Earning $23 an hour. It's a figure you might see on a job posting, a number that feels substantial and promising. It translates to an annual gross income of nearly $48,000, placing you firmly within a critical segment of the American workforce. But what does this number truly represent? Is it a comfortable living, a stepping stone to greater wealth, or a plateau? The answer isn't a simple yes or no. A $23 an hour wage is not just a number; it's a launchpad for a diverse range of rewarding careers, a foundation upon which a stable and prosperous life can be built. It represents the intersection of skilled work, valuable experience, and significant growth potential.

The journey from an hourly wage to a comprehensive annual salary is about more than just multiplication. It’s about understanding the full value of your compensation, recognizing the external factors that shape your earning power, and strategically navigating your career path to unlock future growth. This guide is designed to be your definitive resource for that journey. We will dissect the $23 an hour figure from every conceivable angle, transforming it from a simple data point into a powerful tool for career planning.

I've spent over two decades as a career analyst, guiding thousands of professionals from their first job to senior leadership roles. I recall a client, a bright and ambitious individual named Alex, who started as an administrative coordinator at exactly $23 an hour. Alex initially felt stuck, viewing the hourly rate as a ceiling. Together, we mapped out a plan—focusing on acquiring project management certifications and mastering data analysis tools—that transformed that role into a springboard, leading to a position as a Project Manager earning a six-figure salary within five years. Alex's story isn't an exception; it's a testament to the potential hidden within this wage bracket when approached with strategy and foresight.

This article will provide you with the same expert insights and data-driven analysis. We will explore the types of jobs that pay this wage, delve into the nuances of salary and benefits, analyze the critical factors that can elevate your earnings, and lay out a clear, actionable roadmap for career advancement. Whether you are currently earning $23 an hour or aspiring to, this guide will equip you with the knowledge and confidence to maximize your potential and build a truly fulfilling career.

### Table of Contents

- [What Does a $23 an Hour Career Look Like?](#what-does-a-23-an-hour-career-look-like)

- [The $23 an Hour Salary: A Deep Dive](#the-23-an-hour-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth for $23/Hour Roles](#job-outlook-and-career-growth-for-23hour-roles)

- [How to Start and Advance in a $23/Hour Career Path](#how-to-start-and-advance-in-a-23hour-career-path)

- [Conclusion: Your Career is More Than a Number](#conclusion-your-career-is-more-than-a-number)

What Does a $23 an Hour Career Look Like?

A wage of $23 per hour is not tied to a single job title but rather a broad and diverse category of professions. These roles are the backbone of our economy, requiring a valuable blend of specialized knowledge, technical skills, and crucial soft skills. They are often found in critical support functions, skilled trades, and entry-to-mid-level positions across numerous industries. These are not just "jobs"; they are the starting blocks for meaningful careers.

The U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook provides a clear window into the types of professions that fall within this pay grade. The median hourly pay for all occupations in the U.S. was $23.23 in May 2023, meaning a $23/hour role is remarkably representative of the national average.

Here are some prominent examples of careers where an hourly wage of around $23 is common, particularly for those with some experience:

- Bookkeeping, Accounting, and Auditing Clerks: These professionals are the bedrock of financial organization, responsible for producing financial records for organizations. The BLS reports a median pay of $22.61 per hour for this group as of May 2023. Their work requires meticulous attention to detail and proficiency with accounting software.

- Computer User Support Specialists: In our tech-driven world, these specialists are essential. They provide help and advice to people and organizations using computer software and equipment. Their median pay, according to the BLS, was $27.35 per hour in May 2023, with entry-level positions often starting closer to the $20-$23 range.

- Skilled Trades (e.g., Carpenters, Electricians): Many skilled trades offer robust, middle-class wages without requiring a four-year degree. For instance, Carpenters had a median pay of $26.47 per hour in 2023. These roles demand physical skill, precision, and extensive on-the-job training or apprenticeships.

- Executive Administrative Assistants: Far more than secretarial work, these roles are strategic partners to high-level executives. They manage complex schedules, prepare reports, and often act as an office's central nervous system. While the general "Secretaries and Administrative Assistants" category has a median pay of $21.84, specialized executive assistants often command wages well into the $23-$30/hour range.

- Social and Human Service Assistants: These individuals provide client services in a variety of fields, such as psychology, rehabilitation, and social work. The BLS lists their median pay at $18.94 per hour, but those with an associate's degree and experience in specific areas can certainly reach the $23/hour mark.

### A Day in the Life: The "Emerging Professional"

To make this more concrete, let's imagine a composite character, "Jamie," an Operations Coordinator at a mid-sized tech company, earning $23 an hour.

- 8:45 AM: Jamie arrives, grabs coffee, and reviews their calendar and project management board (like Asana or Trello). They identify the top three priorities for the day: finalize logistics for the upcoming quarterly all-hands meeting, onboard a new sales team member, and generate a weekly report on office supply usage for the finance department.

- 9:15 AM: The first task is onboarding. Jamie meets the new hire, provides them with their laptop and security badge, and walks them through the company's core software systems. This requires excellent communication and a friendly, welcoming demeanor.

- 11:00 AM: Jamie switches to the all-hands meeting logistics. This involves coordinating with the catering vendor, confirming the A/V setup with the IT team, and sending out a final confirmation email to all staff with the agenda. This showcases project coordination and organizational skills.

- 1:00 PM: After lunch, Jamie dedicates time to "deep work." They pull data from an inventory management system into Excel, create a pivot table to analyze spending trends, and write a brief summary for the finance report. This demonstrates analytical skills.

- 3:00 PM: The afternoon is filled with responsive tasks. Jamie answers emails from various departments, helps a colleague troubleshoot a printer issue (problem-solving!), and books travel for two executives attending a conference next month.

- 4:45 PM: Before logging off, Jamie updates the project board, moving completed tasks and noting progress on others. They send a quick summary email to their manager, ensuring alignment for the next day.

Jamie’s day is a blend of routine and unexpected challenges, requiring a versatile skill set that includes communication, technology proficiency, organization, and problem-solving. This is the reality of many $23/hour roles: they are dynamic, essential, and rich with opportunities to learn and demonstrate value.

The $23 an Hour Salary: A Deep Dive

Understanding what $23 an hour means financially requires looking beyond the hourly rate. You must convert it into an annual salary, account for taxes and deductions, and, most importantly, consider the immense value of your total compensation package.

### The Basic Calculation: From Hourly to Annual

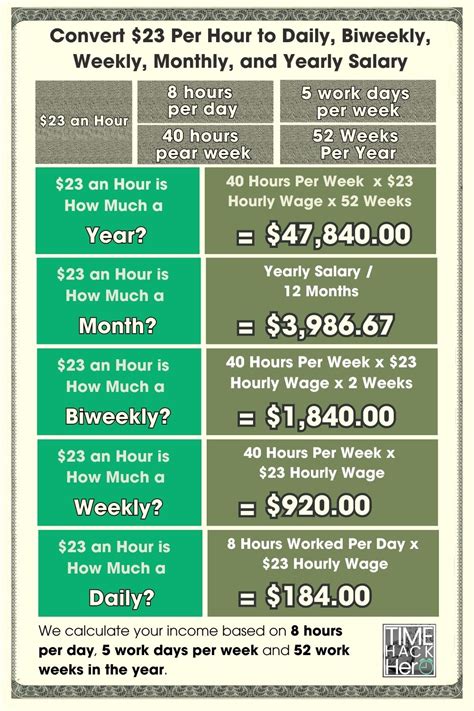

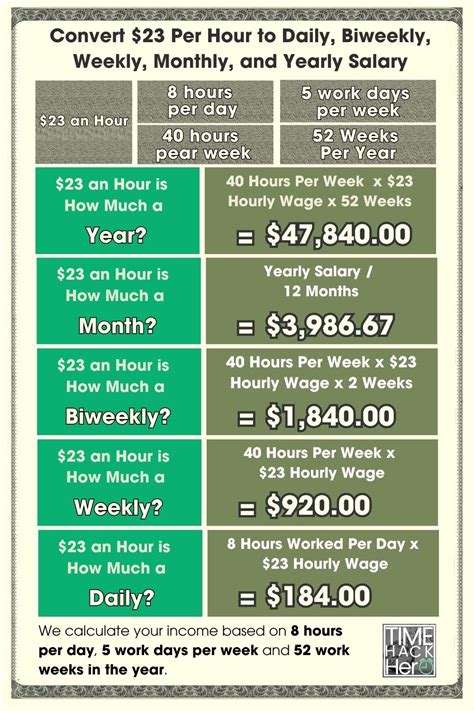

The standard formula for converting an hourly wage to an annual salary is based on a 40-hour workweek and a 52-week year.

$23 per hour × 40 hours per week = $920 per week

$920 per week × 52 weeks per year = $47,840 per year (Gross Annual Salary)

This $47,840 is your *gross income*—the total amount of money you earn before any deductions are taken out. It's the figure often cited in job offers and salary discussions.

### Gross vs. Net Income: What You Actually Take Home

Your *net income*, or take-home pay, is the amount you receive after taxes and other deductions. This is the money that actually hits your bank account. The difference between gross and net can be significant, typically ranging from 15% to 30%, depending on your location, filing status, and benefit choices.

Let's break down a sample bi-weekly paycheck for someone earning $47,840 annually:

- Gross Bi-weekly Pay: $1,840.00

- Deductions (Sample):

- Federal Income Tax: ~$150.00

- State Income Tax (Varies greatly): ~$75.00

- FICA (Social Security & Medicare): ~$140.76

- Health Insurance Premium: ~$80.00

- 401(k) Contribution (5%): ~$92.00

- Total Deductions: ~$537.76

- Net Bi-weekly Pay (Take-Home): ~$1,302.24

In this example, your annual take-home pay would be approximately $33,858, though this can vary widely. Understanding this distinction is crucial for effective budgeting and financial planning.

### How Does $47,840 Compare?

To put this salary in context, let's look at national benchmarks. According to the U.S. Bureau of Labor Statistics, the median usual weekly earnings for full-time wage and salary workers in the United States was $1,145 in the fourth quarter of 2023. This translates to an annual median salary of $59,540.

This means an annual salary of $47,840 is below the national median for all full-time workers. However, it is a very competitive wage for many entry-to-mid-level roles and in regions with a lower cost of living. It serves as a solid foundation, not an endpoint.

### Salary Progression: From Entry-Level to Senior

A career path that starts at $23/hour has significant upward mobility. As you gain experience, develop specialized skills, and take on more responsibility, your earning potential increases substantially.

Here is a typical salary progression for a professional career track that might begin at this wage, based on data aggregated from sources like Payscale and Salary.com:

| Career Stage | Years of Experience | Typical Hourly Range | Typical Annual Salary Range | Key Responsibilities & Growth Drivers |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $20 - $25 | $41,600 - $52,000 | Mastering core job functions, learning company systems, demonstrating reliability and a positive attitude. |

| Mid-Career | 3-8 Years | $26 - $38 | $54,080 - $79,040 | Handling complex projects independently, mentoring junior staff, developing a specialization, proactive problem-solving. |

| Senior / Lead | 8+ Years | $39 - $55+ | $81,120 - $114,400+ | Strategic oversight, managing teams or major functions, budget responsibility, influencing departmental decisions. |

*(Note: These are generalized figures. Actual progression varies by industry, location, and individual performance.)*

### The Hidden Value: Total Compensation

Your hourly wage is only one piece of the puzzle. Total compensation includes your salary plus the monetary value of all the benefits your employer provides. This "hidden paycheck" can add another 20-40% to your overall financial package. When evaluating a job offer, you must analyze the entire package.

Key components of total compensation include:

- Health Insurance: Employer contributions to health, dental, and vision insurance premiums are a major financial benefit. A family plan can be worth over $15,000 annually.

- Retirement Savings Plans: A 401(k) or 403(b) plan with an employer match is essentially free money. A common match is 50% of your contribution up to 6% of your salary. For a $47,840 salary, a 3% match is an extra $1,435 per year toward your retirement.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. Two weeks of paid vacation is equivalent to earning $1,840 without having to work.

- Bonuses and Profit Sharing: Performance-based bonuses or company-wide profit sharing can provide a significant annual boost to your income.

- Tuition Reimbursement: Many companies will help pay for further education, certifications, or professional development courses, an investment in your future earning power worth thousands of dollars.

- Other Perks: This can include life insurance, disability insurance, flexible spending accounts (FSAs), gym memberships, and transportation subsidies.

When you factor in these benefits, a job offering $23 an hour could have a total compensation value well over $60,000 per year, making it a much more powerful financial proposition.

Key Factors That Influence Your Salary

While $23 an hour is a specific number, your actual and potential earnings are not static. They are influenced by a dynamic interplay of factors. Understanding and strategically leveraging these variables is the key to accelerating your income growth throughout your career. This section provides an exhaustive breakdown of the six primary drivers of your salary.

###

1. Level of Education and Certification

Your educational background is a foundational element of your earning potential. While many roles in the $23/hour range are accessible with a high school diploma and relevant experience, higher education and specialized credentials create a direct and measurable path to higher pay.

- Degrees: The U.S. Bureau of Labor Statistics consistently shows a strong correlation between education level and earnings. In 2022, the median weekly earnings for a high school graduate were $853, while those with a Bachelor's degree earned $1,432—a 68% increase.

- Associate's Degree: This two-year degree, often from a community college, is highly effective for specific career tracks like paralegals, IT support, and certain healthcare technicians. It can be the credential that lifts you from a sub-$20/hour role into the $23/hour+ bracket.

- Bachelor's Degree: A four-year degree is often the minimum requirement for professional and management tracks. In a role like an Operations Coordinator, having a B.A. in Business Administration or a related field can make you eligible for promotions to Analyst or Manager roles far more quickly.

- Master's Degree: While not necessary for most $23/hour jobs, a Master's degree (like an MBA or a specialized Master's) is a powerful tool for moving into senior leadership and can dramatically increase long-term earning potential, often leading to salaries well over $100,000.

- Certifications: In today's skills-based economy, certifications can be just as valuable as a formal degree, if not more so. They demonstrate verifiable expertise in a specific domain. For a professional earning around $23 an hour, pursuing a certification is one of the highest-return investments you can make.

- IT: A Computer User Support Specialist can significantly increase their value by earning CompTIA A+, Network+, or Security+ certifications.

- Project Management: An Administrative or Operations Coordinator who earns the Certified Associate in Project Management (CAPM) or the prestigious Project Management Professional (PMP) certification can transition to a dedicated Project Coordinator or Project Manager role, often with a 20-30% salary increase.

- Bookkeeping: Becoming a Certified Bookkeeper (CB) through the American Institute of Professional Bookkeepers (AIPB) adds a layer of credibility and can lead to higher-paying clients or more senior roles.

- Human Resources: An HR assistant can pursue the SHRM-CP (Society for Human Resource Management Certified Professional) to qualify for HR Generalist positions.

###

2. Years of Experience

Experience is perhaps the most powerful determinant of salary growth. With each year you work, you accumulate not just time but a deeper well of practical knowledge, efficiency, and problem-solving skills. Employers pay a premium for employees who can operate with less supervision, mentor others, and handle complex situations with poise.

The salary trajectory detailed earlier illustrates this perfectly. Let's revisit it with more narrative:

- 0-2 Years (The Learning Phase): Your primary value is your potential. You are paid to learn and execute well-defined tasks. Your focus should be on absorbing everything you can, building a reputation for reliability, and mastering the fundamental skills of your role and industry.

- 3-8 Years (The Contribution Phase): You have moved beyond basic competency. You can now work independently, anticipate needs, and begin to contribute on a more strategic level. At this stage, you should be taking on "stretch" assignments, volunteering for complex projects, and starting to specialize. This is where you see the most significant percentage-based jumps in your salary, either through promotions or by leveraging your experience to move to a new company. According to Payscale, workers who switch jobs often see a salary increase of 10% or more, compared to smaller annual raises for those who stay.

- 8+ Years (The Leadership Phase): You are now a subject matter expert. Your value lies in your strategic insight, your ability to lead teams (formally or informally), and your deep institutional knowledge. At this level, salary negotiations are less about market rates for a "job" and more about the unique value you bring to the organization. Earnings can plateau if you don't transition into management or a highly specialized individual contributor role.

###

3. Geographic Location

Where you live is one of the most significant and least controllable factors affecting your salary. A $48,000 salary can afford a comfortable lifestyle in one city and be barely enough to scrape by in another. Companies adjust their pay scales based on the local cost of living and the competitiveness of the local talent market.

Cost of Living (COL): This index measures the relative cost of maintaining a certain standard of living in different locations, including housing, food, transportation, and healthcare. A high COL area requires a higher salary to attract talent.

Here's a comparison of how a $47,840 salary might be perceived in different U.S. metropolitan areas, using cost of living data relative to the national average (100):

| City | Cost of Living Index (Approx.) | Adjusted "Real Feel" Salary | Lifestyle Implications |

| :--- | :--- | :--- | :--- |

| Manhattan, NY | 227.7 | ~$21,000 | Extremely challenging. This salary would likely require multiple roommates and very frugal living. |

| San Francisco, CA | 179.1 | ~$26,700 | Very difficult. Housing costs would consume a massive portion of income. |

| Boston, MA | 149.7 | ~$31,900 | A tight budget. Could be manageable with roommates but little room for savings or discretionary spending. |

| Chicago, IL | 105.1 | ~$45,500 | Close to the national average. A viable salary for a single person, allowing for modest comfort and savings. |

| Houston, TX | 93.3 | ~$51,300 | Comfortable. This salary would go significantly further, allowing for better housing options and more savings. |

| Brownsville, TX | 73.1 | ~$65,400 | Very comfortable. The purchasing power of this salary is exceptionally high, affording a high quality of life. |

*(COL data based on sources like the Council for Community and Economic Research (C2ER) and Payscale's Cost-of-Living Calculator.)*

The rise of remote work has complicated this factor. Some companies now use location-based pay, adjusting your salary if you move. Others have adopted a single national rate. When considering a job, especially a remote one, it's critical to understand the company's policy on geographic pay adjustments.

###

4. Company Type & Industry

The type of organization you work for and the industry it operates in have a profound impact on compensation structures.

- Large Corporations (Fortune 500): These companies typically have highly structured salary bands, excellent benefits packages (health insurance, 401k matching), and clear paths for advancement. While starting salaries might be market-standard, the total compensation package is often superior.

- Startups: Often offer lower base salaries and less comprehensive benefits. However, they may compensate with equity (stock options), which carries high risk but high potential reward. They also offer opportunities for rapid growth and broad experience, as employees often wear many hats.

- Small to Medium-Sized Businesses (SMBs): Compensation can vary widely. Pay may be less standardized, offering more room for negotiation if you can prove your value. Benefits can be less robust than at large corporations.

- Government (Federal, State, Local): Government jobs are known for their exceptional job security, defined-benefit pension plans, and generous time off. While base salaries may sometimes lag behind the private sector, the stability and total long-term value of the benefits package can be immense.

- Non-Profit Organizations: These organizations are mission-driven, which