Serving on a board of directors represents a pinnacle of professional achievement. It’s a role that combines strategic influence, fiduciary responsibility, and the opportunity to shape the future of an organization. But beyond the prestige, what is the financial reality of this position?

The compensation for board members is as varied as the organizations they serve, ranging from vital, unpaid volunteer work at non-profits to lucrative six-figure packages at major corporations. For aspiring executives and seasoned professionals, understanding this landscape is key. While the average cash compensation for a director at a large public company often falls between $250,000 and $350,000 annually, this figure only tells part of the story.

This article will break down the complexities of board member compensation, exploring the factors that determine earning potential and the overall career outlook.

What Does a Board Member Do?

Before diving into salary, it’s crucial to understand the role. A board member is not an employee; they are a fiduciary who governs the organization on behalf of its stakeholders (shareholders in a for-profit company, or the community in a non-profit).

Key responsibilities include:

- Strategic Oversight: Guiding and approving the company's long-term vision, mission, and strategic goals.

- CEO Selection and Evaluation: Hiring, setting compensation for, and evaluating the performance of the Chief Executive Officer.

- Financial Stewardship: Overseeing the organization's financial health, approving budgets, and ensuring accurate reporting.

- Risk Management: Identifying and mitigating major risks to the organization, from financial and operational to reputational and cybersecurity threats.

- Governance and Compliance: Ensuring the organization operates legally, ethically, and in accordance with its own bylaws.

This is a demanding role that requires significant time commitment for board meetings, committee work, and preparation.

Average Board Member Salary

Board member compensation is not a typical salary. It's usually a package consisting of an annual retainer, meeting fees, and, most significantly in the corporate world, equity. The figures differ dramatically between for-profit and non-profit sectors.

### For-Profit Corporate Boards

For-profit board compensation is designed to attract top-tier talent. The structure typically includes:

- Annual Cash Retainer: A fixed annual fee for service.

- Equity Awards: Stock options or Restricted Stock Units (RSUs), which align the director's interests with those of the shareholders. This often forms the largest part of the compensation.

- Committee Fees: Additional retainers for serving on or chairing key committees (e.g., Audit, Compensation).

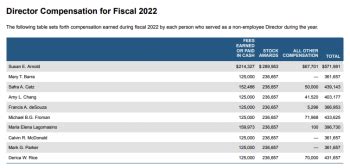

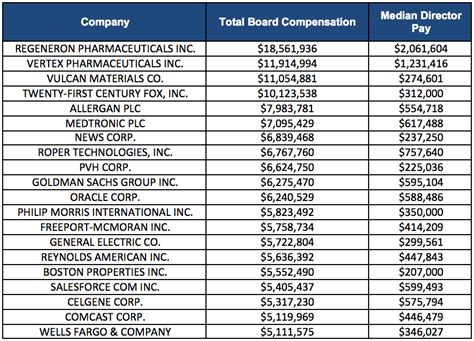

According to a 2023 report from the Spencer Stuart Board Index, which surveys S&P 500 companies, the average total compensation for a non-employee director was $329,484. Data from Salary.com corroborates this, reporting a median total compensation for a Top-Tier Board Member at $280,317, with a typical range falling between $223,000 and $341,000.

### Non-Profit Boards

The motivation for serving on a non-profit board is fundamentally different. It is primarily a volunteer role driven by a passion for the organization's mission.

- The vast majority of non-profit board members are unpaid. According to BoardSource, a leading authority on non-profit governance, compensating board members is rare and often discouraged to avoid conflicts of interest.

- Some very large non-profits, such as major hospital systems or large foundations, may offer a modest stipend or honorarium to cover expenses or as a small token of appreciation, but this is the exception, not the rule.

Key Factors That Influence Salary

Compensation isn't uniform. Several key factors dictate how much a board member can expect to earn, particularly in the for-profit sector.

### Company Type

This is the single most significant factor.

- Publicly Traded Companies: S&P 500 and other large-cap public companies offer the highest compensation due to their size, complexity, regulatory scrutiny, and high level of risk and accountability.

- Private & Venture-Backed Companies: Compensation is highly variable. An early-stage startup might offer only equity, while a large, established private company may offer a cash retainer that is substantial but typically less than a public company's.

- Non-Profit Organizations: As discussed, these are almost always unpaid, mission-driven volunteer positions.

### Years of Experience

There is no "entry-level" board member. Directors are selected based on decades of proven leadership and expertise. However, experience *as a director* carries a premium. A seasoned director who has served on multiple boards, especially one with a strong track record of navigating crises or successful mergers, is more valuable and can command higher compensation. Many former C-suite executives (CEOs, CFOs) transition into a "portfolio career" of serving on several boards.

### Geographic Location

While the rise of virtual meetings has made geography less of a barrier, it still plays a role. Board opportunities are concentrated in major business hubs where corporate headquarters are located, such as New York, Silicon Valley, Chicago, and Houston. Companies in these high-cost, competitive markets may offer slightly higher compensation to attract the best local and national talent.

### Level of Education

While a specific degree is not a requirement, the vast majority of corporate board members are highly educated. An MBA, JD (law degree), or other advanced degree is common. This level of education signals a high degree of analytical skill, financial literacy, and strategic thinking. It functions less as a direct salary driver and more as a baseline qualification for consideration.

### Area of Specialization

Modern boards are built like a team, with each member bringing a unique, critical skill set. Certain areas of expertise are in high demand and can significantly influence a director's value.

- Financial Expertise: The Sarbanes-Oxley Act requires public companies to have at least one "audit committee financial expert." This makes former CFOs and senior accounting partners highly sought-after.

- Cybersecurity & Technology: With digital transformation and cyber threats being top-of-mind risks, directors with deep technology or cybersecurity experience are in high demand.

- ESG (Environmental, Social, Governance): As investors and regulators increase their focus on ESG issues, directors with expertise in sustainability, social impact, and corporate governance are becoming invaluable.

- Chairing a Committee: Directors who serve as the chair of a major committee (Audit, Compensation, Nominating/Governance) almost always receive a higher retainer for the increased workload and responsibility.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) does not track "Board Member" as a distinct profession. However, it can be viewed as a capstone to a career as a "Top Executive."

For Top Executives, the BLS projects a job growth of 3% from 2022 to 2032, which is about as fast as the average for all occupations. While the number of board seats is relatively fixed, turnover creates opportunities.

The demand is growing for a new *type* of director: one who is more diverse (in terms of gender, ethnicity, and experience) and possesses modern skills in areas like digital technology, ESG, and human capital management. Therefore, while competition for these prestigious seats is incredibly fierce, the outlook is strong for professionals who cultivate these in-demand specializations throughout their careers.

Conclusion

Serving on a board of directors is less of a job and more of a calling—a culmination of a successful career. For those aspiring to this level, the key takeaways are clear:

- Compensation is a Tale of Two Sectors: The path is financially lucrative in the for-profit world, driven by cash and equity, while it is philanthropically rewarding in the non-profit world.

- Expertise is Your Currency: Your value as a board candidate is determined by your unique skills, especially in high-demand areas like finance, technology, and ESG.

- It's a Marathon, Not a Sprint: Board positions are earned through a long and distinguished career. Focus on building a track record of leadership, strategic success, and unimpeachable integrity.

For professionals mapping out their long-term career goals, a board seat is an exceptional target—one that offers the chance to lead at the highest level and leave a lasting impact on an organization's legacy.