Buying a Home on a $100K Salary: A Complete Affordability Guide

Earning a six-figure salary is a tremendous professional achievement, placing you well above the national median income. For many, reaching the $100,000 mark is the green light to start seriously considering homeownership. But what does that number actually translate to in the housing market?

The answer is more complex than a single number. Your purchasing power depends on a variety of factors, from your debt and savings to the interest rate you secure. This guide will break down the rules, calculations, and key variables to help you determine exactly how much house you can realistically afford on your $100,000 salary.

The Starting Point: Core Rules of Home Affordability

Before diving into specifics, lenders and financial advisors use two primary rules of thumb to get a baseline for home affordability.

1. The 28/36 Rule: This is the most common guideline used by mortgage lenders.

- The "28" (Front-End Ratio): You should spend no more than 28% of your *gross monthly income* on your total housing payment. This payment, often called PITI, includes the Principal, Interest, Taxes, and Insurance.

- The "36" (Back-End Ratio): Your total monthly debt payments should not exceed 36% of your *gross monthly income*. This includes your potential housing payment (PITI) *plus* all other recurring debt, such as car loans, student loans, and credit card payments.

2. The 3x to 4x Salary Rule: A simpler, though less precise, guideline is that you can afford a home that costs between three to four times your gross annual salary. For a $100,000 salary, this would suggest a home price between $300,000 and $400,000. This is a quick estimate and does not account for the critical factors below.

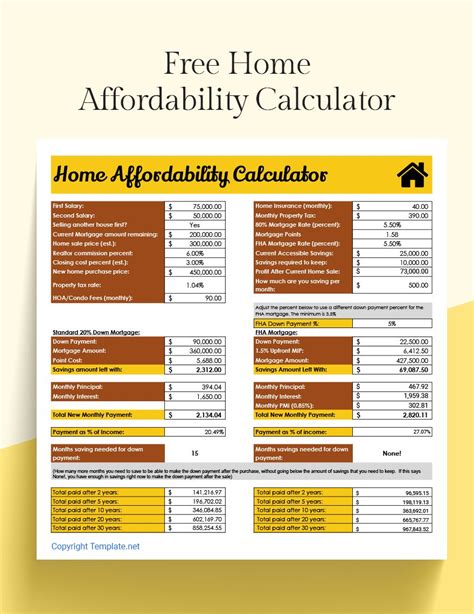

Average Affordability on a $100k Salary: A Baseline Calculation

Let's apply the 28/36 rule to a $100,000 salary to establish a baseline.

- Gross Annual Income: $100,000

- Gross Monthly Income: $100,000 / 12 = $8,333

Applying the 28% Front-End Rule:

- $8,333 (Gross Monthly Income) x 0.28 = $2,333 per month

- This is the maximum recommended monthly payment for your mortgage principal, interest, property taxes, and homeowners insurance (PITI).

What does a $2,333 monthly payment translate to in home price?

Assuming a 20% down payment, a 30-year fixed-rate mortgage at 7.0% interest, and average annual property taxes (1.1%) and insurance ($1,500/year), a $2,333 monthly payment could afford a home priced around $350,000.

Applying the 36% Back-End Rule:

- $8,333 (Gross Monthly Income) x 0.36 = $3,000 per month

- This is your maximum total monthly debt. If your mortgage payment is $2,333, this leaves only $667 for all other debts (car, student loans, etc.). If your other debts are higher, your maximum affordable mortgage payment must decrease.

Result: For most people on a $100k salary, a comfortable and realistic home price range is $300,000 to $425,000, heavily dependent on the factors below.

Key Factors That Influence Your Home Affordability

Your salary is just the starting point. These five factors will ultimately determine your true purchasing power.

###

1. Debt-to-Income (DTI) Ratio

This is the single most important metric for lenders. It’s the 36% rule in action. If you have significant student loan debt or a high car payment, your DTI will be higher, reducing the amount of mortgage you can qualify for.

- Example A (Low Debt): You earn $100k ($8,333/month) and have a $300/month car payment. Your non-housing debt is low, so you can likely qualify for a higher mortgage payment, pushing you toward the $400,000+ home price range.

- Example B (High Debt): You earn $100k but have an $800/month student loan payment and a $500/month car payment. Lenders will see your $1,300 in existing debt and limit your housing payment significantly, potentially pushing your affordability down toward the $250,000 - $300,000 range.

###

2. Down Payment Amount

The size of your down payment directly impacts your loan amount and monthly payment. The gold standard is a 20% down payment, which allows you to avoid Private Mortgage Insurance (PMI). PMI is an extra fee (often 0.5% to 2% of the loan amount annually) that protects the lender if you default.

- 20% Down on a $350,000 Home: $70,000. This avoids PMI and results in a lower monthly payment.

- 5% Down on a $350,000 Home: $17,500. This makes homeownership more accessible but means you’ll pay a higher monthly payment due to PMI and a larger loan principal.

###

3. Geographic Location

A $100,000 salary provides vastly different lifestyles depending on where you live. This is arguably the biggest external factor.

- High Cost-of-Living (HCOL) Areas: In cities like San Jose, CA, or Boston, MA, a $100k salary may not be sufficient to purchase even a starter condo, as median home prices can exceed $1 million.

- Low Cost-of-Living (LCOL) Areas: In cities like Cleveland, OH, or St. Louis, MO, a $100k salary is very strong. A budget of $350,000 could buy a large, updated single-family home.

- Property Taxes: Location also determines your property tax rate, which can vary from less than 0.5% to over 2.5% of the home's value annually, dramatically changing your monthly PITI payment.

###

4. Interest Rates and Credit Score

The mortgage interest rate you secure is critical. A seemingly small difference has a massive long-term impact. Your credit score is the primary driver of your interest rate. A higher score (740+) typically gets you the best rates.

Impact of a 1% Interest Rate Change on a $300,000 Loan (30-year fixed):

- At 6.5%: Monthly Principal & Interest ≈ $1,896

- At 7.5%: Monthly Principal & Interest ≈ $2,098

This $202 difference per month adds up to over $72,000 over the life of the loan.

###

5. The "Hidden Costs" of Homeownership

Your monthly PITI payment is just the beginning. You must also budget for:

- Maintenance and Repairs: A common rule is to budget 1% of the home's value annually (e.g., $3,500 per year for a $350k home).

- HOA Fees: If you buy in a community with a Homeowners Association, these fees can range from $50 to over $500 per month.

- Utilities: These are often higher in a larger home than in an apartment.

- Closing Costs: These typically range from 2% to 5% of the home's purchase price.

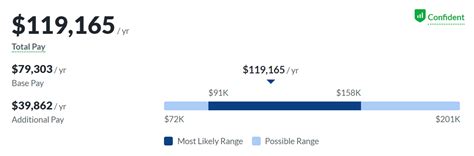

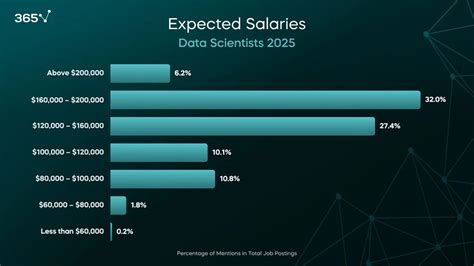

Job Outlook for a $100k Salary

Achieving a six-figure income is possible across many industries, particularly those with high demand. According to the U.S. Bureau of Labor Statistics (BLS), several fields offer strong earning potential and robust growth outlooks through 2032.

- Software Developers: With a 2023 median pay of $132,930 per year and a projected growth rate of 25% (much faster than average), tech remains a top field for high earners.

- Financial Managers: These professionals had a 2023 median pay of $139,790 per year and are expected to grow by 16%, overseeing the financial health of organizations.

- Medical and Health Services Managers: With a median pay of $110,680 per year and a staggering 28% projected growth, this is a booming field in the healthcare industry.

(Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, 2023)

Pursuing education and gaining experience in these and other high-demand sectors like engineering, law, and specialized sales provides a clear path to the $100k salary benchmark and the home-buying power that comes with it.

Conclusion: Your Path to Homeownership

A $100,000 salary is a powerful tool for building wealth and achieving the dream of homeownership. While a general estimate suggests you can afford a home in the $300,000 to $425,000 range, this figure is not absolute.

The most important takeaways are:

1. Know Your Numbers: Calculate your DTI ratio and understand the 28/36 rule.

2. Minimize Debt, Maximize Savings: Paying down high-interest debt and saving for a 20% down payment will dramatically increase your purchasing power.

3. Location is Everything: Be realistic about what your salary can buy in your desired geographic area.

4. Shop for the Best Rate: A strong credit score is your best asset in securing a low interest rate.

Ultimately, you are in control. By managing your finances strategically, you can leverage your impressive $100k salary to make a smart, confident, and affordable home purchase.