Introduction

Earning $27 an hour represents a significant financial milestone for millions of Americans. It's a wage that can signify a transition from just getting by to building a stable, comfortable life. It’s the point where you can begin to plan for the future—saving for a down payment, investing in your retirement, and enjoying life's pleasures without constant financial anxiety. But what does $27 an hour truly mean for your annual salary and lifestyle? What kinds of careers offer this level of compensation, and most importantly, how can you achieve it?

This comprehensive guide is designed to answer every one of those questions. We will move beyond the simple math and dive deep into the real-world implications of earning $27 an hour, which translates to a gross annual salary of $56,160 (based on a standard 40-hour work week). This income level places you firmly within the national median, offering a solid foundation for financial security and career growth. Throughout my career as a professional development analyst, I've seen countless individuals transform their lives by strategically targeting and achieving this income level. I recall mentoring a young graphic designer who felt stuck at a $18/hour agency job. By identifying key skills gaps and focusing on building a specialized portfolio, she was able to land a corporate role starting at exactly $27 an hour within a year, a move that completely changed her financial trajectory and professional confidence. Her story is a testament to the fact that with the right knowledge and strategy, this goal is well within your reach.

This article will serve as your roadmap. We will deconstruct the salary, explore the jobs that pay it, analyze the factors that can increase your earnings, and provide a step-by-step plan to help you secure a position at this level and beyond.

### Table of Contents

- [What Does a $27 an Hour Job Look Like?](#what-does-a-27-an-hour-job-look-like)

- [$27 an Hour: Deconstructing Your Annual Salary and Compensation](#27-an-hour-deconstructing-your-annual-salary-and-compensation)

- [Key Factors That Influence Your Earning Potential](#key-factors-that-influence-your-earning-potential)

- [Job Outlook and Career Growth for $27/Hour Roles](#job-outlook-and-career-growth-for-27hour-roles)

- [How to Land a $27 an Hour Job: Your Step-by-Step Guide](#how-to-land-a-27-an-hour-job-your-step-by-step-guide)

- [Conclusion: Your Path to a Prosperous Career](#conclusion-your-path-to-a-prosperous-career)

---

What Does a $27 an Hour Job Look Like?

A $27 per hour wage is not tied to a single profession but represents a common compensation level for a wide array of skilled and experienced roles across various industries. These are not typically entry-level, minimum-wage positions; they require a specific skill set, a degree of specialized training, post-secondary education, or several years of tangible experience. These roles are the backbone of the economy, demanding a blend of technical know-how and critical soft skills.

The jobs in this pay bracket are incredibly diverse. You'll find them in healthcare, technology, skilled trades, business administration, and creative fields. The common thread is that they provide a clear value proposition to the employer, justifying a salary that is significantly above the federal minimum wage. For example, a Licensed Practical Nurse (LPN) provides essential patient care under the supervision of a registered nurse, a responsibility that commands this level of pay. Similarly, an experienced Executive Assistant is a strategic partner to a leader, managing complex schedules and communications, making them indispensable.

Here's a look at some of the common jobs and their core responsibilities that often fall within the $25-$30 per hour range:

- Skilled Trades:

- Electrician (Apprentice/Journeyman): Installing, maintaining, and repairing electrical systems in homes and businesses. Requires extensive training and licensure.

- Plumber: Assembling, installing, and repairing pipes and fixtures for water, gas, and drainage systems.

- HVAC Technician: Installing and servicing heating, ventilation, and air conditioning systems.

- Healthcare (Non-Doctor/RN):

- Licensed Practical Nurse (LPN): Providing basic nursing care, including monitoring patient health, administering medication, and providing personal care.

- Medical or Clinical Laboratory Technician: Performing routine medical laboratory tests for the diagnosis, treatment, and prevention of disease.

- Respiratory Therapist: Caring for patients with breathing or cardiopulmonary disorders.

- Technology & IT:

- IT Support Specialist (Tier 2): Troubleshooting more complex hardware, software, and networking issues that Tier 1 support cannot resolve.

- Junior Web Developer: Writing, testing, and maintaining code for websites and web applications under the guidance of senior developers.

- Business & Administration:

- Executive Assistant: Providing high-level administrative support to executives, managing schedules, correspondence, and travel.

- Paralegal or Legal Assistant: Assisting lawyers by preparing legal documents, conducting research, and maintaining files.

- Bookkeeper: Recording financial transactions, updating statements, and checking financial records for accuracy for small to mid-sized businesses.

- Market Research Analyst (Entry to Mid-Level): Gathering and analyzing data on consumers and competitors to help companies understand market conditions.

### A Day in the Life: "Alex," an Operations Coordinator

To make this tangible, let's imagine a "Day in the Life" of Alex, an Operations Coordinator for a mid-sized logistics company, earning $27 an hour.

- 8:30 AM: Alex arrives at the office, grabs a coffee, and reviews the daily shipping manifest. They notice a potential delay for a key client due to a weather issue in the Midwest.

- 9:00 AM: Alex joins the morning team huddle, reporting the potential delay and proposing a re-routing option they've already researched. Their proactive approach is noted by the manager.

- 10:00 AM: Alex spends the next two hours on the phone and email, coordinating with the trucking carrier to confirm the new route, updating the client on the revised ETA, and adjusting the internal tracking system (using software like SAP or Oracle). This requires clear communication and problem-solving skills.

- 12:00 PM: Lunch break.

- 1:00 PM: Alex focuses on a weekly project: analyzing last week's delivery performance data in Excel. They create pivot tables and charts to identify trends in on-time delivery rates and fuel costs, preparing a summary for their manager.

- 3:00 PM: A new, urgent request comes in. A high-value shipment needs to be expedited. Alex must quickly source a new carrier, negotiate a rate, and process the necessary paperwork, ensuring all compliance standards are met.

- 4:30 PM: Alex finalizes their performance report, adding insights and recommendations for improving efficiency next week.

- 5:00 PM: Before logging off, Alex does a final check on all critical shipments for the day, ensuring everything is on track for the evening shift. They leave the office with a sense of accomplishment, having solved problems and directly contributed to the company's success.

This example illustrates the key characteristics of a $27/hour job: responsibility, specialized knowledge (logistics software, Excel), critical thinking, and strong communication skills.

---

$27 an Hour: Deconstructing Your Annual Salary and Compensation

Understanding what $27 an hour translates to annually is the first step, but a deep dive reveals that your gross salary is only one part of your total financial picture. A savvy professional analyzes their entire compensation package to understand their true earnings.

### The Baseline Calculation: Gross Annual Income

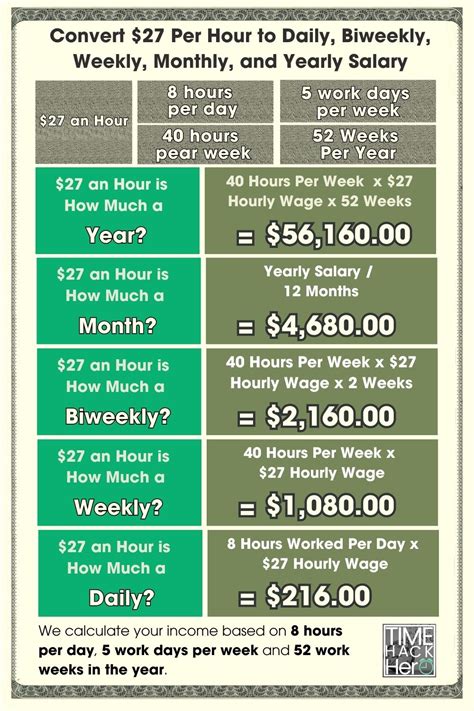

Let's start with the straightforward math. Assuming a standard full-time schedule, your gross (pre-tax) income is calculated as follows:

- Hourly Rate: $27

- Hours per Week: 40

- Weeks per Year: 52

> $27/hour × 40 hours/week × 52 weeks/year = $56,160 per year

This $56,160 figure is your baseline annual salary. It's a solid, middle-class income in most parts of the United States. According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all workers was $48,060 in May 2023, meaning a $56,160 salary puts you comfortably above the national midpoint.

### From Gross to Net: Understanding Your Take-Home Pay

Your take-home pay (net income) is what you actually receive after taxes and other deductions. This is a crucial number for budgeting and financial planning. Deductions can vary significantly based on your location, filing status, and benefit choices, but here's a general breakdown:

- Federal Income Tax: Depends on your tax bracket and filing status (single, married, etc.).

- State & Local Income Tax: Varies from 0% in states like Texas and Florida to over 10% in high-tax states like California and New York.

- FICA Taxes: This is a flat tax for Social Security (6.2%) and Medicare (1.45%), totaling 7.65% for employees.

- Pre-Tax Deductions: Health insurance premiums, 401(k) or 403(b) retirement contributions, and Health Savings Account (HSA) contributions.

As a rough estimate, you can expect total deductions to be between 20% and 30% of your gross pay.

- Low-End Estimate (20% deductions): $56,160 x 0.80 = $44,928 take-home pay (or ~$3,744/month)

- High-End Estimate (30% deductions): $56,160 x 0.70 = $39,312 take-home pay (or ~$3,276/month)

Knowing your likely take-home pay provides a realistic foundation for building a budget.

### Salary Progression by Experience Level

A $27/hour wage is often a mid-career benchmark rather than a starting or ending point. Salary aggregator data from sources like Payscale and Salary.com shows a clear progression for the types of roles we've discussed.

| Experience Level | Years of Experience | Typical Hourly Range | Typical Annual Salary Range |

| :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $20 - $24 | $41,600 - $49,920 |

| Mid-Career | 3-8 Years | $25 - $35 | $52,000 - $72,800 |

| Senior/Experienced | 8+ Years | $36 - $45+ | $74,880 - $93,600+ |

*Source: Synthesized data from Payscale, Glassdoor, and BLS reports for relevant occupations.*

As you can see, $27/hour sits squarely in the mid-career range. This demonstrates that there is significant room for growth. A professional who starts at $22/hour can reasonably expect to reach and surpass the $27/hour mark within a few years by gaining valuable experience and skills.

### The Hidden Value: Total Compensation Beyond Salary

A sophisticated career analyst never looks at salary alone. The true value of a job offer lies in its total compensation package. The benefits offered can be worth thousands, or even tens of thousands, of dollars annually. When evaluating a role that pays $27 an hour, you must consider:

- Health Insurance: This is often the most valuable benefit. Employer-sponsored health, dental, and vision insurance can save you thousands per year compared to buying a plan on the open market. A good family plan can have an employer-paid premium value of over $15,000 annually.

- Retirement Savings Plans (401(k) or 403(b)): The key here is the employer match. A common match is 50% of your contributions up to 6% of your salary. On a $56,160 salary, if you contribute 6% ($3,370), your employer adds an additional $1,685 of "free money" to your retirement account. This is a 3% raise you don't see in your paycheck.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. A standard package might include 10 vacation days, 5 sick days, and 10 paid holidays. That's 25 days, or 5 full weeks, of paid time off. The value is your daily rate ($27 x 8 hours = $216) multiplied by the number of days off. 25 days x $216/day = $5,400.

- Bonuses and Profit Sharing: While not always guaranteed, performance bonuses or company-wide profit sharing can significantly boost your annual earnings. A 5% annual bonus on a $56,160 salary is an extra $2,808.

- Tuition Reimbursement & Professional Development: Companies may offer to pay for certifications, workshops, or even a master's degree. A single certification could cost $1,000-$3,000, and a tuition reimbursement program can be worth over $5,000 per year. This is an investment in your future earning power.

- Other Perks: Don't discount other benefits like life insurance, disability insurance, flexible spending accounts (FSAs), commuter benefits, and gym memberships.

When you add it all up, a job offer of $56,160 could have a total compensation value of $70,000 or more. Always ask for a detailed benefits summary when considering an offer.

---

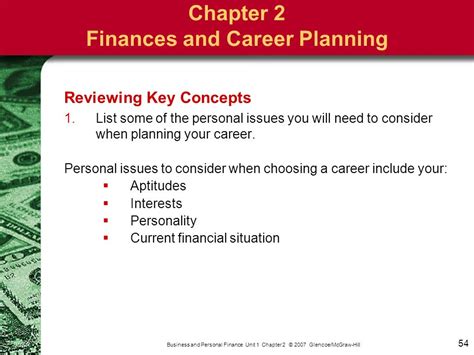

Key Factors That Influence Your Earning Potential

While $27 an hour is a great benchmark, it's not a static figure. Your individual earning potential, even within the same job title, is influenced by a powerful combination of factors. Mastering and strategically leveraging these elements is the key to not only reaching $27/hour but soaring far beyond it. This is the most critical section for anyone looking to maximize their income.

###

Level of Education and Certification

Your educational background is often the foundation upon which your salary is built. While a four-year degree is not a prerequisite for all $27/hour jobs (especially in the skilled trades), it undeniably opens more doors and creates a higher salary floor and ceiling in many white-collar professions.

- High School Diploma / GED: For roles in this pay range, a high school diploma is usually the minimum. However, to reach $27/hour, it almost always needs to be paired with significant on-the-job training, an apprenticeship (e.g., for electricians, plumbers), or a specific vocational certification.

- Associate's Degree (A.A., A.S.): A two-year degree from a community college is a highly effective and cost-efficient path to many $27/hour careers. Fields like nursing (for LPNs or preparing for an RN), respiratory therapy, paralegal studies, and IT support often have excellent associate's programs that lead directly to well-paying jobs. According to Payscale, workers with an Associate's degree earn a median pay that is roughly $10,000 more per year than those with only a high school diploma.

- Bachelor's Degree (B.A., B.S.): A four-year degree is the standard entry point for many professional roles like Market Research Analyst, Operations Coordinator, or Junior Developer. It provides a deeper theoretical foundation and signals a higher level of analytical and communication skills to employers. According to the BLS, in 2022, the median weekly earnings for bachelor's degree holders were $1,432, significantly higher than the $853 for high school graduates. This degree provides the platform to grow well beyond the $27/hour mark.

- Professional Certifications: In the modern economy, skills-based certifications are increasingly powerful salary boosters. They validate your expertise in a specific technology, methodology, or skill set.

- In IT: A CompTIA Security+ or Network+ certification can elevate an IT Support Specialist's pay.

- In Business: A Certified Associate in Project Management (CAPM) or later, a Project Management Professional (PMP), can add a 15-20% salary premium.

- In Bookkeeping: Becoming a Certified QuickBooks ProAdvisor can allow you to command a higher rate.

- In Healthcare: Specialized certifications in areas like phlebotomy or EKG for medical assistants can increase pay and job opportunities.

Actionable Advice: Continuously assess your field for in-demand certifications. Many employers will pay for this training through their professional development budget.

###

Years of Experience

Experience is perhaps the single most significant driver of salary growth. Employers pay for proven results and reduced risk. An employee with eight years of experience has encountered and solved a wide range of problems that a new hire has yet to see.

Let's map out a hypothetical salary journey for an "Operations Coordinator" to illustrate this:

- Entry-Level (0-2 years): Starting at $22/hour ($45,760/year). In this phase, you are learning the company's systems, proving your reliability, and mastering the core functions of your role.

- Mid-Career (3-5 years): You've proven your competence and are now taking on more complex tasks. You might be training new hires or leading small projects. Your performance and growing expertise lead to a promotion or merit increase to $27/hour ($56,160/year). You have become a trusted, fully functional member of the team.

- Experienced (6-10 years): You are now a subject matter expert. You're not just executing tasks; you're improving processes. You might be managing a key client account or optimizing a major part of the supply chain. Your salary grows to $35/hour ($72,800/year).

- Senior/Lead (10+ years): You are now in a leadership position, either managing a team (Operations Manager) or acting as a principal individual contributor solving the most complex operational challenges. Your pay could now be $45/hour or more ($93,600+/year).

Actionable Advice: Meticulously document your accomplishments at each stage. Don't just list duties on your resume; quantify your impact. For example, instead of "Managed inventory," write "Implemented a new inventory tracking system that reduced waste by 15% and saved $20,000 annually."

###

Geographic Location

Where you live and work dramatically impacts the real-world value of your salary. A $56,160 salary can afford a very comfortable lifestyle in a low-cost-of-living (LCOL) area but may feel stretched in a high-cost-of-living (HCOL) metropolis. Companies adjust their pay scales based on the local market rate for talent and the cost of living.

Here’s a comparison of how the same job might be compensated and what that salary is "worth" when adjusted for cost of living (COL), using a national average as a baseline of 100.

| City | Typical Salary for a Paralegal | Cost of Living Index (vs. Nat'l Avg) | Adjusted "Real" Salary |

| :--- | :--- | :--- | :--- |

| San Francisco, CA | $75,000 | 179 (79% higher) | ~$41,899 |

| New York, NY | $72,000 | 167 (67% higher) | ~$43,113 |

| Boston, MA | $68,000 | 148 (48% higher) | ~$45,945 |

| National Average | $56,000 | 100 | $56,000 |

| Dallas, TX | $55,000 | 101 (1% higher) | ~$54,455 |

| Kansas City, MO | $52,000 | 86 (14% lower) | ~$60,465 |

| Huntsville, AL | $50,000 | 83 (17% lower) | ~$60,240 |

*Source: Salary data is an aggregation from Glassdoor and Salary.com. Cost of Living data from Payscale's Cost of Living Calculator.*

This table is illuminating. While the paralegal in San Francisco earns a much higher nominal salary, their purchasing power is actually *lower* than the national average due to exorbitant housing and living costs. Conversely, the paralegal in Kansas City earns slightly less in absolute dollars but enjoys a significantly higher standard of living because their money goes much further.

The rise of remote work has added a new dimension to this. Some companies now pay a single national rate regardless of location, while others are implementing location-based pay tiers. This is a critical factor to clarify during any job interview process for a remote role.

Actionable Advice: Use online cost-of-living calculators to compare job offers in different cities. A lower salary in a LCOL city may be a financially smarter move than a higher salary in an HCOL city.

###

Company Type & Size

The type of organization you work for has a profound effect on your compensation structure, work culture, and career trajectory.

- Startups: Often offer lower base salaries due to cash constraints. To compensate, they may offer potentially lucrative stock options. The work environment is fast-paced and less structured, offering rapid learning opportunities but less job security. A $27/hour role here might come with significant responsibility and a title that sounds more senior than at a larger company.

- Large Corporations (e.g., Fortune 500): Typically offer the most competitive base salaries and the most robust benefits packages (excellent health insurance, generous 401(k) matches). Pay scales are well-defined and often rigid. Roles are more specialized, and career progression happens along a more structured, albeit sometimes slower, path.

- Small to Medium-Sized Businesses (SMBs): Compensation can be highly variable. They may not match corporate salaries but can offer more flexibility, a better work-life balance, and a chance to have a more visible impact on the business. Profit-sharing bonuses can be common in successful SMBs.

- Non-Profits: Generally pay less than for-profit entities for similar roles. People are often drawn to these organizations for mission-driven work. While the base salary for a role might be closer to $24/hour, the sense of purpose and strong community can be a major non-monetary benefit.

- Government (Federal, State, Local): Government jobs are known for their exceptional job security, excellent pension plans, and comprehensive benefits. The base salary might be on par with or slightly below the private sector, but the total compensation value, when factoring in retirement and benefits, is often superior. Pay is determined by rigid grade and step systems (like the GS scale for federal employees).

###

Area of Specialization

Within any given profession, specialization is a powerful lever for increasing your income. By developing deep expertise in a high-demand niche, you become more valuable and less replaceable.

Let's look at a few examples:

- IT Support: A generalist IT Support Specialist might earn $25/hour. An IT Specialist who focuses on Cybersecurity (managing firewalls, responding to incidents) or Cloud Computing (managing AWS or Azure environments) can