Navigating the world of work can be a complex journey, especially when you're starting out or evaluating a job that pays around $13 an hour. You might be a student looking for part-time work, a recent graduate entering the workforce, or someone considering a career change. Whatever your situation, understanding the full picture of a $13 an hour salary is the first step toward making informed decisions and building a future you can be proud of. This wage is a reality for millions of Americans, and while it presents challenges, it can also be a crucial stepping stone to greater opportunities.

The purpose of this guide is not just to break down the numbers, but to provide a complete roadmap. We will explore the types of jobs that typically offer this wage, analyze what this income means for your budget and lifestyle, and most importantly, lay out a clear, actionable path to increase your earning potential. Early in my career counseling practice, I worked with a young man who felt stuck in a retail job paying just over this amount. He saw it as a dead end. But by reframing his customer service experience as "client relationship management" and helping him acquire a simple digital marketing certificate online, he transitioned into an entry-level marketing assistant role within six months, nearly doubling his hourly wage. His story is a powerful reminder that where you start does not have to be where you end up. This guide is designed to be your expert partner in that journey.

---

### Table of Contents

- [What Kind of Jobs Pay $13 an Hour?](#what-kind-of-jobs-pay-13-an-hour)

- [Understanding Your Income: A Deep Dive into a $13 an Hour Wage](#understanding-your-income-a-deep-dive-into-a-13-an-hour-wage)

- [Key Factors That Will Influence Your Salary](#key-factors-that-will-influence-your-salary)

- [Career Pathways and Growth From a $13 an Hour Job](#career-pathways-and-growth-from-a-13-an-hour-job)

- [How to Move Up and Earn More: A Step-by-Step Guide](#how-to-move-up-and-earn-more-a-step-by-step-guide)

- [Conclusion: Taking Control of Your Career Path](#conclusion-taking-control-of-your-career-path)

---

What Kind of Jobs Pay $13 an Hour?

A wage of $13 per hour is common for many entry-level, service-oriented, and essential roles across the United States. While the federal minimum wage remains at $7.25 per hour, many states and cities have enacted higher minimums, pushing the effective floor for wages closer to this range in many regions. These positions are the backbone of our economy, requiring direct interaction with customers, hands-on labor, and a strong work ethic. They are often accessible to individuals without a four-year college degree and provide a critical entry point into the workforce.

Below is an overview of common jobs that frequently offer wages in the $12 to $15 per hour range, depending on location and employer.

Common Roles and Core Responsibilities:

- Retail Sales Associate / Cashier: The face of a retail store. Responsibilities include assisting customers, answering questions about products, operating the cash register, processing payments and returns, stocking shelves, and maintaining the store's appearance.

- Fast Food and Counter Worker: Works in quick-service restaurants. Daily tasks involve taking customer orders, preparing food items like sandwiches and salads, operating fryers and grills, ensuring food safety standards, and keeping the kitchen and dining areas clean.

- Home Health and Personal Care Aide: Provides essential assistance to elderly, convalescing, or disabled individuals in their own homes. Duties can include helping with bathing and dressing, light housekeeping, meal preparation, medication reminders, and providing companionship.

- Customer Service Representative (Entry-Level): Often works in call centers or office settings. This role involves answering customer phone calls and emails, resolving issues, processing orders, providing information about products or services, and documenting interactions in a CRM (Customer Relationship Management) system.

- Warehouse and Stocking Associate: Works in distribution centers, warehouses, or the back rooms of large stores. Key tasks include receiving and unloading shipments, scanning and tracking inventory, picking and packing orders for shipment, and operating basic warehouse equipment like pallet jacks.

- Hotel Desk Clerk / Guest Services Agent: The first point of contact for guests at a hotel. Responsibilities include managing reservations, checking guests in and out, answering questions about the hotel and local area, handling payments, and resolving any guest concerns.

### A "Day in the Life" Example: A Home Health Aide

To make this more concrete, let's walk through a typical day for a Home Health Aide named Maria, who earns $13.50 an hour.

- 8:00 AM: Maria arrives at the home of her first client, Mr. Henderson, an 82-year-old man with mobility challenges. She greets him warmly and asks how he slept.

- 8:15 AM: She assists Mr. Henderson with his morning routine, which includes getting out of bed, bathing, and dressing. She does this with patience and care, ensuring his safety and dignity.

- 9:00 AM: Maria prepares a healthy breakfast according to his dietary plan and makes sure he takes his morning medications. While he eats, she tidies the kitchen and does a load of laundry.

- 10:00 AM: They spend some time talking, looking at old photos, or playing a card game. This companionship is a vital part of her role, combating the loneliness many seniors face.

- 11:00 AM: Maria does some light housekeeping, such as vacuuming the living room and cleaning the bathroom.

- 12:00 PM: She prepares a simple lunch for Mr. Henderson and leaves a pre-made dinner in the refrigerator with clear heating instructions for later. She documents her visit in the agency's logbook, noting his food intake, mood, and any concerns.

- 12:30 PM: Maria says her goodbyes and travels to her next client's home, where her afternoon will involve a similar, yet uniquely tailored, set of supportive tasks.

This example illustrates that jobs in this wage bracket are far from simple. They require a blend of hard skills (like food preparation or operating a register) and crucial soft skills like empathy, communication, patience, and problem-solving.

Understanding Your Income: A Deep Dive into a $13 an Hour Wage

Earning $13 an hour translates to a specific annual income, but what you actually take home and what that money can afford depends on several factors, including taxes, benefits, and local cost of living. Understanding these numbers is fundamental to managing your finances and planning for the future.

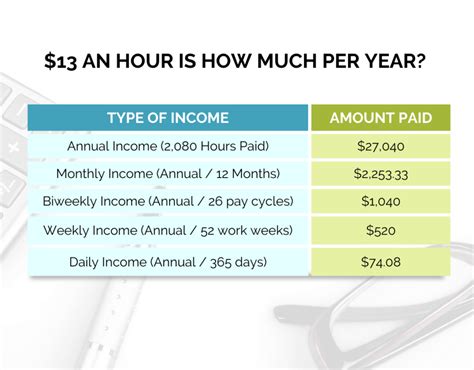

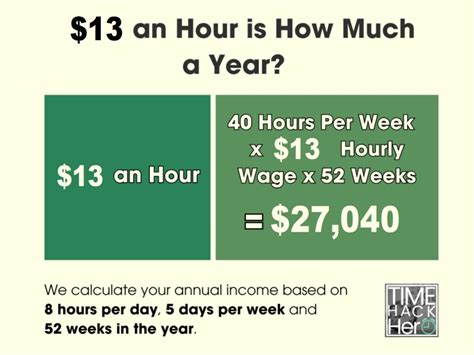

### From Hourly Wage to Annual Salary: The Gross Numbers

First, let's calculate the gross income—the amount you earn before any deductions.

- Hourly: $13.00

- Weekly (40 hours): $13/hour * 40 hours = $520

- Monthly (approx. 4.33 weeks): $520/week * 4.33 weeks = $2,251.60

- Annually (52 weeks): $520/week * 52 weeks = $27,040

So, a full-time job at $13 an hour equates to a gross annual salary of approximately $27,040.

### Gross Pay vs. Net Pay: What You Actually Take Home

Your take-home pay (net pay) will be significantly less than your gross pay due to taxes and other deductions. These typically include:

- Federal Income Tax: The amount depends on your filing status (single, married, etc.) and any dependents.

- State Income Tax: Varies by state. Some states have a flat tax, some have a progressive tax, and some (like Texas and Florida) have no state income tax at all.

- FICA Taxes: This is a mandatory federal payroll tax that funds Social Security (6.2%) and Medicare (1.45%). You pay 7.65% of your gross income, and your employer matches it.

Let's estimate the net pay for a single individual with no dependents earning $27,040 annually. After federal, state (assuming a modest state tax), and FICA taxes, the total tax burden could be around 15-20%.

- Estimated Annual Net Pay: $27,040 - (18% tax) ≈ $22,172

- Estimated Monthly Net Pay: ≈ $1,847

This is the amount you have for all your living expenses: rent, utilities, food, transportation, healthcare, and any savings.

### Context is Everything: Comparisons and Benchmarks

To understand what a $13/hour wage truly means, we need to compare it to key economic benchmarks.

- Federal Minimum Wage: As of late 2023, the federal minimum wage is $7.25 per hour. A $13/hour wage is nearly 80% higher, reflecting a push from states and employers to offer more competitive entry-level pay.

- State Minimum Wages: According to the U.S. Department of Labor, as of January 2024, over 30 states have minimum wages higher than the federal level. For example, states like California ($16.00/hour), Washington ($16.28/hour), and Massachusetts ($15.00/hour) have mandated wages above $13/hour. In contrast, states like Georgia and Wyoming still adhere to the federal minimum or have lower state minimums that apply in specific cases. A $13/hour job is therefore a standard entry-level wage in some parts of the country but would be below the legal minimum in others.

- Federal Poverty Level: The U.S. Department of Health & Human Services sets annual poverty guidelines. For 2024, the federal poverty level for a one-person household is $15,060, and for a two-person household, it is $20,440. A gross annual income of $27,040 is comfortably above the poverty line for an individual but falls much closer to it for someone supporting a child or another person, especially after taxes.

- The "Living Wage" Concept: A living wage is the theoretical income needed to meet a family's basic needs in a specific location. The MIT Living Wage Calculator is a powerful tool for this. For example, in Harris County, Texas (Houston), the calculated living wage for a single adult is $18.66 per hour. In a lower-cost area like a rural county in Alabama, it might be closer to $14.85 per hour. In almost all cases, $13 per hour falls short of what is considered a living wage for a self-sufficient adult, meaning budgeting is extremely tight.

### The Full Compensation Picture: Beyond the Hourly Rate

Compensation isn't just about the wage. Benefits can add significant value to your total earnings. When evaluating a $13/hour job, ask about:

- Health Insurance: Is it offered? What is the monthly premium you would have to pay? Does it cover dental and vision?

- Paid Time Off (PTO): How many paid vacation, sick, and personal days do you get per year?

- Retirement Savings: Is a 401(k) or similar plan available? Does the company offer a match (e.g., matching your contributions up to 3% of your salary)? A company match is essentially free money and a powerful wealth-building tool.

- Tuition Assistance or Professional Development: Some larger companies (like Starbucks and Walmart) offer programs to help pay for college or certifications.

- Employee Discounts: A common perk in retail and hospitality that can help your budget.

A job at $13/hour with good health insurance and a 401(k) match is far more valuable than a job at $13.50/hour with no benefits at all. Always analyze the complete compensation package.

Key Factors That Will Influence Your Salary

While $13 an hour might be your starting point, it is not a fixed destination. Your earning potential is influenced by a combination of personal choices, skills, and market forces. Understanding these factors is the key to strategically navigating your career and commanding a higher wage. This section provides an in-depth analysis of the levers you can pull to increase your income.

### ### Level of Education

Education remains one of the most reliable predictors of income. While many $13/hour jobs only require a high school diploma or equivalent, investing in further education—even short-term programs—can open doors to higher-paying roles.

- High School Diploma/GED: This is the baseline for most entry-level service and labor jobs. It qualifies you for roles like cashier, stocker, and fast-food worker.

- Professional Certifications: This is often the fastest and most cost-effective way to boost your pay. A targeted certification demonstrates specialized knowledge. For example:

- A Certified Nursing Assistant (CNA) certificate can move a home health aide's pay from $13/hour to $16-$20/hour. According to the BLS, the median pay for nursing assistants is $17.35 per hour as of May 2023.

- A Forklift Operator Certification can increase a warehouse worker's earning potential significantly.

- A ServSafe Manager Certification can help a food service worker advance to a supervisor or kitchen manager role.

- The CompTIA A+ certification is a gateway to entry-level IT support roles, which typically start well above $20/hour.

- Associate's Degree (A.A., A.S.): A two-year degree from a community college can be a powerful stepping stone. Degrees in fields like paralegal studies, respiratory therapy, web development, or business administration can lead to jobs that start in the $20-$30 per hour range. The BLS reports that in 2022, workers with an associate's degree had median weekly earnings of $1,005, compared to $853 for those with only a high school diploma. That's an annual difference of nearly $8,000.

- Bachelor's Degree (B.A., B.S.): A four-year degree unlocks the highest earning potential over a lifetime. While it's a significant investment of time and money, the long-term payoff is substantial. The median weekly earnings for bachelor's degree holders were $1,432 in 2022, equating to an annual income over $74,000.

### ### Years of Experience

In any field, experience is a form of currency. As you spend more time in a role and industry, you become more efficient, knowledgeable, and valuable to your employer. This progression is often reflected in your pay.

- Entry-Level (0-2 Years): At this stage, you are learning the fundamentals of the job. Your pay will likely be at the starting rate for the position, such as the $13-$15/hour range. The focus here is on mastering your responsibilities, demonstrating reliability, and being a good team player.

- Mid-Career (2-5 Years): After a few years, you are no longer a novice. You can work independently, solve common problems, and may even begin to mentor new hires. This is the point where you can often move into a "Senior" version of your role (e.g., Senior Cashier, Senior Guest Services Agent) or a lead position (Shift Lead). This often comes with a pay bump into the $16-$19 per hour range. According to Payscale, a Retail Shift Supervisor's average hourly pay is around $16.30, demonstrating this clear upward step.

- Experienced/Senior (5+ Years): With extensive experience, you possess deep institutional and industry knowledge. You are a go-to person for complex issues and are a candidate for supervisory or management positions. A retail associate could become an Assistant Store Manager or a Store Manager. An experienced home health aide could become a scheduler or care coordinator for an agency. These roles typically transition from hourly pay to an annual salary, often in the $45,000-$65,000+ range ($21-$31+ per hour).

Your experience is not just about time served; it's about the value you create. Document your accomplishments—like reducing customer complaints by 15% or training five new employees—to make a strong case for a raise or promotion.

### ### Geographic Location

Where you live is one of the single most significant factors determining your wages and, just as importantly, your purchasing power. A $13/hour wage means something very different in rural Arkansas than it does in San Francisco.

- High Cost of Living (HCOL) Areas: In major metropolitan areas like New York City, Boston, San Francisco, and Los Angeles, the cost of living is extremely high. Consequently, many of these cities have enacted their own high minimum wages. For instance, the minimum wage in Seattle is $19.97/hour (for large employers) as of 2024. In these locations, a $13/hour job is virtually nonexistent and would be far below a sustainable wage.

- Medium Cost of Living (MCOL) Areas: In many mid-sized cities and suburbs across the country (e.g., Houston, Phoenix, Atlanta), $13/hour is a common starting wage for entry-level service jobs. However, as noted by the MIT Living Wage Calculator, it is often still insufficient to cover all basic living expenses without a very strict budget or supplemental income.

- Low Cost of Living (LCOL) Areas: In rural regions and smaller towns, particularly in the South and Midwest, the cost of housing, transportation, and goods is lower. In these areas, $13/hour may be a competitive wage for non-skilled labor and can stretch further. However, these areas may also offer fewer opportunities for career advancement.

Salary Variation by State (Example for Customer Service Representative):

Salary.com data shows how the salary for the same job can vary dramatically. An entry-level Customer Service Representative might earn:

- San Jose, CA: ~$49,000/year (~$23.50/hour)

- Chicago, IL: ~$42,000/year (~$20.20/hour)

- Jackson, MS: ~$35,000/year (~$16.80/hour)

This shows that moving to a different city or state can be a viable strategy for increasing your nominal wage, but it's crucial to research the corresponding cost of living.

### ### Company Type & Size

The type of organization you work for can have a major impact on your pay and benefits, even for the exact same job.

- Large Corporations: Big-box retailers (like Target and Costco) and national chains (like Starbucks and Chipotle) often have internal policies to pay above the local minimum wage to attract and retain talent. For example, Target announced a starting wage range of $15 to $24 per hour. Costco is renowned for its high wages and excellent benefits. These companies have the resources to offer more robust compensation packages, including health insurance and retirement plans.

- Small & Medium-Sized Businesses (SMBs): A local "mom-and-pop" shop or a small regional company may have tighter margins and may only be able to offer the local minimum wage or slightly above. While the pay might be lower, working for an SMB can sometimes offer more flexibility, a closer-knit work environment, and a chance to learn multiple aspects of the business.

- Non-Profits: Non-profit organizations are mission-driven, but they often operate on tight budgets. Pay can be lower than in the for-profit sector. However, the work can be incredibly rewarding, and some non-profits offer excellent benefits and a positive work-life balance.

- Government/Public Sector: Entry-level government jobs (e.g., a clerk at the DMV or a maintenance worker for a city park) are often unionized and come with very stable employment and excellent benefits packages, including pensions, which are rare in the private sector. The hourly wage might start around the $13-$17/hour mark but comes with a total compensation package that is often superior to a private sector equivalent.

### ### Area of Specialization

Even within the broad category of "entry-level work," some fields offer better pay and a clearer path for growth. Choosing your industry wisely is a strategic career move.

- Retail/Food Service: These are the most common entry points but often have the flattest wage growth unless you move into management. Median pay for cashiers, per the BLS, was $14.40/hour in May 2023.

- Healthcare Support: This sector is booming. Roles like Home Health Aide, Certified Nursing Assistant (CNA), and Phlebotomist are in high demand. While starting pay may be around $13-$15/hour, the path to higher wages through certification (e.g., becoming a Licensed Practical Nurse) is very clear. The BLS projects the Home Health and Personal Care Aide field to grow by 22% over the next decade, much faster than the average.

- Skilled Trades (Apprenticeships): While an apprenticeship might start at a wage similar to $13/hour, you are being paid to learn a valuable trade. Electrician, plumber, and HVAC technician apprentices see their wages increase systematically as they gain skills. Upon becoming a licensed journeyman, hourly wages can jump to $30, $40, or even more.

- Administrative/Office Support: An entry-level office assistant or data entry clerk might start in the $14-$17/hour range. This environment allows you to develop valuable computer skills (e.g., Microsoft Office Suite), communication skills, and an understanding of business operations, which can be transferred to higher-paying administrative or operational roles.

### ### In-Demand Skills

Regardless of your job title or industry, the specific skills you possess are your greatest asset. Cultivating a mix of hard and soft skills can make you a more valuable employee and justify a higher wage.

High-Value Soft Skills:

- Communication: Clearly and professionally interacting with customers, colleagues, and managers.

- Problem-Solving: Taking initiative to resolve a customer complaint or fix an operational snag without needing constant supervision.

- Reliability and Punctuality: Simply showing up on time, every time, for every shift makes you a highly valued team member.

- Teamwork: Collaborating effectively with others to achieve a common goal.

High-Value Hard Skills to Acquire:

- Bilingualism: In customer-facing roles, fluency in a second language (especially Spanish) can command a wage premium of 5-20%, according to some studies. It's often referred to as a "language differential."

- Technical Proficiency: Beyond basic computer use, skills in specific software can set you apart. This includes proficiency in Microsoft Excel, QuickBooks (for administrative roles), or a Point of Sale (POS) system (for retail/food service).

- Sales and Upselling: In retail or service jobs, demonstrating an ability to increase sales through recommendations and excellent service is a quantifiable skill you can put on a resume and use to negotiate a raise.

- Inventory Management: Understanding how to track, manage, and order stock is a critical skill for advancing in retail or warehouse environments.

- Cash Handling and Reconciliation: Being trusted with managing a cash drawer and accurately balancing it at the end of a shift is a key responsibility that can lead to supervisory roles.

By focusing on these six factors, you can create a personalized strategy to move beyond a $13 an hour salary and build a more financially secure career.

Career Pathways and Growth From a $13 an Hour Job

A job that pays $13 an hour should be viewed not as a final destination, but as a starting line. These roles provide a foothold in the professional world and are rich with opportunities to develop foundational skills that are transferable across industries. With a strategic mindset, you can leverage your entry-level experience into a fulfilling and more lucrative long-term career.

### The Overall Job Outlook for Entry-Level Roles

The job outlook for the types of positions that commonly pay around $13 an hour is a mixed but generally stable picture, according to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook.

- Retail Salespersons: The BLS projects a 1% decline in employment for retail salespersons from 2022 to 2032. This slight decline reflects the continued growth of e-commerce. However, because it is such a large occupation, the BLS still projects about 333,700 openings each year, on average, over the decade, primarily due to the need to replace workers who transfer to different occupations or exit the labor force. This means opportunities will remain plentiful.

- Cashiers: Similarly, employment for cashiers is projected to decline by 10% over the next decade due to automation, self-checkout kiosks, and online purchasing. Despite this, there will still be around 268,600 openings each year on average.

- Home Health and Personal Care Aides: This is a major growth area. The BLS projects a staggering 22% growth from 2022 to 2032, which is much faster than the average for all occupations. The aging of the baby-boomer generation is driving immense demand for home-based care. This field offers not just job security but a clear pathway for advancement.

- Food and Beverage Serving and Related Workers: Employment in this sector is projected to grow 10% over the next decade, faster than average. As the economy grows, people tend to dine out more, creating consistent demand for these roles.

The key takeaway is that while some traditional entry-level roles face pressure from technology, others—particularly in service and healthcare—are expanding rapidly. The challenge and opportunity lie in using these roles as a launchpad.

### Internal Promotion: Climbing the Ladder Where You Are

The most direct path to a higher wage is often within your current company. Employers prefer to promote from within because it's less expensive than external hiring, and internal candidates already know the company culture and operations.

A Typical Retail Career Ladder:

1.