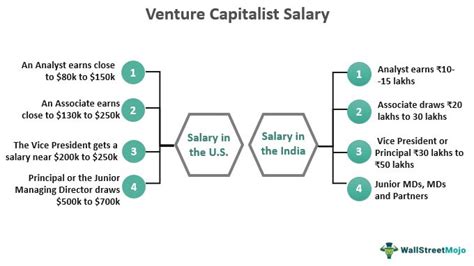

Here’s a more detailed breakdown by career level, incorporating data from industry reports and aggregators like Glassdoor and Payscale:

- VC Analyst / Pre-MBA Associate (0-3 years experience):

- Base Salary: $90,000 - $150,000

- Bonus: Typically 10-50% of base salary.

- Carried Interest: Usually none, or a very small allocation.

- Post-MBA Associate / Senior Associate (3-6 years experience):

- Base Salary: $150,000 - $250,000

- Bonus: Can be substantial, often 30-70% of base.

- Carried Interest: Often begin receiving a small allocation of carry.

- Principal / Vice President (6-10+ years experience):

- Base Salary: $200,000 - $350,000+

- Carried Interest: This becomes a significant part of compensation, with the potential for payouts far exceeding the base salary if the fund is successful.

- Partner / General Partner:

- Base Salary: $300,000 - $700,000+

- Carried Interest: This is the primary driver of income. For partners at successful funds, carried interest can result in multi-million dollar payouts over the life of a fund.

Key Factors That Influence Salary

Compensation isn't one-size-fits-all. Several critical factors determine how much a venture capitalist earns.

### Level of Education

A strong educational background is often a prerequisite for breaking into venture capital. An MBA from a top-tier business school (such as Stanford, Harvard, or Wharton) is highly valued and can command a higher starting salary and a faster track to a post-MBA associate role. Furthermore, advanced degrees in specialized fields, such as a Ph.D. in biotechnology or a M.D. for a healthcare fund, are extremely valuable and can lead to higher compensation due to the specific expertise they bring to the due diligence process.

### Years of Experience

Experience is arguably the most significant factor influencing base salary and, more importantly, a stake in carried interest. The VC career path is a clear progression:

- Analysts and Associates focus on sourcing, research, and financial modeling.

- Principals and VPs take the lead on deals and begin managing portfolio companies.

- Partners are responsible for the firm's overall strategy, making final investment decisions, and managing relationships with the fund's investors.

With each step up the ladder, both base salary and the allocation of carried interest increase dramatically, reflecting greater responsibility and impact on the fund's success.

### Geographic Location

Where you work matters. Venture capital is heavily concentrated in specific innovation hubs, and salaries are adjusted accordingly to reflect the cost of living and competition for talent. According to Salary.com, salaries in key markets are significantly higher than the national average:

- San Francisco Bay Area, CA: Approximately 25% above the national average.

- New York, NY: Approximately 20% above the national average.

- Boston, MA: Approximately 11% above the national average.

Working in these core markets not only provides a higher base salary but also offers access to larger, more successful funds with greater potential for carried interest.

### Company Type

The size, reputation, and performance of the VC firm are massive drivers of compensation.

- Assets Under Management (AUM): A firm with $1 billion in AUM will generally offer higher salaries and larger carry allocations than a firm with a $50 million fund.

- Firm Performance: Carried interest is entirely dependent on the fund's success. A Partner at a top-quartile firm with several blockbuster exits (like an early investment in a company like Uber or Airbnb) will earn exponentially more than a Partner at a firm whose investments have failed to generate returns.

### Area of Specialization

Many VC firms specialize in specific sectors. An investor with deep, proven expertise in a hot-growth area can command a premium salary. For example, a VC with a background in artificial intelligence, cybersecurity, financial technology (FinTech), or biotechnology is highly sought after. Their specialized knowledge is critical for identifying winning companies and conducting effective due diligence, making them more valuable to the firm.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not have a specific category for "Venture Capitalist," the most relevant proxy is Financial Managers, a group that includes professionals who manage investments.

According to the BLS, employment for Financial Managers is projected to grow 17 percent from 2021 to 2031, which is much faster than the average for all occupations. The BLS attributes this growth to the increasing complexity of the global economy and the continued need for expert financial management. As the startup ecosystem continues to thrive and technology evolves, the demand for skilled investors to identify and fund the next wave of innovation is expected to remain strong.

Conclusion

A career in venture capital is as challenging as it is rewarding. While the headlines often focus on the multi-million dollar payouts, it's a long-term game built on expertise, networking, and a high tolerance for risk.

Here are the key takeaways for anyone considering this path:

- Compensation is a Tale of Two Parts: Your earnings will consist of a competitive base salary and, more importantly, performance-based carried interest.

- Experience is King: Your salary and influence grow directly with your experience and track record.

- Location and Specialization Matter: Working in a major tech hub and having expertise in a high-growth sector will significantly boost your earning potential.

- Success is Tied to the Fund: The ultimate financial reward comes from the success of your firm's investments, making it a high-risk, high-reward profession.

For ambitious professionals passionate about technology and business building, venture capital offers a unique opportunity to achieve immense financial success while playing a direct role in shaping the future of industries.