Are you seeking a career in the booming Texas economy that combines financial acumen, strategic importance, and significant earning potential? Do you envision yourself as a trusted advisor, the go-to expert who guides businesses through complex financial landscapes? If so, the path of a Certified Public Accountant (CPA) in the Lone Star State may be your ideal destination. With a robust demand for skilled financial professionals, Texas offers a landscape ripe with opportunity, where a CPA salary Texas professionals command is not just competitive but a clear reflection of the immense value they bring to the table.

The journey to becoming a CPA is rigorous, but the rewards are substantial. This is more than just a job; it’s a professional designation that signifies a gold standard of expertise, ethics, and dedication in the world of accounting and finance. Early in my career advising startups, I witnessed firsthand the transformative power of a skilled CPA. A brilliant founder was on the verge of losing his company due to chaotic financials and poor tax planning. It was a Texas-based CPA who stepped in, untangled the mess, implemented sound financial controls, and provided the strategic forecasting that ultimately secured a vital round of funding. That experience cemented my belief that CPAs are not mere number-crunchers; they are the architects of financial stability and the enablers of growth.

This comprehensive guide is designed to be your definitive resource for understanding everything about a CPA career in Texas. We will dissect salary expectations, explore the myriad factors that influence your earnings, map out the career trajectory, and provide a clear, step-by-step roadmap to earning your license.

### Table of Contents

- [What Does a CPA in Texas Actually Do?](#what-does-a-cpa-in-texas-actually-do)

- [Average CPA Salary Texas: A Deep Dive](#average-cpa-salary-texas-a-deep-dive)

- [Key Factors That Influence Your CPA Salary in Texas](#key-factors-that-influence-your-cpa-salary-in-texas)

- [Job Outlook and Career Growth for Texas CPAs](#job-outlook-and-career-growth-for-texas-cpas)

- [How to Become a CPA in Texas: Your Step-by-Step Guide](#how-to-become-a-cpa-in-texas-your-step-by-step-guide)

- [Conclusion: Is a CPA Career in Texas Right for You?](#conclusion-is-a-cpa-career-in-texas-right-for-you)

What Does a CPA in Texas Actually Do?

Before we dive into the numbers, it's crucial to understand the scope and significance of the CPA role. The "Certified Public Accountant" designation is a license, not a job title, granted by the Texas State Board of Public Accountancy (TSBPA). This license unlocks a vast array of career opportunities far beyond the stereotypical image of a tax preparer hunched over a calculator during tax season.

At their core, CPAs are fiduciaries of financial trust. They provide assurance to investors, regulators, and business owners that financial information is accurate and reliable. Their responsibilities, however, are incredibly diverse and can be broadly categorized into several key areas:

- Public Accounting (Assurance/Audit and Tax): This is the most traditional path. In audit, CPAs examine a company's financial statements to express an opinion on their fairness and compliance with Generally Accepted Accounting Principles (GAAP). In tax, they help individuals and corporations navigate complex tax laws, ensuring compliance while strategizing to minimize tax liability.

- Corporate Accounting (Industry): CPAs are the financial backbone of businesses of all sizes, from Fortune 500 giants in Dallas to tech startups in Austin. They work in roles like Staff Accountant, Financial Analyst, Controller, or Chief Financial Officer (CFO), managing budgets, overseeing financial reporting, conducting internal audits, and providing strategic financial guidance to executive leadership.

- Advisory and Consulting: This is a high-growth, high-impact area. CPAs leverage their financial expertise to consult on mergers and acquisitions (M&A), perform forensic accounting investigations to uncover fraud, implement new IT financial systems, advise on risk management, and guide companies on strategic financial planning.

- Government and Non-Profit: Federal, state, and local government agencies (like the IRS or FBI) and non-profit organizations rely on CPAs to manage public funds, ensure regulatory compliance, and maintain financial transparency and accountability.

#### A Day in the Life: Senior Tax Associate in Houston

To make this tangible, let's imagine a day in the life of "David," a Senior Tax Associate at a mid-sized public accounting firm in Houston during the fall, a key planning season.

- 8:30 AM: David arrives, grabs coffee, and reviews his calendar. His first task is to respond to emails from a major client in the energy sector regarding their Q3 estimated tax payments and the potential implications of a new piece of federal energy tax credit legislation.

- 9:30 AM: He joins a video conference with his team manager and a client's Controller to discuss year-end tax planning strategies. They model different scenarios related to capital expenditures and inventory accounting methods to project the impact on the company's 2024 tax liability.

- 11:00 AM: David spends the next two hours reviewing the complex partnership tax return prepared by a junior associate. He checks for accuracy, ensures all supporting documentation is in place, and leaves detailed review notes identifying areas that need clarification or correction. This mentorship is a key part of his senior role.

- 1:00 PM: Lunch, often a quick bite at his desk while catching up on the Wall Street Journal or an industry accounting publication to stay current.

- 2:00 PM: He dives into research for another client, a rapidly growing real estate development company. They are considering a 1031 exchange, and David uses specialized tax research software to analyze the specific rules and potential pitfalls, drafting a memo to summarize his findings and recommendations.

- 4:30 PM: David dedicates the last part of his day to administrative tasks and professional development. He logs his billable hours, updates the engagement budget, and completes a required Continuing Professional Education (CPE) webinar on international tax developments.

- 6:00 PM: He wraps up, sends a final summary email to his manager, and plans his top priorities for the next day before heading home.

This example illustrates the dynamic blend of technical expertise, client communication, strategic thinking, and mentorship that defines the modern CPA role in Texas.

Average CPA Salary Texas: A Deep Dive

Now for the central question: What can you expect to earn as a CPA in Texas? The Lone Star State's dynamic economy, with no state income tax, makes it an attractive location for financial professionals. The CPA salary Texas offers is highly competitive and reflects the state's economic strength and diverse industrial base, from energy and manufacturing to technology and healthcare.

It's important to analyze data from multiple authoritative sources to get a complete picture. We'll look at broad data from the U.S. Bureau of Labor Statistics (BLS) and more specific CPA-focused data from reputable salary aggregators.

#### National and State-Level Benchmarks

The U.S. Bureau of Labor Statistics (BLS) provides a comprehensive overview for the broader category of "Accountants and Auditors." While this includes non-CPAs, it establishes a reliable baseline.

- National Average: According to the May 2023 BLS Occupational Employment and Wage Statistics, the national mean annual wage for Accountants and Auditors was $91,690. The salary range typically spanned from $51,770 (10th percentile) to $141,890 (90th percentile).

- Texas State Average: For the same period, the BLS reports that Texas is one of the top states for employment in this field. The statewide mean annual wage for Accountants and Auditors in Texas was $94,510, noticeably higher than the national average.

This data confirms that Texas is a strong market for accounting professionals. However, the CPA designation acts as a significant salary accelerant. Professionals holding an active CPA license typically earn a premium of 5-15% over their non-certified peers, and this gap widens considerably with experience and specialization.

#### CPA-Specific Salary Data in Texas

Let's turn to salary aggregators that differentiate for the CPA credential. *(Note: Data is as of late 2023/early 2024 and can fluctuate.)*

- Salary.com: Reports the average CPA salary in Texas as $87,131, with a typical range falling between $79,252 and $95,951. This likely represents CPAs in the earlier stages of their careers.

- Glassdoor: Shows a total pay average for a CPA in Texas around $91,675 per year, with a likely range of $73K - $116K when considering base pay and additional compensation like bonuses.

- Payscale: Estimates the average salary for a CPA in Texas to be approximately $83,000 per year.

The key takeaway is that a starting point for a licensed CPA in Texas is comfortably in the $80,00 to $95,000 range, with significant upward mobility.

#### Salary by Experience Level in Texas

Your earning potential grows dramatically as you accumulate experience. Here is a detailed breakdown of what a typical CPA salary trajectory looks like in Texas.

| Experience Level | Years of Experience | Typical Salary Range (Texas) | Role Examples |

| :--- | :--- | :--- | :--- |

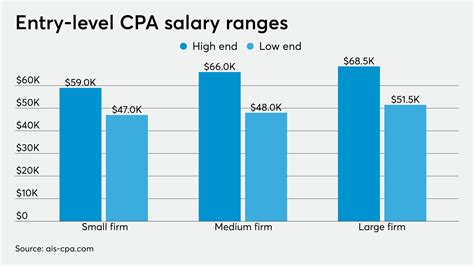

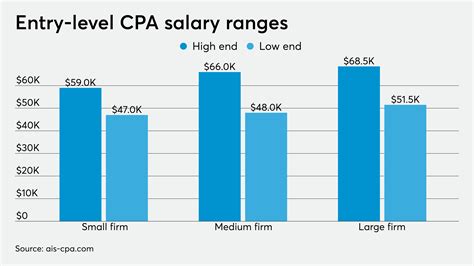

| Entry-Level / Associate | 0-2 Years | $65,000 - $85,000 | Staff Auditor, Tax Associate, Staff Accountant |

| Mid-Career / Senior | 3-7 Years | $85,000 - $125,000 | Senior Auditor, Senior Tax Accountant, Senior Financial Analyst |

| Manager / Senior Manager | 8-15 Years | $120,000 - $180,000+ | Audit Manager, Tax Manager, Controller, Director of Finance |

| Director / Partner / CFO | 15+ Years | $180,000 - $350,000+ | Partner (Public Accounting), CFO, VP of Finance, Chief Audit Executive |

*Sources: Synthesized from BLS, Robert Half Salary Guide, Salary.com, and Glassdoor data for major Texas metro areas.*

#### Breaking Down Total Compensation

Base salary is only one piece of the puzzle. A CPA's total compensation package, especially in Texas's competitive market, is often sweetened with significant variable pay and benefits.

- Bonuses: Annual performance-based bonuses are standard, particularly in public accounting and corporate finance. These can range from 5% of base salary at the senior level to over 30% for managers and directors, often tied to individual performance, firm/company profitability, and billable hours.

- Profit Sharing: Common in mid-sized and local public accounting firms. This allows employees to receive a share of the firm's profits, directly linking their success to the organization's performance and fostering an ownership mentality.

- Stock Options and Equity: In publicly traded companies or high-growth tech startups (prevalent in Austin and Dallas), equity can be a major component of compensation for senior-level CPAs (Controllers, VPs, CFOs), offering immense long-term wealth-building potential.

- Benefits and Perks:

- Health Insurance: Comprehensive medical, dental, and vision plans are standard.

- Retirement: 401(k) plans with a generous company match (e.g., 4-6%) are a critical part of the package.

- Paid Time Off (PTO): Generous PTO policies are used to attract and retain talent in a demanding profession.

- Professional Development: Companies typically pay for CPA license renewal fees and provide a substantial budget for Continuing Professional Education (CPE), a mandatory requirement to maintain the license. Many also pay for professional association memberships (e.g., AICPA, TXCPA).

- Flexibility: Post-pandemic, hybrid work models and flexible schedules have become a key, non-monetary benefit.

When evaluating a CPA salary Texas job offer, it is essential to consider the entire compensation structure, as bonuses and benefits can add another 15-40% to your total earnings.

Key Factors That Influence Your CPA Salary in Texas

While averages provide a useful benchmark, your individual salary is determined by a complex interplay of factors. Mastering and strategically navigating these elements is the key to maximizing your earning potential throughout your career. This section, the most detailed in our guide, will break down each critical variable.

### 1. Level of Education and Certifications

Your educational foundation sets the stage for your career. While a bachelor's degree is the minimum, advanced degrees and additional certifications create a clear path to higher compensation.

- The 150-Hour Requirement: To be licensed as a CPA in Texas, you must complete 150 semester hours of college coursework. This effectively means most candidates pursue a master's degree.

- Master of Accountancy (MAcc) or Master in Professional Accounting (MPA): These are the most common and direct routes. They provide specialized, advanced coursework in accounting that prepares you for the CPA exam and the rigors of the profession. Holding a MAcc can command a starting salary that is $5,000-$10,000 higher than a candidate with only a bachelor's degree.

- Master of Science in Taxation (MST): For those committed to a career in tax, this specialized degree is highly valued and can lead to higher salaries within tax service lines.

- MBA with an Accounting Concentration: An MBA can be extremely valuable, particularly for those aiming for high-level corporate finance roles like Controller or CFO. It combines financial expertise with broader business strategy, leadership, and management skills, often leading to the highest long-term earning potential in industry roles.

- Additional Certifications: While the CPA is the gold standard, layering it with other certifications can make you a highly sought-after specialist, justifying a significant salary premium.

- Certified Internal Auditor (CIA): Essential for a career in internal audit.

- Certified Fraud Examiner (CFE): Critical for forensic accounting and fraud investigation roles.

- Certified Information Systems Auditor (CISA): In high demand for IT audit and cybersecurity assurance roles.

### 2. Years and Quality of Experience

Experience is arguably the single most powerful driver of salary growth. However, it's not just the number of years that matters, but the *quality* and *type* of experience you gain.

- The Big Four Premium: Starting your career at one of the Big Four firms (Deloitte, PwC, EY, KPMG) is like a rocket booster. While known for demanding hours, the training is world-class, the client exposure (often Fortune 500) is unparalleled, and the brand name on your resume opens doors for the rest of your career. CPAs with 3-5 years of Big Four experience are highly coveted in the industry and can command top-dollar salaries when they transition to corporate roles.

- Public vs. Industry Trajectory: The salary progression differs. Public accounting often has a steeper initial growth curve (Associate -> Senior -> Manager). An exit to industry after 3-5 years in public accounting (typically at the Senior or Manager level) often comes with a significant salary bump (15-25%) and better work-life balance.

- Demonstrating Progression: A resume that shows clear advancement—from staff to senior, leading teams, managing complex projects, and taking on more responsibility—is far more valuable than one showing ten years in the same role. Your salary negotiations should be framed around the value and complexity you can handle, not just your tenure.

### 3. Geographic Location Within Texas

"Texas" is not a monolith. The cost of living and, consequently, salaries can vary significantly between its major metropolitan areas. Companies in high-cost-of-living (HCOL) cities must offer higher salaries to attract talent.

- The Major Hubs: Houston and Dallas-Fort Worth (DFW): These are the largest markets for CPAs in Texas.

- Houston: As the energy capital of the world, CPAs with experience in the oil and gas industry (upstream, midstream, downstream accounting, SEC reporting for energy firms) are in extremely high demand and can command a salary premium. The BLS reports the Houston-The Woodlands-Sugar Land metro area has a mean annual wage of $99,990 for accountants.

- Dallas-Fort Worth: A major corporate headquarters hub (AT&T, American Airlines, Texas Instruments) and a massive financial services center. This creates a high demand for CPAs in corporate finance, M&A advisory, and public accounting serving a diverse client base. The DFW metroplex has a mean annual wage of $95,300.

- The Tech Hub: Austin: Austin's booming technology sector has created a unique, high-demand market. CPAs with experience in software revenue recognition (ASC 606), startup finance, and M&A due diligence for tech companies are highly sought after. The competitive nature of the tech industry often drives salaries higher to compete with tech company compensation packages. The Austin-Round Rock metro area boasts the highest mean wage in the state at $99,900.

- Other Key Markets:

- San Antonio: A strong base in military, healthcare, and tourism provides stable demand for CPAs, with a mean wage of $84,590.

- Midland/Odessa: In the heart of the Permian Basin, these smaller cities can offer surprisingly high salaries for CPAs serving the oil and gas industry, often including hardship or location-based premiums.

Generally, you can expect salaries in Houston, Dallas, and Austin to be 5-15% higher than in San Antonio, El Paso, or other smaller metropolitan areas.

### 4. Company Type and Size

The type of organization you work for has a profound impact on your compensation, culture, and career path.

- Big Four Public Accounting Firms: Offer the highest starting salaries and a very structured, rapid promotion path. The trade-off is often long hours, especially during busy season. A Senior Manager at a Big Four firm in Dallas can easily earn a base salary of $160,000 - $190,000 plus a substantial bonus.

- National and Regional Firms (e.g., BDO, Grant Thornton, Moss Adams): Offer very competitive salaries, often just shy of the Big Four, but are frequently lauded for a better work-life balance. They provide a strong alternative with a different firm culture.

- Local and Boutique Firms: Initial salaries may be slightly lower, but these firms can offer a faster track to partnership, more direct client contact early in your career, and a significant share of the firm's profits as a partner.

- Large Corporations (Industry): Working in the accounting or finance department of a Fortune 500 company offers high salaries, excellent benefits, and opportunities for internal mobility. The path from Senior Accountant to Accounting Manager to Controller is a well-trodden and lucrative one. A Controller at a large public company in Houston could earn $150,000 - $220,000+.

- Startups and Small/Medium-Sized Enterprises (SMEs): Base salaries might be lower than at large corporations, but the potential for equity (stock options) can be enormous if the company is successful. These roles often require a CPA to be a "jack-of-all-trades," handling everything from bookkeeping to strategic finance.

- Government and Non-Profit: These sectors typically offer lower base salaries. However, they compensate with exceptional job security, excellent government benefits (pensions), and a superior work-life balance. For a CPA prioritizing stability and mission over maximum compensation, this is an excellent path.

### 5. Area of Specialization

Once you are established, specializing in a high-demand niche is one of the most effective ways to increase your value and your salary. Generalists are always needed, but specialists solve unique, expensive problems.

- Advisory/Consulting: This is often the most lucrative specialization.

- M&A and Transaction Services: CPAs who guide companies through the due diligence process of buying or selling businesses are highly paid for their critical insights.

- IT Audit & Cybersecurity: As business becomes more digital, assuring the security and integrity of financial systems is paramount. CPAs with a CISA certification are in exceptionally high demand.

- Forensic Accounting: These financial detectives investigate fraud, embezzlement, and other financial crimes. Due to the specialized skills and high-stakes nature of the work, they command premium fees and salaries.

- International Tax: For the massive multinational corporations operating in Texas, CPAs who understand the complexities of transfer pricing and international tax treaties are invaluable and compensated accordingly.

- Niche Industry Expertise: Becoming the go-to expert in a specific Texas industry—be it energy, real estate, healthcare, or technology—makes you a strategic asset. A CPA who deeply understands the specific accounting and tax rules for oil and gas partnerships will earn more in Houston than a generalist.

- Environmental, Social, and Governance (ESG): This is a rapidly emerging field. As investors and regulators demand more transparency in ESG reporting, CPAs with expertise in creating and auditing these metrics will see their demand and salaries soar.

### 6. In-Demand Skills

Beyond core accounting knowledge, a specific set of technical and soft skills can differentiate you in the job market and lead to a higher salary.

- Technical Skills:

- Data Analytics and Visualization: Proficiency in tools like Power BI, Tableau, and Alteryx is no longer a "nice-to-have." The ability to analyze large datasets to uncover trends, identify anomalies, and present findings clearly is a major value-add.

- Enterprise Resource Planning (ERP) Systems: Deep knowledge of major ERP systems like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is highly valued in corporate accounting roles.

- Advanced Excel: Moving beyond VLOOKUPs to master Power Query, Power Pivot, and complex financial modeling is a fundamental expectation.

- Soft Skills:

- Communication and Presentation: You must be able to explain complex financial concepts to non-financial stakeholders (like marketing VPs or operations managers) in a clear and compelling way.

- Strategic Thinking: The most valuable CPAs are those who can move beyond historical reporting to provide forward-looking insights and strategic recommendations that guide business decisions.

- Leadership and Team Management: As you progress to manager and director levels, your ability to lead, mentor, and develop a team becomes a primary determinant of your success and compensation.

Job Outlook and Career Growth for Texas CPAs

A high salary is attractive, but long-term career stability and growth opportunities are what make a profession truly rewarding. For CPAs in Texas, the future is exceptionally bright. The combination of a thriving state economy, complex business regulations, and the evolving nature of finance creates a sustained, high demand for licensed accounting professionals.

#### A Profession in Demand: The Data

The U.S. Bureau of Labor Statistics provides a positive outlook for the accounting profession.