Introduction

Have you ever looked at a job posting and wondered, "Who decides this salary?" Or perhaps you’ve debated with colleagues about fair pay, questioning the complex alchemy that seems to dictate your paycheck. If you’re a person driven by data, fascinated by market dynamics, and passionate about creating equitable and motivating workplaces, you might be asking more than just "what is a mean salary?" You might be asking if the career that *answers* that question is the right one for you. This is the world of the Compensation Analyst, one of the most critical and increasingly strategic roles within modern business.

Compensation Analysts are the architects of an organization's pay philosophy. They are the analytical minds who don't just calculate a mean (or average) salary; they dissect it, understand its components, and use that knowledge to build compensation structures that attract top talent, retain high performers, and ensure internal fairness. The national average salary for a Compensation Analyst in the United States hovers around $78,000 per year, with a typical range falling between $65,000 for entry-level positions and soaring well over $120,000 for senior or specialized roles. It's a field where your expertise directly translates into both significant earning potential and profound organizational impact.

I remember my first major project as a junior HR professional was to assist our Senior Compensation Manager with a company-wide salary band review. Watching her transform mountains of raw market data—spreadsheets that seemed to stretch for miles—into a clear, logical, and fair pay structure was a revelation. It wasn't just about numbers; it was about values, strategy, and people. That experience cemented my belief that compensation is the bedrock of the employer-employee relationship, and the professionals who manage it are indispensable.

This guide is designed to be your definitive resource for understanding this rewarding career. We will delve into every facet of the profession, from the daily tasks and deep salary analysis to the skills you need to thrive and the path you can take to get started.

### Table of Contents

- [What Does a Compensation Analyst Do?](#what-does-a-compensation-analyst-do)

- [Average Compensation Analyst Salary: A Deep Dive](#average-compensation-analyst-salary-a-deep-dive)

- [Key Factors That Influence a Compensation Analyst's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Compensation Analysts](#job-outlook-and-career-growth)

- [How to Get Started as a Compensation Analyst](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career in Compensation Analysis Right for You?](#conclusion)

---

What Does a Compensation Analyst Do?

At its core, a Compensation Analyst is a specialized Human Resources professional who ensures that an organization's pay practices are competitive, equitable, and legally compliant. They are part analyst, part strategist, and part communicator. They blend quantitative skills with a deep understanding of human motivation and business goals. While the title might sound purely numerical, the work is intensely human-centric, impacting every single employee in an organization.

Their primary objective is to design, implement, and manage a company's entire compensation system. This includes base salaries, bonuses, incentive plans, and sometimes stock options. They are the guardians of "total rewards," a philosophy that considers all the ways an employee is compensated for their work, both directly and indirectly.

Let’s break down the core responsibilities and typical projects you would encounter in this role:

Core Responsibilities:

- Market Pricing and Salary Surveys: This is the bedrock of the job. Analysts participate in and analyze data from third-party salary surveys (from firms like Radford, Mercer, or Willis Towers Watson). They match internal jobs to survey jobs to determine the "market rate" for each position. This is where they calculate mean, median, and various percentile salaries to understand the competitive landscape.

- Job Evaluation and Leveling: They use established methodologies (like point-factor or market-pricing systems) to determine the relative worth of different jobs within the organization. This process creates a logical internal hierarchy and ensures that roles of similar scope and impact are paid similarly, a concept known as internal equity.

- Designing and Maintaining Salary Structures: Based on market data and internal job evaluations, analysts build salary ranges or "bands" for every job level. These structures provide a framework for hiring managers and HR to make consistent and fair pay decisions.

- Data Analysis and Reporting: A significant portion of their time is spent in spreadsheets and HR Information Systems (HRIS). They analyze pay gaps, model the cost of salary increases, track bonus payouts, and prepare detailed reports for leadership to inform strategic decisions.

- Compliance and Governance: They must be experts in labor laws related to pay, such as the Fair Labor Standards Act (FLSA) in the U.S., which governs minimum wage and overtime. Increasingly, they are also at the forefront of pay equity analysis, ensuring there are no systemic pay disparities based on gender, race, or other protected characteristics.

- Communication and Collaboration: Analysts don't work in a vacuum. They partner closely with HR Business Partners, Talent Acquisition teams, and business leaders to provide guidance on job offers, promotions, and other compensation-related issues. They must be able to explain complex data in a simple, compelling way.

### A Day in the Life of a Mid-Career Compensation Analyst

To make this more tangible, let's walk through a typical day:

- 9:00 AM - 9:30 AM: Start the day by reviewing emails and urgent requests. A recruiter needs a salary range for a new, hard-to-fill cybersecurity role. A manager has a question about a promotional increase for a top performer.

- 9:30 AM - 11:00 AM: Tackle the recruiter's request. The cybersecurity role is unique, so it's not a perfect match in the standard salary surveys. You pull data from three different tech-specific surveys, blend the data for roles with similar skill sets (e.g., Threat Intelligence Analyst, Security Engineer), and analyze the 50th and 75th percentile market data. You prepare a summary and recommended salary band, sending it to the recruiter with notes on the competitive market.

- 11:00 AM - 12:30 PM: Shift gears to a major project: the annual salary increase cycle. You pull a large dataset from the HRIS containing every employee's current salary, performance rating, and position in their salary range. You begin modeling different scenarios in Excel: what is the total budget impact of a 3% average increase versus a 3.5% increase? How can the budget be distributed to reward top performers more heavily?

- 12:30 PM - 1:30 PM: Lunch break.

- 1:30 PM - 3:00 PM: Weekly team meeting with the entire compensation department. The team discusses ongoing projects, new pay transparency laws being enacted in several states, and progress on the upcoming submission for a major industry salary survey.

- 3:00 PM - 4:30 PM: Meet with an HR Business Partner and a Director of Marketing. The Director wants to create a new bonus plan for their team to incentivize product launch success. You act as a consultant, asking probing questions: What specific behaviors do you want to drive? How will we measure success? What is the proposed budget? You agree on next steps, which involve you modeling a few potential plan designs.

- 4:30 PM - 5:00 PM: Wrap up the day by responding to the manager's promotion question from the morning, providing guidance based on the company's promotion policies and the employee's new position within their salary band. You update your project tracker before logging off.

---

Average Compensation Analyst Salary: A Deep Dive

Understanding the earning potential is a critical step in evaluating any career path. For Compensation Analysts, the financial rewards are robust and grow significantly with experience and expertise. This role is highly valued because it directly impacts a company's ability to compete for talent and manage its largest expense: payroll.

It's important to distinguish between the mean salary and the median salary. The mean is the average of all salaries added up and divided by the number of salaries. The median is the midpoint salary, where half of the people earn more and half earn less. For salary data, the median is often a more reliable indicator as it is less skewed by a few extremely high or low earners. Most official sources, like the U.S. Bureau of Labor Statistics (BLS), report the median salary.

### National Salary Benchmarks

Let's look at what the most reputable sources say about Compensation Analyst salaries in the United States.

- U.S. Bureau of Labor Statistics (BLS): The BLS groups this role under "Compensation, Benefits, and Job Analysis Specialists." As of May 2022 (the most recent comprehensive data), the BLS reports a median annual wage of $73,930. The lowest 10 percent earned less than $47,970, and the highest 10 percent earned more than $117,790.

- Salary.com: This site provides more granular, real-time data. As of late 2023, Salary.com reports the median salary for a Compensation Analyst I (entry-level) in the U.S. is around $65,500, for a Compensation Analyst II (mid-career) it's $78,200, and for a Senior Compensation Analyst (Analyst III) it's $92,400. This demonstrates the clear progression in base pay.

- Payscale: Payscale's data, updated continuously, shows an average base salary of approximately $71,500 per year. Their reported range is typically from $54,000 to $96,000 for the core role.

- Glassdoor: Based on thousands of user-submitted salary reports, Glassdoor places the total pay for a Compensation Analyst at an average of $88,500 per year in the United States, with an estimated base pay average of $77,000 and additional pay (bonuses, profit sharing) averaging around $11,500.

Key Takeaway: While figures vary slightly by source, a consistent picture emerges. An entry-level analyst can expect to start in the $60,000s, a mid-career professional will likely earn in the $70,000s to $80,000s, and a senior analyst can comfortably command a salary in the $90,000s or low $100,000s.

### Salary Progression by Experience Level

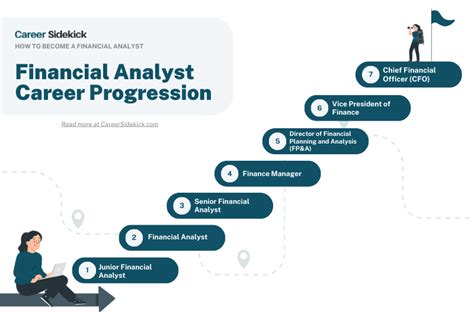

Your salary as a Compensation Analyst is not static. It is designed to grow as you accumulate skills, take on more complex projects, and demonstrate greater strategic impact. Here’s a typical salary trajectory:

| Experience Level | Typical Title(s) | Typical Salary Range (Base Pay) | Key Responsibilities & Skills |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 Years) | Compensation Analyst I, Junior Analyst, HR Analyst (Compensation Focus) | $60,000 - $72,000 | Assisting with salary survey submissions, running basic reports, conducting routine job evaluations, learning the company's pay structures and HRIS. Focus is on execution and learning. |

| Mid-Career (2-5 Years) | Compensation Analyst II, Compensation Analyst | $72,000 - $90,000 | Managing survey participation independently, market pricing a wide range of jobs, contributing to salary structure design, performing moderately complex data analysis, and advising junior HR staff. |

| Senior-Level (5-8+ Years) | Senior Compensation Analyst, Lead Compensation Analyst | $90,000 - $120,000+ | Leading major projects (e.g., annual compensation cycle, new incentive plan design), mentoring junior analysts, handling complex/executive-level job pricing, conducting pay equity audits, and presenting to senior leadership. |

| Management/Leadership (8+ Years) | Compensation Manager, Director of Compensation, VP of Total Rewards | $120,000 - $250,000+ | Setting the overall compensation strategy, managing a team of analysts, overseeing all compensation programs (including executive and sales comp), managing vendor relationships, and serving as the primary advisor to the C-suite on all pay-related matters. |

*Salary ranges are national averages and can be significantly higher in high-cost-of-living areas or specific industries. Source: Aggregated data from BLS, Salary.com, and industry observations.*

### Beyond the Base Salary: Understanding Total Compensation

A Compensation Analyst's pay isn't just their salary. As experts in "total rewards," they are often recipients of a comprehensive package. When evaluating an offer, it's crucial to look at the full picture.

- Annual Bonuses/Incentives: This is the most common form of additional cash compensation. Most analysts are eligible for an annual bonus based on company and individual performance. For an analyst-level role, this might be 5-15% of their base salary. For a manager or director, it could be 15-30% or more.

- Profit Sharing: Some companies, particularly in the private sector, offer a profit-sharing plan where a portion of the company's profits is distributed among employees.

- Stock Options/Equity: This is especially prevalent in the tech industry and at publicly traded companies. Equity can be a significant component of total compensation, particularly for senior and leadership roles, offering the potential for substantial financial upside.

- Retirement Benefits: A strong 401(k) or 403(b) plan with a generous company match is a key part of the package. A 100% match on the first 5-6% of your contributions is a powerful wealth-building tool.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance are standard. Many companies also offer wellness stipends, gym memberships, and robust mental health support.

- Paid Time Off (PTO): A generous PTO policy, including vacation, sick leave, and holidays, is a valuable, non-monetary part of compensation.

When all these elements are combined, the "total compensation" for a skilled Compensation Analyst can be substantially higher than their base salary alone, making it a financially attractive and stable career choice.

---

Key Factors That Influence a Compensation Analyst's Salary

While the national averages provide a great starting point, your actual salary as a Compensation Analyst will be determined by a combination of several key factors. This is, after all, the very work you would be doing—analyzing these factors to price jobs. Understanding them is essential for maximizing your own earning potential. This section will provide an in-depth exploration of the variables that have the biggest impact on your paycheck.

### ### Level of Education and Certifications

Your educational background forms the foundation of your career and is a primary determinant of your starting salary and long-term growth potential.

Educational Degrees:

- Bachelor's Degree: This is the standard entry-level requirement. The most common and relevant fields of study are Human Resources, Business Administration, Finance, Economics, or Mathematics/Statistics. A degree in one of these areas equips you with the necessary blend of business acumen, HR principles, and quantitative skills. Employers see this as the non-negotiable ticket to entry.

- Master's Degree: While not typically required for an entry-level analyst role, a master's degree can provide a significant advantage and a higher starting salary. It becomes particularly valuable for career advancement into management and leadership. Relevant advanced degrees include:

- Master of Business Administration (MBA): An MBA is highly valued because it provides a holistic understanding of business strategy, finance, and operations, allowing you to connect compensation decisions directly to the company's bottom line. Professionals with an MBA often move into strategic or leadership roles more quickly.

- Master's in Human Resources (MHR) or Industrial-Organizational Psychology: These specialized degrees provide deep expertise in HR theory, labor relations, organizational behavior, and statistical analysis as it applies to people, making them a perfect fit for a compensation career.

The Impact of Professional Certifications:

In the world of compensation, professional certifications are arguably as important as advanced degrees, if not more so. They signal a deep commitment to the profession and a mastery of a specialized body of knowledge. Holding a key certification can instantly increase your marketability and salary. The most prestigious certifying body is WorldatWork.

- Certified Compensation Professional (CCP®): This is the gold standard certification for compensation professionals. Earning it requires passing a series of ten exams covering topics from base pay and variable pay design to market pricing, global compensation, and statistics. Holding a CCP is a clear signal to employers that you are a subject matter expert. Many companies list the CCP as a "preferred" or even "required" qualification for senior analyst and manager roles. Analysts with a CCP can often command a 5-15% salary premium over their non-certified peers.

- Global Remuneration Professional (GRP®): For analysts working in multinational corporations or specializing in international compensation, the GRP is the premier global certification. It covers the complexities of compensating employees across different countries, currencies, and legal environments.

- Advanced Certified Compensation Professional (ACCP™): This is a higher-level certification for senior leaders, focusing more on strategy, executive compensation, and aligning total rewards with business objectives.

### ### Years of Experience

Experience is the single most powerful driver of salary growth in this field. As you progress from an entry-level analyst executing tasks to a senior strategist shaping policy, your value—and your pay—increases dramatically.

- Entry-Level (0-2 years): At this stage, you are learning the ropes. Your salary (e.g., $60k-$72k) reflects that you are being trained and are primarily focused on tactical execution under supervision.

- Mid-Career (2-5 years): You are now a fully proficient professional. You can work independently, manage complex projects, and begin to mentor others. Your salary (e.g., $72k-$90k) reflects this reliability and expanded skill set. You are a trusted doer.

- Senior-Level (5-8+ years): You have moved from "doer" to "influencer." You are not just analyzing data; you are interpreting it to provide strategic recommendations. You lead major initiatives and are a subject matter expert. Your salary (e.g., $90k-$120k+) reflects your ability to solve complex problems and influence business leaders. This is the stage where your expertise creates significant leverage.

- Leadership (8+ years): As a Manager or Director, you are now responsible for the entire function and the performance of a team. Your focus is on strategy, budget management, and executive advising. Your compensation (e.g., $120k-$250k+) is tied to the overall success of the company's talent and financial strategies.

### ### Geographic Location

Where you work has a massive impact on your salary. Compensation is highly localized, designed to reflect the cost of living and the cost of labor in a specific geographic market. A job in a major metropolitan hub will almost always pay more than the exact same job in a rural area.

Here's a look at how salaries for Compensation Analysts can vary by location, using data from sources like Salary.com and Glassdoor to illustrate the differences.

Top-Paying Metropolitan Areas:

These cities have a high cost of living and a high concentration of large corporate headquarters, particularly in the high-paying tech and finance sectors.

- San Francisco Bay Area, CA (San Francisco, San Jose): Often 25-40% above the national average. A mid-career analyst could earn $100,000 - $130,000.

- New York City, NY: Typically 20-30% above the national average.

- Boston, MA: A hub for tech, biotech, and finance, often paying 15-25% above average.

- Washington, D.C.: A strong market with many large government contractors and associations, paying 10-20% above average.

- Seattle, WA: Home to major tech giants, with salaries often 15-25% above the national benchmark.

Average-Paying Metropolitan Areas:

These cities have a more moderate cost of living and offer salaries that are generally in line with or slightly above the national average.

- Chicago, IL

- Dallas, TX

- Atlanta, GA

- Denver, CO

Lower-Paying Regions:

Salaries will generally be below the national average in smaller cities and rural areas where the cost of living and competition for talent are lower. However, the purchasing power of that salary might be equivalent to or even greater than a higher salary in an expensive city.

The Impact of Remote Work: The rise of remote work has added a new layer of complexity. Companies are still defining their geographic pay policies. Some pay all remote employees based on a national average, some adjust pay based on the employee's location, and others pay the same high rate (e.g., a "San Francisco salary") regardless of where the employee lives to attract the best talent. As a Compensation Analyst, you may even be involved in designing these very policies.

### ### Company Type & Size

The type and size of your employer create different work environments and compensation philosophies.

- Large Corporations (Fortune 500): These companies typically have the most sophisticated compensation departments. They offer structured career paths, well-defined salary bands, and robust benefits packages. Salaries are often competitive and may include generous annual bonuses and stock for senior roles. The work is often specialized.

- Startups and Tech Companies: Compensation here can be a mix. Base salaries might be competitive or slightly lower than at a large corporation, but this is often offset by a significant equity component (stock options or RSUs) that carries high potential rewards if the company succeeds. The environment is fast-paced, and your role may be broader.

- Non-Profits and Universities: These organizations are mission-driven. Cash compensation is often lower than in the for-profit sector. A mid-career analyst might earn 10-20% less in base salary. However, this can be balanced by excellent benefits, particularly strong retirement plans and generous paid time off.

- Government (Federal, State, Local): Government roles offer unparalleled job security and excellent benefits. Pay is determined by rigid, transparent pay scales (like the GS scale for federal employees). While the ceiling for pay may be lower than in the private sector, the predictability and work-life balance are major draws.

- Consulting Firms: Working for a compensation consulting firm (like Mercer, Aon, Willis Towers Watson) is another path. Here, you work with multiple clients on a project basis. The work is incredibly varied and provides immense learning opportunities. Pay is often very high, but the hours can be demanding.

### ### Area of Specialization

As you advance in your career, you can specialize in a particular niche of compensation, which can significantly boost your earning potential.

- Executive Compensation: This is one of the most lucrative specializations. These analysts and managers design the complex compensation packages for C-suite executives, including base salary, short-term incentives, long-term equity awards, and perks. This requires deep knowledge of SEC regulations and corporate governance. Senior specialists in this area can easily earn $150,000 - $200,000+.

- Sales Compensation: This specialty focuses on designing and administering commission and incentive plans for sales teams. It requires a deep understanding of sales cycles and what motivates a sales force. It's a highly analytical and data-intensive field with a direct link to revenue generation.

- International/Global Compensation: For multinational corporations, managing pay across dozens of countries is a massive challenge. Specialists in this area deal with currency fluctuations, different legal requirements, and cultural norms around pay. This expertise is rare and highly valued.

- Equity Compensation: In tech and public companies, managing stock option and RSU programs is a full-time, complex job. This specialization requires knowledge of accounting, tax, and legal implications of equity awards.

### ### In-Demand Skills

Beyond your formal qualifications, a specific set of technical and soft skills can make you a more effective—and higher-paid—Compensation Analyst.

Technical & Analytical Skills:

- Advanced Microsoft Excel: This is non-negotiable. You must be a master of pivot tables, VLOOKUP/INDEX(MATCH), complex formulas, and data modeling. The ability to manipulate large datasets cleanly and efficiently is the foundation of the job.

- HR Information Systems (HRIS): Proficiency in major HRIS platforms like Workday, SAP SuccessFactors, or Oracle HCM Cloud is highly sought after. Experience with the compensation modules within these systems is a huge plus.

- Data Visualization Tools: The ability to present complex data in a simple, visual way is a superpower. Skills in tools like Tableau or Power BI allow you to create compelling dashboards and charts that help leaders make sense of the numbers.

- Statistical Analysis: A solid understanding of statistical concepts (mean, median, percentiles, standard deviation, regression analysis) is crucial for a deep and accurate interpretation of market data and for conducting pay equity audits.

Soft Skills:

- Communication and Presentation Skills: You must be able to explain the "why" behind the numbers to non-analytical audiences, from recruiters to C-suite executives.

- Business Acumen: The best analysts understand the business they support. They know the company's goals, its financial health, and its competitive challenges, and they align their compensation strategies accordingly.

- Discretion and Ethical Judgment: You will be handling highly confidential and sensitive information. Unimpeachable integrity is an absolute requirement.

- Negotiation and Influence: You will often need to influence managers to make the right pay decision, even if it's not the one they initially wanted. This requires tact, data-backed reasoning, and strong persuasive skills.

---

Job Outlook and Career Growth

When considering a long-term career, job security and opportunities for advancement are just as important as the starting salary. For Compensation Analysts, the future looks bright and full of opportunities for growth, driven by evolving business needs and a greater focus on fair and strategic pay.

### Official Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) provides the most authoritative long-term forecast for professions. In their Occupational Outlook Handbook, the BLS projects that employment for Compensation, Benefits, and Job Analysis Specialists will grow by 7 percent from 2022 to 2032. This growth rate is faster than the average for all occupations, which stands at 3 percent.

The BLS anticipates about 10,600 openings for these specialists each year, on average, over the decade. Many of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire. This steady demand, coupled with faster-than-average growth, points to a stable and secure career field.

### Emerging Trends and Future Drivers of Demand

The 7% growth figure only tells part of the story. The *nature* of the work is evolving, and several powerful trends are increasing the strategic importance and visibility of the compensation function. These trends will shape the profession for years to come and create new opportunities for skilled analysts.

1. The Rise of Pay Transparency:

A wave of new legislation across the United States (in states like Colorado, California, Washington, and New York City) now requires employers to disclose salary ranges in job postings. This is a seismic shift. Companies can no longer operate with opaque pay practices. This trend elevates the Compensation Analyst's role from a back-office function to a public-facing, strategic necessity. Companies need experts who can:

- Develop and defend logical, market-based, and internally equitable salary ranges.

- Train managers and recruiters on how