Earning a six-figure salary is a significant career milestone for many professionals. A salary of $120,000 per year places you in a strong financial position, opening doors to greater financial security and opportunities. But what does that impressive annual figure actually mean in your day-to-day life? Understanding its hourly equivalent is crucial for budgeting, comparing job offers (especially salaried vs. hourly roles), and evaluating your earning power.

This article breaks down a $120,000 salary into its hourly rate, explores the factors that can help you reach this income level, and provides a data-driven look at the career outlook for high-earning professions.

What Does a $120,000 Salary to an Hourly Rate Look Like?

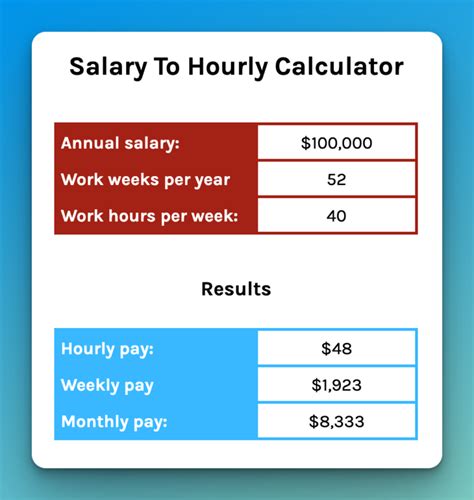

Before diving into the careers that command this salary, let's answer the core question. Converting an annual salary to an hourly wage is a straightforward calculation. The standard formula assumes a 40-hour workweek and 52 weeks in a year.

The Basic Calculation:

- Total hours worked per year: 40 hours/week × 52 weeks/year = 2,080 hours

- Hourly Rate: $120,000 / 2,080 hours = $57.69 per hour

So, at a standard 40-hour workweek, a $120,000 annual salary is equivalent to making approximately $57.69 per hour.

It's important to remember that this is a pre-tax figure. Your take-home (net) pay will be lower after federal, state, and local taxes, as well as deductions for things like health insurance and retirement savings, are taken out.

Furthermore, many salaried professionals work more than 40 hours per week. If you're in a role that demands 50 hours per week, your effective hourly rate changes:

- For a 50-hour workweek: 50 hours/week × 52 weeks/year = 2,600 hours

- Effective Hourly Rate: $120,000 / 2,600 hours = $46.15 per hour

Understanding this effective rate is key to assessing work-life balance and the true value of your time.

Average $120,000 Salary: Putting It in Context

A $120,000 salary is significantly higher than the national average in the United States. According to the U.S. Bureau of Labor Statistics (BLS), the median weekly earnings for full-time wage and salary workers was $1,145 in the fourth quarter of 2023, which annualizes to approximately $59,540.

This means a $120,000 salary is more than double the national median, signifying a high level of skill, experience, or demand for your profession. While this salary is a specific target, it falls within the typical range for many mid-to-senior level professional roles, which can span from $95,000 to over $150,000 depending on a variety of factors.

Key Factors That Influence Salary

Reaching a $120,000 salary isn't a matter of chance; it's the result of a strategic combination of skills, experience, and positioning. Here are the most critical factors that determine earning potential.

### Level of Education

A higher level of education often correlates directly with higher earning potential. While a bachelor's degree is the foundation for many professional roles, advanced degrees can unlock access to higher-paying positions.

- Master's Degree: For roles in business (MBA), technology (M.S. in Data Science), or healthcare (Master of Health Administration), a graduate degree can be a prerequisite for leadership positions that command salaries in the $120k range.

- Professional & Doctoral Degrees: Fields like law (JD), medicine (MD), and specialized research (Ph.D.) often have starting salaries that approach or exceed this level due to the extensive education required.

### Years of Experience

Experience is arguably one of the most powerful drivers of salary growth. Companies pay a premium for professionals who have a proven track record of delivering results.

- Entry-Level (0-2 years): Typically earn the lowest salary in a given field.

- Mid-Career (3-8 years): Professionals who have honed their skills and can work independently often see significant salary jumps, moving into the $100k+ range.

- Senior/Lead Level (8+ years): With deep expertise and potential leadership responsibilities, senior professionals in high-demand fields can easily command $120,000 and above. For example, Payscale data indicates that while a junior Software Engineer might start around $80,000, a senior-level engineer with experience can earn an average of $130,000 or more.

### Geographic Location

Where you work matters immensely. A $120,000 salary provides a very different lifestyle in a major metropolitan hub compared to a smaller city. Companies adjust their pay scales based on the local cost of living and competition for talent.

- High Cost-of-Living (HCOL) Areas: In cities like San Francisco, New York, and Boston, a $120,000 salary is common for mid-level professionals but has less purchasing power. According to Salary.com's Cost of Living calculator, a $120k salary in Indianapolis, Indiana, would need to be over $190k in San Francisco to maintain the same standard of living.

- Low Cost-of-Living (LCOL) Areas: In many parts of the Midwest and South, a $120,000 salary is considered exceptionally high and provides significant financial comfort. The rise of remote work has allowed some professionals to leverage this by earning a high salary while living in an LCOL area.

### Company Type

The type and size of your employer have a direct impact on compensation.

- Large Tech Companies (FAANG, etc.): These companies are known for offering top-tier salaries, stock options, and benefits to attract the best talent. A $120k salary might be an entry-level or early-career benchmark here.

- Startups: While early-stage startups may offer lower base salaries, they often compensate with significant equity (stock options) that could lead to a large payout if the company succeeds.

- Established Corporations: Fortune 500 companies in industries like finance, consulting, and manufacturing offer competitive, stable salaries, with $120k being a common target for experienced managers and specialists.

- Government & Non-Profit: These sectors typically offer lower base salaries than the private sector but often provide excellent benefits, job security, and better work-life balance.

### Area of Specialization

Within any given profession, specialization can be a key to higher earnings. Becoming an expert in a niche, high-demand area allows you to command a premium.

- In Technology: A generalist web developer might earn a solid salary, but a specialist in Artificial Intelligence, Machine Learning, or Cybersecurity can command significantly more.

- In Marketing: A marketing generalist's salary may be lower than that of a specialist in SEO/SEM, Marketing Automation, or Data Analytics.

- In Healthcare: While a Registered Nurse earns a good wage, a Nurse Practitioner or a Certified Registered Nurse Anesthetist (CRNA) earns substantially more due to their advanced specialization and training.

Job Outlook

The jobs that typically pay in the $120,000 range are concentrated in sectors with strong growth prospects. The U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook provides excellent insight into future demand.

- Software Developers: The BLS projects employment for software developers to grow 25% from 2022 to 2032, much faster than the average for all occupations. This sustained demand keeps salaries high.

- Financial Managers: With a projected growth of 16%, the need for skilled financial managers to guide investment strategies and ensure financial health remains robust.

- Nurse Practitioners: This field is projected to grow by an astounding 45% over the next decade, driven by an aging population and an increased emphasis on preventative care.

These trends indicate that pursuing careers in technology, specialized business functions, and advanced healthcare is a reliable path toward achieving and exceeding a $120,000 salary.

Conclusion

Breaking a $120,000 salary down to its hourly rate—approximately $57.69 per hour for a standard workweek—provides a powerful new perspective on your time and value. It's a salary that places you well above the national average and reflects a high level of professional achievement.

For those aspiring to reach this level, the path is clear:

1. Invest in Your Skills: Pursue relevant education and continuous learning to stay at the forefront of your industry.

2. Gain Valuable Experience: Build a strong track record of success and seek out roles with increasing responsibility.

3. Be Strategic: Understand how factors like location, company type, and specialization can be leveraged to maximize your earning potential.

Achieving a $120,000 salary is an ambitious but attainable goal. By focusing on high-growth fields and strategically managing your career, you can position yourself for exceptional financial and professional success.