Introduction

The $60,000 per year salary. For many professionals, this figure represents a significant career milestone. It’s a number that often signifies a transition from entry-level roles into a more established, stable career path with growing responsibilities. It suggests competence, experience, and the potential for a comfortable lifestyle. But what does earning a $60k salary truly mean? How does that annual figure translate into your actual 60k salary monthly take home pay? What kinds of jobs offer this level of compensation, and what is the long-term outlook for careers in this bracket?

This guide is designed to be the definitive resource for anyone targeting this salary level. We will dissect every component of a $60,000 salary, from the gross-to-net calculation that determines your take-home pay to the specific skills, educational backgrounds, and strategic career moves that can help you achieve it. Whether you are a recent graduate mapping out your future, a professional looking to make a career change, or someone simply trying to understand the financial realities of this income level, this article will provide you with the data-driven insights and actionable advice you need.

I recall my first role that crossed the $60,000 threshold. It felt like a monumental achievement, and I immediately started budgeting with the simple calculation of $5,000 per month. The reality of my first paycheck—after taxes, health insurance, and 401(k) contributions—was a crucial lesson in financial literacy. Understanding that gap between gross and net pay is the first step toward true financial planning and career empowerment.

This comprehensive analysis will equip you with the expertise to not only reach the $60,000 benchmark but to understand its value, maximize your earnings, and build a sustainable, rewarding career.

### Table of Contents

- [1. Deconstructing the Paycheck: What is a $60k Salary Monthly Take-Home?](#deconstructing-the-paycheck-what-is-a-60k-salary-monthly-take-home)

- [2. What Kinds of Jobs Pay $60,000 a Year?](#what-kinds-of-jobs-pay-60000-a-year)

- [3. The $60,000 Salary: A Deep Dive into Compensation](#the-60000-salary-a-deep-dive-into-compensation)

- [4. Key Factors That Influence Your Path to a $60,000 Salary](#key-factors-that-influence-your-path-to-a-60000-salary)

- [5. Job Outlook and Career Growth Beyond the $60k Benchmark](#job-outlook-and-career-growth-beyond-the-60k-benchmark)

- [6. Your Roadmap: How to Land a $60,000 a Year Job](#your-roadmap-how-to-land-a-60000-a-year-job)

- [7. Conclusion: Building Your Career Toward and Beyond $60k](#conclusion-building-your-career-toward-and-beyond-60k)

---

1. Deconstructing the Paycheck: What is a $60k Salary Monthly Take-Home?

Before exploring the careers that pay $60,000, it's essential to understand what this amount means for your bank account. The difference between gross income (the stated salary) and net income (take-home pay) can be substantial. Let's break down a hypothetical monthly paycheck for someone earning a $60,000 annual salary.

Gross Annual Salary: $60,000

Gross Monthly Income: $5,000

From this $5,000, several deductions are made. These can vary significantly based on your location, filing status, and benefit choices, but here is a representative example for a single filer with no dependents living in a state with a moderate income tax.

| Deduction Category | Estimated Monthly Amount | Explanation |

| :--- | :--- | :--- |

| Gross Monthly Pay | $5,000 | Your salary before any deductions. |

| Federal Income Tax | ~$450 - $550 | Varies based on your W-4 withholdings. For 2023-2024, a $60k salary falls into the 22% marginal tax bracket for a single filer, but effective tax rate is lower. |

| FICA Taxes (Social Security & Medicare) | ~$383 | A flat 7.65% tax on your gross income (6.2% for Social Security up to a certain income limit, and 1.45% for Medicare). |

| State Income Tax | ~$150 - $250 | Highly variable. States like Texas and Florida have 0% state income tax, while states like California and New York have higher progressive rates. This estimate is for a state with a ~4-5% rate. |

| Health Insurance Premium | ~$100 - $300 | This is the employee's portion of the monthly premium for a standard employer-sponsored health plan. Can be higher for premium plans or family coverage. |

| 401(k) Retirement Contribution | ~$250 (5%) | A common recommendation is to contribute at least enough to get a full employer match. A 5% contribution is a typical starting point. |

| Total Estimated Monthly Deductions | ~$1,333 - $1,733 | The sum of all the deductions listed above. |

| Estimated Monthly Take-Home Pay (Net Pay) | ~$3,267 - $3,667 | The amount that is actually deposited into your bank account. |

As this breakdown clearly shows, a $60,000 salary does not equal $5,000 in your pocket each month. A more realistic estimate for monthly take-home pay is between $3,200 and $3,700. Understanding this reality is the foundation of effective budgeting and financial planning. When evaluating a job offer, always consider the complete compensation package—including the cost of benefits and state tax implications—to accurately project your disposable income.

---

2. What Kinds of Jobs Pay $60,000 a Year?

A $60,000 salary is not tied to a single profession but is a common compensation point for a wide array of roles, particularly for professionals with 2-5 years of experience or those in skilled entry-level positions. According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all occupations was $46,310 in May 2022, placing a $60,000 salary comfortably above the national median.

Here are a few examples of common professions where a $60,000 salary is a typical benchmark, along with a "Day in the Life" to make the roles more tangible.

### A. Marketing Specialist / Marketing Coordinator

Marketing specialists develop and execute campaigns to promote a company's products or services. This field is broad, with specializations in digital marketing, content creation, social media, and market research.

- Salary Context: Payscale reports the average salary for a Marketing Specialist in the United States is approximately $59,980 per year. Early career professionals might start closer to $50,000, reaching and exceeding $60,000 with a few years of experience and demonstrated success.

- A Day in the Life: Your morning might start by analyzing the performance data from a recent email marketing campaign using tools like Mailchimp or HubSpot. You then collaborate with the graphic design team on visuals for an upcoming social media push. After lunch, you might write and edit a blog post for the company website, ensuring it is optimized for search engines (SEO). The day could end with a strategy meeting to brainstorm ideas for the next quarter's advertising budget.

### B. Staff Accountant

Staff accountants are the backbone of a company's finance department. They are responsible for maintaining financial records, preparing reports, and reconciling bank statements.

- Salary Context: According to Salary.com, the average salary for a Staff Accountant I in the U.S. is $63,101 as of late 2023. This is a role where a recent graduate with a degree in accounting can quickly reach the $60k mark.

- A Day in the Life: You arrive and begin processing accounts payable, ensuring vendor invoices are accurate and paid on time. You then spend a significant portion of your day in Excel or accounting software like QuickBooks or NetSuite, working on the general ledger and preparing journal entries for the month-end close process. You might assist a senior accountant with gathering documents for an external audit or run a report on departmental spending for a manager. Accuracy and attention to detail are paramount throughout your day.

### C. Human Resources (HR) Generalist

HR Generalists handle a wide variety of functions related to a company's employees, including recruiting, onboarding, benefits administration, employee relations, and compliance with labor laws.

- Salary Context: Glassdoor lists the estimated total pay for an HR Generalist in the U.S. at $66,500 per year, with a likely range between $55,000 and $81,000. Professionals often reach this level after a few years as an HR Coordinator or Assistant.

- A Day in the Life: Your day could begin with screening resumes and conducting phone interviews for an open position. You might then meet with a new hire to complete their onboarding paperwork and explain the company's benefits package. In the afternoon, you could be tasked with investigating a minor employee complaint, ensuring you follow company policy and document everything carefully. Later, you might work on updating the employee handbook or preparing materials for an upcoming performance review cycle.

### D. Project Coordinator / Junior Project Manager

Project Coordinators provide administrative and operational support to project managers and teams. They help track project timelines, manage resources, facilitate communication, and ensure that deliverables are met.

- Salary Context: The average base salary for a Project Coordinator, according to Payscale, is $55,250, but with experience and in higher-cost-of-living areas, this role frequently pays over $60,000. It is a common stepping stone to a full Project Manager role, where salaries increase significantly.

- A Day in the Life: You start your day by updating the project plan in a tool like Asana, Trello, or Jira, reflecting progress made the previous day. You then schedule and prepare the agenda for a weekly team check-in meeting. A significant part of your role is communication; you might spend time following up with team members on their task statuses, clarifying requirements, and sending out summary notes after meetings. You might also be responsible for maintaining the project budget spreadsheet or organizing project documentation in a shared drive.

---

3. The $60,000 Salary: A Deep Dive into Compensation

A salary is more than just a single number; it's part of a total compensation package. When you're evaluating an offer or targeting a specific income level, it's vital to understand all the components that contribute to your overall financial well-being. A $60,000 base salary can be augmented significantly by bonuses, benefits, and other forms of remuneration.

### National Averages and Salary Ranges

To put the $60,000 salary in perspective, it's useful to look at its position within the broader U.S. labor market.

- National Median Wage: The Bureau of Labor Statistics (BLS) reported the median annual wage for all workers in the U.S. was $46,310 in May 2022. This means a $60,000 salary is roughly 30% higher than the midpoint for all jobs.

- Median Household Income: The U.S. Census Bureau reported a median household income of $74,580 in 2022. It's important to note this figure often includes multiple earners in a single household. For an individual, $60,000 is a very solid income.

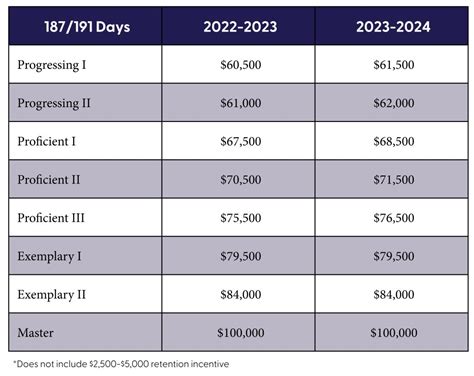

Salary ranges for jobs that pay around $60k are often wide, reflecting differences in experience, location, and performance. Here's a typical salary progression you might see for a professional role, based on data compiled from sources like Salary.com and Glassdoor.

| Experience Level | Typical Title | Typical Salary Range | Description |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 Years) | Coordinator, Specialist I, Analyst I | $45,000 - $60,000 | In this stage, you are learning the fundamentals of your role and industry. Reaching the upper end of this range often requires a relevant degree from a good university or valuable internship experience. |

| Mid-Career (2-5 Years) | Specialist II, Generalist, Analyst II | $55,000 - $75,000 | This is the sweet spot where a $60,000 salary is most common. You have proven your competence, can work independently, and are taking on more complex tasks or projects. |

| Experienced/Senior (5-10 Years)| Senior Specialist, Senior Accountant | $70,000 - $90,000+ | At this stage, you have deep expertise. A $60,000 salary would be considered low unless you are in a very low-cost-of-living area, a non-profit, or a role with an unusually good work-life balance. |

### Components of Total Compensation

When a company makes you a job offer, the base salary is just the beginning. The concept of "Total Rewards" or "Total Compensation" includes all the ways an employer remunerates its employees.

1. Base Salary:

This is the fixed, guaranteed amount you are paid, as discussed. It's the foundation of your compensation, paid out in regular intervals (bi-weekly, semi-monthly, etc.). At the $60k level, this is the most significant part of your pay.

2. Variable Pay (Bonuses and Incentives):

This is performance-based pay that is not guaranteed. It can dramatically increase your total annual earnings.

- Annual Performance Bonus: Many companies offer a bonus based on a combination of individual and company performance. For a professional at the $60k level, this could range from 5% to 15% of the base salary ($3,000 - $9,000).

- Sign-On Bonus: A one-time payment offered to a new employee as an incentive to join the company. This can be particularly common in competitive fields or to compensate a candidate for a bonus they are leaving behind at their old job. It could range from $1,000 to $5,000 or more.

- Profit Sharing: Some companies distribute a portion of their profits to employees. This is typically paid out annually and can fluctuate significantly from year to year.

3. Equity/Stock Options (Less Common at this Level):

While more common in tech companies and for senior-level roles, some startups may offer stock options even to employees at the $60k salary level. This gives you the right to purchase company stock at a predetermined price in the future, which can be highly valuable if the company succeeds.

4. Benefits (The Hidden Paycheck):

The value of a good benefits package cannot be overstated and can be worth thousands of dollars annually.

- Health Insurance: This includes medical, dental, and vision insurance. A company that covers 80-100% of your monthly premium is offering a significantly better package than one that only covers 50%. This can be a difference of several hundred dollars per month.

- Retirement Savings Plan: A 401(k) or 403(b) plan is standard. The key differentiator is the employer match. A common match is "50% of the first 6% you contribute," which is essentially a guaranteed 3% raise that goes directly into your retirement account.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. A generous PTO policy (e.g., 20 days of vacation + 10 holidays) is more valuable than a standard one (e.g., 10 days of vacation + 8 holidays).

- Other Perks: These can include tuition reimbursement, wellness stipends, paid parental leave, life insurance, and disability insurance. These benefits provide both financial value and a crucial safety net.

When comparing job offers, it's a valuable exercise to quantify the value of the benefits package. A role with a $60,000 salary but an excellent benefits package might be financially superior to a role with a $65,000 salary and subpar benefits.

---

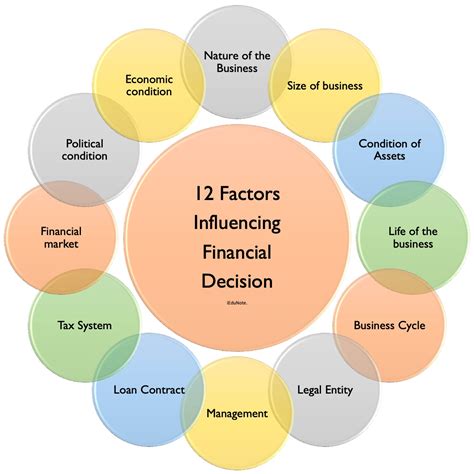

4. Key Factors That Influence Your Path to a $60,000 Salary

Achieving a $60,000 salary is not a matter of luck; it's the result of a combination of strategic decisions, skill development, and market awareness. Several key factors directly influence your earning potential and the speed at which you can reach this career milestone. Understanding and leveraging these factors is critical to your career trajectory.

###

Level of Education

Your educational background is often the first filter used by recruiters and sets the foundation for your starting salary.

- High School Diploma / Associate's Degree: While it's possible to reach a $60,000 salary in certain skilled trades, administrative roles, or sales with just a high school diploma or an associate's degree, the path is often longer. It typically requires significant on-the-job experience and a proven track record.

- Bachelor's Degree: For most professional roles in fields like business, finance, marketing, HR, and tech, a bachelor's degree is the standard entry requirement. According to the BLS, in 2022, the median weekly earnings for a full-time worker with a bachelor's degree was $1,432, which annualizes to approximately $74,464. This demonstrates that a bachelor's degree puts a $60,000 salary well within reach, often directly out of college or within the first couple of years. The prestige of the university and the specific field of study (e.g., Engineering or Computer Science vs. Liberal Arts) can also significantly impact starting salaries.

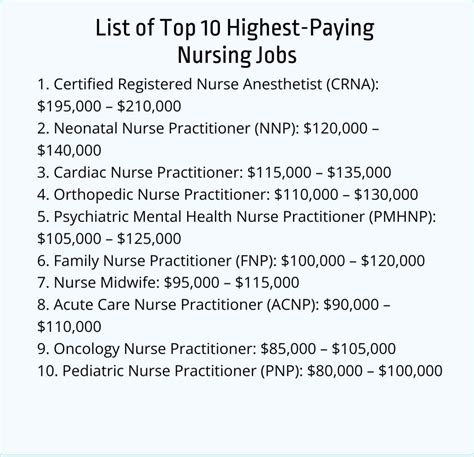

- Master's Degree: An advanced degree can provide a substantial salary boost. For some fields, like a Data Scientist or certain education administrators, it's a prerequisite. In others, like business (MBA) or finance (Master's in Finance), it can lead to higher-level starting positions and command a salary well above $60,000. The BLS reports median weekly earnings for master's degree holders at $1,661, or about $86,372 annually.

- Certifications: Industry-recognized certifications act as a powerful signal of specialized expertise and can directly translate to higher pay. They demonstrate commitment to your field and proficiency in a specific skill set.

- For Project Management: A Certified Associate in Project Management (CAPM) can help a Project Coordinator get hired, and a Project Management Professional (PMP) can easily elevate their salary far beyond $60k.

- For Human Resources: A SHRM-CP (Certified Professional) from the Society for Human Resource Management validates your knowledge and can increase your salary by 5-10% compared to non-certified peers.

- For Marketing: Certifications in Google Analytics, Google Ads, or HubSpot can make a Marketing Specialist more valuable, particularly in data-driven roles.

- For Accounting/Finance: A Certified Public Accountant (CPA) is the gold standard and virtually guarantees a salary well in excess of $60,000, even early in a career.

###

Years of Experience

Experience is arguably the single most important factor in salary growth. Employers pay for proven ability and reduced risk. Here is a more detailed look at the salary trajectory:

- 0-2 Years (Foundation Building): As mentioned, salaries typically range from $45,000 to $60,000. The primary goal here is to absorb as much knowledge as possible, master the core functions of your job, build professional relationships, and demonstrate reliability. Excelling in your initial role can lead to a significant pay bump after 1-2 years, either through an internal promotion or by leveraging that experience to get a better-paying job elsewhere.

- 3-5 Years (Acceleration Phase): This is where professionals often cross the $60,000 threshold and accelerate toward $75,000 or more. You are no longer just executing tasks; you are beginning to manage small projects, train junior colleagues, and contribute to strategy. You have a track record of accomplishments that you can quantify on your resume (e.g., "Managed a marketing campaign that increased leads by 15%" or "Helped streamline the month-end close process, reducing it by two days"). This is the prime time to negotiate raises or change jobs for a significant salary increase (often 15-20%).

- 5+ Years (Expertise and Leadership): With over five years of experience, you are considered a senior professional or an emerging leader. Your salary should comfortably exceed $60,000 and push toward six figures in many professional fields. Your value lies in your deep subject matter expertise, strategic thinking, and potential ability to manage people or complex, high-impact projects.

###

Geographic Location

Where you live and work has a massive impact on your salary. Companies adjust pay scales based on the local cost of labor and cost of living. A $60,000 salary can afford a very comfortable lifestyle in one city and feel like a struggle in another.

- High-Cost-of-Living (HCOL) Areas: Cities like San Francisco, New York City, Boston, and San Jose have extremely high housing costs and overall expenses. To attract talent, companies in these areas offer inflated salaries. A role that pays $60,000 in a mid-sized city might pay $75,000-$85,000 in an HCOL city. However, that extra money is immediately consumed by higher rent, taxes, and daily expenses.

- Medium-Cost-of-Living (MCOL) Areas: Cities like Austin, Denver, Chicago, and Atlanta fall into this category. They offer a great balance of robust job markets and more manageable living costs. A $60,000 salary here typically affords a good quality of life. These cities are often where this salary level is most common for professionals with a few years of experience.

- Low-Cost-of-Living (LCOL) Areas: In smaller cities and rural areas, particularly in the Midwest and South, the cost of living is significantly lower. While salaries are also lower, your purchasing power can be much greater. A job that pays $60,000 in a major metro might only pay $50,000 in an LCOL area, but that $50,000 might go much further.

Example Salary Comparison for a "Staff Accountant" (Data from Salary.com, late 2023):

- San Francisco, CA (HCOL): Average salary ~$75,000

- Chicago, IL (MCOL): Average salary ~$65,000

- Kansas City, MO (LCOL): Average salary ~$60,000

The rise of remote work has complicated this