A Vice President (VP) role at Goldman Sachs represents a significant milestone in a finance professional's career. It signifies expertise, leadership, and a key position within one of the world's most prestigious investment banks. But beyond the prestige, what is the tangible financial reward? The answer is substantial, with total compensation packages often soaring well into the six-figure range, making it one of the most sought-after positions in the financial industry.

This article provides a data-driven analysis of a Goldman Sachs VP salary, exploring the components of their compensation, the key factors that influence their earnings, and the career outlook for this demanding yet rewarding role.

What Does a Vice President at Goldman Sachs Do?

First, it's crucial to understand that a "Vice President" in investment banking is not an executive board member as the title might imply in other industries. Instead, it is a mid-senior level rank for an experienced professional. A VP sits between the junior ranks (Analysts and Associates) and the senior leadership (Managing Directors and Partners).

Key responsibilities typically include:

- Project and Deal Execution: VPs are the primary day-to-day managers of transactions, whether it's an IPO, a merger & acquisition (M&A) deal, or a major financing round.

- Client Management: They serve as a key point of contact for clients, building relationships and ensuring the smooth delivery of the bank's services.

- Team Leadership: VPs manage and mentor teams of Associates and Analysts, reviewing their financial models, presentations, and analyses to ensure accuracy and quality.

- Strategic Contribution: They contribute to pitch books and strategic recommendations, leveraging their industry expertise to help win new business.

In essence, a VP is the engine of the deal team, responsible for both execution and management.

Average Vice President Salary at Goldman Sachs

Compensation for a Goldman Sachs VP is multifaceted, consisting of a base salary and a significant variable component (the annual bonus). This structure is designed to reward performance at the individual, divisional, and firm-wide levels.

While exact figures fluctuate based on market conditions and performance, we can establish a reliable range based on aggregated data.

- Average Base Salary: According to the latest data from salary aggregators like Glassdoor and Levels.fyi, the typical base salary for a Vice President at Goldman Sachs in the United States ranges from $175,000 to $250,000 per year.

- Average Total Compensation (Base + Bonus): The bonus is where compensation dramatically increases. This variable pay can range from 50% to over 150% of the base salary. This places the average total compensation for a Goldman Sachs VP in the $350,000 to $500,000+ range. In exceptional years for both the individual and the firm, this figure can be even higher.

It's important to note that this is an average. A first-year VP will earn less than a senior VP who is on the cusp of a promotion to Managing Director.

Key Factors That Influence Salary

Several critical factors determine where a VP's salary falls within this wide range. Understanding them is key to maximizing earning potential.

### Level of Education

While a bachelor's degree from a top-tier ("target") university is the standard entry point into investment banking, a Master of Business Administration (MBA) plays a significant role in the path to VP. Many professionals enter investment banking as an Associate after completing an MBA from a top program (such as an M7 or T15 school). This path can lead to a higher starting salary as an Associate and a faster, more direct track to the VP promotion. However, for those promoted internally from an Analyst role, years of high performance can be just as valuable as a graduate degree.

### Years of Experience

Experience is arguably the most critical factor. The investment banking career path is highly structured:

- Analyst: 2-3 years

- Associate: 3-4 years

- Vice President: Promotion typically occurs after 5-7 years of total experience.

Within the VP title itself, there are levels of seniority. A VP in their first year will be at the lower end of the compensation band. A seasoned VP with 10+ years of total experience will command a salary and bonus at the highest end of the range and will be actively considered for a promotion to Managing Director, which involves another significant leap in compensation.

### Geographic Location

Where you work matters immensely. Compensation is adjusted based on the cost of living and the concentration of financial activity.

- Top Tier (New York City, London): As the firm's headquarters and a global financial epicenter, New York offers the highest compensation packages to attract top talent in a high-cost-of-living environment.

- Major Hubs (San Francisco, Chicago): These cities also host major Goldman Sachs offices, particularly for tech banking (San Francisco). Salaries are highly competitive, though they may be slightly below New York levels.

- Growing Hubs (Salt Lake City, Dallas): Goldman Sachs has significantly expanded its presence in these "nearshore" locations. While the base salaries and bonuses are still exceptional compared to most other professions, they are adjusted downwards to reflect a lower cost of living. A VP in Salt Lake City might earn a total compensation package that is 15-25% lower than their New-York-based counterpart, but with significantly greater purchasing power.

### Company Type

The query is specific to Goldman Sachs, a "bulge bracket" investment bank. These top-tier global banks (including J.P. Morgan, Morgan Stanley, etc.) compete for the same elite talent pool and therefore offer the highest levels of compensation. Earning potential at a bulge bracket firm like Goldman Sachs is generally higher than at smaller, "boutique" investment banks or in corporate development roles at non-financial companies, especially when considering the size and scale of the annual bonus.

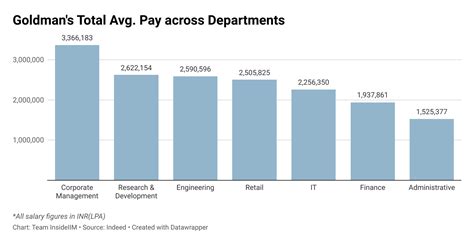

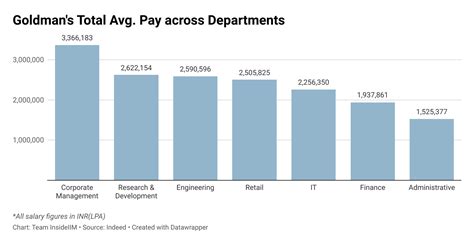

### Area of Specialization

Not all VPs at Goldman Sachs are in the Investment Banking Division (IBD). Compensation varies significantly based on the division's proximity to revenue generation.

- Highest Earning Divisions: VPs in front-office, revenue-generating roles like the Investment Banking Division (M&A, Leveraged Finance), Global Markets (Sales & Trading), and Asset & Wealth Management (specifically private equity and alternative investments) typically receive the largest bonuses.

- Other Key Divisions: VPs in crucial functions like Risk Management, Compliance, Corporate Treasury, and Engineering (including "Strats" or quants) are also highly compensated. While their bonuses might be less directly tied to deal flow, their expertise is critical to the firm's success, and they earn salaries far above the national average. However, their total compensation may be modestly lower than that of their front-office counterparts.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) does not track investment banking roles specifically. However, we can look at the broader category of "Financial Managers" for an industry-wide perspective. The BLS projects a 16% growth in employment for financial managers from 2022 to 2032, a rate described as "much faster than the average for all occupations."

While the industry outlook is strong, it's important to recognize that roles at Goldman Sachs are subject to the cyclical nature of the global economy. Hiring and compensation can be impacted by market downturns. Nonetheless, the demand for skilled financial professionals who can navigate complex transactions remains consistently high, making the career path a durable one for top performers. Competition for these roles is, and will remain, incredibly fierce.

Conclusion

A Vice President position at Goldman Sachs is the culmination of years of dedication, high performance, and deep expertise. The financial rewards reflect this high bar, with total compensation packages that are among the most lucrative in the professional world.

For those aspiring to this career, here are the key takeaways:

- Total Compensation is Key: Focus on the total package (base + bonus), as the variable bonus constitutes a massive portion of annual earnings.

- Performance is Paramount: Your bonus, and ultimately your career trajectory, is tied directly to your performance and the success of your division and the firm.

- Experience, Location, and Division Matter: These three factors are the primary drivers of your earning potential within the VP band.

The path is demanding, requiring long hours and resilience, but for those who succeed, a career as a Goldman Sachs VP offers unparalleled opportunities for professional growth and significant financial reward.

Disclaimer: *Salary data is based on publicly available, aggregated sources and is subject to change based on market conditions, individual performance, and other factors. The figures provided are estimates for informational purposes.*