Embarking on a career in banking can be a stable and rewarding path, and for many, the journey begins in the essential role of a bank teller. As one of the largest financial institutions in the United States, Wells Fargo is a major employer of banking professionals. If you're considering this role, your primary question is likely about compensation. A position as a Wells Fargo bank teller offers a competitive starting wage with salaries potentially ranging from over $35,000 to nearly $50,000 annually, depending on a variety of key factors.

This guide will provide a data-driven look at what you can expect to earn as a Wells Fargo bank teller, the factors that influence your pay, and the long-term outlook for the profession.

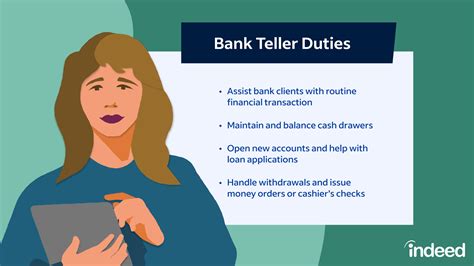

What Does a Wells Fargo Bank Teller Do?

A bank teller is the face of the bank, serving as the primary point of contact for customers' daily banking needs. The role is a blend of meticulous financial handling and exceptional customer service. While specific duties may vary, a Wells Fargo bank teller is typically responsible for:

- Processing Transactions: Accurately handling deposits, withdrawals, loan payments, and money orders.

- Customer Service: Greeting customers, answering questions about products and services, and resolving account issues.

- Cash Management: Managing and balancing a cash drawer, adhering to strict security protocols.

- Identifying Customer Needs: Recognizing opportunities to refer customers to other banking professionals for services like mortgages, investments, or business accounts.

- Compliance: Following all bank policies and federal regulations to ensure the security and integrity of financial transactions.

It's a role that requires a high degree of trust, attention to detail, and strong interpersonal skills.

Average Wells Fargo Bank Teller Salary

When evaluating compensation, it's helpful to look at data from multiple authoritative sources. Wells Fargo has made public commitments to increasing its minimum wage, which directly impacts teller salaries.

As of 2024, Wells Fargo has established an hourly minimum wage that ranges from $17 to $24 per hour, with the exact amount depending on the employee's geographic location. This policy sets a strong baseline for entry-level compensation.

Let's break down what this means for an annual salary and how it compares to industry averages:

- Typical Annual Salary: Based on the company's stated hourly range, a full-time Wells Fargo teller can expect a starting annual salary between $35,360 and $49,920.

- Salary Aggregator Data: Reputable sites confirm this range. For example, Glassdoor reports an average total pay for a Wells Fargo Teller of around $43,500 per year, which includes base salary and potential additional compensation. Salary.com places the typical range for a "Bank Teller I" in the U.S. between $34,000 and $42,000, with major banks like Wells Fargo often paying at the higher end of this scale.

- Industry Benchmark: According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all tellers was $36,800 in May 2023. Wells Fargo's commitment to a higher minimum wage positions its compensation package competitively within the industry.

*(Sources: Wells Fargo, Glassdoor, Salary.com, U.S. Bureau of Labor Statistics)*

Key Factors That Influence Salary

Your starting salary and earning potential are not fixed. Several factors can significantly impact your compensation as a Wells Fargo bank teller.

### Level of Education

For an entry-level teller position, a high school diploma or equivalent is typically the only educational requirement. While an associate's or bachelor's degree in finance, business, or a related field may not drastically increase your *starting* pay as a teller, it is a powerful catalyst for career advancement. A degree can significantly speed up your promotion to higher-paying roles such as Personal Banker, Lead Teller, or Branch Manager.

### Years of Experience

Experience is one of the most direct influencers of a teller's salary. As you gain experience, your value to the bank increases. The career path often looks like this:

- Entry-Level Teller (0-2 years): You will likely start at the bank's established minimum wage for your location.

- Experienced Teller (2-5 years): With a proven track record of accuracy and customer service, you can expect annual raises and a salary that moves toward the mid-to-upper end of the pay scale.

- Lead Teller / Head Teller (5+ years): Tellers who take on supervisory responsibilities, train new hires, and handle more complex transactions can earn a premium. According to Payscale, experienced head tellers can see their compensation increase by 15-25% or more compared to entry-level positions.

### Geographic Location

Where you work matters immensely. Wells Fargo's tiered minimum wage system ($17-$24/hour) is a direct reflection of this. Tellers working in major metropolitan areas with a high cost of living (like New York City, San Francisco, or Boston) will be at the top end of this pay scale. Conversely, those in smaller cities or rural areas with a lower cost of living will likely have a starting wage closer to the bottom end of the range. Always research the cost of living in your specific area to understand the true value of your salary.

### Company Type

While this article focuses on Wells Fargo, it's useful to know how it compares. Large national banks like Wells Fargo typically offer more structured pay scales, higher starting wages, and more comprehensive benefits packages (health insurance, 401(k), paid time off) than smaller community banks or credit unions. This structured environment can also provide clearer paths for career advancement within the same organization.

### Area of Specialization

Within the teller role, opportunities for specialization can lead to higher pay. This "specialization" often means transitioning into a more advanced role. Consider these paths:

- Universal Banker: This is an increasingly common hybrid role. A Universal Banker performs traditional teller duties but is also trained to handle more complex tasks like opening new accounts, discussing loan products, and troubleshooting complex service issues. This added responsibility comes with a higher salary.

- Lead Teller: As mentioned, taking on leadership duties, managing schedules, and acting as a point of escalation for customer issues will increase your earning potential.

- Business Banking Focus: Some tellers may specialize in handling the needs of small business clients, which requires a deeper knowledge of business accounts and services and can be a stepping stone to a higher-paying role in business banking.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) projects that employment for tellers will decline by 12% from 2022 to 2032. This projection is largely due to the rise of online and mobile banking, which has automated many traditional teller transactions.

However, this statistic doesn't tell the whole story. While the number of traditional teller roles may decrease, the nature of the job is evolving. Banks still need a human presence to build customer relationships, solve complex problems, and provide services that a mobile app cannot. The teller of the future is less of a transaction processor and more of a financial service specialist—a "Universal Banker." The skills you develop as a teller—cash handling, customer service, and product knowledge—are foundational and highly transferable to other, more secure roles within the financial industry.

Conclusion

A career as a Wells Fargo bank teller is an excellent entry point into the world of finance. With a competitive, location-adjusted starting salary and a clear path for growth, it provides a stable foundation for a long-term career.

Key Takeaways:

- Competitive Pay: Expect a starting hourly wage between $17 and $24, leading to an annual salary of roughly $35,000 to $50,000.

- Growth is Key: Your earnings will grow with experience, especially as you move into Lead Teller or Universal Banker roles.

- Location Matters: Your salary will be significantly influenced by the cost of living in your city.

- A Stepping Stone, Not a Ceiling: While the long-term outlook for the *traditional* teller role is declining, the position provides the essential skills to pivot into more advanced, in-demand roles within banking.

For anyone seeking a stable job that builds a foundation in customer service and finance, the role of a Wells Fargo bank teller remains a valuable and accessible career choice.