Earning $60 an hour is a significant professional milestone, placing you firmly in the six-figure salary club and opening the door to a wide range of rewarding and high-impact careers. But what does that hourly rate actually translate to annually? And what kind of professions command this level of compensation?

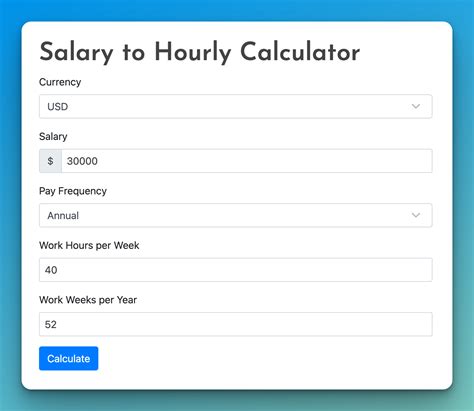

Simply put, a $60 hourly rate equates to $124,800 per year before taxes, assuming a standard 40-hour workweek and 52 weeks of work. This level of income is characteristic of experienced professionals in demanding, high-skill fields like technology, healthcare, and finance. This guide will break down the numbers, explore the types of jobs that pay in this range, and detail the key factors that can influence your earning potential.

What Does a $60/Hour Professional Do?

While "$60 an hour" is not a specific job title, it's a compensation benchmark for roles that require a blend of advanced education, specialized skills, and significant professional experience. These positions often involve complex problem-solving, strategic decision-making, and leadership.

Here are a few examples of professions where earning $60 an hour (or a ~$125,000 salary) is common:

- Software Developer/Engineer: These tech professionals design, develop, and maintain software applications and systems. They write code, fix bugs, and collaborate with teams to build the digital tools that power our world. A mid-level to senior software engineer, especially in a high-demand area, can easily command this rate.

- Physician Assistant (PA): Working under the supervision of a physician, PAs are licensed clinicians who examine, diagnose, and treat patients. Their work is critical to the healthcare system, and their advanced medical training justifies a high level of compensation. According to the U.S. Bureau of Labor Statistics (BLS), the median pay for PAs in 2023 was $130,490 per year, or $62.74 per hour.

- Financial Manager: Tasked with the financial health of an organization, financial managers oversee investment activities, produce financial reports, and develop long-term financial goals. Their strategic guidance is vital to a company's stability and growth. The BLS reports a 2023 median pay for Financial Managers of $139,790 per year.

Average Salary for a $60/Hour Role

The direct calculation for a $60 hourly rate is $124,800 per year ($60/hour x 40 hours/week x 52 weeks/year). However, this is just a baseline. In reality, total compensation for professionals at this level can vary significantly.

A typical salary range for roles that pay around $60 per hour can span from $95,000 to over $170,000 annually.

- Entry-Level (for high-skill fields): Professionals just starting in these demanding fields, or those in lower-cost-of-living areas, might begin in the $85,000 to $110,000 range.

- Mid-Career/Median: The $125,000 figure represents a strong median for an experienced professional with a proven track record.

- Senior/Lead Positions: With extensive experience, leadership responsibilities, and specialized expertise, top earners in these fields can push their salaries well above $170,000, often supplemented by significant bonuses and stock options.

Key Factors That Influence Salary

Reaching and exceeding the $60/hour mark is not just about your job title; it's about a combination of powerful factors that determine your market value.

### Level of Education

Education is a foundational element for high-earning potential. While a bachelor's degree is the standard entry point for many professional roles, an advanced degree is often a prerequisite for top-tier salaries.

- Bachelor's Degree: Essential for roles like Software Engineer or Financial Analyst.

- Master's Degree or Higher: Fields like healthcare and advanced tech often require or highly reward a master's degree. For example, Physician Assistants must complete a master's program. In tech, a Master's in Data Science or Artificial Intelligence can unlock higher-paying, more specialized roles.

### Years of Experience

Experience is arguably the most critical driver of salary growth. Companies pay a premium for professionals who can solve problems efficiently, mentor junior colleagues, and lead complex projects without supervision.

- 0-2 Years (Entry-Level): Focus is on learning and applying foundational skills.

- 3-7 Years (Mid-Level): Professionals demonstrate autonomy and a deeper understanding of their field, often seeing the most significant salary jumps. It's at this stage that many reach the $125,000 benchmark.

- 8+ Years (Senior/Principal): These veterans lead teams, set strategy, and tackle the most complex challenges. According to Payscale, a professional with over 10 years of experience can expect to earn substantially more than their mid-level counterparts.

### Geographic Location

Where you work has a massive impact on your paycheck. Salaries are adjusted to reflect the local cost of living and the demand for talent in that specific market.

- High Cost of Living (HCOL) Hubs: Major metropolitan areas like San Francisco, New York City, San Jose, and Boston offer the highest salaries to compensate for steep living expenses. A software engineer earning $150,000 in San Francisco might earn $115,000 for the exact same role in a city like Austin, TX.

- Lower Cost of Living (LCOL) Areas: While the base salary may be lower in cities across the Midwest or South, your purchasing power might be equivalent or even greater.

- Remote Work: The rise of remote work has complicated this factor, but many companies still use location-based pay bands, adjusting salaries based on the employee's home address.

### Company Type

The type of company you work for directly influences your compensation package.

- Large Tech Companies (FAANG, etc.): Giants like Google, Meta, and Apple are known for paying top-of-market base salaries, plus generous bonuses and stock options (RSUs), often pushing total compensation well past the $200,000 mark for experienced engineers.

- Startups: A well-funded startup may offer a competitive salary but often uses equity (stock options) as a major incentive, which carries higher risk and potential for a massive reward.

- Established Corporations (Non-Tech): Companies in finance, healthcare, or manufacturing offer stable, competitive salaries and strong benefits but may have less explosive growth potential than tech.

- Government/Public Sector: While base salaries may lag behind the private sector, government jobs offer unparalleled job security, excellent benefits, and pension plans.

### Area of Specialization

Within any given profession, specialized, high-demand niches command a salary premium.

- In Technology: A generalist Web Developer may earn less than a specialist in high-demand fields like Cybersecurity, Artificial Intelligence/Machine Learning (AI/ML), or Cloud Architecture (AWS, Azure).

- In Healthcare: A Physician Assistant specializing in a high-stakes field like dermatology or cardiothoracic surgery will typically earn more than one in family medicine.

- In Finance: An investment banker or a specialist in quantitative finance will earn significantly more than a corporate financial analyst.

Job Outlook

The long-term career outlook for professions that pay around $60 per hour is exceptionally strong. These roles are central to economic growth and innovation, and the demand for skilled talent is projected to increase significantly.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook (2022-2032 projections):

- Software Developers: Employment is projected to grow 25%, which is much faster than the average for all occupations.

- Physician Assistants: Employment is projected to grow 27%, a reflection of the growing demand for healthcare services.

- Financial Managers: Employment is projected to grow 16%, also much faster than the average, as the need for sound financial management remains critical across all industries.

This robust growth indicates that investing in the skills and education required to reach this income level provides excellent job security and ample opportunities for future advancement.

Conclusion

Converting a $60 hourly rate to an annual salary reveals an impressive income of approximately $124,800. This figure represents more than just a number; it's a testament to a professional's expertise, dedication, and value in the modern economy.

For those aspiring to reach this level, the path is clear:

- Invest in Education: Obtain the necessary degrees and certifications for high-skill fields.

- Build Experience: Methodically grow your skills and take on increasing responsibility.

- Be Strategic: Understand how your location, company choice, and area of specialization can be leveraged to maximize your earnings.

With a strong job outlook and a clear path forward, a six-figure salary is an attainable and highly rewarding goal for any ambitious professional.