Table of Contents

- [Introduction: Decoding the $31 an Hour Milestone](#introduction)

- [What Do Jobs Paying $31 an Hour Actually Look Like?](#what-it-looks-like)

- [A Deep Dive into a $31 an Hour Salary](#deep-dive)

- [The 6 Key Factors That Influence Your Salary](#key-factors)

- [Job Outlook and Career Growth for a $31/Hour Professional](#job-outlook)

- [Your Step-by-Step Guide to Earning $31 an Hour and Beyond](#how-to-get-started)

- [Conclusion: Turning a $31/Hour Salary into a Launchpad for Success](#conclusion)

Introduction: Decoding the $31 an Hour Milestone

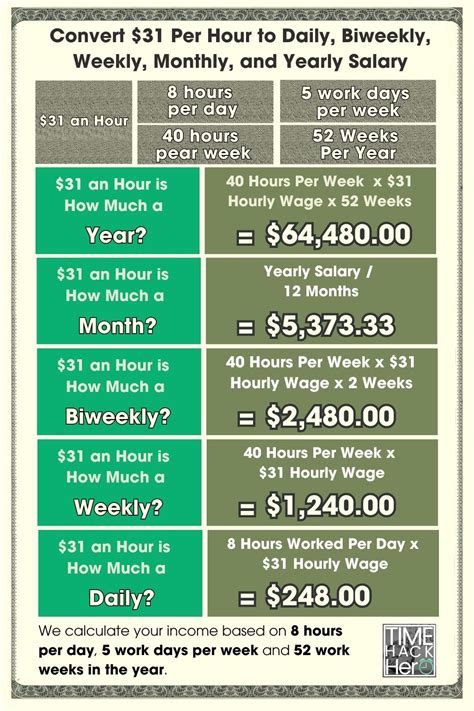

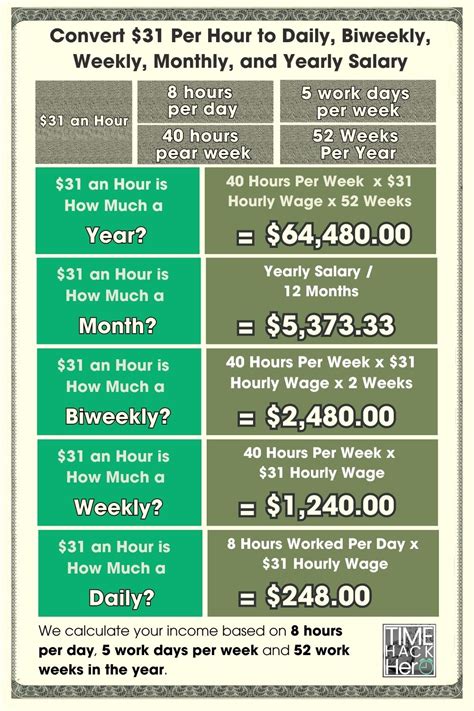

Earning $31 an hour is a significant financial and professional benchmark. It translates to an annual salary of approximately $64,480 before taxes, assuming a standard 40-hour workweek. This figure places you comfortably above the national median individual income in the United States, representing a level of financial stability and professional competence that many aspire to achieve. It’s the kind of income that allows for a comfortable lifestyle, the ability to save for the future, and the satisfaction of knowing your skills are valued in the marketplace.

But what does it really mean to earn $31 an hour? Is it a good salary in your city? What kind of jobs pay this amount, and what does it take to get there? More importantly, how can you use this salary as a launchpad for even greater career growth and earning potential? This guide is designed to be your definitive resource, providing an exhaustive, data-driven analysis to answer every question you have about this career milestone.

I once worked with a client, a talented marketing coordinator who felt stuck in the low $50,000 range. After we strategically revamped her resume to highlight her data analysis skills and prepped her for salary negotiations, she landed a new role as a Marketing Specialist starting at exactly $65,000 a year. The sense of validation and security she felt was palpable; it was more than just money, it was proof of her professional growth. This guide is built on hundreds of such experiences, combining deep market analysis with the real-world strategies that help professionals like you secure the compensation they deserve.

We will dissect this salary from every angle, leveraging up-to-date information from authoritative sources like the U.S. Bureau of Labor Statistics (BLS), Payscale, and Glassdoor. You'll gain a clear understanding of the roles that offer this level of pay, the critical factors that can increase your earnings, the long-term career outlook, and a concrete, step-by-step plan to achieve your goal.

What Do Jobs Paying $31 an Hour Actually Look Like?

A $31 per hour ($64,480/year) salary is typically associated with skilled professional roles that require a blend of formal education, specialized training, and a few years of hands-on experience. These are not entry-level, minimum-wage positions; they are the backbone of many corporate departments, healthcare facilities, and technical teams.

Professionals in this bracket have moved beyond basic task execution. They are expected to manage small projects, analyze data to inform decisions, communicate effectively with stakeholders, and operate with a degree of autonomy. They possess a specific, marketable skill set—whether in finance, marketing, human resources, technology, or healthcare.

To make this concrete, let's explore a "Day in the Life" for two common professions that often fall within this salary range for individuals with 2-5 years of experience.

### A Day in the Life of a Mid-Level Marketing Specialist

Salary Context: According to Salary.com, the median salary for a Marketing Specialist II in the United States is around $67,780 as of late 2023, placing $31/hour squarely in the typical range.

- 9:00 AM - 9:30 AM: Morning Sync & Analytics Review. Sarah starts her day by reviewing the performance dashboards for her ongoing campaigns. She checks key metrics like click-through rates (CTR) on the latest email newsletter, engagement on social media posts, and lead generation from a recent Google Ads campaign. She flags a dip in website traffic from organic search for later investigation.

- 9:30 AM - 11:00 AM: Content Creation & Collaboration. Sarah works on drafting copy for an upcoming product launch. This involves writing a press release, creating social media snippets for LinkedIn and Twitter, and collaborating with the graphic designer via Slack to finalize an infographic.

- 11:00 AM - 12:00 PM: Campaign Strategy Meeting. She joins a video call with the Senior Marketing Manager and a product manager to plan the Q2 digital marketing strategy. Sarah presents her findings from the morning's analytics review and suggests A/B testing new ad creative to improve conversion rates. Her input is valued because it's backed by data.

- 12:00 PM - 1:00 PM: Lunch.

- 1:00 PM - 3:00 PM: SEO & Website Management. Remembering the dip in organic traffic, Sarah spends two hours on search engine optimization (SEO). She uses tools like Ahrefs or SEMrush to conduct keyword research, identifies a few blog posts that could be updated for better ranking ("content refresh"), and makes minor updates to the company's website using their Content Management System (CMS), like WordPress.

- 3:00 PM - 4:30 PM: Vendor Communication & Project Management. Sarah coordinates with an external PR agency to ensure they have the materials for the upcoming launch. She uses a project management tool like Asana or Trello to track deliverables and deadlines, ensuring everything is on schedule.

- 4:30 PM - 5:00 PM: End-of-Day Wrap-up. She responds to final emails, updates her project trackers, and outlines her top three priorities for the next day.

### A Day in the Life of an HR Generalist

Salary Context: Payscale reports the average salary for an HR Generalist is approximately $62,500, with a typical range of $50k - $78k. A professional with 3-4 years of experience could easily command a $31/hour wage.

- 9:00 AM - 10:00 AM: Email Triage & Urgent Employee Inquiries. David, an HR Generalist, begins his day by sorting through his inbox. He handles an urgent request from a manager about the process for placing an employee on a Performance Improvement Plan (PIP) and responds to an employee's question about their 401(k) vesting schedule.

- 10:00 AM - 12:00 PM: Recruiting & Onboarding. David's top priority is filling a vacant Accountant position. He spends this block screening resumes in the Applicant Tracking System (ATS), conducting a 30-minute phone screen with a promising candidate, and scheduling follow-up interviews with the hiring manager. He also prepares the new hire orientation packet for a new employee starting next week.

- 12:00 PM - 1:00 PM: Lunch.

- 1:00 PM - 2:30 PM: Employee Relations & Policy Interpretation. A manager comes to David for advice on handling a conflict between two team members. David listens carefully, documents the situation, refers to the company's employee handbook, and provides guidance on mediating the discussion while ensuring compliance with labor laws.

- 2:30 PM - 4:00 PM: HRIS Management & Reporting. David needs to run a report on employee turnover for the last quarter. He logs into the company's Human Resource Information System (HRIS), like Workday or ADP, pulls the necessary data, and formats it into a simple Excel chart for the upcoming HR leadership meeting. He ensures data accuracy and confidentiality.

- 4:00 PM - 5:00 PM: Benefits Administration & Planning. With open enrollment approaching, David reviews materials from the company's health insurance broker. He helps draft internal communications to explain the new plan options to employees and schedules a series of informational webinars.

In both examples, the work is multi-faceted, requires specific software skills, strong communication, and the ability to solve problems independently. This is the essence of a job that pays $31 an hour.

A Deep Dive into a $31 an Hour Salary

A $31 hourly wage, or approximately $64,480 annually, is a strong income that requires a detailed financial and professional context. It's not just a number; it represents a specific tier in the national economic landscape. Let's break it down with authoritative data.

### National Context: Where Does $64,480 Stand?

To understand the value of this salary, we must compare it to national benchmarks.

- Median Personal Income: According to the U.S. Census Bureau's most recent data (Current Population Survey), the median personal income in the United States was $40,480 in 2022. This means a salary of $64,480 is nearly 60% higher than that of the typical individual American earner.

- Median Household Income: The median household income in the U.S. was $74,580 in 2022. A single individual earning $64,480 contributes a very significant portion of this median figure, and a dual-income household where both partners earn a similar amount would be well into the upper-middle class.

- Federal Poverty Level: For a single-person household in 2023, the federal poverty guideline is $14,580. A $64,480 salary is more than four times this amount, highlighting a substantial level of financial security.

Conclusion: Objectively, a $31/hour salary positions you in a solid, middle-class to upper-middle-class bracket as an individual earner.

### Salary Progression: From Entry-Level to Senior Professional

A $31/hour wage is rarely a starting salary for a post-college professional. It typically represents the earnings of someone in their mid-career stage, having accumulated a few years of valuable experience.

Here’s a typical salary progression for a professional role like a Financial Analyst or HR Specialist, based on data aggregated from sources like Glassdoor and Payscale:

| Career Stage | Years of Experience | Typical Hourly Wage Range | Typical Annual Salary Range | Key Responsibilities & Title Examples |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $22 - $28/hour | $45,000 - $58,000 | Titles: Junior Analyst, Coordinator, Specialist I. Responsibilities: Task execution, data entry, learning systems, supporting senior staff. |

| Mid-Career | 2-5 Years | $28 - $38/hour | $58,000 - $79,000 | Titles: Analyst, Specialist, Generalist. Responsibilities: Managing small projects, independent analysis, process improvement, mentoring junior staff. This is the sweet spot for a $31/hour salary. |

| Senior-Level | 5-10 Years | $38 - $55/hour | $79,000 - $115,000 | Titles: Senior Analyst, Senior Specialist, Team Lead. Responsibilities: Leading complex projects, strategy development, stakeholder management, formal mentoring. |

| Lead/Manager | 10+ Years | $55 - $80+/hour | $115,000 - $165,000+ | Titles: Manager, Director, Principal. Responsibilities: Departmental leadership, budget ownership, people management, long-term strategic planning. |

As this table clearly shows, the $31/hour mark is a critical stepping stone. It signifies you have successfully navigated the entry-level phase of your career and are now a fully contributing, independent professional.

### Beyond the Paycheck: The Total Compensation Package

An expert career analysis goes beyond the hourly wage. The true value of a job offer is its total compensation package. A company offering $31/hour with a stellar benefits package can be far more lucrative than a company offering $33/hour with poor benefits. When evaluating an offer, consider these components:

- Base Salary: This is your $64,480 annual income. It's the guaranteed foundation of your compensation.

- Performance Bonuses: Many professional roles are eligible for annual bonuses based on individual and company performance. These can range from 3% to 15% of your base salary, potentially adding an extra $1,900 - $9,600 to your annual earnings.

- Profit Sharing: Some companies, particularly private or employee-owned firms, distribute a portion of their profits to employees. This can be a significant, though often variable, addition to your income.

- 401(k) or 403(b) Retirement Plans: This is a critical wealth-building tool. A common employer match is 50% of your contribution up to 6% of your salary, or a dollar-for-dollar match up to 3-5%. On a $64,480 salary, a 4% match is an extra $2,579 in "free money" per year toward your retirement.

- Health Insurance: The value of employer-sponsored health, dental, and vision insurance cannot be overstated. A good PPO plan for an individual can have a premium cost of over $8,000 per year. If your employer covers 80% of that, they are contributing an additional $6,400 in non-taxed benefits.

- Paid Time Off (PTO): Consider the number of vacation days, sick days, and paid holidays. A generous PTO policy (e.g., 20 days + 10 holidays) is worth thousands of dollars in paid leave.

- Other Perks: Don't discount other benefits like tuition reimbursement, professional development stipends, wellness programs, life insurance, and disability insurance. A $2,000 annual stipend for certifications or courses is a direct investment in your future earning potential.

When you add it all up, a role with a $31/hour base salary can easily have a total compensation value of $75,000 to $85,000 or more.

The 6 Key Factors That Influence Your Salary

Earning $31 an hour is not a static state. It's a point on a spectrum, and numerous factors can push you toward the lower or higher end of that spectrum—or help you leap to the next tier entirely. As a career analyst, I've seen professionals with identical job titles have a $30,000 salary variance based on these critical differentiators. Mastering them is the key to maximizing your income.

### 1. Level of Education and Certifications

Your educational foundation sets the floor for your earning potential. While experience eventually becomes the dominant factor, education opens the first doors and can provide a permanent salary edge.

- Associate's vs. Bachelor's Degree: For most professional roles paying in this range (e.g., marketing, finance, HR), a Bachelor's degree is the standard requirement. While some technical roles (like IT Support or Web Developer) may be accessible with an Associate's degree and significant certifications, a Bachelor's degree in a relevant field (e.g., Business Administration, Finance, Communications, Computer Science) provides a much clearer path. According to the BLS, in 2022, median weekly earnings for those with a Bachelor's degree were $1,432, compared to $963 for those with an Associate's degree—a massive 49% premium.

- The Impact of a Master's Degree: Pursuing a Master's degree (e.g., an MBA, Master's in HR Management, Master's in Marketing Analytics) can be a powerful accelerator. It often allows you to command a higher starting salary and qualifies you for leadership-track roles sooner. The BLS reports median weekly earnings for Master's degree holders at $1,661, about 16% higher than Bachelor's degree holders. For a $64,480 salary, this premium could translate to an extra $10,000+ per year.

- High-Value Certifications: In the modern job market, targeted certifications can be just as impactful as a degree, especially for demonstrating specific, in-demand skills. They prove your expertise in a niche area and can directly lead to higher pay.

- For HR: A SHRM-CP (Society for Human Resource Management Certified Professional) or PHR (Professional in Human Resources) certification is the gold standard. Payscale data consistently shows that HR professionals with these certs earn thousands more annually than their non-certified peers.

- For Marketing: Certifications like Google Ads Search Certification, Google Analytics IQ, HubSpot Inbound Marketing, or Salesforce Certified Marketing Cloud Administrator are highly sought after. A Digital Marketing Specialist with advanced analytics and automation certs will earn significantly more than a generalist.

- For IT/Tech: A CompTIA Security+, Cisco Certified Network Associate (CCNA), or AWS Certified Cloud Practitioner can elevate an IT Support Specialist into a higher-paying Network or Cloud Engineer role.

- For Project Management: The Certified Associate in Project Management (CAPM) or the more advanced Project Management Professional (PMP) from the Project Management Institute (PMI) are universally recognized and can add a 10-20% salary premium.

### 2. Years of Relevant Experience

Experience is the most powerful driver of salary growth over time. It's a proxy for your ability to solve complex problems, navigate corporate politics, and deliver results with less supervision.

- 0-2 Years (The Foundation): At this stage, you're learning the ropes. Your salary is likely in the $22-$28/hour range. Your focus should be on absorbing as much as possible, mastering core tools, and building a track record of reliability.

- 2-5 Years (The Sweet Spot for $31/hour): This is where you transition from a "doer" to a "thinker-doer." You've seen enough to anticipate problems, suggest process improvements, and manage small projects from start to finish. You have proven your value, and this is the point where your salary should cross the $30-$32/hour threshold. This is also the prime time to make a strategic job move, as companies are often willing to pay a premium for "plug-and-play" talent with a few years of proven experience.

- 5-10 Years (Senior & Lead Level): With this level of experience, you should be aiming well beyond $31/hour. You are now a subject matter expert. Your value lies in strategic thinking, mentoring others, and leading complex, high-impact initiatives. Salaries here often push into the $85,000 - $115,000+ range ($40-$55/hour). If you have over five years of experience and are still at $31/hour, you are likely underpaid unless you are in a very low-cost-of-living area or a non-profit role.

### 3. Geographic Location

Where you live is arguably one of the most significant factors influencing your salary. A $65,000 salary can feel like a fortune in one city and be barely enough to get by in another. Companies adjust their pay scales based on the local cost of living and the competitiveness of the local talent market.

Here’s a comparative look at how the same job title's salary can vary, based on data from salary aggregators like Salary.com and NerdWallet's cost-of-living calculator:

| Metro Area | Example Median Salary (HR Generalist) | Cost of Living vs. National Average | What $65k Feels Like (Purchasing Power) |

| :--- | :--- | :--- | :--- |

| San Francisco, CA | ~$92,000 | +91% | ~$34,000 |

| New York, NY | ~$85,000 | +68% | ~$38,700 |

| Boston, MA | ~$81,000 | +51% | ~$43,000 |

| Chicago, IL | ~$73,000 | +12% | ~$58,000 |

| Atlanta, GA | ~$69,000 | +1% | ~$64,350 |

| Dallas, TX | ~$68,000 | -1% | ~$65,650 |

| Kansas City, MO | ~$65,000 | -10% | ~$72,200 |

| Cleveland, OH | ~$63,000 | -15% | ~$76,500 |

Key Takeaway: Someone earning $31/hour ($65k) in Kansas City has the same purchasing power as someone earning over $92,000 in San Francisco. The rise of remote work has complicated this, but many companies are now implementing location-based pay tiers even for remote employees. If you have the flexibility to move, relocating to a "Tier 2" city with a strong job market but a lower cost of living (like Atlanta, Dallas, or Charlotte) can be one of the fastest ways to increase your disposable income.

### 4. Company Type, Size, and Industry

The type of organization you work for has a profound impact on your compensation structure.

- Startups: Early-stage startups may offer a lower base salary (e.g., $28/hour instead of $31/hour) but compensate with potentially lucrative stock options. The culture is often fast-paced with broad responsibilities, offering rapid skill development.

- Large Corporations (Fortune 500): These companies typically offer the highest base salaries and most structured compensation packages. They have defined pay bands, regular performance reviews, and excellent benefits (strong 401k match, premium health insurance). A large tech or finance company is the most likely place to exceed the $31/hour benchmark for a given role.

- Small to Medium-Sized Businesses (SMBs): Compensation here can be highly variable. Pay is often more negotiable but may lack the robust benefits of a large corporation. However, you may have more direct impact and visibility with leadership.

- Government (Federal, State, Local): Government jobs are known for stability, excellent benefits (pensions, generous leave), and work-life balance. The base salary might be slightly lower than in the private sector for a comparable role, but the total compensation value, when benefits are factored in, is often very competitive. Pay is rigidly defined by scales like the GS (General Schedule) system.

- Non-Profits: Mission-driven organizations typically pay less than their for-profit counterparts. A $31/hour wage would likely be for a more experienced professional or manager in this sector. The reward is often intrinsic—working for a cause you believe in.

Industry Matters: An HR specialist working at a high-margin tech company or investment bank will almost always earn more than an HR specialist with the same experience working in retail or hospitality.

### 5. Area of Specialization

Generalists get paid, but specialists get paid *more*. As you progress in your career, developing a deep expertise in a high-demand niche is the fast track to a higher salary.

Let's use our Marketing example:

- Marketing Generalist: ~$65,000/year ($31/hour). Handles a bit of everything: social media, email, content.

- SEO Specialist: ~$75,000/year. A technical expert in search engine optimization. Companies pay a