Introduction

Earning $41 an hour is a significant professional milestone. It's a testament to your skills, dedication, and the value you bring to an organization. But what does that number truly represent when you zoom out to view the landscape of your entire career? How does it translate into an annual salary, and more importantly, what kind of life and professional trajectory can it support? This guide is designed to answer those questions and more. We will not only do the simple math but also embark on a deep dive into the world of careers that command this level of compensation.

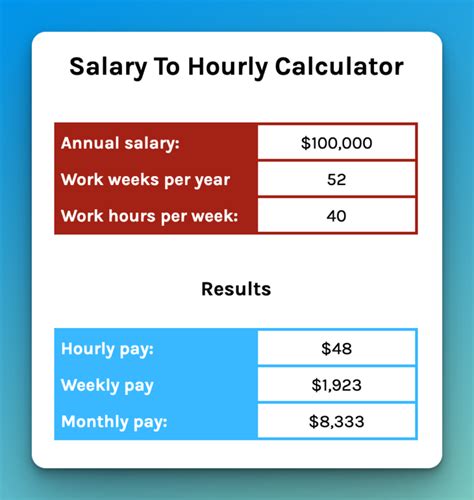

A $41 hourly wage translates to an annual salary of $85,280, assuming a standard 40-hour workweek for 52 weeks a year. This figure places you comfortably above the national median household income, opening doors to greater financial security, personal growth, and professional advancement. It signifies a transition from simply having a job to building a robust, high-impact career. The professions that fall into this bracket are typically in high-demand sectors like technology, healthcare, finance, and specialized business roles—fields that are not just surviving but thriving in our modern economy.

I recall a client I once advised, a talented graphic designer who had spent years working on an hourly, freelance basis. When she was offered her first full-time salaried role at a rate equivalent to her peak hourly earnings, her biggest challenge wasn't negotiating the pay but shifting her mindset. She had to move from thinking in billable hours to thinking about long-term value, career progression, and strategic impact. This guide aims to facilitate that same mental shift for you, providing a comprehensive roadmap from an hourly rate to a fulfilling salaried career.

This article will serve as your ultimate resource, exploring the roles, responsibilities, salary dynamics, and long-term outlook for professionals in this earnings bracket. We will leverage authoritative data from sources like the U.S. Bureau of Labor Statistics (BLS) and leading salary aggregators to ensure you have the most accurate and actionable information at your fingertips.

### Table of Contents

- [What Does a $41/Hour Professional Do?](#what-does-a-41hour-professional-do)

- [Average $41 Hourly to Salary: A Deep Dive](#average-41-hourly-to-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in a High-Earning Career](#how-to-get-started-in-a-high-earning-career)

- [Conclusion: Your Path Forward](#conclusion-your-path-forward)

---

What Does a $41/Hour Professional Do?

While no single job title is "the $41/hour professional," this pay rate is characteristic of mid-career roles that demand a blend of specialized knowledge, critical thinking, and a significant degree of autonomy. These are not entry-level positions; they are roles entrusted with meaningful responsibilities that directly impact a company's success. Professionals earning this wage are typically past the initial learning curve of their careers and are now applying their expertise to solve complex problems, manage projects, and often, guide junior team members.

The common thread across these diverse professions is value creation. Whether you're writing code, managing patient care, analyzing financial data, or developing a marketing campaign, your work has a clear and measurable positive effect on your organization's goals. You are no longer just executing tasks assigned by others; you are increasingly involved in the *why* behind the work, contributing to strategy and improving processes.

Let's explore some prime examples of careers where earning $41 an hour ($85,280/year) is a common benchmark for experienced professionals:

- Software Developer: These tech professionals design, develop, and maintain software applications. At this pay grade, a developer is likely a mid-level engineer, capable of taking ownership of significant features, writing clean and efficient code, and collaborating effectively within an agile team.

- Registered Nurse (RN) with Specialization: While a new graduate RN might start at a lower rate, an RN with a few years of experience and a specialization in a high-demand area like the Intensive Care Unit (ICU), operating room, or oncology can easily command this wage. Their role involves complex patient assessment, administering advanced treatments, and making critical decisions under pressure.

- Financial Analyst: A financial analyst with 3-5 years of experience is a core part of a corporate finance team. They are responsible for financial modeling, budgeting, forecasting, and analyzing business performance to provide insights that guide executive decision-making.

- Senior Marketing Manager: This professional moves beyond executing daily marketing tasks and is responsible for developing and overseeing comprehensive marketing strategies. They manage budgets, analyze campaign performance using sophisticated analytics, and often lead a small team or manage key vendor relationships.

### A Day in the Life: "Alex, the Mid-Career Professional"

To make this more tangible, let's imagine a composite character named Alex, who represents a professional earning around $41/hour.

8:30 AM: Alex starts the day by reviewing overnight performance metrics. If Alex is a Software Developer, this might be checking error logs and application performance dashboards. If a Marketing Manager, it's reviewing ad campaign CPR (Cost Per Result) and website traffic. For a Financial Analyst, it's scanning market news and overnight trading reports.

9:00 AM: Team stand-up meeting. Alex provides a concise update on their projects, identifies any blockers, and coordinates with colleagues. This is a collaborative, problem-solving session, not a simple reporting-out.

9:30 AM - 12:00 PM: Deep work session. This is the core of Alex's value creation. The Software Developer writes code for a new user-facing feature. The RN does rounds, assesses critically ill patients, and collaborates with doctors on care plans. The Financial Analyst builds a new financial model to evaluate a potential acquisition. The Marketing Manager writes the strategic brief for a new product launch.

12:00 PM - 1:00 PM: Lunch break.

1:00 PM - 2:30 PM: Project/Stakeholder Meeting. Alex presents their findings or progress to a wider group. The Financial Analyst might present a budget variance report to department heads. The Software Developer could demo a new feature to the product manager. The Marketing Manager might pitch a new campaign concept to the Director of Marketing. This requires strong communication and persuasion skills.

2:30 PM - 4:30 PM: Mentoring and collaboration. Alex spends time assisting a junior team member who is struggling with a technical problem or reviewing their work. This could also involve peer-reviewing a colleague's code or providing feedback on a coworker's presentation.

4:30 PM - 5:00 PM: Planning and wrap-up. Alex updates their project management tools (like Jira or Asana), responds to final emails, and plans their priorities for the next day. This ensures a smooth start and continuous progress on long-term goals.

This "day in the life" illustrates that a $41/hour role is dynamic, demanding a mix of technical expertise, collaborative soft skills, and strategic thinking.

---

Average $41 Hourly to Salary: A Deep Dive

As established, the direct conversion of a $41 hourly wage is $85,280 per year. However, this figure represents the *gross annual salary* based on a 40-hour workweek. In the world of salaried professionals, this number is just the starting point of a more complex and potentially more lucrative total compensation package.

The $85,280 mark is a significant salary level in the United States. To put it in perspective, the U.S. Bureau of Labor Statistics (BLS) reported that the median annual wage for all workers was $48,060 in May 2023. Earning nearly double the national median places you in a strong economic position.

Let's break down the salary landscape for professions that commonly feature this pay rate, analyzing how compensation evolves with experience.

### Salary Progression by Experience Level

The journey to an $85k+ salary is a progression. Very few professionals start their careers at this level. It is typically achieved after accumulating several years of valuable experience and demonstrating consistent high performance.

| Career Stage | Typical Salary Range (National Average) | Key Characteristics & Responsibilities | Representative Roles at this Stage |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 Years) | $60,000 - $75,000 | Focus on learning core skills, executing well-defined tasks, and supporting the team. Requires direct supervision. | Junior Developer, Staff Nurse (RN), Junior Financial Analyst, Marketing Coordinator |

| Mid-Career (3-8 Years) | $75,000 - $110,000 | This is the sweet spot where the $41/hour ($85,280) rate typically falls. Professionals have developed autonomy, manage their own projects, contribute to strategy, and may begin mentoring others. | Software Engineer, Specialized RN, Financial Analyst / Senior Analyst, Marketing Manager |

| Senior-Level (8-15+ Years)| $110,000 - $150,000+ | Leads complex, high-impact projects or teams. Sets strategic direction, responsible for major business outcomes, and mentors multiple team members. | Senior/Lead Software Engineer, Nurse Manager, Finance Manager, Senior Marketing Manager |

| Principal/Leadership | $150,000 - $250,000+ | Defines the technical or business strategy for an entire department or function. Manages managers, controls large budgets, and reports to executive leadership. | Principal Engineer, Director of Nursing, Director of Finance, Director of Marketing |

*Source: Salary data is a synthesized average based on figures from Payscale, Glassdoor, and Salary.com, cross-referenced with BLS Occupational Outlook Handbook data for relevant professions, updated for late 2023/early 2024 trends.*

### Beyond the Base Salary: Understanding Total Compensation

For salaried professionals, especially in the corporate world, the base salary is only one part of the financial picture. Understanding the complete compensation package is crucial when evaluating a job offer.

- Base Salary: This is your guaranteed annual pay, the $85,280 we've been discussing. It's the most stable component of your income.

- Performance Bonus: This is a variable cash payment tied to your individual performance, your team's performance, and/or the company's profitability. For a professional at the $85k level, an annual bonus can range from 5% to 15% of their base salary ($4,200 - $12,700). This is common in fields like finance, sales, and management. According to Salary.com, a Financial Analyst II can expect a bonus representing about 6% of their salary on average.

- Profit Sharing: Some companies distribute a portion of their profits to employees. This is typically paid out annually and can be a significant addition to your income, though it's dependent on the company having a profitable year.

- Stock Options & Restricted Stock Units (RSUs): Particularly prevalent in the tech industry and publicly traded companies, equity compensation gives you a stake in the company's success.

- RSUs: You are granted shares of company stock that vest over a period (typically 3-4 years). Once vested, they are yours to keep or sell.

- Stock Options: You are given the right to buy company stock at a predetermined price (the "strike price") in the future. If the stock's market value rises above your strike price, you can buy it cheap and sell it for a profit.

- Equity can dramatically increase total compensation. A software engineer at a large tech company might have a base salary of $110,000 but receive an additional $40,000 in RSUs per year, bringing their total compensation to $150,000.

- Retirement Savings Plans (401k/403b): This is a critical component of long-term wealth building. Most employers offer a matching contribution. A common match is 50% of your contribution up to 6% of your salary. On an $85,280 salary, if you contribute 6% ($5,117), your employer would add an additional $2,558, which is essentially "free money" and a 3% raise.

- Health and Wellness Benefits: The value of a comprehensive benefits package cannot be overstated. This includes medical, dental, and vision insurance. A good employer-sponsored family health plan can be worth over $15,000 per year, a value that doesn't show up in your paycheck but significantly impacts your disposable income. Other wellness benefits may include gym memberships, mental health support (EAPs), and flexible spending accounts (FSAs).

- Paid Time Off (PTO): Salaried roles typically come with a package of vacation days, sick leave, and paid holidays. A standard package might include 15 vacation days, 5 sick days, and 10 public holidays, totaling 30 paid days off per year. This is a significant quality-of-life benefit compared to many hourly roles where time off is unpaid.

When you sum these components, a job with an $85,280 base salary can easily have a total compensation value well over $100,000 per year. This is a crucial distinction when comparing an hourly role to a salaried one.

---

Key Factors That Influence Your Salary

Reaching and exceeding the $41/hour benchmark is not a matter of chance. It's the result of a strategic interplay of several key factors. Understanding these levers is the most powerful tool you have for actively managing your career and maximizing your earning potential. This section, the most detailed in our guide, will break down each of these critical elements.

###

Level of Education

Your educational foundation is often the entry ticket to professional careers. While a high school diploma can lead to high-paying skilled trade jobs, the professions typically in the $85k+ bracket almost always require a post-secondary degree.

- Bachelor's Degree (B.S./B.A.): This is the standard requirement for roles like Software Developer, Financial Analyst, and Marketing Manager. The specific field of study is crucial. A Bachelor of Science in Computer Science, Finance, or a related STEM field provides a direct and efficient path to a high-paying career. For example, the BLS notes that a bachelor's degree is the typical entry-level education for Software Developers.

- Master's Degree (M.S./MBA): An advanced degree can act as a significant salary accelerator and a pathway to leadership.

- Specialized Master's: A Master of Science in Data Science, Cybersecurity, or Finance can make you a more competitive candidate for specialized, high-paying roles right out of graduate school.

- Master of Business Administration (MBA): An MBA, particularly from a top-tier program, is a well-established route to higher management and a substantial salary increase. Professionals often pursue an MBA mid-career to pivot into leadership or a more lucrative industry like consulting or investment banking. A professional with an MBA can expect a salary premium of 30-50% or more compared to their pre-MBA earnings.

- Professional Degrees and Certifications: In many fields, certifications hold as much, if not more, weight than a graduate degree for salary negotiation.

- Healthcare: For a Registered Nurse, earning certifications like the CCRN (Critical Care Registered Nurse) or PCCN (Progressive Care Certified Nurse) can lead to a "certification differential" bonus and open doors to higher-paying specialized units. Advancing to a Nurse Practitioner (NP) or Physician Assistant (PA) requires a Master's degree and can push salaries well into the six-figure range. The median pay for PAs was $126,010 per year in 2022, according to the BLS.

- Finance: The Chartered Financial Analyst (CFA) designation is the gold standard for investment management professionals and can significantly boost earning potential. The Project Management Professional (PMP) is highly valued across industries for those managing complex projects.

- Technology: Cloud certifications like AWS Certified Solutions Architect or Microsoft Certified: Azure Administrator are in extremely high demand and can add thousands to a developer's or IT professional's salary.

###

Years of Experience

Experience is arguably the single most significant factor in salary growth. It's a proxy for your ability to solve complex problems, navigate corporate structures, and deliver results with less supervision.

- 0-2 Years (The Foundation): In this phase, your primary goal is to learn. Your salary ($60k-$75k) reflects that you are still an investment for the company. You're building your technical skills, learning the industry, and proving your reliability.

- 3-5 Years (The Takeoff): This is where you transition from a net learner to a net contributor. You've seen multiple project cycles, can anticipate problems, and can work independently. Your salary breaks into the $75k-$95k range, firmly encompassing the $41/hour mark. This is when you've earned trust and are given ownership of important work.

- 6-10 Years (The Senior/Lead): You are now a subject matter expert. You not only solve the hardest technical problems but also elevate the entire team through mentorship and strategic guidance. Your salary reflects this leadership and impact, moving into the $100k-$140k range. You may take on a formal team lead role or be a "principal" individual contributor valued for your deep expertise.

- 10+ Years (The Strategist/Director): With over a decade of experience, you are likely operating at a strategic level. You're not just deciding *how* to do the work, but *what* work should be done to advance the business. This often involves managing teams, controlling budgets, and influencing executive decisions. Salaries at this level can vary widely but are typically $150k and up, with leadership roles in high-demand fields reaching well over $200k.

###

Geographic Location

Where you live and work has a massive impact on your salary. A high salary in a low-cost-of-living (LCOL) area can provide a much better quality of life than an even higher salary in a high-cost-of-living (HCOL) area. The rise of remote work has complicated this, but geography remains a top factor.

Let's compare the median salary for a Software Developer with 5 years of experience across different U.S. cities, using data synthesized from Glassdoor and Payscale:

| City | Median Salary | Cost of Living Index (100 = National Avg) | Adjusted Buying Power (Illustrative) |

| :--- | :--- | :--- | :--- |

| San Francisco, CA | ~$165,000 | 194.8 | High Salary, Very High Cost |

| New York, NY | ~$145,000 | 168.6 | High Salary, High Cost |

| Seattle, WA | ~$140,000 | 149.7 | High Salary, High Cost |

| Austin, TX | ~$115,000 | 101.5 | Good Salary, Average Cost |

| Raleigh, NC | ~$110,000 | 95.8 | Good Salary, Low Cost |

| Kansas City, MO | ~$98,000 | 86.8 | Lower Salary, Very Low Cost |

*Note: Cost of living data from Payscale's Cost of Living Calculator.*

This table demonstrates the trade-off. While the salary in San Francisco is highest, the extreme cost of living may negate the financial advantage compared to a city like Raleigh, where a strong tech salary is paired with a much lower cost of living. For job seekers, this means a $98,000 offer in Kansas City might provide more disposable income than a $115,000 offer in Austin. With remote work, some companies are adjusting salaries based on location ("geo-arbitrage"), while others are offering a single national rate, creating huge opportunities for those in LCOL areas.

###

Company Type & Size

The type of organization you work for creates vastly different compensation structures and work environments.

- Large Tech Corporations (FAANG - Facebook/Meta, Apple, Amazon, Netflix, Google): These companies pay at the top of the market. A mid-level engineer who might make $110k at a non-tech company could make a $140k base salary plus $60k in RSUs at a FAANG company, for a total compensation of $200k. The trade-off can be high pressure, intense competition, and a vast, bureaucratic environment.

- Established Non-Tech Corporations: A Fortune 500 company in manufacturing, retail, or healthcare will offer competitive salaries, excellent benefits, and strong job stability. A financial analyst at Ford or a marketing manager at Procter & Gamble can expect a salary around our $85k benchmark with a solid bonus and a great 401k match. The pace may be slower, and they may not offer the explosive equity potential of tech.

- Startups: Compensation at startups is a high-risk, high-reward proposition.

- Early-Stage (Seed/Series A): Base salaries will be below market rate (e.g., $70k instead of $90k). The trade-off is a significant grant of stock options. If the company succeeds and goes public or is acquired, these options could be worth a life-changing amount of money. If it fails, they are worthless.

- Late-Stage (Pre-IPO): As startups mature, their base salaries become more competitive with the market, and they often offer a mix of options and more liquid RSUs.

- Government & Non-Profit: These sectors typically offer lower base salaries than the private sector. A government IT specialist might earn $75k in a role that would pay $95k in the corporate world. However, they compensate with exceptional job security, excellent government-funded pensions, and a strong work-life balance. The mission