For millions of Americans, the journey into the professional world or a new career chapter begins with a clear, tangible number. A wage of $16 an hour is a significant benchmark—a figure that represents stability for some, a starting point for others, and a critical step up from minimum wage in many parts of the country. But what does a $16 an hour annual salary truly mean for your life, your budget, and your future? It translates to an annual income of $33,280 before taxes, a sum that holds vastly different potential depending on where you live, what you do, and where you want to go. This guide is designed not just to analyze that number, but to transform it from a simple wage into a strategic launchpad for your career.

We will move beyond the basic math and delve into the very fabric of the jobs that pay this wage. We'll explore the daily responsibilities, the industries that need your skills, and most importantly, the clear, actionable steps you can take to elevate your earning potential far beyond this starting point. Early in my career counseling work, I met a young administrative assistant earning just about this wage. She felt stuck, viewing her job as a series of disconnected tasks. We worked together to reframe her perspective, identifying how her "task" of scheduling meetings was actually "executive time management" and her "note-taking" was "corporate record-keeping." This shift in perspective, combined with targeted skill development, helped her double her salary in just three years. That experience taught me that no wage is a final destination; it's a foundation upon which a remarkable career can be built.

This comprehensive article will serve as your ultimate resource, providing the expert analysis, data-driven insights, and professional guidance needed to make the most of a $16 an hour role and build a clear path toward your long-term financial and professional goals.

### Table of Contents

- [What Kind of Jobs Pay $16 an Hour?](#what-kind-of-jobs-pay-16-an-hour)

- [The $16 an Hour Annual Salary: A Deep Dive](#the-16-an-hour-annual-salary-a-deep-dive)

- [Key Factors That Influence Your Salary (And How to Leverage Them)](#key-factors-that-influence-your-salary-and-how-to-leverage-them)

- [Job Outlook and Career Growth for $16/Hour Roles](#job-outlook-and-career-growth-for-16hour-roles)

- [How to Get Started and Begin Your Upward Journey](#how-to-get-started-and-begin-your-upward-journey)

- [Conclusion: Your Career is More Than a Number](#conclusion-your-career-is-more-than-a-number)

---

What Kind of Jobs Pay $16 an Hour?

A $16 per hour wage isn't tied to a single profession but rather represents an earning level common across several critical, foundational sectors of the economy. These are often roles that serve as the backbone of daily commerce, customer interaction, and administrative support. While the specific tasks vary, they almost universally require a core set of "soft skills" like communication, reliability, and problem-solving, making them excellent training grounds for future career growth.

These positions are your entry point into the workforce or a specific industry. They are the jobs where you learn the rhythm of a professional environment, interact with diverse groups of people, and build a track record of dependability.

Here are some of the most common jobs and roles where a $16/hour wage is typical, especially for those with 0-3 years of experience:

- Customer Service Representative: The voice of a company. You'll answer customer inquiries via phone, email, or chat, resolve issues, process orders, and provide information about products and services. This role is a crucible for developing patience, empathy, and conflict resolution skills.

- Retail Sales Associate / Cashier: The face of a brand. Responsibilities include assisting customers, managing inventory, operating point-of-sale (POS) systems, and maintaining the appearance of the sales floor. Experienced associates in high-traffic stores often reach or exceed this wage.

- Administrative Assistant (Entry-Level): The organizational hub of an office. You'll manage schedules, answer phones, handle correspondence, organize files, and perform data entry. This role provides a bird's-eye view of how a business operates.

- Bank Teller: A frontline position in the financial services industry. Tellers process deposits, withdrawals, and loan payments, answer customer questions about accounts, and identify opportunities to cross-sell bank products. Accuracy and trustworthiness are paramount.

- Home Health Aide or Personal Care Aide: A role with immense personal impact. You'll assist clients with daily living activities, such as bathing, dressing, and meal preparation. As the population ages, demand for these roles is soaring.

- Food and Beverage Server / Shift Lead: In many states with higher minimum wages or in popular, high-volume restaurants, an experienced server's base pay (before tips) can approach this level, and shift leads often earn this wage or more.

- Warehouse Associate / Stocker: Essential to the logistics and e-commerce chain. These roles involve receiving shipments, picking and packing orders, operating machinery like forklifts (with certification), and maintaining warehouse inventory.

### A "Day in the Life" at $16 an Hour

To make this more tangible, let's imagine a composite "Day in the Life" for someone in a customer-facing/administrative role at this wage, blending elements from the jobs above.

8:45 AM: Arrive, clock in, and grab a coffee. You quickly review your email and a handover document from the previous shift. A few customer support tickets came in overnight that need to be prioritized.

9:00 AM - 11:00 AM: The phone lines and online chat are open. Your morning is a flurry of activity. You help one customer track a missing package, walk another through a password reset for their online account, and answer questions about a new product promotion. Between calls, you process three online orders that came in, ensuring the shipping details are correct in the system.

11:00 AM - 12:00 PM: Things quiet down slightly. You use this time for project work. Your manager asked you to update the contact information in the company's CRM (Customer Relationship Management) database. You meticulously go through a list of 50 clients, verifying phone numbers and email addresses. Accuracy is key.

12:00 PM - 1:00 PM: Lunch break.

1:00 PM - 3:30 PM: The afternoon rush begins. A frustrated customer calls because their product arrived damaged. You listen patiently, express sincere empathy, and follow the company protocol for returns and replacements, successfully turning a negative experience into a positive one. You also handle front-desk duties for an hour, greeting visitors and sorting incoming mail.

3:30 PM - 4:45 PM: Your final block of time is dedicated to closing duties. You respond to any remaining emails, prepare a brief summary report of the day's customer interactions (e.g., number of calls, common issues), and tidy up your workstation. You also help a newer team member understand how to process a complex refund.

4:45 PM - 5:00 PM: You create your handover notes for the evening shift, highlighting any unresolved issues that need their attention. You clock out, feeling a sense of accomplishment for the dozens of problems you solved and people you helped throughout the day.

This example illustrates that while the wage might be considered entry-level, the work is dynamic, demanding, and builds a portfolio of highly transferable skills.

---

The $16 an Hour Annual Salary: A Deep Dive

Understanding what $16 an hour means requires looking at it from multiple angles: annually, monthly, weekly, and after taxes. This comprehensive breakdown provides a realistic picture of the financial landscape at this income level.

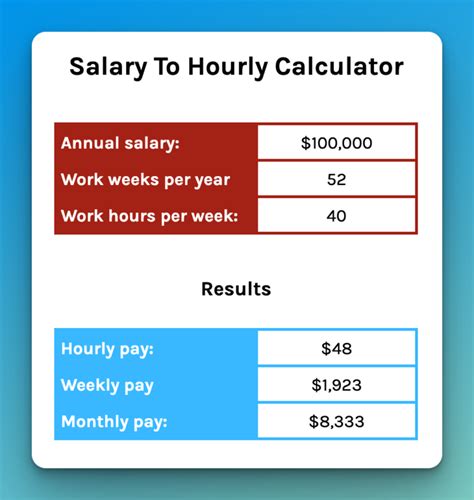

The foundational calculation is straightforward:

- Hourly: $16.00

- Weekly (40 hours): $16 x 40 = $640

- Monthly (approx.): $640 x 4.33 weeks = $2,771.20

- Annually (52 weeks): $640 x 52 = $33,280

This gross annual income of $33,280 is your starting point. However, your *take-home pay* (net income) will be lower after federal, state, and local taxes, as well as other deductions.

### From Gross Pay to Take-Home Pay

Let's estimate the net pay. Tax situations are highly personal, varying by state, filing status (single, married, etc.), and deductions. For this example, let's assume a single filer with no dependents in a state with a moderate income tax (e.g., around 5%).

- Gross Annual Income: $33,280

- Federal Income Tax (approx.): ~$2,200

- FICA (Social Security & Medicare): ~$2,546 (7.65% of gross)

- State Income Tax (approx. 5%): ~$1,664

- Total Estimated Taxes: ~$6,410

Estimated Annual Take-Home Pay: $33,280 - $6,410 = $26,870

Estimated Monthly Take-Home Pay: $26,870 / 12 = $2,239

This monthly net income of approximately $2,239 is the real number you have for budgeting purposes. It's the amount that needs to cover rent, utilities, food, transportation, healthcare, and any savings or debt repayment. According to the MIT Living Wage Calculator, this income level is below the "living wage" for a single adult in many major metropolitan areas but may be sufficient in lower-cost-of-living rural areas or in a dual-income household.

### The Salary Range Around $16 an Hour

While we're focusing on $16/hour, it's important to see this as a point on a spectrum. The roles we discussed often have a defined pay scale based on experience and performance.

| Experience Level | Typical Hourly Wage Range | Typical Annual Salary (Gross) | Notes |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-1 year) | $14.50 - $16.00 | $30,160 - $33,280 | Focus is on learning core job functions and demonstrating reliability. |

| Mid-Level (2-4 years) | $16.00 - $18.50 | $33,280 - $38,480 | Employee is fully proficient, may handle more complex tasks, and might train new hires. |

| Experienced/Senior (5+ years) | $18.50 - $22.00+ | $38,480 - $45,760+ | Often takes on leadership roles (Shift Lead, Team Captain), handles escalated issues, or becomes a subject matter expert. |

*Source: Data compiled and synthesized from salary ranges on Payscale, Indeed, and Glassdoor for roles like "Customer Service Representative" and "Administrative Assistant" as of late 2023.*

### Beyond the Paycheck: Total Compensation

Your hourly wage is only one piece of the puzzle. Total compensation includes your salary plus the value of any benefits and perks your employer provides. When comparing job offers, especially if the hourly rates are similar, the benefits package can be the deciding factor.

Common Components of Total Compensation:

- Health Insurance: This is often the most valuable benefit. An employer-sponsored health plan can save you thousands of dollars a year compared to purchasing insurance on the open market. Look at the monthly premium (what you pay), the deductible (what you pay before insurance kicks in), and the co-pays.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. A typical offering for a full-time role might be 10 vacation days, 5 sick days, and 8 paid holidays per year. That's 23 paid days, or nearly a full month of paid time you're not working—a value of over $2,900 at a $16/hour wage.

- Retirement Savings Plan (401(k) or 403(b)): The opportunity to save for retirement in a tax-advantaged account is crucial. The most powerful feature is the employer match. If a company matches 100% of your contributions up to 3% of your salary, they are giving you an extra $998 per year ($33,280 x 0.03) just for saving. This is free money and a guaranteed 100% return on your investment.

- Other Potential Benefits:

- Tuition Reimbursement: Some large companies offer to pay for part or all of your college tuition or professional certifications. This is an incredibly valuable benefit for career advancement.

- Discounts: Employee discounts on company products or services can add up.

- Life and Disability Insurance: Provides a financial safety net for you and your family.

- Bonuses: Performance-based bonuses, while less common for hourly roles, can provide a significant income boost.

When you're earning $16 an hour, a strong benefits package can be worth an additional $5,000 to $15,000 in value per year, making a seemingly modest wage much more powerful.

---

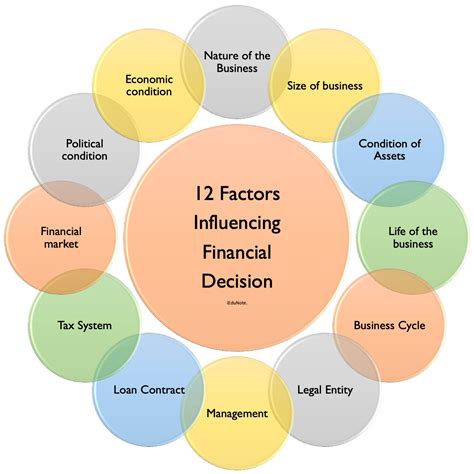

Key Factors That Influence Your Salary (And How to Leverage Them)

Your starting wage is not your destiny. The single most important concept for anyone earning $16 an hour is that this wage is highly sensitive to a specific set of factors. By understanding and strategically improving in these areas, you can create a clear and rapid path to a higher income. This section is your roadmap to moving from $16 to $20, $25, and beyond.

###

1. Level of Education & Certification

While many $16/hour jobs only require a high school diploma or GED, additional education is one of the most reliable levers for increasing your earnings. It signals to employers that you have specialized knowledge, discipline, and commitment.

- The Impact of Degrees: According to the U.S. Bureau of Labor Statistics (BLS), education level has a direct and significant correlation with earnings. In 2022, the median weekly earnings for a full-time worker with only a high school diploma were $853. For someone with an Associate's degree, it was $1,005, and for a Bachelor's degree, it was $1,432.

- From High School to Associate's: Moving from a high school diploma ($853/week) to an Associate's degree ($1,005/week) represents a potential 18% increase in income. For someone at $16/hr ($640/week), this could be the path to nearly $19/hr.

- Actionable Advice: Consider programs at a local community college. An Associate of Applied Science (A.A.S.) in fields like Business Administration, Accounting, or Paralegal Studies can directly qualify you for higher-paying administrative or specialized roles.

- The Power of Certifications: Certifications are a faster, more cost-effective way to gain a specific, in-demand skill. They are tangible proof of your expertise in a particular area.

- For Administrative Roles: Becoming a Microsoft Office Specialist (MOS), particularly in Excel, can immediately increase your value. Advanced Excel skills (pivot tables, VLOOKUPs, macros) are highly sought after for roles in data entry, analysis, and office management, often paying $18-$25/hour.

- For Customer Service/Sales Roles: Certifications from platforms like HubSpot Academy (e.g., in Inbound Sales or Customer Service Management) or Salesforce (e.g., Salesforce Certified Administrator) can be a gateway to higher-paying roles in tech or B2B sales, where salaries often start above $50,000 per year.

- For Technical/IT-Adjacent Roles: Entry-level certifications like the Google IT Support Professional Certificate or the CompTIA A+ can be the first step out of general customer service and into a help desk or IT support role, which typically starts at $20-$25/hour.

- Actionable Advice: Many certifications (like those from Google or HubSpot) are available online at a low cost or even for free. Dedicate a few hours each week to completing one; it's a direct investment in your earning power.

###

2. Years of Experience

Experience is the currency of the workplace. In the early stages of your career, every year you work, learn, and grow translates directly into higher earning potential. Employers pay for proven reliability and expertise.

- The 0- to 2-Year Mark (The Foundation): Your primary goal is to be a sponge. Master the core functions of your job, show up on time, maintain a positive attitude, and be a reliable team player. Your goal is to move from "new hire" ($15-$16/hr) to "trusted employee" ($16-$17/hr).

- The 2- to 5-Year Mark (The Expansion): You are now a proficient team member. This is the time to be proactive.

- Volunteer for Complex Tasks: Ask to handle the more difficult customer cases, assist with inventory reconciliation, or help train new hires.

- Become a "Go-To" Person: Be the one your colleagues and manager turn to with questions about a specific process or system. This informal leadership is highly visible.

- Track Your Accomplishments: Keep a "brag book" or a simple document listing your achievements. For example: "Successfully de-escalated 15 high-level customer complaints in Q3," or "Identified and corrected an error in the scheduling system, saving an estimated 5 hours of administrative work per week."

- Salary Impact: At this stage, you have a strong case for moving into the $18-$22/hour range, either through a promotion or by leveraging your experience to get a higher-paying job at another company. Payscale data consistently shows that workers with 5-9 years of experience earn significantly more than their entry-level counterparts in the same role.

- The 5+ Year Mark (The Leadership Path): With significant experience, you can transition from "doing" the work to "leading" the work. Look for opportunities as a Shift Supervisor, Team Lead, Office Manager, or Senior Customer Service Representative. These roles add leadership and management responsibilities, commanding higher pay and offering a new set of skills for your resume. This is the path to $22-$28/hour and beyond.

###

3. Geographic Location

Where you work is one of the single biggest determinants of your hourly wage. A $16/hour wage feels very different in rural Arkansas than it does in San Francisco, California. This is due to variations in state/city minimum wage laws and the local cost of living.

- High Minimum Wage States/Cities: In states like Washington ($16.28/hr state minimum), California ($16.00/hr), and New York (variable, but up to $16.00/hr in NYC and surrounding areas), a $16 wage is at or near the legal minimum. In these locations, this wage is for the most basic entry-level positions.

- Federal Minimum Wage States: In states that adhere to the federal minimum of $7.25/hr, a $16 wage is more than double the minimum. In places like Texas, Georgia, or Pennsylvania, $16/hr is a very competitive wage for retail, administrative, and customer service roles.

Here’s a comparative look at the purchasing power of a $33,280 annual salary, using data from Payscale's Cost of Living Calculator (relative to the national average):

| City | Cost of Living Index | $33,280 Buys You... | Implication |

| :--- | :--- | :--- | :--- |

| New York, NY (Brooklyn) | 83% Above Average | A lifestyle equivalent to ~$18,185 | Extremely difficult to live on; requires multiple roommates or subsidies. |

| Chicago, IL | 8% Above Average | A lifestyle equivalent to ~$30,815 | Tight but more manageable, especially outside the downtown core. |

| Dallas, TX | 4% Above Average | A lifestyle equivalent to ~$31,900 | Very close to the national average; a feasible budget can be created. |

| Omaha, NE | 12% Below Average | A lifestyle equivalent to ~$37,820 | The salary goes much further, allowing for more savings and discretionary spending. |

- Actionable Advice:

- If you live in a High-Cost-of-Living (HCOL) area: Your primary focus must be on rapid skill acquisition to move into higher-paying industries (like tech, finance, or healthcare). A $16/hr job should be viewed as a short-term stepping stone.

- If you live in a Low-Cost-of-Living (LCOL) area: A $16/hr wage can provide a more stable foundation. You have more breathing room to save, invest in certifications, and plan your next career move without the same level of financial pressure.

- Consider Remote Work: The rise of remote work has created a powerful opportunity. If you can secure a remote customer service or administrative job that pays a national average (or a rate based on a HCOL area) while living in a LCOL area, you can dramatically increase your purchasing power.

###

4. Company Type & Size

The type of organization you work for has a profound impact on your pay and benefits.

- Startups vs. Large Corporations: A small, local retail shop may only be able to afford $15-$16/hour. A massive corporation like Amazon, Target, or Bank of America has standardized pay scales that often start higher. For example, Target and Amazon have corporate minimum wages that are at or above $15/hour nationwide, with pay often being higher in competitive markets. Large corporations are also more likely to offer robust benefits packages, including tuition reimbursement and 401(k) matching.

- Non-Profits vs. For-Profits: Non-profits typically have tighter budgets and may offer slightly lower pay than their for-profit counterparts. However, they can offer excellent experience, a strong sense of mission, and sometimes better work-life balance.

- Industry Matters: An administrative assistant at a high-end law firm or a booming tech company will almost certainly have a higher earning potential than an administrative assistant at a small construction company. The profitability and pay scales of the industry trickle down to its support staff.

###

5. Area of Specialization

Even within a general job title, specialization can create a significant pay gap. This is about moving from being a generalist to an expert.

- Customer Service Specializations:

- Generalist: Answers basic billing questions. ($16/hr)

- Specialist: Becomes a Technical Support Representative (Tier 1), helping users troubleshoot software issues. This requires more technical knowledge and commands a higher wage. ($19-$22/hr)

- Expert: Becomes a Bilingual Customer Service Representative (especially for Spanish). Companies will pay a premium, often an extra $1-$3 per hour, for this skill. ($18-$21/hr)

- Administrative Specializations: