Earning a specific hourly wage is more than just a number on a paycheck; it's the foundation of your financial life and the starting point of your career journey. If you're currently earning or considering a job that pays $20 an hour, you're likely asking crucial questions: What does that actually mean for my annual income? What kind of lifestyle can I afford? And most importantly, what are my prospects for growth? This guide is designed to answer those questions and more, transforming the abstract figure of "$20 an hour" into a clear, actionable roadmap for your professional and financial future.

I've spent over two decades as a career analyst, guiding thousands of professionals through the complexities of compensation, career transitions, and long-term growth. I've seen firsthand how understanding the true value of your wage is the first step toward unlocking greater potential. I once coached a young professional stuck in what they felt was a dead-end administrative role at just under $20 an hour. By breaking down their earnings, identifying in-demand skills they could acquire, and charting a clear path to a specialized role, they were able to double their hourly wage in just three years. That journey from uncertainty to empowerment is what this guide is all about.

This comprehensive article will serve as your ultimate resource, breaking down everything you need to know about living on and, crucially, growing from a $20 an hour salary.

### Table of Contents

- [What Does $20 an Hour Actually Mean for Your Wallet?](#breakdown)

- [What Kind of Jobs Pay Around $20 an Hour?](#jobs)

- [A Deep Dive into Your Annual Salary and Take-Home Pay](#salary)

- [Key Factors to Earn *More* Than $20 an Hour](#factors)

- [Job Outlook and Career Trajectory From a $20/Hour Position](#outlook)

- [How to Land a $20/Hour Job (and Grow From There)](#get-started)

- [Conclusion: Taking Control of Your Career Path](#conclusion)

What Kind of Jobs Pay Around $20 an Hour?

While "$20 an hour" isn't a job title itself, it represents a specific and important tier in the labor market. This wage—equating to approximately $41,600 per year for a full-time employee—is a common starting point or median wage for a wide variety of skilled and essential roles across numerous industries. These are not just "jobs"; they are often the foundational roles that keep businesses, healthcare systems, and administrative offices running smoothly.

These positions typically require a high school diploma or an associate's degree, along with specific on-the-job training or vocational certification. They are characterized by a need for reliability, strong organizational or technical skills, and excellent interpersonal abilities. Let's explore the landscape of professions where a $20/hour wage is a common benchmark.

### Common Roles and Responsibilities

Jobs in this pay range often fall into several key categories: Administrative Support, Healthcare Services, Skilled Trades, and Customer & Client Services.

- Administrative & Office Support: These professionals are the backbone of any office. Their duties include managing schedules, organizing files, handling correspondence, booking travel, and ensuring the operational efficiency of a department. They are masters of multitasking and often proficient in office software suites like Microsoft Office 365 or Google Workspace.

- Customer & Client Services: This is a broad category for professionals on the front lines of business-to-consumer interaction. They handle inquiries, resolve problems, process orders, and provide information about products and services. Success in these roles requires immense patience, clear communication, and strong problem-solving skills.

- Healthcare Support: As the healthcare industry expands, so does the need for support staff. These roles involve direct patient interaction, such as taking vital signs, as well as crucial administrative tasks like scheduling appointments, managing patient records, and handling medical billing and coding.

- Skilled Trades (Entry-Level/Apprentice): Many skilled trades offer entry points or apprenticeships around this wage, with significant potential for growth. These individuals work with their hands and specialized tools in fields like construction, manufacturing, and maintenance, performing tasks like assembling components, assisting senior tradespeople, and learning the fundamentals of their craft.

### A "Day in the Life" Example: The Medical Administrative Assistant

To make this more concrete, let's imagine a "Day in the Life" of a Medical Administrative Assistant, a common role that often pays in the $18-$22 per hour range.

8:15 AM: Sarah arrives at the busy cardiology clinic where she works. Her first task is to check the office voicemail and email for any urgent patient messages or cancellations that came in overnight. She updates the day's schedule in the Electronic Health Record (EHR) system accordingly.

9:00 AM: The first patients begin to arrive. Sarah greets them warmly, verifies their identity and insurance information, and provides them with the necessary digital or paper forms. She handles co-pays, answers questions about their appointments, and ensures a smooth check-in process.

11:00 AM: Between check-ins, Sarah is on the phone. She's scheduling a follow-up appointment for a patient, coordinating with a hospital to obtain a patient's recent lab results, and calling an insurance company to get pre-authorization for a specialized procedure one of the cardiologists has ordered.

1:00 PM: Lunch break.

2:00 PM: The afternoon is focused on "back-office" tasks. Sarah sorts and scans new patient documents into the EHR system, ensuring every record is accurate and up-to-date. She then prepares the schedule for the next day, printing out encounter forms for each physician.

4:00 PM: The last patient has checked out. Sarah spends the final hour of her day "closing the books." She reconciles the day's co-payments, batches the credit card transactions, and tidies the reception area, ensuring everything is ready for a smooth start tomorrow.

This example illustrates the blend of interpersonal skills (patient interaction), technical proficiency (EHR software), and meticulous organization required in many jobs at the $20/hour level.

A Deep Dive into Your Annual Salary and Take-Home Pay

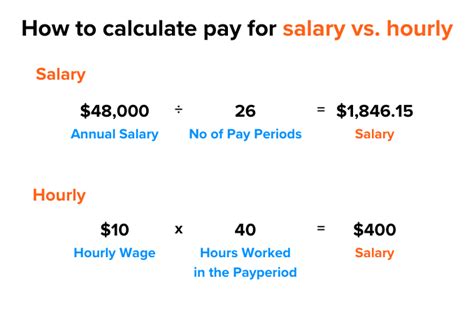

Understanding what a $20 hourly wage translates to in weekly, monthly, and annual terms is the first step in taking control of your finances. While the base calculation is straightforward, it's the deductions and variables that determine your actual take-home pay. This section provides a comprehensive breakdown.

### From Hourly to Annually: The Gross Pay Calculation

The standard assumption for a full-time work year is 40 hours per week for 52 weeks a year. Let's do the math:

- Hourly Rate: $20.00

- Weekly Gross Pay: $20/hour × 40 hours/week = $800

- Monthly Gross Pay (approx.): $800/week × 4.33 weeks/month = $3,464

- Annual Gross Pay: $800/week × 52 weeks/year = $41,600

This $41,600 is your *gross annual income*. It's the total amount of money you earn before any taxes or other deductions are taken out. This figure is important because it's what lenders use to evaluate mortgage or loan applications and what you'll see listed as "salary" on job postings.

#### The Impact of Overtime and Part-Time Work

Not everyone works exactly 40 hours a week. Here's how your annual gross pay changes based on hours worked:

| Weekly Hours | Hourly Rate | Weekly Gross Pay | Annual Gross Pay (52 Weeks) |

| :--- | :--- | :--- | :--- |

| 30 (Part-Time) | $20.00 | $600 | $31,200 |

| 35 (Full-Time) | $20.00 | $700 | $36,400 |

| 40 (Standard Full-Time) | $20.00 | $800 | $41,600 |

| 45 (with 5 hrs Overtime at 1.5x) | $20.00 | $950 ($800 base + $150 OT) | $49,400 |

*Note: Overtime pay (typically 1.5 times the regular rate for hours worked over 40 in a week) can significantly boost earnings for non-exempt hourly employees, but it's not always guaranteed.*

### Unpacking Your Paycheck: Gross vs. Net Income

Your *net income*, or take-home pay, is the amount you actually receive in your bank account after all deductions. This is the figure you must use for budgeting. The primary deductions are taxes, with others depending on your employer's benefits.

#### 1. Federal and State Income Taxes

- Federal Income Tax: This is your largest tax deduction. The amount withheld depends on your filing status (Single, Married Filing Jointly, etc.) and any allowances you claim on your W-4 form. For a single filer with no dependents earning $41,600, you can expect to fall into the 12% federal tax bracket for a portion of your income.

- State Income Tax: This varies significantly. Seven states (Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming) have no state income tax. Others, like California and New York, have higher, progressive tax rates. Someone in Texas will take home more pay than someone with the exact same job and salary in California.

- FICA Taxes (Social Security and Medicare): This is a flat federal tax that is not dependent on your filing status. You pay 6.2% for Social Security (on income up to $168,600 in 2024) and 1.45% for Medicare, for a total of 7.65%. Your employer matches this contribution.

#### 2. Pre-Tax Deductions (Your Benefits)

These are costs for benefits that are deducted from your paycheck *before* taxes are calculated, which has the advantage of lowering your taxable income.

- Health Insurance Premiums: If you have employer-sponsored health, dental, or vision insurance, your portion of the monthly premium is deducted here.

- Retirement Savings (401(k) or 403(b)): Contributions to a traditional 401(k) are pre-tax. If you contribute 5% of your $41,600 salary, that's $2,080 per year ($173 per month) that goes directly to your retirement account and reduces your taxable income. Many employers offer a "match" (e.g., matching your contributions up to 3-5% of your salary), which is essentially free money and a critical component of your total compensation.

#### Estimated Take-Home Pay Calculation

Let's create a hypothetical example for a single filer in a state with a moderate income tax (e.g., 5%), contributing 5% to their 401(k) and paying $150/month for health insurance.

| Item | Calculation | Amount |

| :--- | :--- | :--- |

| Gross Annual Income | | $41,600 |

| Pre-Tax Deductions | | |

| *Health Insurance Premium* | $150/month x 12 | -$1,800 |

| *401(k) Contribution (5%)* | 5% of $41,600 | -$2,080 |

| Adjusted Gross Income (for tax purposes) | | $37,720 |

| Estimated Taxes | | |

| *FICA (Social Security & Medicare)* | 7.65% of $41,600 | -$3,182 |

| *Federal Income Tax* | (Estimate based on 2024 brackets) | ~$2,750 |

| *State Income Tax* | (Estimate based on 5% rate) | ~$1,886 |

| Total Annual Deductions | | ~$11,700 |

| | | |

| Estimated Annual Net Pay (Take-Home) | $41,600 - $11,700 | ~$29,900 |

| Estimated Monthly Net Pay | $29,900 / 12 | ~$2,491 |

As this illustrates, a $41,600 gross salary can quickly become an annual take-home pay of around $30,000. This is why it's critical to look beyond the hourly wage and understand the full compensation picture when evaluating a job offer.

Key Factors to Earn *More* Than $20 an Hour

A $20/hour wage is a solid foundation, but it should be viewed as a starting point, not a destination. Your ability to increase your earnings significantly is determined by a combination of strategic choices and deliberate skill development. Understanding the factors that drive compensation is the key to unlocking a higher wage. This section explores the most impactful levers you can pull to move from $20/hour to $25, $30, and beyond.

### 1. Level of Education and Certification

While many $20/hour jobs require only a high school diploma, targeted education and certification are the most reliable accelerators for income growth. It's not about getting any degree; it's about acquiring specific, in-demand credentials.

Impact of Education:

- Associate's Degree (A.A., A.S.): Earning a two-year degree from a community college can be a game-changer. For example, an administrative assistant (median pay ~$20.68/hr, per BLS) can transition to a paralegal role (median pay ~$28.87/hr) with an associate's degree in paralegal studies. This single educational step can lead to a ~40% increase in earning potential.

- Bachelor's Degree (B.A., B.S.): A four-year degree opens up a vast new tier of professional roles. The U.S. Bureau of Labor Statistics (BLS) consistently reports a significant wage premium for degree holders. In 2023, the median weekly earnings for a full-time worker with a bachelor's degree were $1,432, compared to $853 for a high school graduate. That's a leap from an equivalent of ~$21/hour to ~$36/hour.

- Professional Certifications: This is often the fastest and most cost-effective route to a pay raise. Certifications validate your expertise in a specific tool, methodology, or subject area.

- Example 1 (IT): A Help Desk Technician earning ~$21/hour can pursue a CompTIA A+ or Network+ certification. With that credential, they become a more competitive candidate for a Network Support Specialist role, which commands an average of ~$32/hour, according to Salary.com.

- Example 2 (Bookkeeping): A Bookkeeping Clerk earning ~$20/hour can become a Certified QuickBooks ProAdvisor. This not only enhances their value to their current employer but also allows them to take on freelance clients at a much higher rate.

- Example 3 (Healthcare): A Medical Assistant (MA) can pursue specialized certifications like a Certified Clinical Medical Assistant (CCMA) or a Registered Medical Assistant (RMA), which often leads to higher pay and more responsibilities.

### 2. Years of Experience

Experience is a powerful driver of salary growth. In nearly every profession, seasoned employees are more valuable than novices because they require less supervision, make fewer errors, and possess deep institutional or industry knowledge.

The Experience-Based Salary Trajectory:

Let's track the typical salary progression for a role that starts around the $20/hour mark, like a Customer Service Representative. Data from Payscale shows a clear upward trend:

- Entry-Level (0-1 year): A new CSR might start in the $16-$18 per hour range. They are learning the products, systems, and communication protocols.

- Early Career (1-4 years): After a year or two, they become proficient. They handle calls more efficiently and can tackle more complex issues. Their wage climbs to the $19-$22 per hour range ($40k-$46k annually). This is the stage where many hit the $20/hour mark.

- Mid-Career (5-9 years): A seasoned CSR is a valuable asset. They may be asked to train new hires, handle escalated calls from difficult customers, or contribute to process improvement. Their wage increases to $23-$26 per hour ($48k-$54k annually). They may now have a title like "Senior Customer Service Representative" or "Tier 2 Support Specialist."

- Experienced/Late-Career (10+ years): With a decade or more of experience, this professional is a subject matter expert. They are prime candidates for promotion into leadership. The career path might diverge here:

- Path A: Team Leader/Supervisor: Moves into management, overseeing a team of CSRs. The salary structure often shifts from hourly to salaried, typically in the $55,000 - $70,000 range (or ~$26-$34/hour).

- Path B: Senior Specialist: Becomes a specialist in a related field like Quality Assurance, Training and Development, or Client Relationship Management, with similar or higher earning potential.

This trajectory demonstrates that simply staying in a role and excelling at it will naturally increase your earnings over time. The key is to be proactive in seeking new responsibilities that align with your growing experience.

### 3. Geographic Location

Where you live is one of the single most significant factors determining your earning potential and, just as importantly, your purchasing power. A $41,600 salary can provide a comfortable lifestyle in one city and be insufficient to cover basic expenses in another.

High-Paying vs. Low-Paying Areas:

Companies adjust their pay scales based on the local cost of labor and cost of living. This creates vast disparities for the exact same job.

Let's look at the median hourly wage for Bookkeeping, Accounting, and Auditing Clerks (a common ~$20/hour role nationally) in different metropolitan areas, using 2023 data from the BLS:

| Metropolitan Area | Median Hourly Wage | Annual Equivalent |

| :--- | :--- | :--- |

| San Jose-Sunnyvale-Santa Clara, CA | $30.82 | $64,110 |

| Seattle-Tacoma-Bellevue, WA | $28.24 | $58,740 |

| Boston-Cambridge-Nashua, MA-NH | $27.13 | $56,430 |

| National Average | $22.34 | $46,470 |

| Phoenix-Mesa-Scottsdale, AZ | $22.75 | $47,320 |

| Dallas-Fort Worth-Arlington, TX | $22.56 | $46,920 |

| Brownsville-Harlingen, TX | $16.89 | $35,130 |

*Source: BLS Occupational Employment and Wage Statistics, May 2023.*

As the data shows, a bookkeeper in San Jose, CA, earns nearly double what their counterpart in Brownsville, TX, earns for the same work. However, the cost of living in San Jose is also exponentially higher. When considering a move for a higher salary, it is crucial to use a cost-of-living calculator to determine if the wage increase will result in a net gain in disposable income.

### 4. Company Type & Size

The type of organization you work for can have a profound impact on your pay and benefits.

- Large Corporations (Fortune 500): These companies typically have more structured and higher-paying compensation bands. They can afford to pay a premium to attract and retain talent. A role at a large tech company or financial institution will almost always pay more than the equivalent role at a small local business. They also tend to offer more robust benefits packages (better health insurance, larger 401(k) matches, tuition reimbursement).

- Startups: Compensation at startups can be a mixed bag. The base salary might be at or slightly below the market rate for a similar role at an established company. However, they often offer equity (stock options) as part of the compensation package. While risky, this can lead to a significant financial windfall if the company is successful.

- Small to Medium-Sized Businesses (SMBs): Pay at SMBs is often highly dependent on the company's profitability and the local market. There may be less room for salary growth, but these roles can offer more responsibility, a tighter-knit culture, and a more direct impact on the business.

- Non-Profits and Government: These sectors are known for offering salaries that may be slightly lower than their for-profit counterparts. However, they compensate with exceptional job security (especially in government), generous pension plans, excellent work-life balance, and the intrinsic reward of mission-driven work. For instance, an Administrative Assistant for a federal agency might earn a salary based on the General Schedule (GS) pay scale, which provides clear, predictable steps for pay increases.

### 5. Area of Specialization

Becoming a specialist rather than a generalist is a surefire way to increase your value. Within any given job category, there are niches that command higher pay due to higher demand or a more complex skill set.

- Administrative Specialization: A general administrative assistant might earn $20/hour. However, an Executive Assistant who supports C-suite executives possesses high-level skills in discretion, complex calendar management, and strategic planning, and can earn $35-$50+ per hour. A Legal Secretary with knowledge of legal terminology and court filing procedures will earn more than a general office secretary.

- Healthcare Support Specialization: A general Medical Assistant (MA) might earn $19/hour. An MA who specializes and gets certified in a high-demand area like Ophthalmology or Dermatology can often command a higher wage due to their specialized knowledge and skills with specific equipment.

- Skilled Trades Specialization: An entry-level construction laborer might start around $18/hour. If they pursue an apprenticeship and specialize as an Electrician or Plumber, their median pay jumps to $30.43/hr and $29.28/hr, respectively, according to the BLS.

### 6. In-Demand Skills

Beyond your core job duties, developing specific, transferable skills can make you a more valuable employee and justify a higher salary.

- Technical Proficiency: Advanced knowledge of key software is highly valued. This includes:

- Microsoft Excel: Moving beyond basic data entry to master pivot tables, VLOOKUPs, and macros.

- CRM Software: Expertise in platforms like Salesforce or HubSpot.

- Project Management Tools: Proficiency in Asana, Trello, or Jira.

- Data Analysis: The ability to interpret data and provide insights is increasingly valuable in all roles. Even in a customer service role, being able to analyze call data to identify trends can lead to a promotion.

- Bilingualism: In customer-facing roles or in regions with diverse populations, fluency in a second language (especially Spanish) can come with a pay differential or bonus.

- Communication & Writing: Strong written and verbal communication skills are essential for advancement. The ability to write clear, professional emails, reports, and presentations is a hallmark of employees on a management track.

By strategically focusing on these six factors, you can create a deliberate plan to grow your income, transforming a $20-an-hour job into a launchpad for a prosperous and fulfilling career.

Job Outlook and Career Trajectory From a $20/Hour Position

A job paying $20 per hour is more than just a means to a paycheck; it's a critical entry point into the workforce and a platform for future growth. The long-term value of such a position depends heavily on the career trajectory it enables. Understanding the job outlook for common roles at this pay level and the typical paths for advancement is essential for making strategic career decisions.

### Overall Job Outlook for Foundational Roles

Many of the jobs that pay around $20 per hour are in stable, essential sectors like healthcare support, administrative services, and logistics. While automation is a consideration for some routine tasks, the need for skilled, reliable humans in these roles remains strong.

Let's examine the 10-year job outlook (2022-2032) for several representative occupations, according to the U.S. Bureau of Labor Statistics' Occupational Outlook Handbook:

| Occupation | Median 2023 Pay (Hourly) | Projected Job Growth (2022-2032) | Comparison to Average Growth |

| :--- | :--- | :--- | :--- |

| Medical Assistants | $18.93 | +14% | Much faster than average |

| Bookkeeping, Accounting, & Auditing Clerks| $22.34 | -2% | Decline |

| Customer Service Representatives | $18.52 | -3% | Decline |

| Secretaries & Administrative Assistants | $20.68 | -7% | Decline |

| General Maintenance & Repair Workers | $21.57 | +1% | Little or no change |

*Source: BLS Occupational Outlook Handbook, accessed 2024.*

Analysis of the Data:

At first glance, this data presents a mixed picture. What does it mean?

- High-Growth Areas: The explosive 14% growth for Medical Assistants is driven by the aging baby-boomer population and an increased demand for preventative medical services. This indicates that healthcare support is a resilient and promising field for those starting out.

- Areas of Contraction: The projected declines in roles like Bookkeeping Clerks and Customer Service Representatives are largely attributed to technology and automation. Software can now automate many basic data entry and bookkeeping tasks, and AI-powered chatbots can handle simple customer inquiries.

This does not mean these are "bad" jobs. It means the nature of these roles is changing. A future-proof professional in these fields will not be the one doing routine, repetitive tasks. They will be the one who can manage the software, handle the complex exceptions the AI cannot, analyze the data the system produces, and provide the high-touch, human element that technology can't replicate.

### Charting Your Career Path: From $20/Hour to a Salaried Professional

The key is to view a $20/hour job as the first step on a ladder. Your goal is to identify the next rungs. Here are common career advancement pathways starting from this wage level:

**Pathway 1