Earning $20 an hour is a significant financial milestone for many Americans. It represents a step into a more stable income bracket, often associated with skilled work, valuable experience, or specialized training. But what does that hourly wage truly mean in terms of an annual salary, lifestyle, and career trajectory? This article breaks down the numbers, explores the types of jobs that pay in this range, and details the key factors that can help you earn even more.

What Does a $20 an Hour Job Look Like?

A $20 an hour wage translates to a diverse landscape of career opportunities. These are not typically minimum-wage, entry-level positions; they are roles that require a specific skill set, a level of responsibility, and often, some form of post-secondary training or on-the-job experience.

Professionals earning in this range are the backbone of many industries. They are the skilled administrative assistants managing a busy office, the pharmacy technicians ensuring prescriptions are filled correctly, the veterinary technicians caring for our pets, and the skilled manufacturing operators running complex machinery. These roles are crucial for the day-to-day operations of businesses in healthcare, technology, finance, and skilled trades. Earning $20 an hour signifies that you have acquired abilities that are in demand and valued by employers.

The Annual Breakdown of a $20 an Hour Salary

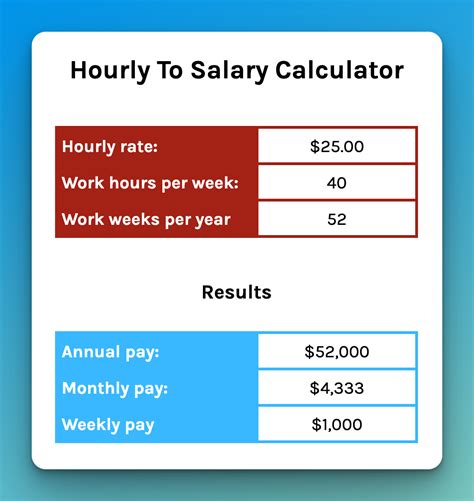

Calculating your annual salary from an hourly wage is straightforward, but seeing the numbers can provide powerful context for financial planning. The standard calculation assumes a 40-hour work week for 52 weeks a year.

$20/hour x 40 hours/week x 52 weeks/year = $41,600/year (Gross Income)

It's vital to remember that $41,600 is your *gross* annual income—the amount you earn before any taxes, insurance premiums, or retirement contributions are deducted. Here is a clearer breakdown:

| Pay Period | Gross Income (Before Taxes) |

| :--- | :--- |

| Hourly | $20.00 |

| Daily (8-hr day)| $160.00 |

| Weekly | $800.00 |

| Bi-Weekly | $1,600.00 |

| Monthly | ~$3,467.00 |

| Annually | $41,600.00 |

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all workers was $48,060 in May 2023. This places a $41,600 salary in a common and competitive range, particularly for those in the early to middle stages of their careers.

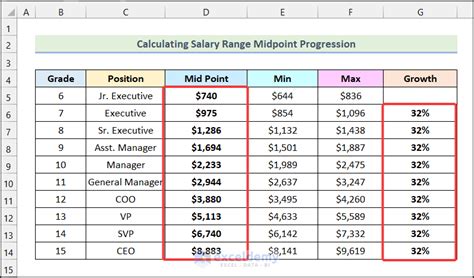

Key Factors That Influence Your Salary

While $20 an hour is a useful benchmark, it's not a fixed number. Your actual earnings can be higher or lower based on several critical factors. Understanding these variables is key to maximizing your income.

###

Level of Education

Education is a powerful lever for increasing earning potential. While a high school diploma can secure jobs in this pay range, further education opens more doors.

- Certifications & Associate's Degrees: Fields like healthcare and IT heavily reward specific credentials. For example, a certified Medical Assistant or a Paralegal with an associate's degree can command wages in the $20/hour range or higher. These focused programs provide job-ready skills that employers pay a premium for.

- Bachelor's Degree: A bachelor's degree often sets the starting salary floor above $20 an hour, particularly in fields like business, finance, and engineering. For roles where a degree is preferred but not required, having one can be a significant negotiating tool.

###

Years of Experience

Experience is often as valuable as education. An entry-level administrative assistant might start at $18/hour, but after five years of experience, developing skills in project management and executive support, they could easily earn $25/hour or more. Salary.com data consistently shows a direct correlation between years in a role and compensation. Seasoned professionals are more efficient, require less supervision, and can mentor junior staff, making them more valuable to a company.

###

Geographic Location

Where you live is one of the most significant factors influencing the value of your salary. A $20/hour wage can provide a comfortable lifestyle in a low-cost-of-living area but may feel stretched in a major metropolitan hub.

For instance, according to BLS wage data by metropolitan area, wages for the same job can vary dramatically. An hourly rate of $20 in a city like Cleveland, Ohio, will go much further than the same rate in New York City or San Francisco, where housing, transportation, and general living costs are substantially higher. Many companies adjust their pay scales based on the local market, so a job paying $20/hour in the Midwest might pay $25/hour or more on the West Coast to compensate.

###

Company Type and Industry

The type of company you work for and its industry have a major impact.

- Company Size: Large, multinational corporations often have more structured compensation bands and can typically offer higher wages and more robust benefits packages than small businesses or non-profits.

- Industry: An administrative professional in the high-demand tech or legal sectors will likely earn more than an individual with similar skills in the retail or hospitality industry. Data from Glassdoor and Payscale shows that industries with higher profit margins and a greater need for specialized skills tend to offer higher pay rates across the board.

###

Area of Specialization

Within any given profession, specialization can be a pathway to higher earnings. A general customer service representative might earn around $18-$19/hour. However, a specialized technical support representative who can troubleshoot complex software issues may earn $22-$25/hour. Similarly, a bookkeeper who specializes in a specific accounting software like QuickBooks or has experience in a regulated industry like construction or healthcare can command a higher wage.

Job Outlook for Roles in This Pay Range

The future is bright for many professions that fall within the $20/hour range. The key is to target roles in growing sectors. The BLS Occupational Outlook Handbook provides critical insights into this.

- Medical Assistants: With a median pay of $18.40/hour ($38,270 per year), this field is projected to grow by 14% between 2022 and 2032, which is much faster than the average for all occupations. An aging population and a greater need for preventative care drive this high demand.

- Bookkeeping, Accounting, and Auditing Clerks: The median pay here is $22.80/hour ($47,430 per year). While technology is automating some tasks, skilled clerks who can manage complex financial software and perform high-level analysis remain essential.

- Administrative Assistants: The median pay is $21.41/hour ($44,540 per year). While the overall number of jobs is projected to decline slightly due to technology, the demand for highly skilled assistants with excellent technical and interpersonal skills remains strong, especially in growing industries like healthcare and professional services.

Conclusion: Using $20/Hour as a Launchpad

A $20 an hour annual salary, or $41,600 a year, is a solid financial foundation and a testament to possessing valuable, in-demand skills. It places you firmly within the national median and opens the door to a wide variety of stable, respectable careers.

The key takeaway is that this salary is not a ceiling but a benchmark. For those aspiring to reach this level, focusing on specific certifications or an associate's degree can be a direct path. For those already there, the path to higher earnings is clear:

- Gain experience and seek out new responsibilities.

- Pursue specializations within your field.

- Stay informed about pay scales in your geographic location and industry.

- Never stop learning. Embrace new technologies and skills to stay ahead of the curve.

By strategically navigating these factors, you can leverage a $20/hour job as a powerful launchpad for long-term career growth and financial success.