Table of Contents

- [What Kind of Work Earns a 7-Figure Salary?](#what-kind-of-work-earns-a-7-figure-salary)

- [Deconstructing a 7-Figure Income: A Deep Dive into Compensation](#deconstructing-a-7-figure-income-a-deep-dive-into-compensation)

- [Key Factors That Influence a 7-Figure Income](#key-factors-that-influence-a-7-figure-income)

- [Job Outlook and Career Growth for High-Earners](#job-outlook-and-career-growth-for-high-earners)

- [How to Start Your Journey Towards a 7-Figure Income](#how-to-start-your-journey-towards-a-7-figure-income)

- [Is a 7-Figure Salary the Right Goal for You?](#is-a-7-figure-salary-the-right-goal-for-you)

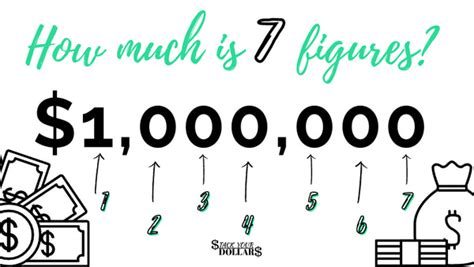

The phrase "7-figure salary" echoes in the halls of ambitious career planning, a symbol of ultimate professional and financial success. It represents an annual income of at least $1,000,000. For many, it’s the Mount Everest of career goals—daunting, distant, yet undeniably alluring. But what is a 7-figure salary in practical terms? It’s more than just a number; it’s a milestone that signifies entry into the top percentile of earners, a level of compensation that can fundamentally alter one's life, legacy, and impact on the world. This income bracket offers not just luxury, but immense freedom, opportunity, and the power to make significant choices without financial constraint.

Reaching this elite level of earning is not the result of a single, defined career path. There is no "7-Figure Salary Major" in college. Instead, it is the culmination of strategic decisions, relentless dedication, specialized expertise, and often, a healthy dose of calculated risk. I once had the privilege of interviewing a tech CEO who had just taken her company public. When I asked about her financial success, she didn't talk about the money itself; she spoke about the "leverage of obsession"—the drive to solve a problem so completely that immense value creation, and therefore compensation, became an inevitable byproduct. Her story crystallized for me that a 7-figure income isn't a goal you chase directly; it's the shadow cast by a colossal professional achievement.

This guide is designed to be your comprehensive roadmap to understanding this elite financial tier. We will demystify the concept, moving beyond the dazzling number to explore the realities of the work involved. We will dissect the anatomy of 7-figure compensation packages, analyze the critical factors that determine such high earnings, and examine the career outlook for a future where you could be one of these top earners. Whether you are a student choosing a major, a mid-career professional seeking to accelerate your growth, or an entrepreneur scaling a new venture, this article will provide the authoritative, data-driven insights you need to navigate the path toward achieving a 7-figure salary.

---

What Kind of Work Earns a 7-Figure Salary?

A 7-figure income is not tied to a single job title but rather to a level of value, responsibility, and impact. The individuals who reach this echelon operate at the apex of their fields, where their decisions carry significant weight and their skills are both rare and in high demand. While the paths are diverse, they can generally be categorized into several archetypes.

The C-Suite Executive: This is perhaps the most traditional image of a 7-figure earner. Chief Executive Officers (CEOs), Chief Financial Officers (CFOs), Chief Operating Officers (COOs), and other top executives at large corporations are compensated for their immense responsibility. They are stewards of company vision, strategy, and performance, managing thousands of employees and billions of dollars in revenue. Their work involves high-stakes decision-making, stakeholder management (board, investors, employees), and navigating complex market dynamics.

The Specialist Professional: This category includes individuals whose expertise is the product of years, often decades, of intensive education and training.

- Medical Specialists: Surgeons, particularly in fields like neurosurgery, orthopedic surgery, and cardiology, perform life-saving procedures that command high compensation. Their earnings reflect the grueling years of medical school, residency, fellowships, and the immense pressure of their daily work.

- Top-Tier Lawyers: Partners at major "Big Law" firms, especially those specializing in lucrative areas like mergers and acquisitions (M&A), intellectual property litigation, or corporate law, can easily earn 7-figure incomes. They advise on billion-dollar deals and high-stakes legal battles where their counsel is indispensable.

The Investment & Finance Professional: Wall Street and the world of high finance are notorious for their massive compensation packages.

- Investment Bankers: Managing directors in investment banking who lead teams on M&A deals, initial public offerings (IPOs), and large-scale debt financing earn substantial salaries and, more significantly, massive bonuses tied to deal performance.

- Hedge Fund & Private Equity Managers: These professionals manage vast pools of capital for wealthy individuals and institutions. Their compensation is often tied directly to the fund's performance, through a model like "2 and 20" (a 2% management fee and 20% of the profits), which can lead to astronomical earnings in successful years.

The Entrepreneur / Business Owner: This is the path of high risk and high reward. Successful entrepreneurs who build a company from the ground up and scale it to a significant size can achieve a 7-figure income through profits, distributions, or by the valuation of their equity in the business. They don't just perform a job; they create the entire system of value, employing others and driving innovation.

The Elite Sales Professional: In many industries, particularly enterprise software, medical devices, and luxury real estate, the top 1% of salespeople can earn 7-figure commissions. These are not simple order-takers; they are strategic consultants who build deep relationships, understand complex client needs, and close multi-million dollar deals. Their income is a direct reflection of the revenue they generate for their company.

### A "Day in the Life" of a C-Suite Executive (Example: COO of a Tech Company)

To make this tangible, let's imagine a day in the life of a Chief Operating Officer at a publicly traded tech company:

- 5:30 AM - 6:30 AM: Wake up, review overnight performance dashboards from international markets, and read curated industry news. This is quiet time for strategic thinking before the day's chaos begins.

- 7:00 AM - 8:30 AM: Commute to the office while taking calls with the head of Asia-Pacific operations to troubleshoot a supply chain issue.

- 8:30 AM - 10:00 AM: Executive leadership team meeting. The CEO, CFO, and other chiefs discuss quarterly financial forecasts, competitive threats, and a potential acquisition target. The COO's role is to ground the strategy in operational reality—can we actually execute this?

- 10:00 AM - 12:00 PM: Back-to-back one-on-ones with direct reports: the VP of Engineering, VP of Global Supply Chain, and VP of Customer Success. These meetings are about removing roadblocks, aligning priorities, and holding teams accountable for key performance indicators (KPIs).

- 12:00 PM - 1:00 PM: A working lunch with the General Counsel to discuss a pending regulatory inquiry in Europe. Every word matters; the legal and financial implications are enormous.

- 1:00 PM - 3:00 PM: Deep-dive session on a major product launch. The COO grills the team on their go-to-market strategy, production ramp-up plans, and contingency plans if things go wrong. The pressure is immense.

- 3:00 PM - 4:30 PM: Investor relations call. The COO and CFO present operational updates to key institutional investors, justifying the company's strategy and defending its performance.

- 4:30 PM - 6:00 PM: Walk the floors. The COO visits different departments to get a feel for morale and uncover issues that don't appear on a spreadsheet.

- 6:00 PM - 7:30 PM: Respond to critical emails, approve high-level budgets, and prepare notes for the next day's Board of Directors committee meeting.

- 7:30 PM onwards: Head home, have dinner with family, and likely spend another hour or two on email or reading briefing documents before bed.

This day is a blend of high-level strategy, intense problem-solving, and relentless communication. The compensation reflects not just the long hours, but the immense pressure and the scope of responsibility for the company's success or failure.

---

Deconstructing a 7-Figure Income: A Deep Dive into Compensation

When we talk about a "7-figure salary," the word "salary" is often a misnomer. For the vast majority of these high-earners, the fixed base salary is only one component—and frequently not the largest—of their total compensation. Understanding the full picture requires dissecting the various elements that contribute to that million-dollar-plus annual income. Total compensation is a package designed to attract, retain, and incentivize top talent to drive exceptional results.

Let's break down the typical components:

1. Base Salary:

This is the fixed, predictable amount of money an individual receives, paid out in regular increments. For 7-figure earners, the base salary provides a stable foundation for their income. While substantial, it's rarely the star of the show. For a C-suite executive at a large public company, a base salary might range from $500,000 to over $1,000,000. According to a 2023 report by Equilar, the median base salary for CEOs at the 500 largest U.S. companies was approximately $1.4 million. However, for a partner at a law firm or a managing director at an investment bank, the "base" might be a more modest draw or salary, with the vast majority of their earnings coming from year-end bonuses or profit distributions.

2. Bonuses (Short-Term Incentives - STIs):

Bonuses are variable, performance-based cash payments. They are designed to reward the achievement of specific, typically annual, goals.

- Performance Bonus: This is the most common type, tied to individual, team, and/or company performance. For a CEO, this could be based on achieving targets for revenue growth, profitability (EBITDA), or stock price appreciation. For a surgeon, it might be tied to patient volume or clinical outcomes. A top salesperson's bonus is their commission, directly calculated as a percentage of the sales they close.

- Signing Bonus: A one-time cash payment used to attract a high-value candidate to a new company. For executive-level hires, this can easily be a six or even seven-figure amount, designed to compensate them for bonuses or unvested equity they are forfeiting by leaving their previous role.

These bonuses can often exceed the base salary. It's not uncommon for a Managing Director at Goldman Sachs or a similar investment bank to have a base salary of, for example, $500,000, but receive a year-end bonus of $1,000,000 to $5,000,000+ in a good year, based on the performance of their deals and the bank's overall profitability.

3. Equity Compensation (Long-Term Incentives - LTIs):

This is often the most lucrative part of a 7-figure compensation package, especially in the corporate and tech worlds. Equity aligns the individual's financial interests with those of the company's shareholders over the long term.

- Stock Options: These give the employee the right to buy a certain number of company shares at a predetermined price (the "strike price") in the future. If the company's stock price rises significantly above the strike price, the employee can exercise their options and sell the shares for a substantial profit.

- Restricted Stock Units (RSUs): These are grants of company shares that "vest" (become fully owned by the employee) over a period of time, typically 3-4 years. Unlike options, RSUs have value even if the stock price doesn't increase, as they represent actual shares. A senior engineering leader at a company like Google or Meta could receive an initial equity grant of $1,000,000 to $2,000,000 vesting over four years, in addition to their salary and bonus. According to Levels.fyi, a platform that crowdsources tech salaries, a Principal Engineer at Google can have a total compensation package exceeding $1 million, with over 50% of that coming from stock grants.

- Performance Shares: These are equity grants that only vest if the company meets specific long-term performance goals, such as total shareholder return (TSR) compared to a peer group.

4. Profit Sharing, Carried Interest, and Partnership Distributions:

This form of compensation is common in partnerships and investment funds.

- Partnership Distributions: Partners in law firms, accounting firms, and consulting firms receive a share of the firm's profits at the end of the year. Senior partners at top firms can see distributions well into the 7-figures.

- Carried Interest ("Carry"): This is the primary incentive for managers in private equity and venture capital. It is a share (typically 20%) of the fund's profits. If a private equity fund buys a company, improves it, and sells it for a large profit, the fund managers receive 20% of that profit. This can lead to eight or even nine-figure paydays for successful fund managers over the life of a fund.

### Compensation Brackets by Archetype (Illustrative)

To visualize how this comes together, here's an illustrative breakdown. Note that these are broad estimates and can vary wildly.

| Career Stage / Archetype | Base Salary Range | Variable/Bonus Range | Equity/Long-Term Range | Total Potential Comp |

| :--- | :--- | :--- | :--- | :--- |

| Mid-Career Surgeon | $350k - $500k | $50k - $200k (Productivity) | N/A (often in private practice) | $400k - $700k |

| Senior Partner (Big Law) | $300k - $500k (Draw) | $1M - $4M+ (Profit Share) | N/A (Partnership Equity) | $1.3M - $4.5M+ |

| Managing Director (Inv. Bank)| $500k - $1M | $1M - $5M+ (Performance Bonus) | Varies (Stock Awards) | $1.5M - $6M+ |

| Principal Engineer (FAANG) | $250k - $350k | $50k - $150k (Cash Bonus) | $400k - $800k (Annual Stock) | $700k - $1.3M+ |

| C-Suite (Fortune 500) | $800k - $1.5M | $1M - $3M (STI) | $5M - $15M+ (LTI/Stock) | $6.8M - $19.5M+ |

*Sources: Data synthesized from reports by Equilar, Major, Lindsey & Africa (for legal), Levels.fyi (for tech), and industry knowledge.*

As this table clearly shows, the journey to a 7-figure income is rarely about a single paycheck. It’s about building a compensation structure where variable and long-term incentives, tied directly to high-impact performance, dramatically outweigh the fixed salary.

---

Key Factors That Influence a 7-Figure Income

Earning a 7-figure income is not a matter of luck; it is the outcome of a confluence of specific, powerful factors. These variables work in concert to create the rare circumstances where such high compensation is justified and awarded. Aspiring professionals must strategically navigate these factors to maximize their earning potential over the course of their career.

###

Level of Education

While a specific degree doesn't guarantee a seven-figure salary, advanced and specialized education is a common denominator in many of the highest-paying professions. It serves as a powerful barrier to entry, ensuring that those who attain the required credentials have a rare and valuable skillset.

- Doctor of Medicine (M.D.) or Doctor of Osteopathic Medicine (D.O.): This is the gateway to the medical profession. However, to reach the 7-figure threshold, specialization is key. After medical school, a grueling residency (3-7 years) followed by a fellowship (1-3 years) in a high-demand field is necessary. According to a 2023 Doximity Physician Compensation Report, specialists like neurosurgeons (average $788,313), thoracic surgeons ($706,775), and orthopedic surgeons ($624,043) are the highest paid, with top practitioners in private practice or high-demand urban centers easily surpassing the $1 million mark.

- Juris Doctor (J.D.): A law degree is the start, but its value is heavily influenced by the prestige of the law school and early career choices. Graduates from "T14" law schools (the top 14 as ranked by U.S. News & World Report) have a significantly higher chance of landing jobs at elite "Big Law" firms. It is within these firms that the path to a 7-figure income exists. Becoming an equity partner, a process that can take 8-10+ years, is where earnings skyrocket from a share of the firm's profits.

- Master of Business Administration (MBA): An MBA, particularly from a top-tier program like Harvard, Stanford, or Wharton, acts as a powerful career accelerator. It is often a prerequisite for high-level roles in investment banking, private equity, and management consulting. More importantly, it is a common credential among C-suite executives of Fortune 500 companies. The network, strategic thinking skills, and brand association of a top MBA can directly lead to opportunities with 7-figure potential.

- Ph.D. in a Quantitative Field: In today's data-driven world, a Ph.D. in fields like Computer Science, Statistics, or Physics can be a ticket to extremely high-paying roles. Quantitative analysis ("quant") hedge funds and high-frequency trading firms actively recruit these individuals to develop complex trading algorithms. Similarly, top tech companies hire Ph.D.s for specialized research and development roles in areas like Artificial Intelligence and Machine Learning, with compensation packages, including stock, often reaching into the high six or low seven figures.

###

Years of Experience

A 7-figure salary is almost never an entry-level reality. It is the reward for a long-term investment in building expertise, a track record of success, and a reputation for excellence. The salary growth trajectory is not linear; it is exponential, with the most significant leaps in compensation occurring at senior and leadership levels.

- Entry-Level (0-3 Years): At this stage, even in high-paying fields, earnings are a fraction of the ultimate goal. A first-year investment banking analyst might earn $150,000 - $200,000, and a first-year associate at a top law firm might make $225,000 (as per the current Cravath scale). The focus here is on learning, execution, and proving one's capability.

- Mid-Career (4-10 Years): This is the period of specialization and advancement. The analyst becomes an associate or Vice President (VP) in banking. The law firm associate becomes a senior associate or counsel. A surgeon completes their residency and fellowship and begins to build a practice. Compensation rises steadily. A VP in investment banking could earn $400,000 - $700,000. It is during this phase that individuals demonstrate the potential for leadership and business generation.

- Senior/Leadership Level (10-20+ Years): This is where the 7-figure threshold is most commonly crossed. The VP becomes a Managing Director. The senior associate becomes a Partner. The surgeon becomes a partner in a private practice or a department head at a major hospital. The successful entrepreneur's business matures. At this level, compensation is directly tied to the value one brings to the organization—the deals sourced, the clients managed, the profits generated, or the strategic direction set. A Managing Director's total compensation can leap to $1.5M - $5M+. An equity partner's draw can be $2M - $4M+. The experience accumulated over decades translates into wisdom, judgment, and a network that is immensely valuable and, therefore, highly compensated.

###

Geographic Location

Where you work has a monumental impact on your earning potential. 7-figure opportunities are not evenly distributed; they are concentrated in major global economic hubs where the cost of living is high, but the concentration of wealth, talent, and high-stakes business is even higher.

- Top-Tier Global Cities: New York City stands as the undisputed capital of high finance, with Wall Street driving some of the highest compensation packages in the world. The San Francisco Bay Area (Silicon Valley) is the epicenter of the tech industry, where equity compensation can create enormous wealth. Other key hubs include London, Hong Kong, Singapore, and Chicago.

- Salary Differentials: The same job title can command vastly different salaries based on location. According to Glassdoor, a senior executive role in New York City or San Francisco can pay 30-50% more than the equivalent role in a city like Kansas City or Phoenix. For example, a senior partner at a law firm in NYC might earn over $3 million, while a partner at a respected regional firm in the Midwest might earn $500,000 for similar work, simply due to the difference in billing rates and the scale of the business transactions.

- Industry Clustering: Industries concentrate geographically, and to be a top earner, you often need to be where the action is. Aspiring investment bankers must be in New York. Ambitious tech entrepreneurs and engineers are drawn to Silicon Valley. This clustering creates a competitive, high-stakes environment that drives salaries upward for the most sought-after talent.

###

Company Type & Size

The context in which you work—the type and size of your employer—is a critical determinant of your compensation structure and potential.

- Large Public Corporations (Fortune 500): These companies offer the most structured path to a 7-figure income, primarily for their C-suite and senior executive ranks. Compensation is a carefully balanced mix of high base salaries, performance bonuses, and substantial long-term equity grants (RSUs, performance shares). The path is long and highly political, but the potential rewards are enormous and relatively transparent, as executive compensation must be publicly disclosed.

- Startups (Venture-Backed): The path here is high-risk, high-reward, and heavily reliant on equity. The base salary for an early employee or founder is often low, sometimes below market rate. The potential for a 7-figure outcome lies almost entirely in the value of the stock options or equity stake. If the startup achieves a successful exit (an acquisition by a larger company or an IPO), these equity holdings can be worth millions or even tens of millions of dollars. A "7-figure year" here might be a single liquidity event rather than a recurring salary.

- Private Companies & Partnerships (Law, Consulting, Finance): These entities offer a direct line of sight between performance and pay. At elite consulting firms like McKinsey or BCG, partners share in the firm's profits. At private equity firms, the partners and managing directors earn carried interest. This model directly rewards business generation and successful investments, leading to some of the most consistent and highest 7-figure incomes.

- Non-Profit & Government: It is exceptionally rare to earn a 7-figure salary in these sectors. While the heads of the largest non-profit foundations or university presidents can sometimes reach this level, it is the exception. The compensation structures are designed to prioritize the mission over personal enrichment.

###

Area of Specialization

Within any given profession, specialization is the key to unlocking the highest levels of income. Generalists are valuable, but hyper-specialists who can solve very specific, very expensive problems are compensated at a premium.

- Medicine: As noted, it's not just about being a doctor, but being a *neurosurgeon*, a *cardiothoracic surgeon*, or an *orthopedic surgeon specializing in spinal fusions*. These sub-specialties require more training and carry higher risks, and the procedures generate more revenue for the hospital or practice.

- Law: A general corporate lawyer is valuable, but a lawyer specializing in *cross-border M&A tax law* for the tech industry can command a much higher premium. Similarly, a *patent litigator* who has won nine-figure settlements for pharmaceutical clients is in a different league.

- Finance: An analyst covering a broad market is different from a *quantitative analyst* who designs high-frequency trading algorithms for emerging market derivatives. A general investment banker is different from a Managing Director who is the go-to expert for *renewable energy infrastructure IPOs*.

- Technology: A general software engineer is well-paid, but an engineer who is one of the world's leading experts in *large-scale distributed databases* or a research scientist with seminal papers in *generative AI models* will receive compensation packages from top firms that far exceed the norm, often breaking the $1 million barrier.

###

In-Demand Skills

Beyond formal credentials and titles, a specific set of high-leverage skills consistently separates top earners from the pack. These are not technical skills learned from a textbook, but meta-skills applied at a strategic level.

- Leadership & People Management: The ability to build, inspire, and manage high-performing teams is paramount. Anyone earning a 7-figure salary (outside of solo performers like traders or surgeons) is leveraging the work of many others. This requires exceptional communication, emotional intelligence, and the ability to set a clear vision.

- Strategic Negotiation: Whether negotiating a corporate merger, a client contract, a partnership deal, or your own compensation package, the ability to navigate high-stakes negotiations and create win-win outcomes is a direct driver of financial success.

- Business Development & Sales: In nearly every field, the highest earners are those who bring in the business. This includes the law firm partner who lands a massive client, the investment banker who sources a new IPO, or the consultant who sells a multi-million dollar engagement. The ability to build relationships, create value, and close deals is a direct path to higher income.

- Capital Allocation & Financial Acumen: Understanding how to deploy capital—whether it's a company's budget, a private equity fund's assets, or a client's wealth—to generate the highest possible return is a core skill for CEOs, CFOs, and finance professionals.

- Risk Management: In a complex world, the ability to identify, assess, and mitigate risk is incredibly valuable. This is true for a surgeon assessing a risky procedure, a CEO navigating a volatile market, or a hedge fund manager balancing a portfolio. Those with superior judgment in high-stakes situations are rewarded accordingly.

---

Job Outlook and Career Growth for High-Earners

Predicting the job outlook for roles that command a 7-figure salary requires looking beyond simple job growth percentages. These positions are, by their nature, scarce. The competition is and will remain ferocious. However, by analyzing the outlook for the *professions* that serve as gateways to these roles, we can identify key trends, future challenges, and opportunities for growth.

Analysis of Key Professions (Based on BLS and Industry Data)

The U.S. Bureau of Labor Statistics (BLS) provides a 10-year outlook for various occupations. While their salary data often caps out and doesn't fully capture the extreme top end of earners, the growth trends are instructive.

- Top Executives: The BLS projects