It’s one of the most persistent and misunderstood aspects of the American workplace: if you’re a salaried employee, does that automatically mean you can’t earn overtime? The short answer is a definitive no. Many salaried professionals in the U.S. are legally entitled to overtime pay, and understanding the rules can significantly impact your annual earnings and work-life balance.

This common misconception stems from a misunderstanding of labor law. The key isn't whether you receive a salary, but whether your specific role is classified as "exempt" or "non-exempt" under the Fair Labor Standards Act (FLSA). This guide will break down the crucial distinctions, salary thresholds, and job duty requirements that determine your eligibility for overtime pay.

Understanding "Salaried": Exempt vs. Non-Exempt Employees

Before diving into the details, it's essential to grasp the two categories of employees as defined by the FLSA. Your eligibility for overtime hinges entirely on which category your job falls into.

- Non-Exempt Employees: These employees are covered by the FLSA's overtime rules. They must be paid overtime—typically at a rate of 1.5 times their regular hourly rate—for any hours worked over 40 in a workweek. Most hourly workers fall into this category, but many salaried employees do as well.

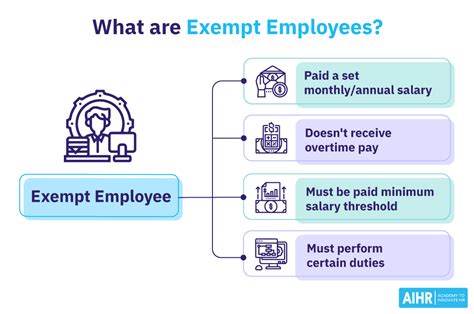

- Exempt Employees: These employees are "exempt" from the FLSA's overtime rules, meaning their employer is not required to pay them overtime. To be classified as exempt, an employee must meet specific criteria related to their salary amount and their job duties.

Simply being paid a salary does not automatically make you an exempt employee. This is the central point of confusion for many workers and even some employers.

The Salary Threshold: A Key Factor for Overtime Eligibility

For most exemptions to apply, an employee must meet a minimum salary threshold set by the U.S. Department of Labor (DOL).

As of 2024, the federal salary threshold for an employee to be considered exempt is $684 per week, which translates to $35,568 per year.

What this means: If you are a salaried employee earning less than $35,568 per year, you are automatically classified as non-exempt and are entitled to overtime pay, regardless of your job title or duties.

It's crucial to note that some states have their own, more generous laws. For example:

- California: In 2024, the salary threshold for exempt employees is $66,560 per year. (Source: California Department of Industrial Relations)

- New York: As of 2024, the threshold varies by region, reaching $62,400 per year in New York City and its surrounding suburbs. (Source: New York State Department of Labor)

Always check your state and local labor laws, as they may provide greater protections than the federal standard.

Key Factors That Determine Overtime Eligibility for Salaried Workers

If your salary is *above* the federal (or state) threshold, your employer must then prove that your specific job responsibilities meet a "duties test" to classify you as exempt. If your role doesn't fit into one of the narrowly defined categories below, you are still entitled to overtime.

###

The "Duties Test": What You Actually Do Matters More Than Your Title

Your job title—whether it’s "Team Lead," "Associate Manager," or "Senior Coordinator"—is irrelevant. Federal law looks at the actual tasks you perform on a day-to-day basis. The primary exemption categories are:

- Executive Exemption: To qualify, an employee's primary duty must be managing the enterprise or a recognized department. They must customarily and regularly direct the work of at least two full-time employees and have the authority to hire or fire (or their recommendations must be given significant weight).

- Administrative Exemption: This is one of the most complex tests. The employee's primary duty must be performing office or non-manual work directly related to the management or general business operations of the employer. This must also include the exercise of discretion and independent judgment with respect to matters of significance. This does not apply to routine clerical work.

- Learned Professional Exemption: The employee’s primary duty must be work requiring advanced knowledge in a field of science or learning, customarily acquired through a prolonged course of specialized intellectual instruction. This includes classic professions like lawyers, doctors, accountants, engineers, and scientists.

###

Area of Specialization: Computer and Creative Professionals

In addition to the main categories, there are specific exemptions for highly skilled roles:

- Computer Employee Exemption: This applies to employees like systems analysts, programmers, and software engineers. Their primary duties must involve tasks such as systems analysis, design and development of computer systems or programs, or modification of programs related to machine operating systems. According to Payscale, the median salary for a Software Engineer is around $94,000, well above the threshold, but their duties must still align with this test to be exempt. (Source: Payscale, 2024)

- Creative Professional Exemption: This applies to those whose primary duty is work requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor. This includes actors, musicians, composers, and many writers or graphic artists.

###

Years of Experience and Level of Education

While experience and education are not direct "tests" on their own, they are crucial components of the other tests. For instance, the "Learned Professional" exemption is directly tied to having an advanced degree or equivalent learning. Similarly, gaining years of experience often leads to taking on duties—like managing a team (Executive) or making significant business decisions (Administrative)—that may shift a role from non-exempt to exempt status over time.

###

Geographic Location and Company Policy

As mentioned, states like California, New York, Washington, and Colorado have higher salary thresholds and sometimes stricter duties tests. Living in one of these states can significantly increase your chances of being overtime-eligible.

Furthermore, some companies have policies that are more generous than the law requires. They may offer overtime pay to all salaried employees below a certain internal level or provide "comp time" (compensatory time off) for extra hours worked, even if not legally obligated to do so.

The Legal and Professional Landscape: What's Changing?

The rules surrounding salaried overtime are not static. The Department of Labor periodically reviews and updates the salary thresholds to account for inflation and changing wages. In fact, the DOL has proposed a new rule that would significantly increase the salary threshold, potentially making millions more salaried workers eligible for overtime in the near future.

This trend reflects a growing national conversation about fair pay, employee burnout, and work-life balance. As an employee, staying informed about these potential changes is key to understanding and protecting your rights.

Conclusion: Know Your Rights and Maximize Your Earnings

Navigating the world of salaried employment requires more than just negotiating your annual pay. Understanding your legal rights to overtime is a critical piece of managing your career and financial well-being.

Key Takeaways:

- "Salaried" does not equal "overtime exempt." This is the single most important lesson.

- Check the Salary Threshold: If you earn less than the federal threshold of $35,568 (or your state's higher threshold), you are eligible for overtime.

- Analyze Your Duties: If you earn more than the threshold, your eligibility depends on whether your specific job duties fit into the strict definitions for an Executive, Administrative, Professional, or other specific exemption. Your title is not what matters.

- Stay Informed: Labor laws change. Keep an eye on new rules from the Department of Labor and your state's labor agency.

If you believe you are being improperly classified as exempt, consider speaking with your HR department or consulting your state's labor board. Being educated on this topic empowers you to ensure you are being compensated fairly for all of your hard work.