The automotive industry offers a variety of dynamic and high-stakes careers, and few are as potentially lucrative as that of a Car Dealership Financial Manager. Often known as an F&I (Finance & Insurance) Manager, this role is the critical link between the customer, the sales team, and the lender. It's a position that rewards sharp financial acumen, sales prowess, and meticulous attention to detail with significant earning potential.

For those considering this career path, a key question is: What can you realistically expect to earn? While salaries are heavily influenced by performance, data shows that a successful F&I Manager can command a six-figure income. This article will break down the salary expectations, the factors that drive earnings, and the overall career outlook for this demanding but rewarding profession.

What Does a Car Dealership Financial Manager Do?

Before diving into the numbers, it's essential to understand the role. A Car Dealership Financial Manager is much more than a number cruncher. They are a master of finance, a skilled salesperson, and a compliance officer rolled into one. Their primary responsibilities include:

- Securing Customer Financing: Working with a network of banks and lenders to find and secure the best possible loan or lease terms for a customer.

- Selling Aftermarket Products: Offering and selling value-added products like extended warranties, GAP (Guaranteed Asset Protection) insurance, tire and wheel protection, and vehicle maintenance plans. This is a major source of profit for the dealership and a key component of the manager's commission.

- Ensuring Legal Compliance: Handling all contracts and legal paperwork related to the vehicle sale, ensuring that all state and federal regulations are strictly followed.

- Managing Customer Relationships: Clearly explaining complex financial terms, contracts, and product benefits to customers to ensure a transparent and positive experience.

Average Car Dealership Financial Manager Salary

The compensation for a car dealership financial manager is unique because it is heavily weighted toward commission and performance bonuses rather than just a flat salary. This structure means that high-performers can significantly out-earn the national average.

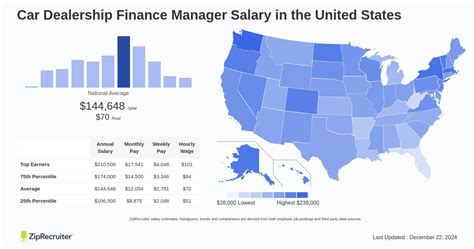

According to data from leading salary aggregators, the national average salary for an Automotive Finance Manager is substantial:

- Salary.com reports that the median salary for an Automotive Finance and Insurance Manager in the United States is $144,302 as of late 2023. The typical salary range falls between $124,196 and $166,610.

- Glassdoor states the likely total pay for a Finance Manager at a car dealership is around $141,835 per year, which includes an average base salary of $69,471 and approximately $72,364 in additional pay (commissions, bonuses, etc.).

- Payscale notes an average salary of $72,580, but with bonuses and commissions, the total pay can range from $45,000 to over $176,000.

The key takeaway is the concept of total compensation. While the base salary may appear modest, the commission earned on financing contracts and aftermarket product sales constitutes the bulk of an F&I manager's income, pushing top earners well into the high six-figures.

Key Factors That Influence Salary

Your earning potential is not static. Several key factors can dramatically impact how much you take home each year.

###

Level of Education

While a bachelor's degree in finance, business, or accounting can provide a strong theoretical foundation and may be preferred by larger, corporate dealer groups, it is not always a strict requirement. In the automotive world, proven experience and a track record of success often outweigh formal education. Many successful F&I managers begin their careers on the sales floor and are promoted based on their performance and understanding of the business. However, having a degree can certainly give you a competitive edge when first entering the field.

###

Years of Experience

Experience is arguably the most significant factor in determining an F&I manager's salary. As you build your skills and reputation, your income potential grows.

- Entry-Level (0-2 years): Professionals in this stage are often transitioning from a sales role. They are learning the intricacies of compliance, building relationships with lenders, and honing their product presentation skills. Their income will be more heavily reliant on a smaller base salary as they build their commission pipeline.

- Mid-Career (3-8 years): With a solid track record, these managers have mastered the sales process, developed strong lender connections, and can efficiently handle a high volume of contracts. Their total compensation sees a significant increase during this phase.

- Senior/Experienced (8+ years): Top-tier F&I managers are elite performers who consistently exceed sales targets. They may oversee an entire finance department or work at a high-volume luxury dealership. These professionals command the highest salaries in the field, often exceeding $200,000 or more annually.

###

Geographic Location

Where you work matters. Dealerships in major metropolitan areas with a higher cost of living and greater sales volume typically offer higher compensation. For example, an F&I manager in Los Angeles or New York City will likely earn more than one in a small, rural town. According to Salary.com, an F&I manager in San Francisco, CA, can expect to earn a median salary that is roughly 25% higher than the national average.

###

Company Type

The type and size of the dealership play a massive role in your earning potential.

- High-Volume vs. Low-Volume: A dealership that sells 500 cars a month presents far more opportunities for commission than one that sells 50.

- Luxury vs. Economy Brands: Working for luxury brands like BMW, Mercedes-Benz, or Lexus can lead to higher earnings. The higher transaction prices of the vehicles can result in larger financing amounts and more valuable aftermarket products, boosting commission totals.

- Large Dealer Groups vs. Single-Owner Stores: Large, publicly-traded dealer groups (e.g., AutoNation, Penske Automotive Group) may offer more structured pay plans, robust benefits, and clear paths for advancement. A single-owner store might offer more flexibility in its pay structure.

###

Area of Specialization

While F&I is a specialty in itself, further expertise can increase your value. A manager who is an expert in subprime lending (helping customers with poor credit) can be invaluable to a dealership looking to serve that market segment. Similarly, those who are consistently the top performers in selling high-margin products like extended warranties are the most sought-after and highest-paid professionals in the finance office.

Job Outlook

The career outlook for financial professionals remains strong. The U.S. Bureau of Labor Statistics (BLS) projects that employment for the broader category of Financial Managers will grow by 16% from 2022 to 2032, which is much faster than the average for all occupations.

While this category is broader than just automotive F&I managers, it signals a healthy demand for skilled financial professionals. As long as consumers continue to buy vehicles and require financing, the need for talented F&I managers will persist. The role will continue to evolve with technology, but its core function as a profit center and compliance checkpoint for the dealership remains secure.

Conclusion

A career as a car dealership financial manager is not for the faint of heart. It requires resilience, a competitive spirit, and the ability to perform under pressure. However, for those who possess the right blend of financial skills and salesmanship, the rewards are exceptional.

Key Takeaways:

- High Earning Potential: This is a performance-driven role with a clear path to a six-figure income.

- Commission is King: Your total compensation is heavily tied to your ability to secure financing and sell aftermarket products.

- Experience Pays: Your value and income grow significantly as you build a proven track record of success.

- Location and Dealership Matter: Working at a high-volume, luxury dealership in a major metro area typically provides the greatest earning potential.

If you are a driven individual with a passion for both finance and sales, the role of a car dealership financial manager offers a challenging and financially rewarding career journey.